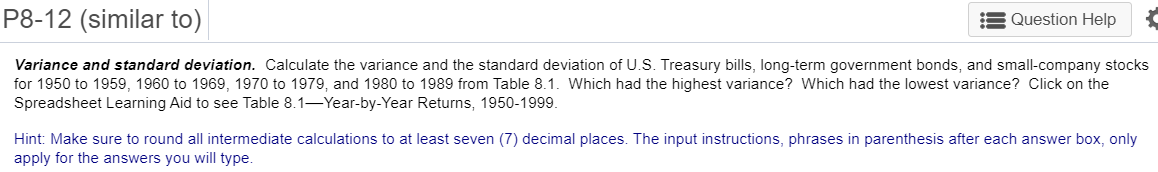

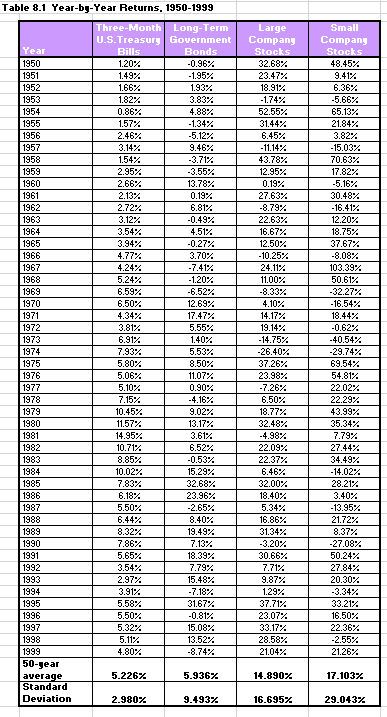

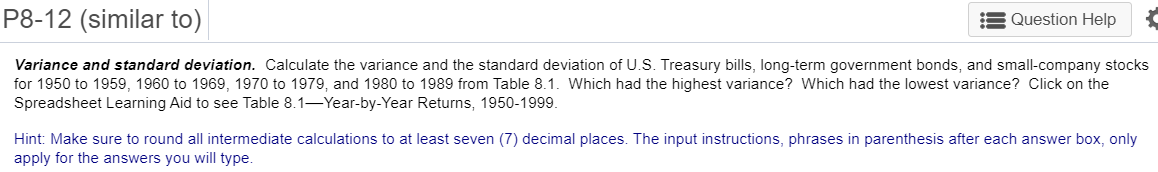

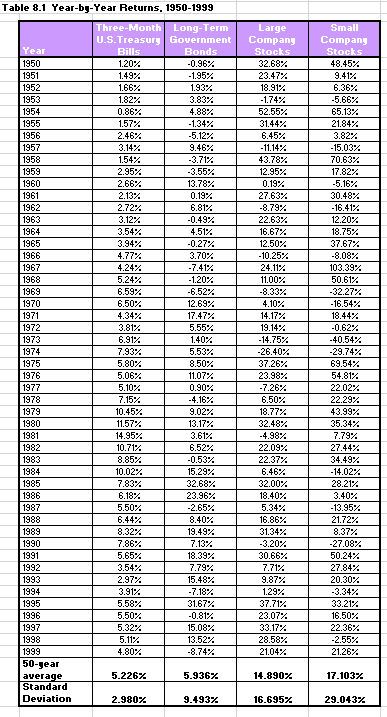

P8-12 (similar to) 8 Question Help Variance and standard deviation. Calculate the variance and the standard deviation of U.S. Treasury bills, long-term government bonds, and small-company stocks for 1950 to 1959, 1960 to 1969, 1970 to 1979, and 1980 to 1989 from Table 8.1. Which had the highest variance? Which had the lowest variance? Click on the Spreadsheet Learning Aid to see Table 8.1-Year-by-Year Returns, 1950-1999. Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases in parenthesis after each answer box, only apply for the answers you will type. Table 8.1 Year-by-Year Returns, 1950-1999 Year 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 Three-Month Long-Term U.S.TreasuryGovernment Bills Bonds 1.20% 0.96% 1.49% -1.95% 1.66% 1.93%. 1.82% 3.83% 0.86% 4.88% 1.57% -134% 2.46% 5.12% 3.14% 9.46% 154%. -3.71% 2.95% -3.55% 2.66% 13.78% 2.13% 0.19% 2.72% 6.81% 3.12% -0.49% 3.54% 4.51% 3.94% -0.27% 4.77% 3.70% 4.24% -7.417 5.24% -1.20% 6.59% -6.52% 6.50% 12.69% 4.34% 17.47% 3.81% 5.55% 6.91% 1.40% 7.93% 5.53% 5.80% 8.50% 5.06% 11.07% 5.10% 0.90% 7.15% -4.16% 10.45% 9.02% 11.57% 13.17% 14.95% 3.61% 10.71% 6.52% 8.85% -0.53% 10.02% 15.29% 7.83% 32.68% 6.18% 23.96% 5.50% -2.65% 6.44% 8.40% 8.32% 19.49% 7.86% 7.13% 5.65% 18.39% 3.54% 7.79% 2.97% 15.48% 3.91% -7.18% 5.58% 3167% 5.50% -0.81% 5.32% 15.08% 5.11% 13.52% 4.80% -8.74% Large Company Stocks 32.68% 23.47% 18.91% -174% 52.55% 31.44% 6.45% - 11.14% 43.78% 12.95% 0.19% 27.63% -8.79% 22.63% 16.67% 12.50% -10.25% 24.11% 11.00% -8.33% 4.10% 14.17% 19.14% - 14.75% -26.40% 37.26% 23.98% -7.26% 6.50% 18.77% 32.48% -4.98% 22.09% 22.37% 6.46% 32.00% 18.40% 5.34% 16.86% 3134% -3.20% 30.66% 7.71% 9.87% 129% 37.71% 23.07% 33.17% 28.58% 21.04% Company Stock 48.45% 9.41% 6.36% -5.66% 65.13% 2184% 3.82% -15.03% 70.63% 17.82% -5.16% 30.48% -16.41% 12.20% 18.75% 37.67% -8.08% 103.39% 50.61%. -32.27% -16.54% 18.44% -0.62% -40.54% -29.74% 69.54% 54.81% 22.02% 22.29% 43.99% 35.34% 7.79% 27.44% 34.49% -14.02% 28.21% 3.40% -13.95% 2172% 8.37% -27.08% 50.24% 27.84% 20.30% -3.34% 33.21% 16.50% 22.36% -2.55% 21.26% 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 50-gear average Standard Deviation 5.226% 5.936% 14.890% 17.103% 2.980% 9.4937 16.695% 29.043% P8-12 (similar to) 8 Question Help Variance and standard deviation. Calculate the variance and the standard deviation of U.S. Treasury bills, long-term government bonds, and small-company stocks for 1950 to 1959, 1960 to 1969, 1970 to 1979, and 1980 to 1989 from Table 8.1. Which had the highest variance? Which had the lowest variance? Click on the Spreadsheet Learning Aid to see Table 8.1-Year-by-Year Returns, 1950-1999. Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases in parenthesis after each answer box, only apply for the answers you will type. Table 8.1 Year-by-Year Returns, 1950-1999 Year 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 Three-Month Long-Term U.S.TreasuryGovernment Bills Bonds 1.20% 0.96% 1.49% -1.95% 1.66% 1.93%. 1.82% 3.83% 0.86% 4.88% 1.57% -134% 2.46% 5.12% 3.14% 9.46% 154%. -3.71% 2.95% -3.55% 2.66% 13.78% 2.13% 0.19% 2.72% 6.81% 3.12% -0.49% 3.54% 4.51% 3.94% -0.27% 4.77% 3.70% 4.24% -7.417 5.24% -1.20% 6.59% -6.52% 6.50% 12.69% 4.34% 17.47% 3.81% 5.55% 6.91% 1.40% 7.93% 5.53% 5.80% 8.50% 5.06% 11.07% 5.10% 0.90% 7.15% -4.16% 10.45% 9.02% 11.57% 13.17% 14.95% 3.61% 10.71% 6.52% 8.85% -0.53% 10.02% 15.29% 7.83% 32.68% 6.18% 23.96% 5.50% -2.65% 6.44% 8.40% 8.32% 19.49% 7.86% 7.13% 5.65% 18.39% 3.54% 7.79% 2.97% 15.48% 3.91% -7.18% 5.58% 3167% 5.50% -0.81% 5.32% 15.08% 5.11% 13.52% 4.80% -8.74% Large Company Stocks 32.68% 23.47% 18.91% -174% 52.55% 31.44% 6.45% - 11.14% 43.78% 12.95% 0.19% 27.63% -8.79% 22.63% 16.67% 12.50% -10.25% 24.11% 11.00% -8.33% 4.10% 14.17% 19.14% - 14.75% -26.40% 37.26% 23.98% -7.26% 6.50% 18.77% 32.48% -4.98% 22.09% 22.37% 6.46% 32.00% 18.40% 5.34% 16.86% 3134% -3.20% 30.66% 7.71% 9.87% 129% 37.71% 23.07% 33.17% 28.58% 21.04% Company Stock 48.45% 9.41% 6.36% -5.66% 65.13% 2184% 3.82% -15.03% 70.63% 17.82% -5.16% 30.48% -16.41% 12.20% 18.75% 37.67% -8.08% 103.39% 50.61%. -32.27% -16.54% 18.44% -0.62% -40.54% -29.74% 69.54% 54.81% 22.02% 22.29% 43.99% 35.34% 7.79% 27.44% 34.49% -14.02% 28.21% 3.40% -13.95% 2172% 8.37% -27.08% 50.24% 27.84% 20.30% -3.34% 33.21% 16.50% 22.36% -2.55% 21.26% 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 50-gear average Standard Deviation 5.226% 5.936% 14.890% 17.103% 2.980% 9.4937 16.695% 29.043%