P7-2C

chart of Poblwm P7-1C

the following form are need to fill up for answers.kindly help me put the correct answers please and thank you.

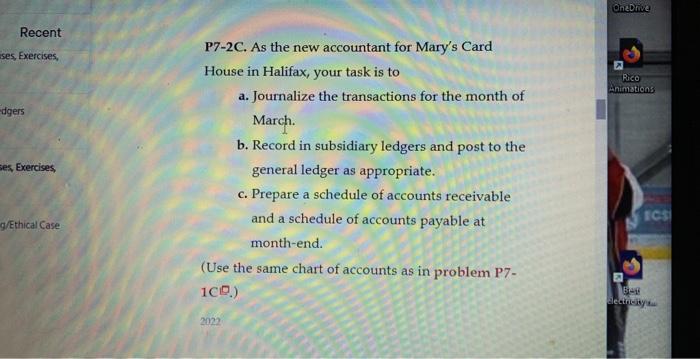

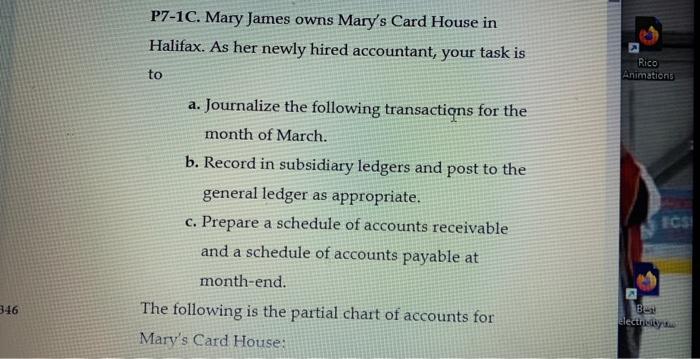

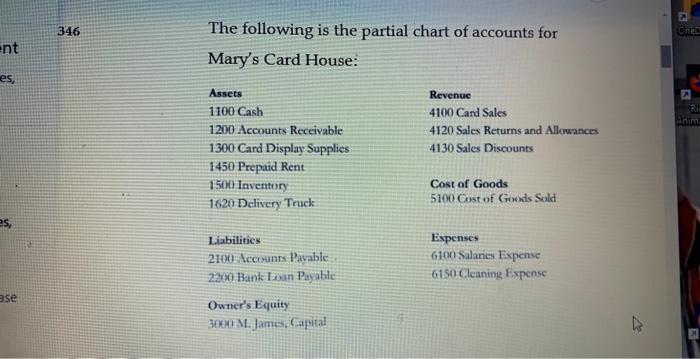

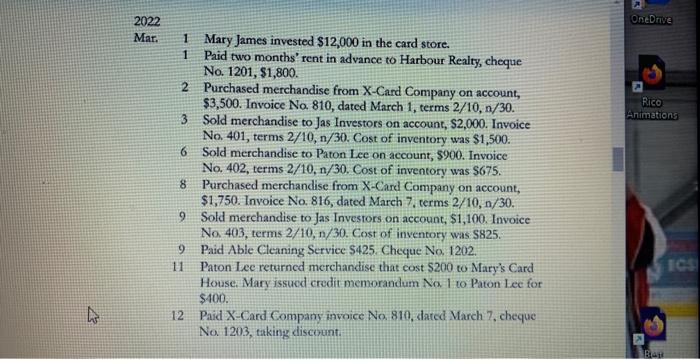

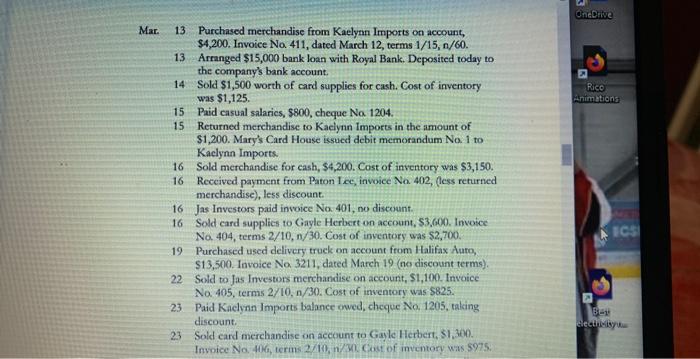

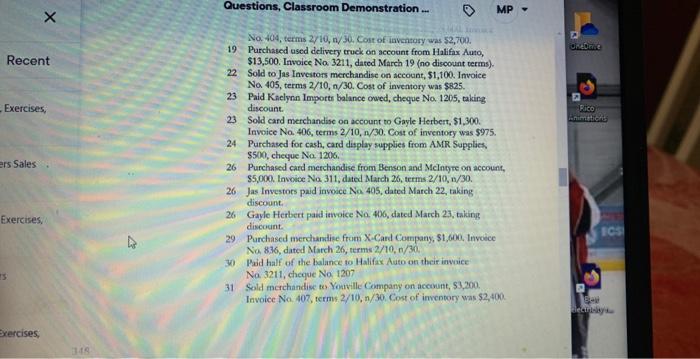

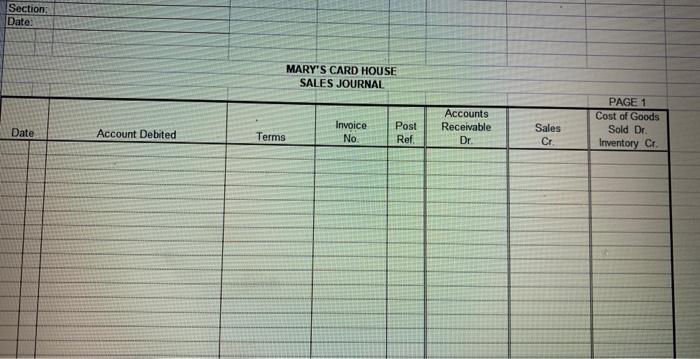

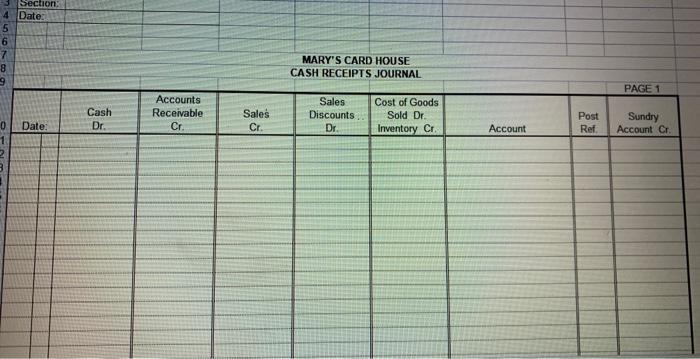

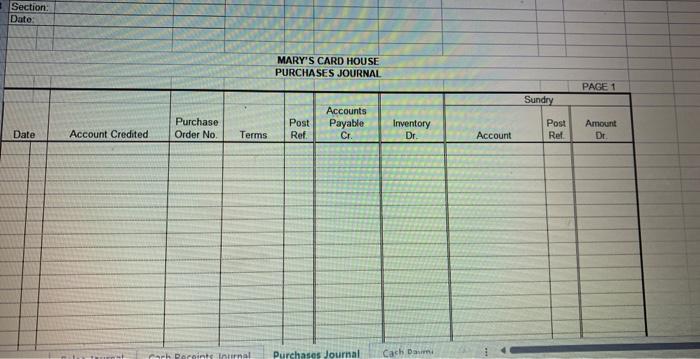

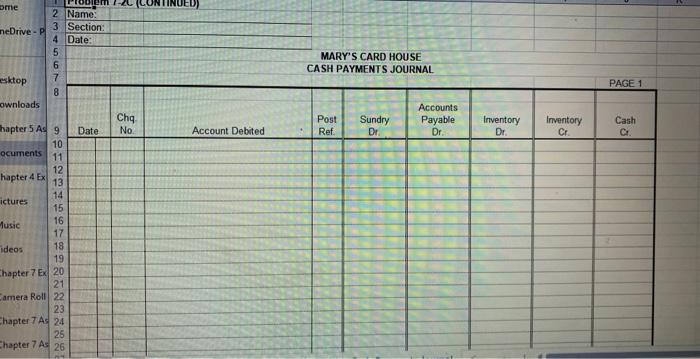

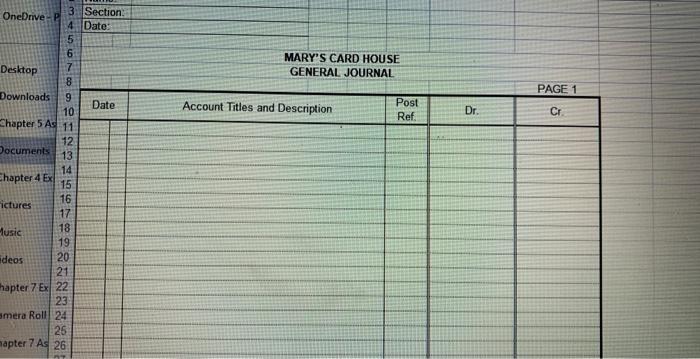

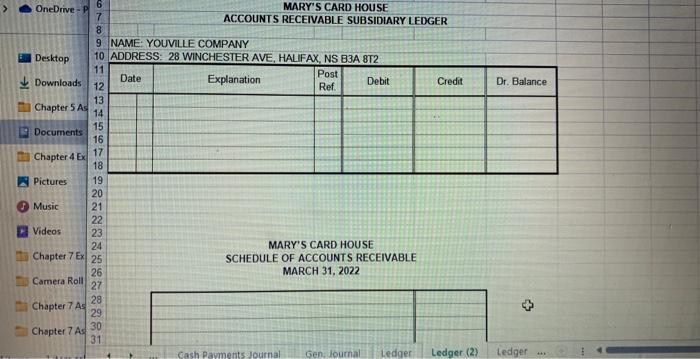

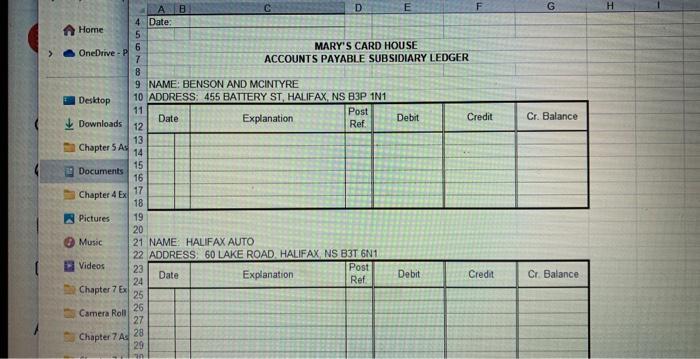

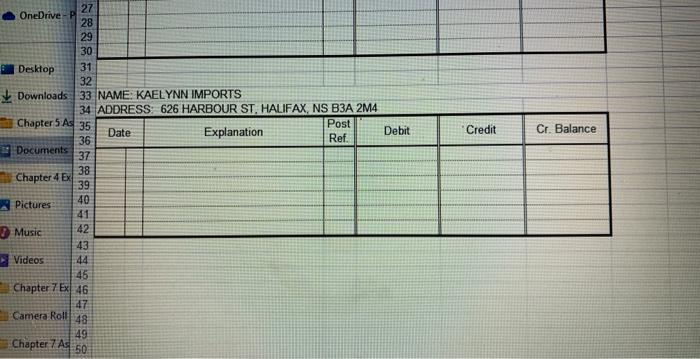

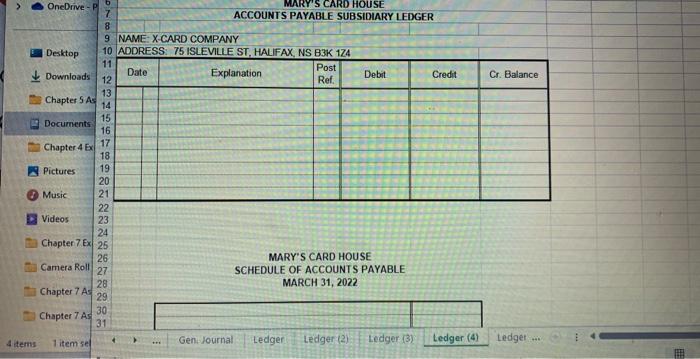

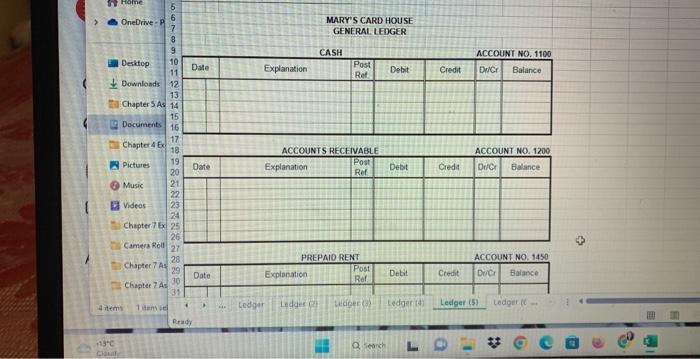

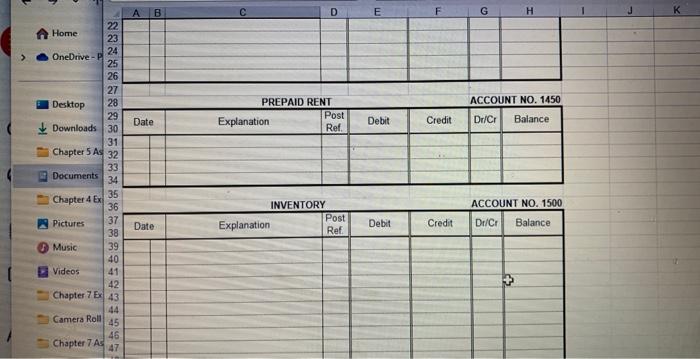

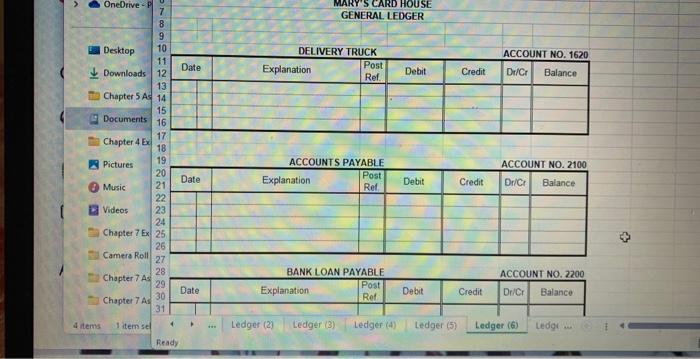

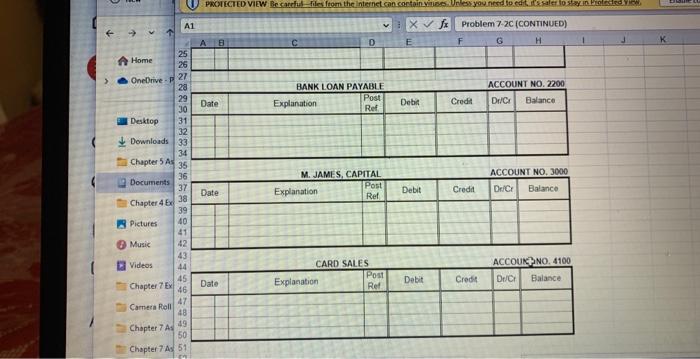

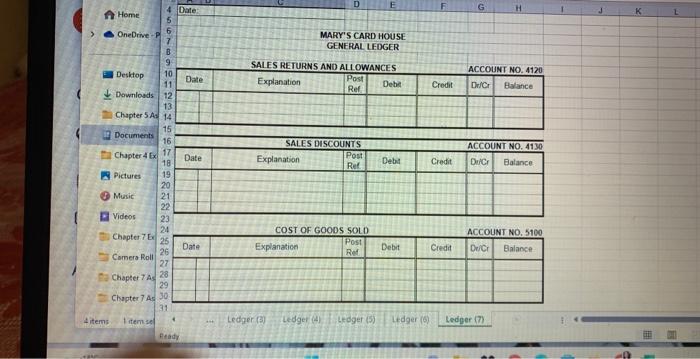

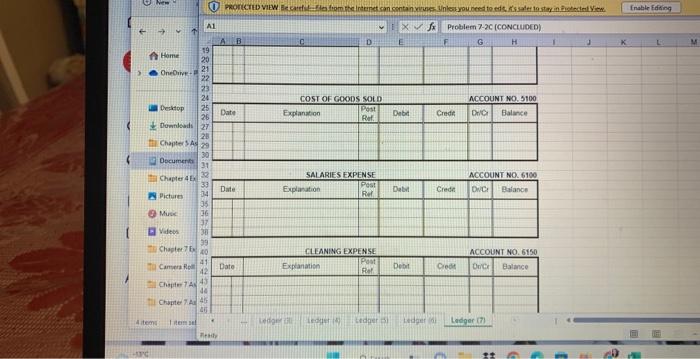

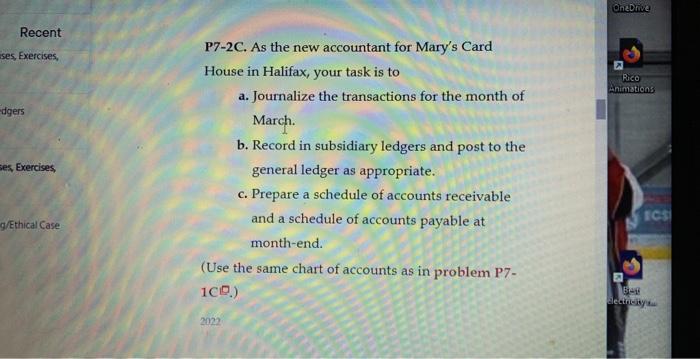

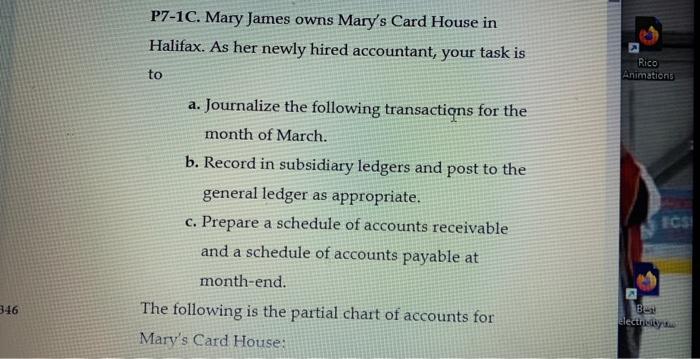

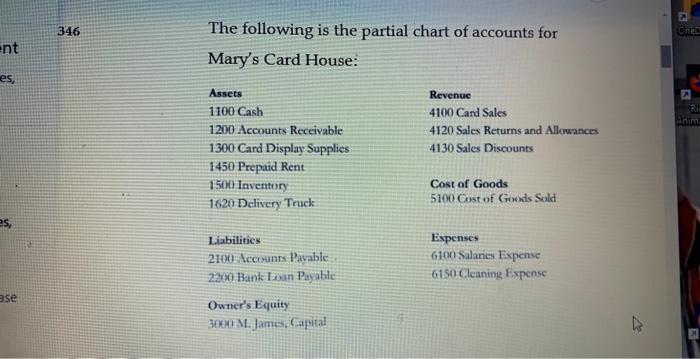

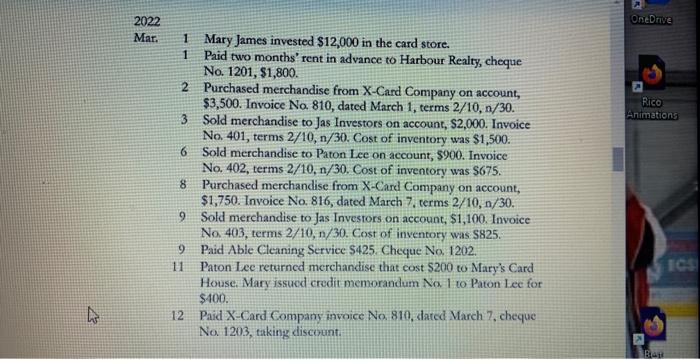

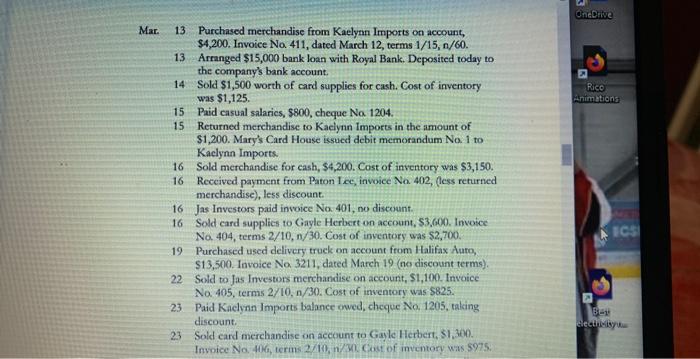

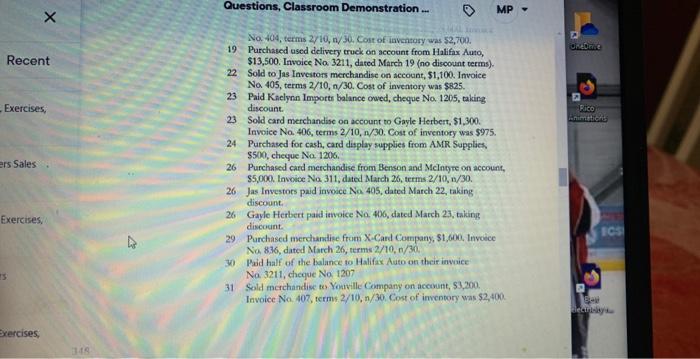

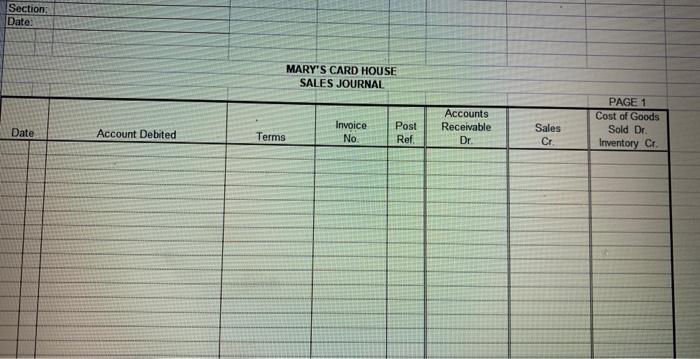

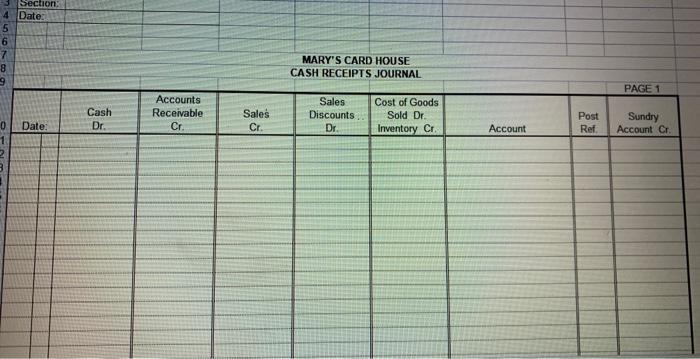

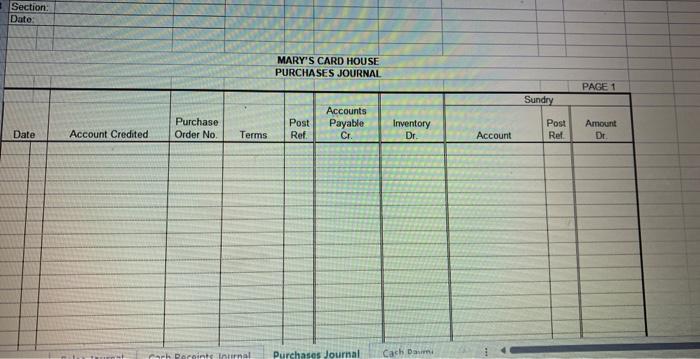

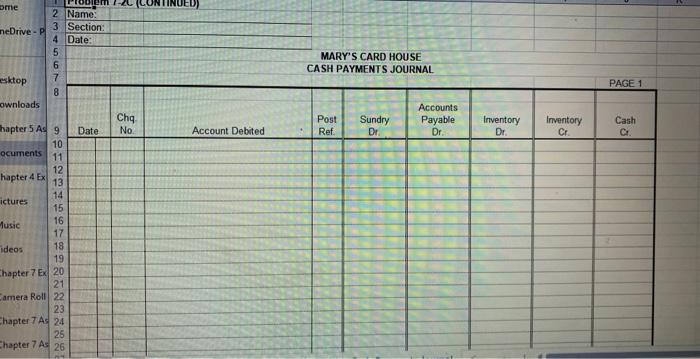

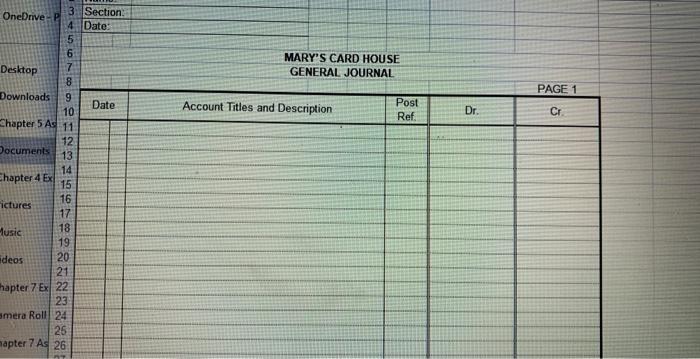

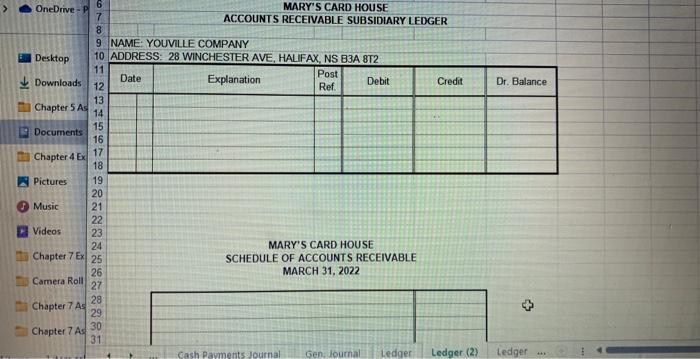

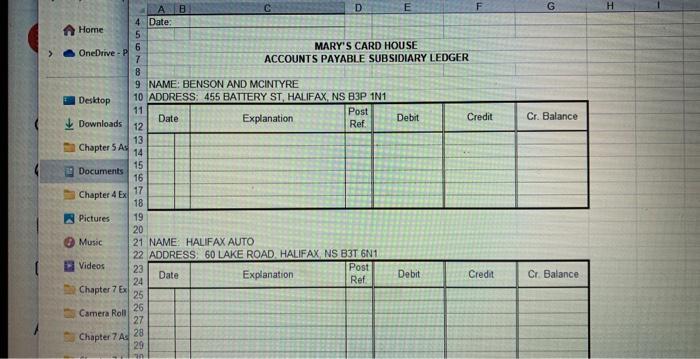

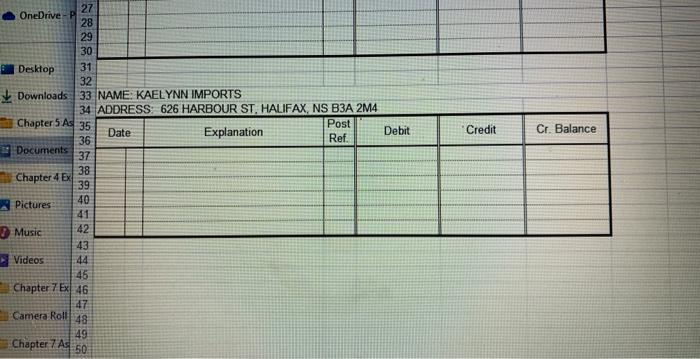

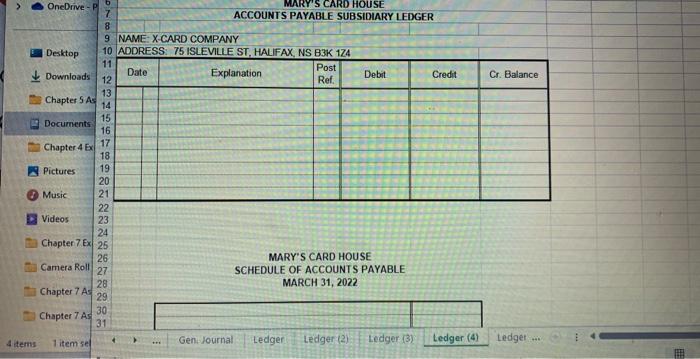

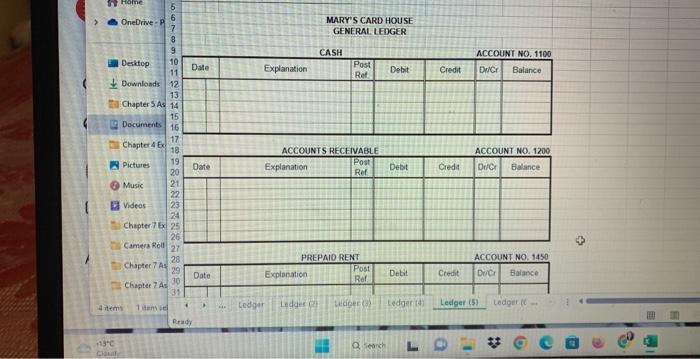

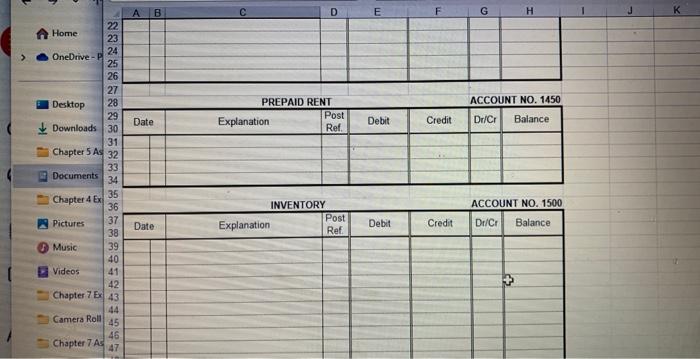

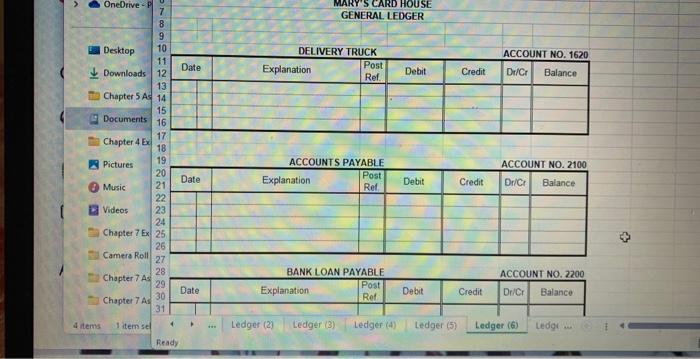

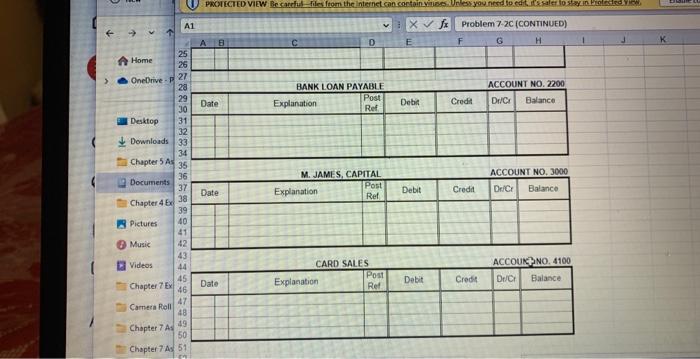

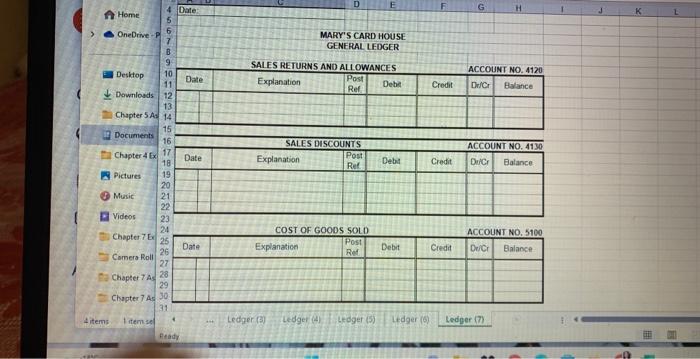

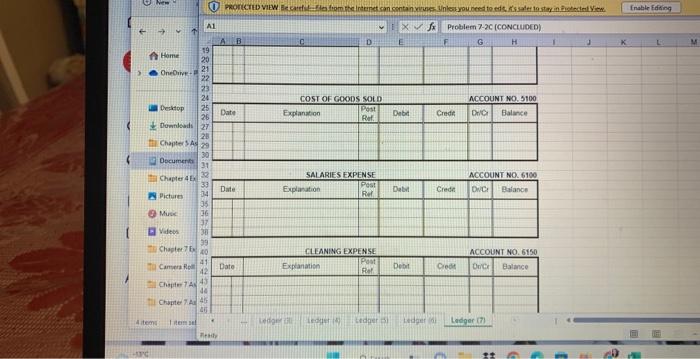

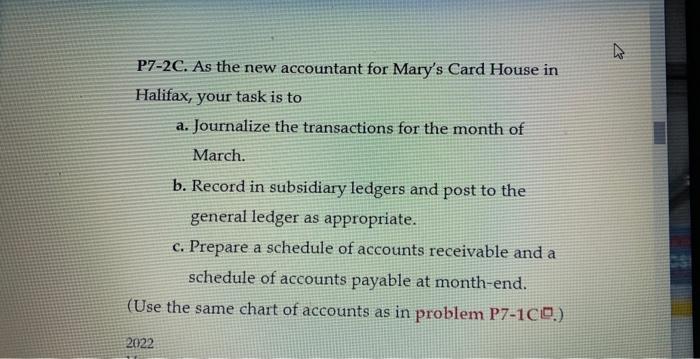

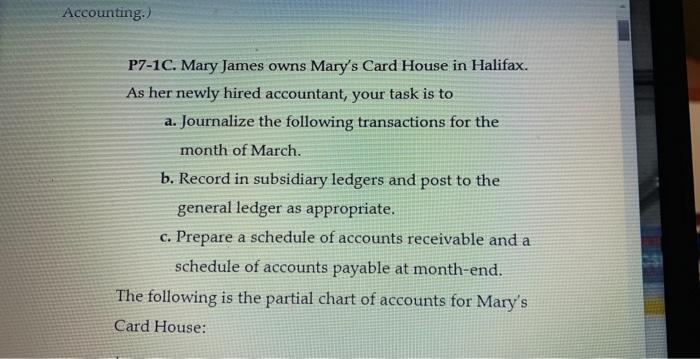

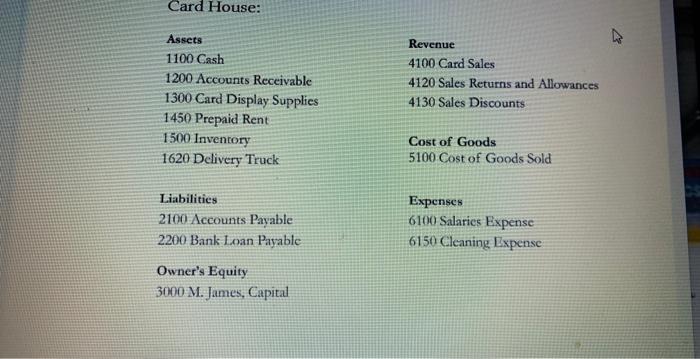

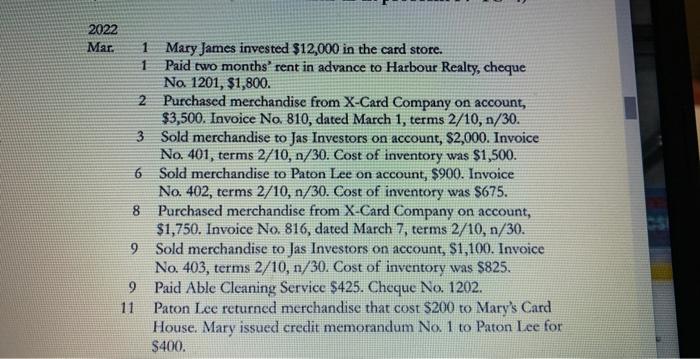

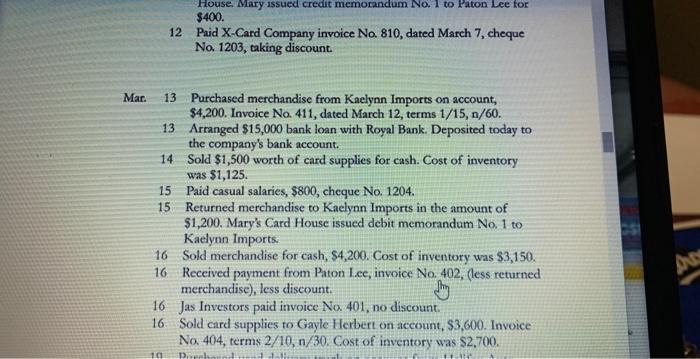

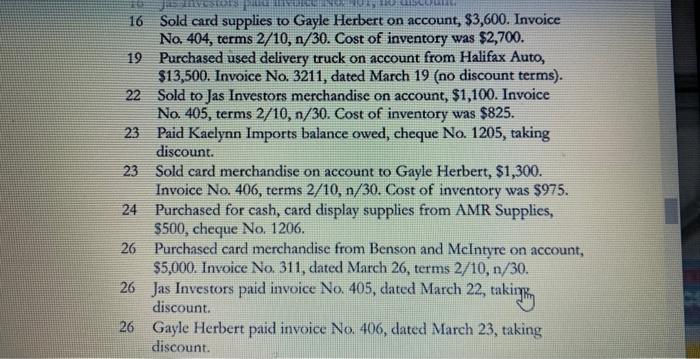

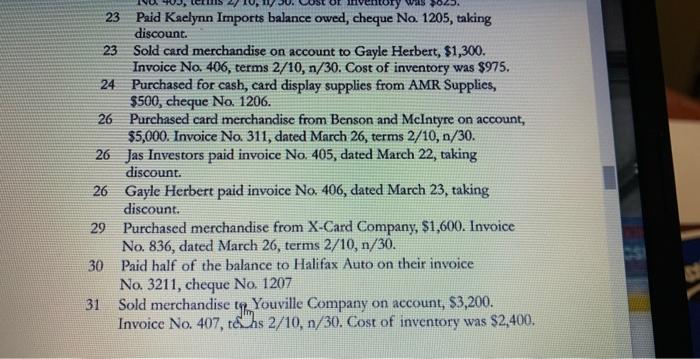

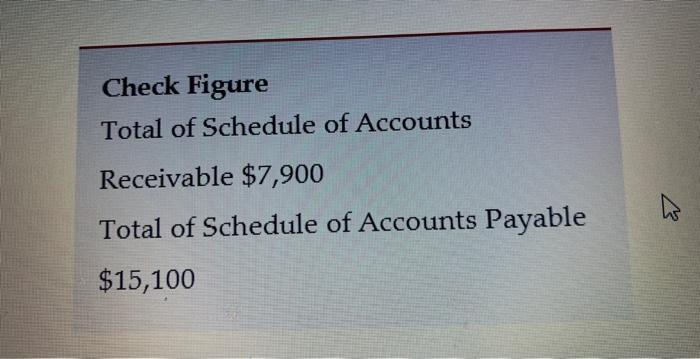

P7-2C. As the new accountant for Mary's Card House in Halifax, your task is to a. Journalize the transactions for the month of March. b. Record in subsidiary ledgers and post to the general ledger as appropriate. c. Prepare a schedule of accounts receivable and a schedule of accounts payable at month-end. (Use the same chart of accounts as in problem P71CD.) P7-1C. Mary James owns Mary's Card House in Halifax. As her newly hired accountant, your task is to a. Journalize the following transactions for the month of March. b. Record in subsidiary ledgers and post to the general ledger as appropriate. c. Prepare a schedule of accounts receivable and a schedule of accounts payable at month-end. The following is the partial chart of accounts for Mary's Card House: The following is the partial chart of accounts for Mary's Card House: 2022 Mar. 1 Mary James invested $12,000 in the card store. 1 Paid two months' rent in advance to Harbour Realty, cheque No. 1201,$1,800. 2 Purchased merchandise from X-Card Company on account, $3,500. Invoice Na. 810 , dated March 1, terms 2/10,n/30. 3 Sold merchandise to Jas Investors on account, $2,000. Invoice No. 401 , terms 2/10,n/30. Cost of inventory was $1,500. 6 Sold merchandise to Paton Lee on account, $900. Invoice No. 402 , terms 2/10,n/30. Cost of inventory was $675. 8 Purchased merchandise from X-Card Company on account, $1,750. Invoice No. 816 , dated March 7. terms 2/10,n/30. 9 Sold merchandise to jas Investors on account, 51,100 . Invoice Na 403 , terms 2/10,n/30. Cost of inventory was $825. 9 Paid Able Cleaning Serviee \$425. Cheque No, 1202. 11 Paton Lee returncd merchandise that cost $200 to Mary's Card House. Mary issucd credit memorandum No I to Paton Lee for $400. 12 Paid X-Card Company invoice Na 810, dared March 7, cheque No. 1203 , taking discount: Mar. 13 Purchased merchandise from Kaelynn Imports on account, $4,200. Invoice No 411 , dated March 12 , terms 1/15,n/60. 13 Arranged $15,000 bank loan with Royal Bank. Deposited today to the company's bank account. 14 Sold $1,500 worth of card supplies for cash. Cost of inventory was $1,125. 15 Paid casual salarics, $800, cheque Na 1204. 15 Returned merchandise to Kaclynn Imports in the amount of \$1,200. Mary's Card House issued debit memorandum No. 1 to Kaclynn Imports. 16 Sold merchandise for eash, $4,200. Cost of inventory was $3,150. 16 Received payment from Paton lec, invoice No. 402, (less returned merchandisc), less discount. 16 Jas Investors paid invoice Na.401, no discount. 16 Sold card supplics to Gayle Herbert on account, $3,600. Invosce No. 404 , terms 2/10,n/30. Cost of inventory was $2,700. 19 Purchased used delivery truek on account from Halifax Auto, $13,500. Invoice Na 3211 , dated March 19 (ne discount terms). 22 Sold to Jas Investors merchandise on account, $1,100. Invoice Na 405, terms 2/10,n/30. Cost of inventory was $825. 23 Paid Kaclynn Imports balance owed, cheque No. 1205, taking discount. 23 Sold card merchandise on aceount to Gayle Herber, $1, te0. Invoice No. 419, terms 2710,n/M. Colt of imventory was $975. No. 404, terms 2710,n/30, Cont of inventory was 52,700. 19 Purchased ased delivery truck on acconnt from Halifax Auto, $13,500. Invoice Na 3211, dated March 19 (no discount terms). 22 Sold to Jas Inveitors merchandise on aceount, $1,100. Invoice No. 405 , terms 2/10,n/30. Cost of inventory was $825. 23 Paid Knelynn Impottr balance cued, cheque No. 1205, taking discount. 23. Sold card merchandise on account to Gayle Herbert, $1,300. Invoice No 406 , terms 2/10, n/30. Cost of inventocy was $975. 24 Purchased for cash, card display rupplies from AMR Supplies, $500, cheue Na1206. 26 Purchased card merchandise from Benson and Mecintyre on account, $5,000. Lnvice Na311, dated March 26 , terms 2/10,n/30. 26 Jas Investors paid invoice Na 405, dated March 22, taking discount. 26. Gayle Herbert paid itwoice No 406, dated March 23, taking discount. 29. Punchased merchandise from X.Card Company, \$1,600, Invoice No 836 , dated March 26 , terms 2/10,n/30. 30) Paid half of the balance to Halifax Auto on their invaice Na 3211, cheque No 1207 31 Sold merchandise to Yoaville Company on account, 93,200. Invoiec No. 402 , terms 2/10,n/30 Cost of inventory was $2,400. Comprehensive review problem: all special journals and the general journal; schedules of accounts payable and accounts receivable Check Figure Total of Schedule of Accounts Receivable $7,900 Total of Schedule of Accounts Payable $15,100 MARY'S CARD HOUSE SAI FS IOIIDNAI MARY'S CARD HOUSE MARY'S CARD HOUSE Section Date: MARY'S CARD HOUSE CASH PAYMENTS JOURNAL PAGE 1 MARY'S CARD HOUSE GENERAL JOURNAL MARY'S CARD HOUSE ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER NAME: YOUVLLE COMPANY ADDRESS: 28 WINCHESIER AVE HAIIFAX NS RAA T? MARY'S CARD HOUSE SCHEDULE OF ACCOUNTS RECEIVABLE MARCH 31, 2022 MARY' S CARD HOUSE ACCOUNTS PAYABLE SUBSIDIARY LEDGER NAME: KAELYNN IMPORTS ARNDECC GOE HADROL ID ST HAI IFAY NS AZA OMA MARY'S CARD HOUSE SCHEDULE OF ACCOUNTS PAYABLE MARCH 31, 2022 MARY' S CARD HOUSE GENERLL LEDGER MARY' C CARD HOUSE GENERAL LEDGER CARN SALES ACCOURBNO.4100 MARY' S CARD HOUSE GENERAL LFDGER P7-2C. As the new accountant for Mary's Card House in Halifax, your task is to a. Journalize the transactions for the month of March. b. Record in subsidiary ledgers and post to the general ledger as appropriate. c. Prepare a schedule of accounts receivable and a schedule of accounts payable at month-end. (Use the same chart of accounts as in problem P7-1CI.) P7-1C. Mary James owns Mary's Card House in Halifax. As her newly hired accountant, your task is to a. Journalize the following transactions for the month of March. b. Record in subsidiary ledgers and post to the general ledger as appropriate. c. Prepare a schedule of accounts receivable and a schedule of accounts payable at month-end. The following is the partial chart of accounts for Mary's Card House: Card House: Assets1100Cash1200AccountsReceivable1300CardDisplaySupplies1450PrepaidRent1500Inventory1620DeliveryTruckRevenue4100CardSales4120SalesReturnsandAllowances4130SalesDiscountsCostofGoods5100CostofGoodsSold Liabilitics Expenses 2100 Accounts Payable 6100 Salarics Expense 2200 Bank Loan Payable 6150 Cleaning Expense Owner's Equity 3000 M. James, Capital 2022 Mar. 1 Mary James invested $12,000 in the card store. 1 Paid two months' rent in advance to Harbour Realty, cheque Na. 1201, \$1,800. 2 Purchased merchandise from X-Card Company on account, $3,500. Invoice No. 810 , dated March 1 , terms 2/10,n/30. 3 Sold merchandise to Jas Investors on account, $2,000. Invoice No. 401, terms 2/10,n/30. Cost of inventory was $1,500. 6 Sold merchandise to Paton Lee on account, $900. Invoice No. 402 , terms 2/10,n/30. Cost of inventory was $675. 8 Purchased merchandise from X-Card Company on account, $1,750. Invoice N0,816, dated March 7, terms 2/10,n/30. 9 Sold merchandise to Jas Investors on account, $1,100. Invoice No. 403 , terms 2/10,n/30. Cost of inventory was $825. 9 Paid Able Cleaning Service \$425. Cheque No. 1202. 11 Paton Lee returned merchandise that cost $200 to Mary's Card House. Mary issued credit memorandum No. 1 to Paton Lee for $400. 12 Paid X-Card Company invoice No. 810, dated March 7, cheque No. 1203, taking discount. Mar. 13 Purchased merchandise from Kaelynn Imports on account, $4,200. Invoice No. 411, dated March 12, terms 1/15,n/60. 13 Arranged $15,000 bank loan with Royal Bank. Deposited today to the company's bank account. 14 Sold $1,500 worth of card supplies for cash. Cost of inventory was $1,125. 15 Paid casual salaries, $800, cheque No. 1204. 15 Returned merchandise to Kaelynn Imports in the amount of \$1,200. Mary's Card House issued debit memorandum No. 1 to Kaelynn Imports. 16 Sold merchandise for cash, $4,200. Cost of inventory was $3,150. 16 Received payment from Paton Lee, invoice No. 402, (less returned merchandise), Iess discount. 16 Jas Investors paid invoice Na 401, no discount. 16. Sold card supplies to Gayle Herbert on account, $3,600. Invoice No. 404 , terms 2/10,n/30. Cost of inventory was $2.700. 16 Sold card supplies to Gayle Herbert on account, \$3,600. Invoice No. 404 , terms 2/10,n/30. Cost of inventory was $2,700. 19 Purchased used delivery truck on account from Halifax Auto, \$13,500. Invoice No. 3211, dated March 19 (no discount terms). 22 Sold to Jas Investors merchandise on account, $1,100. Invoice No. 405 , terms 2/10,n/30. Cost of inventory was $825. 23 Paid Kaelynn Imports balance owed, cheque No. 1205, taking discount. 23 Sold card merchandise on account to Gayle Herbert, $1,300. Invoice No. 406, terms 2/10,n/30. Cost of inventory was $975. 24 Purchased for cash, card display supplies from AMR Supplies, $500, cheque No. 1206. 26 Purchased card merchandise from Benson and Mcintyre on account, $5,000. Invoice No. 311, dated March 26, terms 2/10,n/30. 26 Jas Investors paid invoice No. 405, dated March 22, takigrt discount. 26 Gayle Herbert paid invoice No. 406, dated March 23, taking discount. 23 Paid Krelynn Imports balance owed, cheque No. 1205, taking discount. 23 Sold card merchandise on account to Gayle Herbert, $1,300. Invoice No,406, terms 2/10,n/30. Cost of inventory was $975. 24 Purchased for cash, card display supplies from AMR Supplies, $500, cheque Na. 1206. 26 Purchased card merchandise from Benson and Mclntyre on account, $5,000. Invoice Na.311, dated March 26 , terms 2/10,n/30. 26 Jas Investors paid invoice Na. 405, dated March 22, taking discount. 26 Gayle Herbert paid invoice No. 406, dated March 23, taking discount. 29 Purchased merchandise from X-Card Company, \$1,600. Invoice No. 836 , dated March 26 , terms 2/10,n/30. 30 Paid half of the balance to Halifax Auto on their invoice No. 3211 , cheque No. 1207 31 Sold merchandise tgf Youville Company on account, $3,200. Invoice No. 407, te hs 2/10,n/30. Cost of inventory was $2,400. Comprehensive review problem: all special journals and the general journal; schedules of accounts payable and accounts receivable Check Figure Total of Schedule of Accounts Receivable $7,900 Total of Schedule of Accounts Payable $15,100