Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P7-2 Determining the Acquisition Cost and the Financial Statement Effects of Depreciation, Improvements, and Asset Disposal (AP7-1) LO7-1, 7-2, 7-3, 7-5 On January 2, 2021,

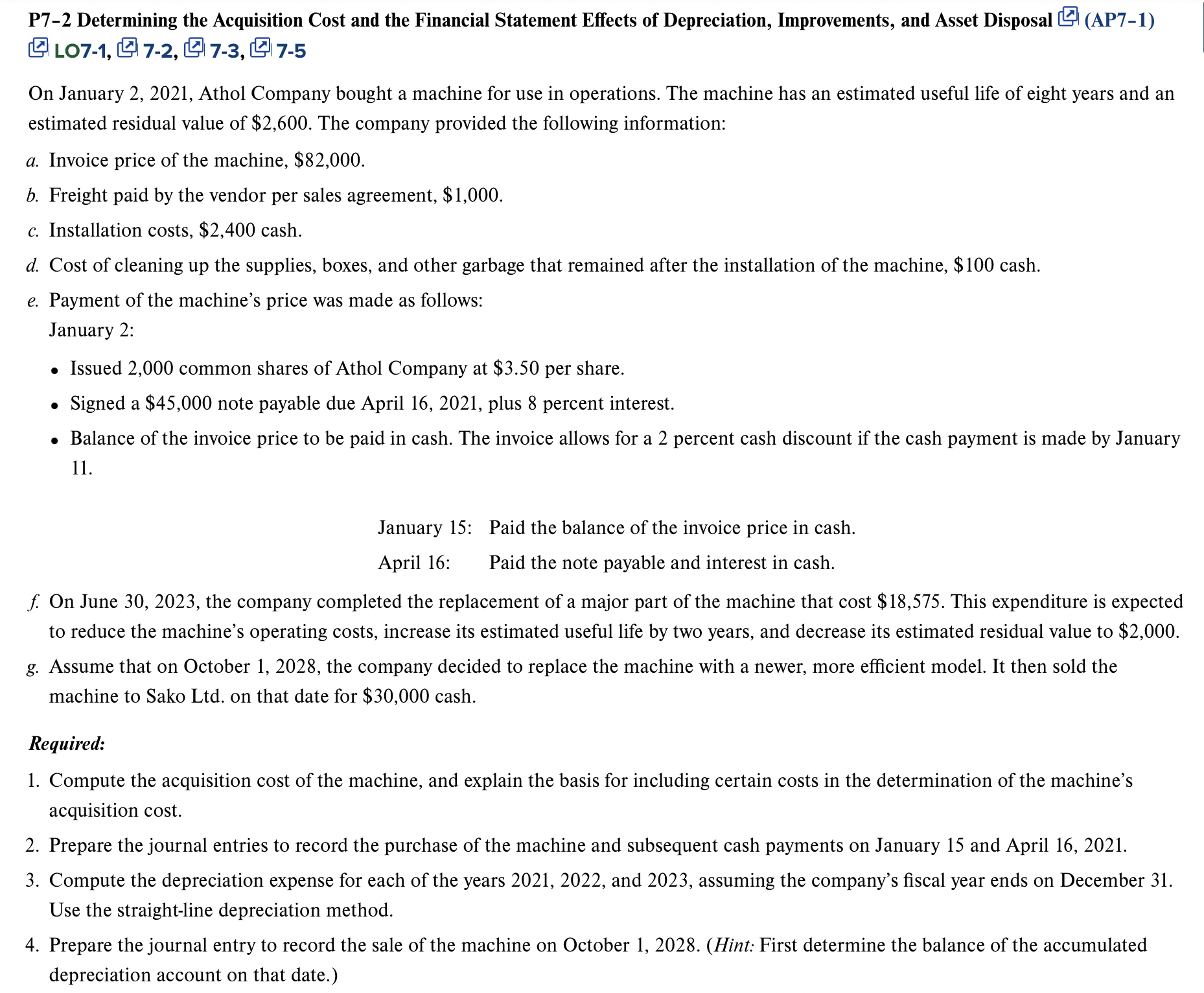

P7-2 Determining the Acquisition Cost and the Financial Statement Effects of Depreciation, Improvements, and Asset Disposal (AP7-1) LO7-1, 7-2, 7-3, 7-5 On January 2, 2021, Athol Company bought a machine for use in operations. The machine has an estimated useful life of eight years and an estimated residual value of $2,600. The company provided the following information: a. Invoice price of the machine, $82,000. b. Freight paid by the vendor per sales agreement, $1,000. c. Installation costs, $2,400 cash. d. Cost of cleaning up the supplies, boxes, and other garbage that remained after the installation of the machine, $100 cash. e. Payment of the machine's price was made as follows: January 2: - Issued 2,000 common shares of Athol Company at $3.50 per share. - Signed a $45,000 note payable due April 16, 2021, plus 8 percent interest. - Balance of the invoice price to be paid in cash. The invoice allows for a 2 percent cash discount if the cash payment is made by January 11. January 15: Paid the balance of the invoice price in cash. April 16: Paid the note payable and interest in cash. f. On June 30,2023 , the company completed the replacement of a major part of the machine that cost $18,575. This expenditure is expected to reduce the machine's operating costs, increase its estimated useful life by two years, and decrease its estimated residual value to $2,000. g. Assume that on October 1, 2028, the company decided to replace the machine with a newer, more efficient model. It then sold the machine to Sako Ltd. on that date for $30,000 cash. Required: 1. Compute the acquisition cost of the machine, and explain the basis for including certain costs in the determination of the machine's acquisition cost. 2. Prepare the journal entries to record the purchase of the machine and subsequent cash payments on January 15 and April 16, 2021. 3. Compute the depreciation expense for each of the years 2021, 2022, and 2023, assuming the company's fiscal year ends on December 31. Use the straight-line depreciation method. 4. Prepare the journal entry to record the sale of the machine on October 1, 2028. (Hint: First determine the balance of the accumulated depreciation account on that date.)

P7-2 Determining the Acquisition Cost and the Financial Statement Effects of Depreciation, Improvements, and Asset Disposal (AP7-1) LO7-1, 7-2, 7-3, 7-5 On January 2, 2021, Athol Company bought a machine for use in operations. The machine has an estimated useful life of eight years and an estimated residual value of $2,600. The company provided the following information: a. Invoice price of the machine, $82,000. b. Freight paid by the vendor per sales agreement, $1,000. c. Installation costs, $2,400 cash. d. Cost of cleaning up the supplies, boxes, and other garbage that remained after the installation of the machine, $100 cash. e. Payment of the machine's price was made as follows: January 2: - Issued 2,000 common shares of Athol Company at $3.50 per share. - Signed a $45,000 note payable due April 16, 2021, plus 8 percent interest. - Balance of the invoice price to be paid in cash. The invoice allows for a 2 percent cash discount if the cash payment is made by January 11. January 15: Paid the balance of the invoice price in cash. April 16: Paid the note payable and interest in cash. f. On June 30,2023 , the company completed the replacement of a major part of the machine that cost $18,575. This expenditure is expected to reduce the machine's operating costs, increase its estimated useful life by two years, and decrease its estimated residual value to $2,000. g. Assume that on October 1, 2028, the company decided to replace the machine with a newer, more efficient model. It then sold the machine to Sako Ltd. on that date for $30,000 cash. Required: 1. Compute the acquisition cost of the machine, and explain the basis for including certain costs in the determination of the machine's acquisition cost. 2. Prepare the journal entries to record the purchase of the machine and subsequent cash payments on January 15 and April 16, 2021. 3. Compute the depreciation expense for each of the years 2021, 2022, and 2023, assuming the company's fiscal year ends on December 31. Use the straight-line depreciation method. 4. Prepare the journal entry to record the sale of the machine on October 1, 2028. (Hint: First determine the balance of the accumulated depreciation account on that date.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started