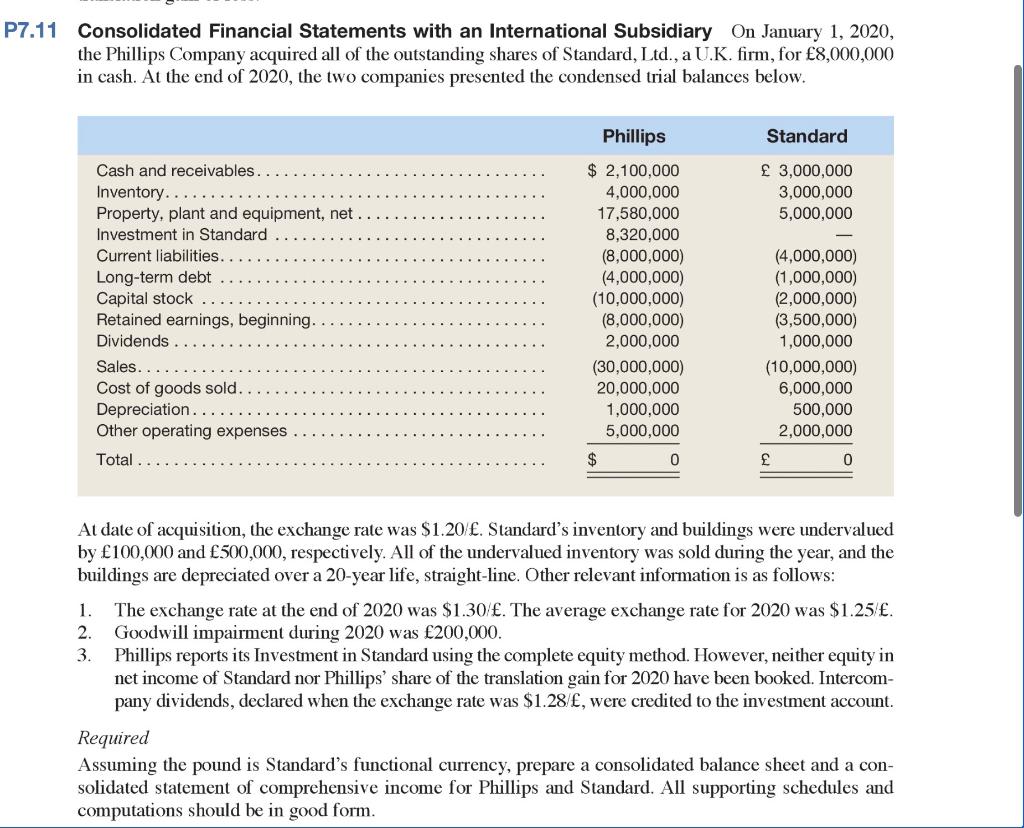

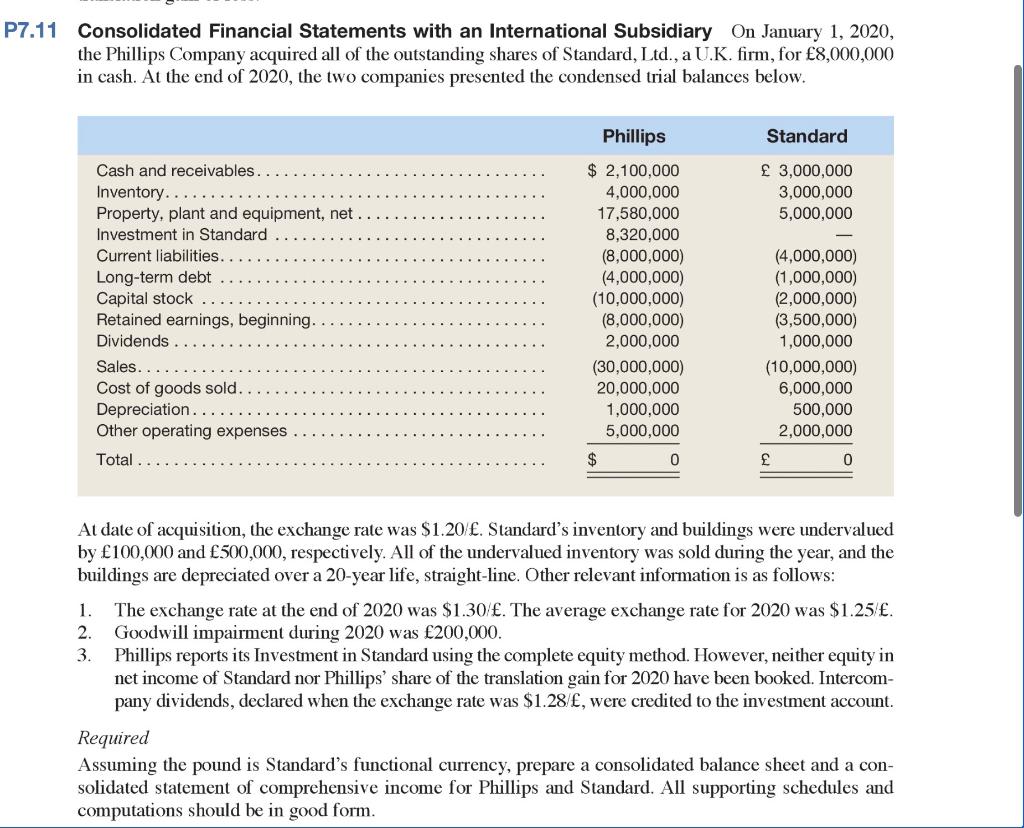

P7.11 Consolidated Financial Statements with an International Subsidiary On January 1, 2020, the Phillips Company acquired all of the outstanding shares of Standard, Ltd., a U.K. firm, for 8,000,000 in cash. At the end of 2020, the two companies presented the condensed trial balances below. Phillips Standard 3,000,000 3,000,000 5,000,000 Cash and receivables. Inventory.... Property, plant and equipment, net Investment in Standard Current liabilities. Long-term debt Capital stock Retained earnings, beginning. Dividends Sales Cost of goods sold. Depreciation.. Other operating expenses Total $ 2,100,000 4,000,000 17,580,000 8,320,000 (8,000,000) (4,000,000) (10,000,000) (8,000,000) 2,000,000 (30,000,000) 20,000,000 1,000,000 5,000,000 (4,000,000) (1,000,000) (2,000,000) (3,500,000) 1,000,000 (10,000,000) 6,000,000 500,000 2,000,000 $ 0 0 At date of acquisition, the exchange rate was $1.20 . Standard's inventory and buildings were undervalued by 100,000 and 500,000, respectively. All of the undervalued inventory was sold during the year, and the buildings are depreciated over a 20-year life, straight-line. Other relevant information is as follows: 1. The exchange rate at the end of 2020 was $1.30/. The average exchange rate for 2020 was $1.25 . 2. Goodwill impairment during 2020 was 200,000. 3. Phillips reports its Investment in Standard using the complete equity method. However, neither equity in net income of Standard nor Phillips' share of the translation gain for 2020 have been booked. Intercom- pany dividends, declared when the exchange rate was $1.28/, were credited to the investment account. Required Assuming the pound is Standard's functional currency, prepare a consolidated balance sheet and a con- solidated statement of comprehensive income for Phillips and Standard. All supporting schedules and computations should be in good form. P7.11 Consolidated Financial Statements with an International Subsidiary On January 1, 2020, the Phillips Company acquired all of the outstanding shares of Standard, Ltd., a U.K. firm, for 8,000,000 in cash. At the end of 2020, the two companies presented the condensed trial balances below. Phillips Standard 3,000,000 3,000,000 5,000,000 Cash and receivables. Inventory.... Property, plant and equipment, net Investment in Standard Current liabilities. Long-term debt Capital stock Retained earnings, beginning. Dividends Sales Cost of goods sold. Depreciation.. Other operating expenses Total $ 2,100,000 4,000,000 17,580,000 8,320,000 (8,000,000) (4,000,000) (10,000,000) (8,000,000) 2,000,000 (30,000,000) 20,000,000 1,000,000 5,000,000 (4,000,000) (1,000,000) (2,000,000) (3,500,000) 1,000,000 (10,000,000) 6,000,000 500,000 2,000,000 $ 0 0 At date of acquisition, the exchange rate was $1.20 . Standard's inventory and buildings were undervalued by 100,000 and 500,000, respectively. All of the undervalued inventory was sold during the year, and the buildings are depreciated over a 20-year life, straight-line. Other relevant information is as follows: 1. The exchange rate at the end of 2020 was $1.30/. The average exchange rate for 2020 was $1.25 . 2. Goodwill impairment during 2020 was 200,000. 3. Phillips reports its Investment in Standard using the complete equity method. However, neither equity in net income of Standard nor Phillips' share of the translation gain for 2020 have been booked. Intercom- pany dividends, declared when the exchange rate was $1.28/, were credited to the investment account. Required Assuming the pound is Standard's functional currency, prepare a consolidated balance sheet and a con- solidated statement of comprehensive income for Phillips and Standard. All supporting schedules and computations should be in good form