Answered step by step

Verified Expert Solution

Question

1 Approved Answer

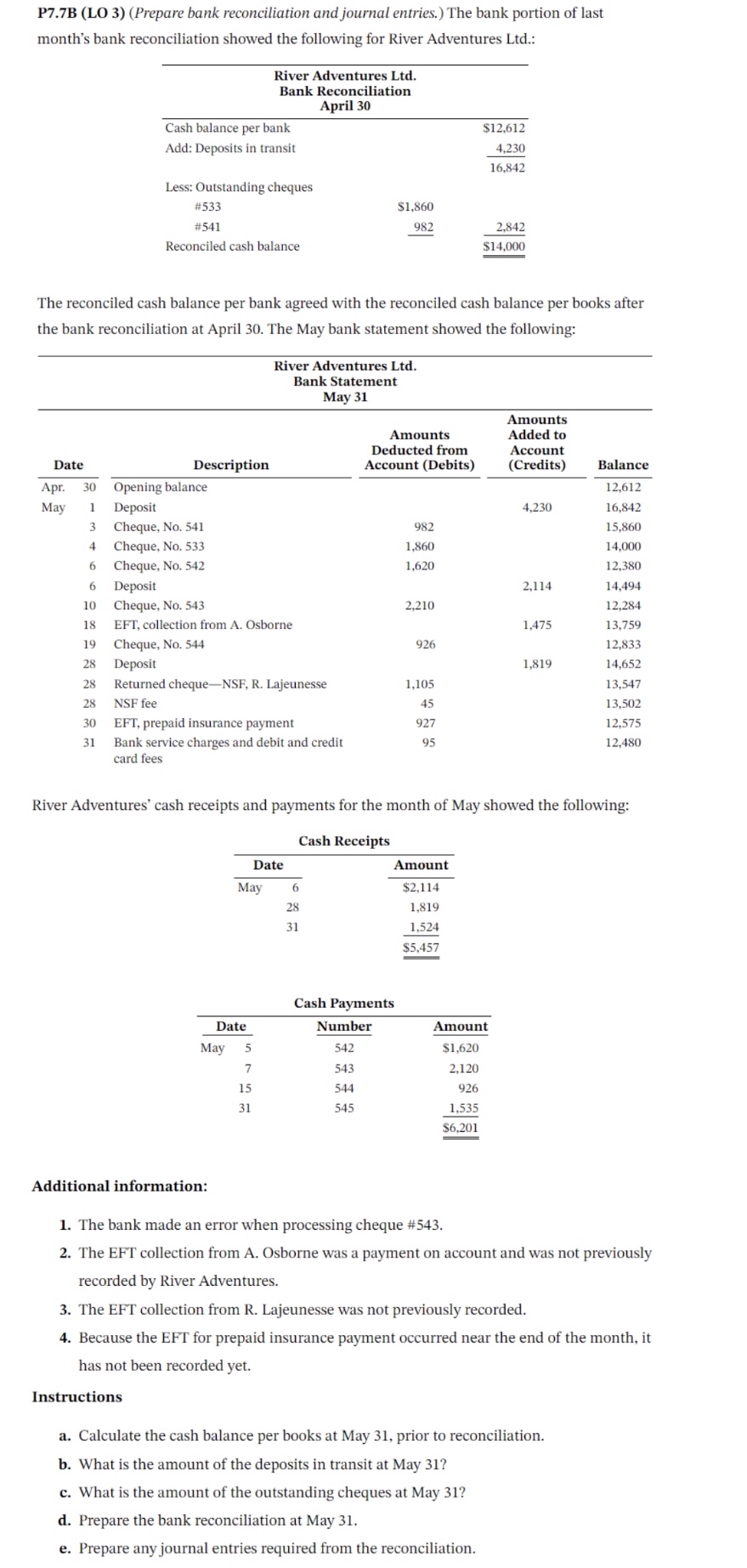

P7.7B (LO 3) (Prepare bank reconciliation and journal entries.) The bank portion of last month's bank reconciliation showed the following for River Adventures Ltd.:

P7.7B (LO 3) (Prepare bank reconciliation and journal entries.) The bank portion of last month's bank reconciliation showed the following for River Adventures Ltd.: River Adventures Ltd. Bank Reconciliation April 30 Cash balance per bank Add: Deposits in transit $12,612 4.230 16,842 Less: Outstanding cheques #533 #541 $1,860 982 2,842 Reconciled cash balance $14,000 The reconciled cash balance per bank agreed with the reconciled cash balance per books after the bank reconciliation at April 30. The May bank statement showed the following: River Adventures Ltd. Bank Statement May 31 Date Description Amounts Deducted from Account (Debits) Amounts Added to Account (Credits) Balance Apr. 30 Opening balance 12,612 May 1 Deposit 4,230 16,842 3 Cheque, No. 541 982 15.860 4 Cheque, No. 533 1,860 14,000 6 Cheque, No. 542 1,620 12,380 6 Deposit 2,114 14,494 10 Cheque, No. 543 2,210 12,284 18 EFT, collection from A. Osborne 1,475 13,759 19 Cheque, No. 544 926 12,833 28 Deposit 1,819 14,652 28 Returned cheque-NSF, R. Lajeunesse 1,105 13,547 28 NSF fee 45 13.502 30 EFT, prepaid insurance payment 927 12,575 31 Bank service charges and debit and credit card fees 95 12,480 River Adventures' cash receipts and payments for the month of May showed the following: Cash Receipts Date Amount May 6 $2,114 28 1,819 31 1,524 $5.457 Cash Payments Date Number Amount May 5 542 $1,620 7 543 2,120 15 544 926 31 545 1,535 $6,201 Additional information: 1. The bank made an error when processing cheque #543. 2. The EFT collection from A. Osborne was a payment on account and was not previously recorded by River Adventures. 3. The EFT collection from R. Lajeunesse was not previously recorded. 4. Because the EFT for prepaid insurance payment occurred near the end of the month, it has not been recorded yet. Instructions a. Calculate the cash balance per books at May 31, prior to reconciliation. b. What is the amount of the deposits in transit at May 31? c. What is the amount of the outstanding cheques at May 31? d. Prepare the bank reconciliation at May 31. e. Prepare any journal entries required from the reconciliation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started