Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P7-6 can u show me how to solve it includes step by step for the answer?also the answer for the question of course thank you

P7-6 can u show me how to solve it includes step by step for the answer?also the answer for the question of course thank you

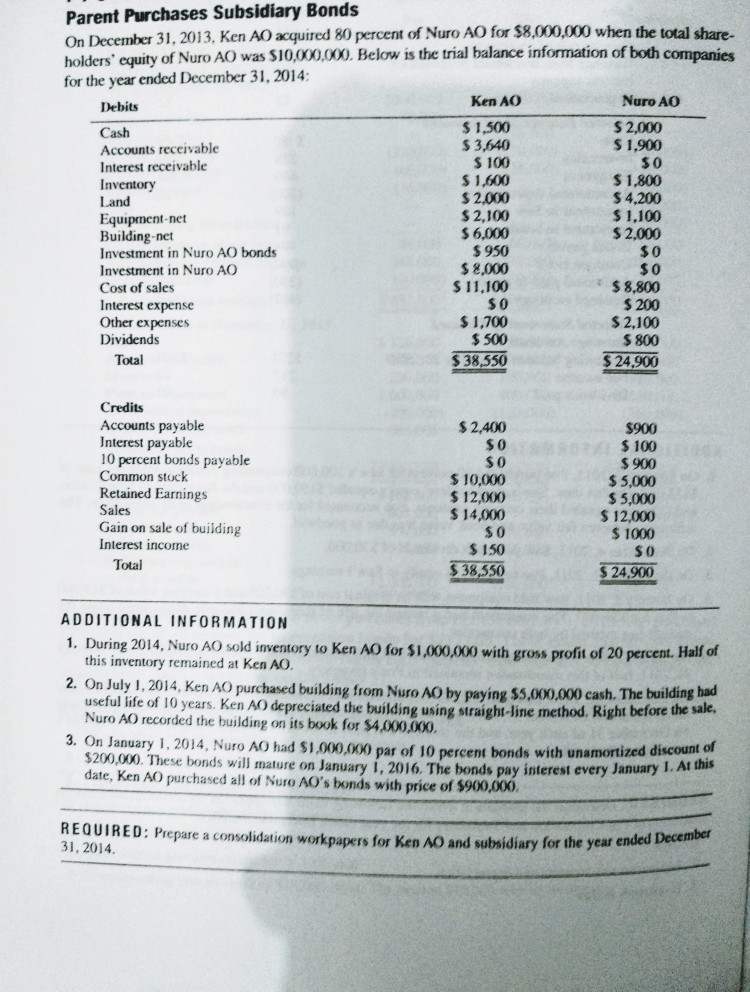

Parent Purchases Subsidiary Bond:s On December 31, 2013, Ken AO acquired 80 percent of Nuro AO for $8,000,000 when the total share- holders' equity of Nuro AO was $10,000,000. Below is the trial balance information of both companies for the year ended December 31, 2014: Ken AO Nuro AC $ 1,500 $ 3,640 $ 100 S 1,600 2,000 $ 2,100 S 6,000 $ 1,900 Accounts receivable Interest receivable Inventory $ 1,800 S 4,200 $ 1,100 $ 2,000 Equipment-net Building-net Investment in Nuro AO bonds Investment in Nuro AO Cost of sales Interest expense Other expenses Dividends $ 8,000 $ 11,100 $ 8,800 $ 2,100 $ 24,900 $1,700 $38,550 Accounts payable Interest payable 10 percent bonds payable Common stock Retained Earnings $ 2,400 $ 100 $ 10,000 $ 12,000 $ 14,000 $ 5,000 $ 5,000 12,000 $ 1000 Gain on sale of building Interest income $38,550 24,900 ADDITIONAL INFORMATION uring 2014, Nuro AO sold inventory to Ken A0 for $1,000,000 with gross profit of 20 percent. Half of this inventory remained at Ken AO. 2. On July 1.2014, Ken A0 purchased building from Nuro AO by paying $5, 000.000 cash. The building had useful life of 10 years. Ken AO depreciated the building using straight-line method. Rig Nuro AO recorded the building on its book for $4000,000 3. On January 1, 2014, Nuro AO had $1,000,000 par of 10 percent bonds with unamorti $200,000. These bonds will mature on January i, 2016. The bonds pay interest every Jan date, Ken AO purchased all of Nuro AO's bonds with price of $900,000 RE QU?RE D : Prepare a consolidation workpapers for Ken AO and subsidiary fo the year 31, 2014 mberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started