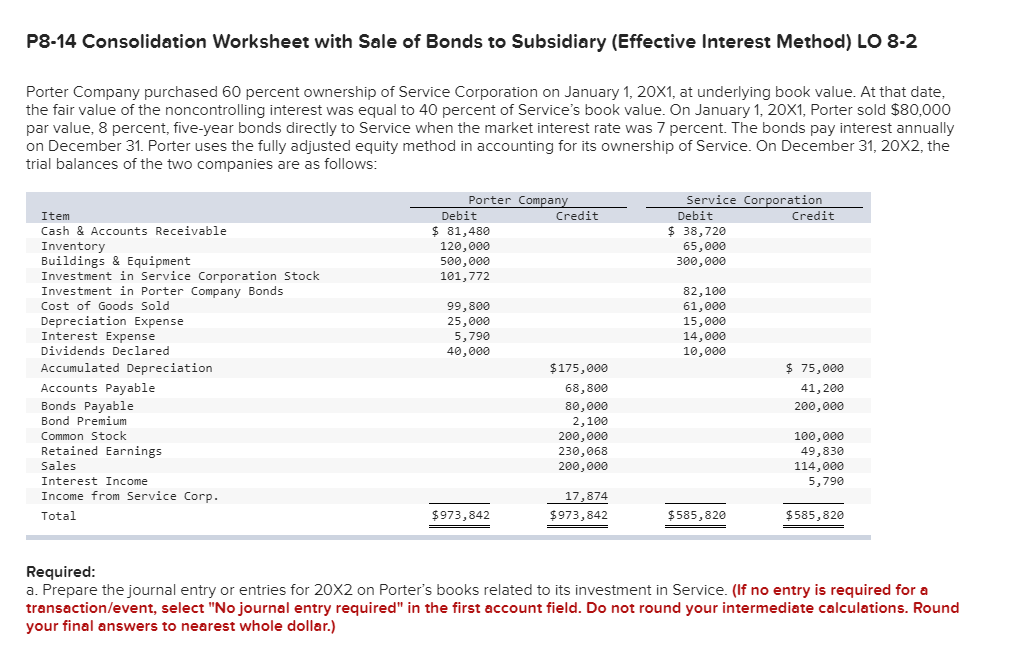

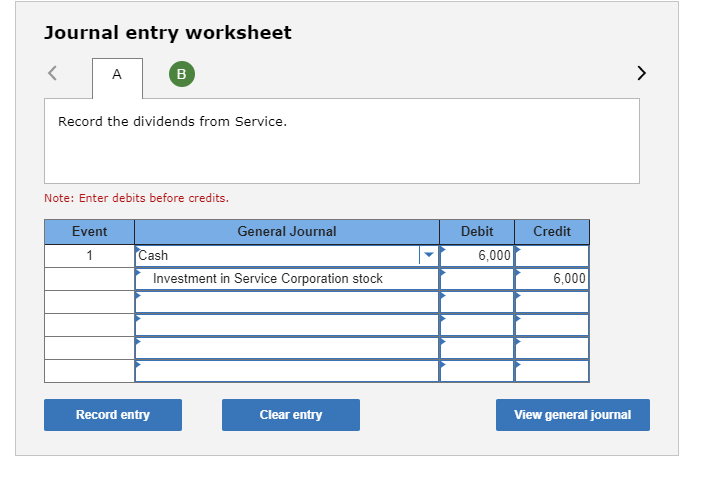

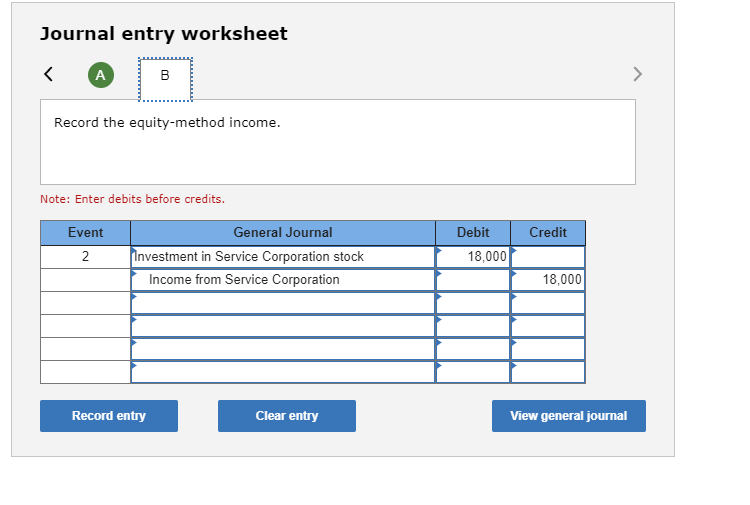

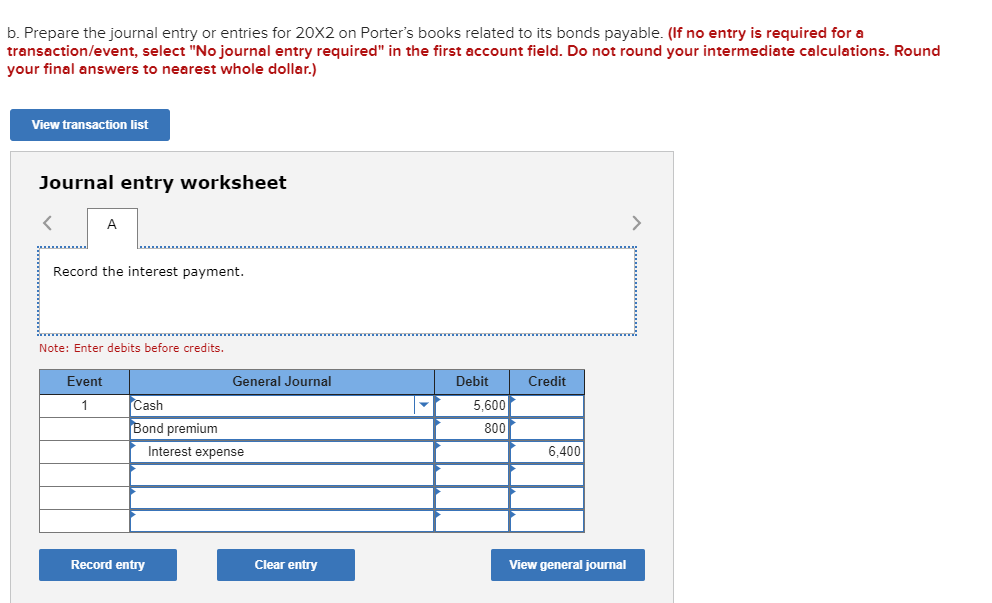

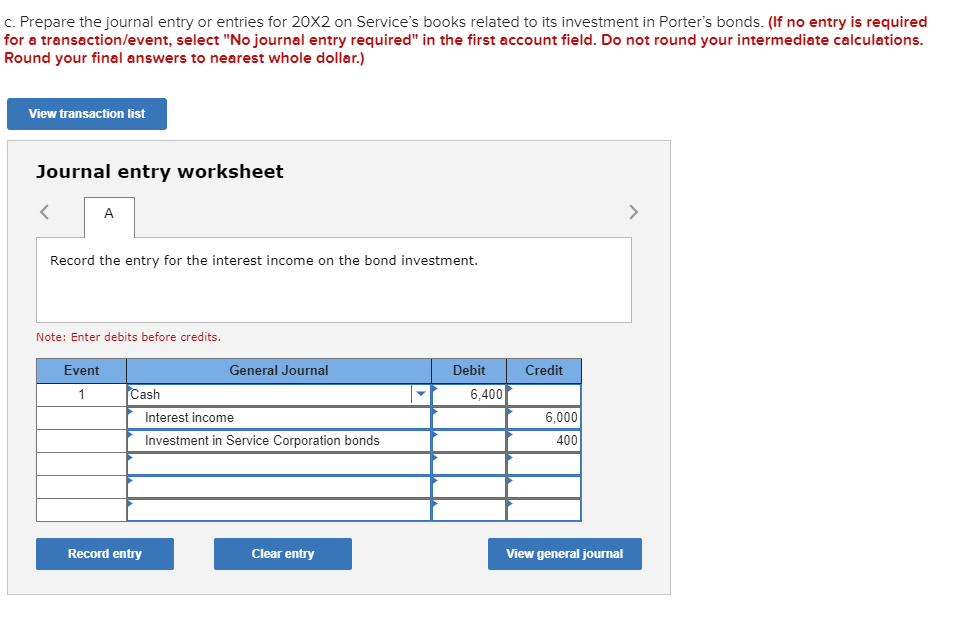

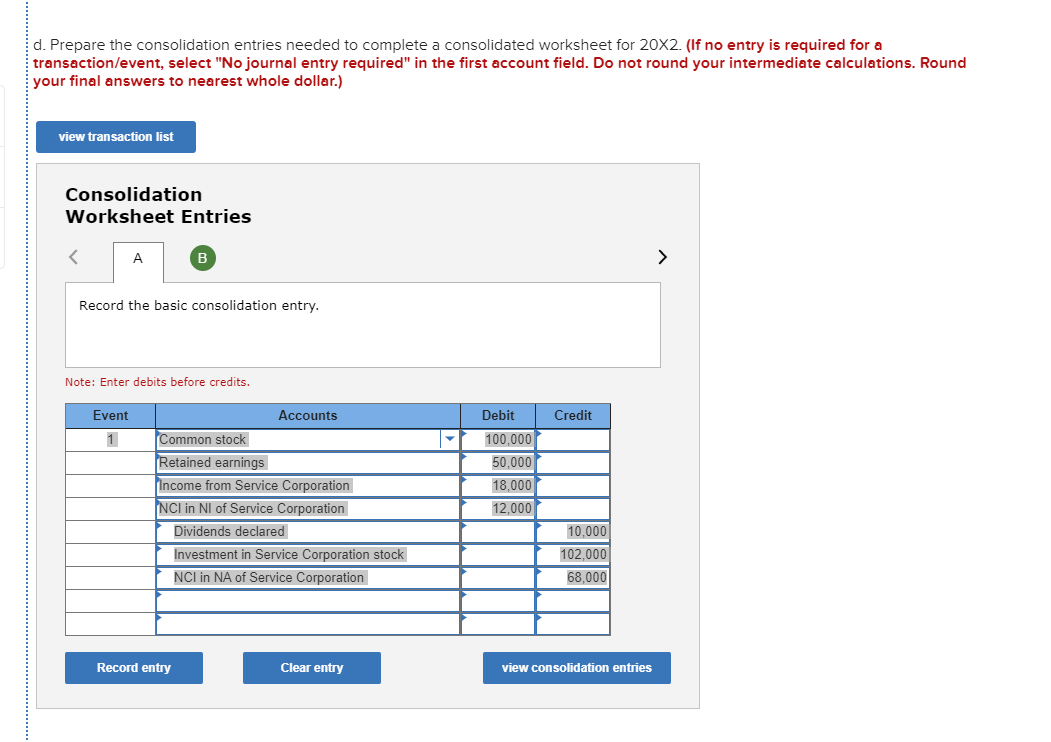

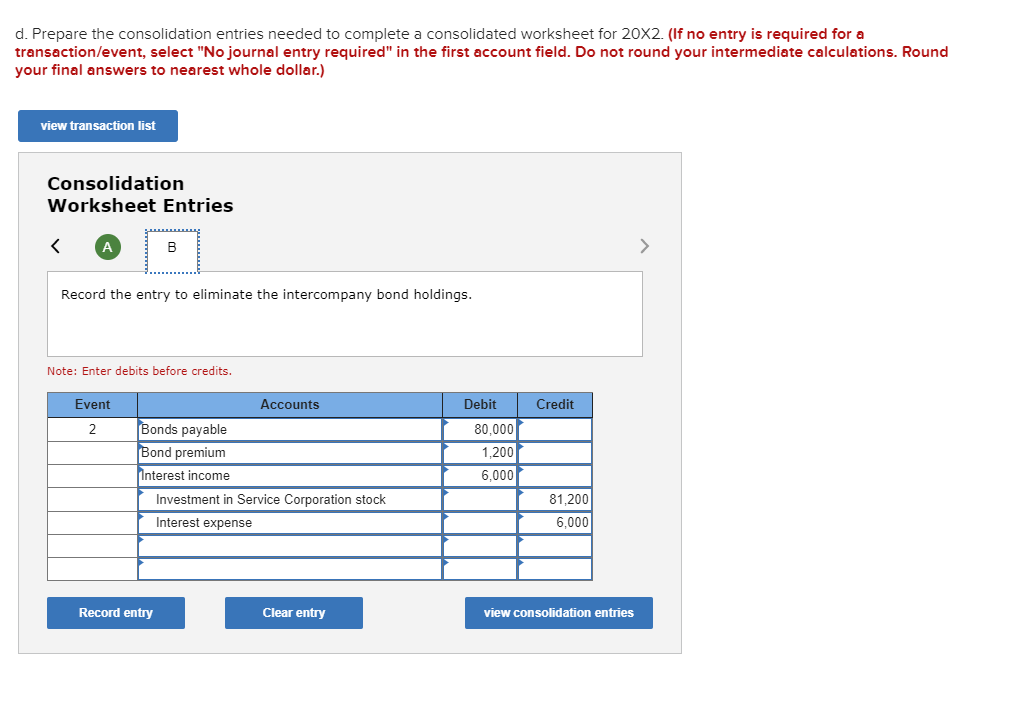

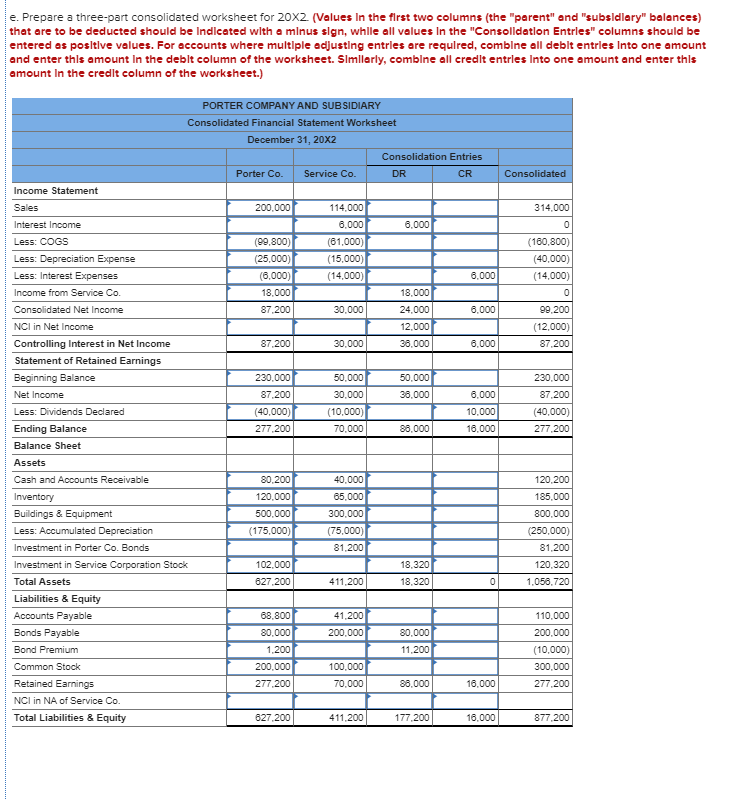

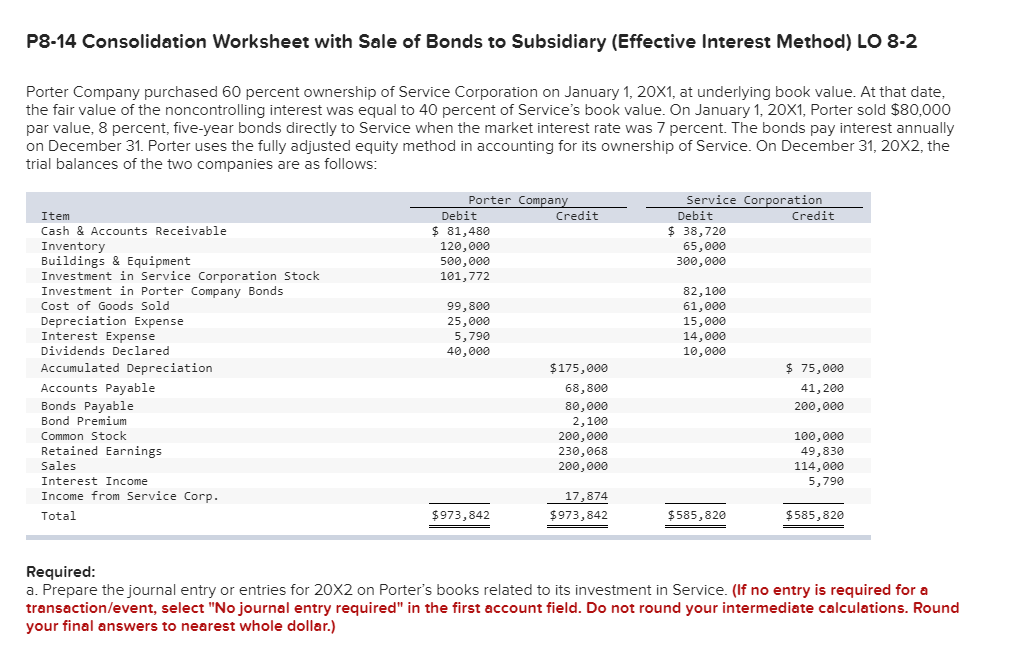

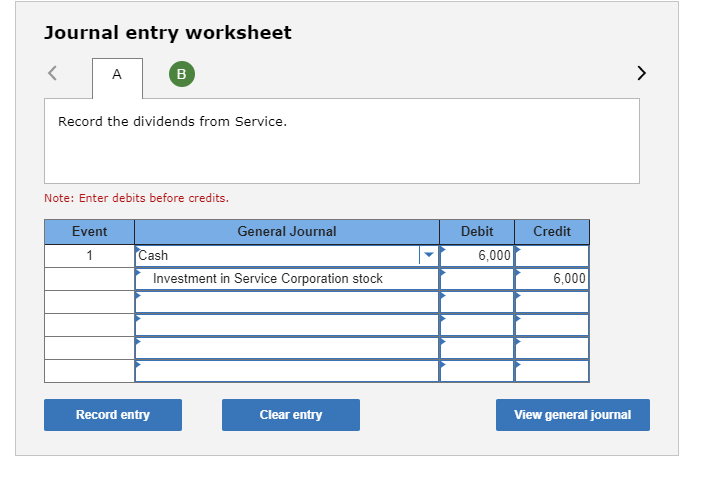

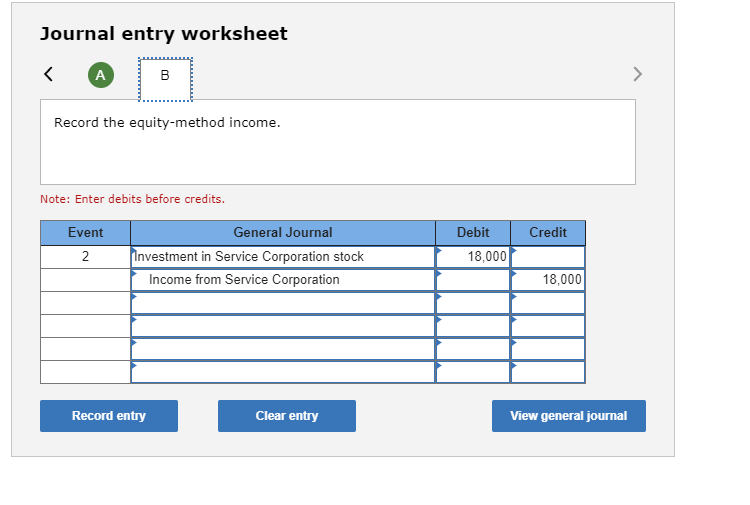

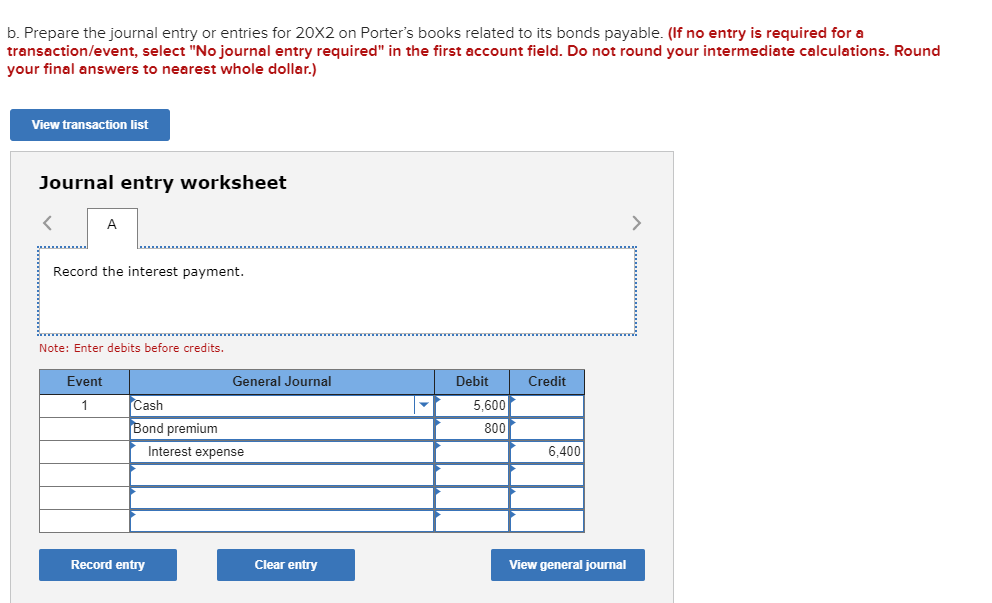

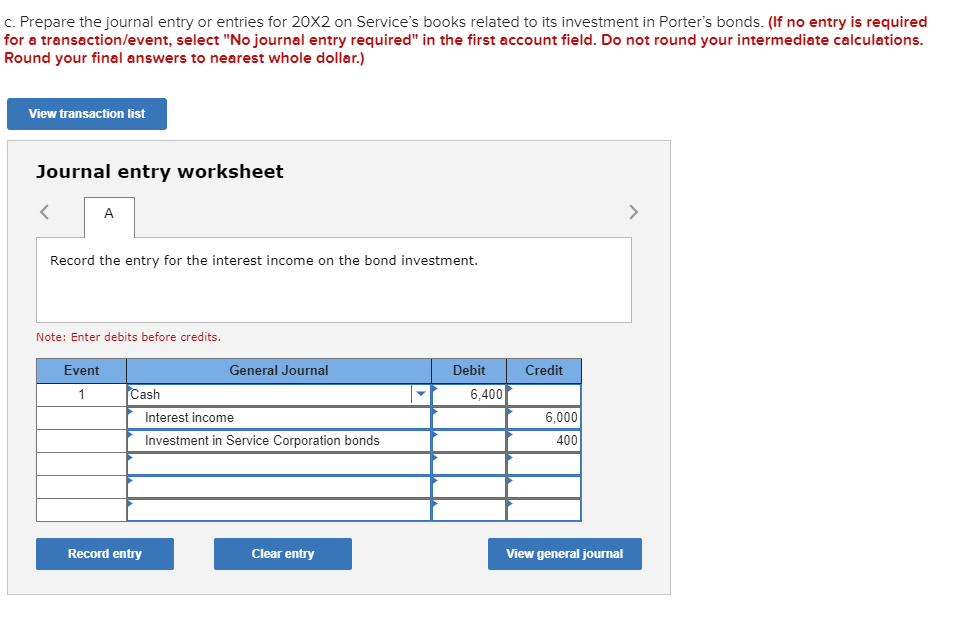

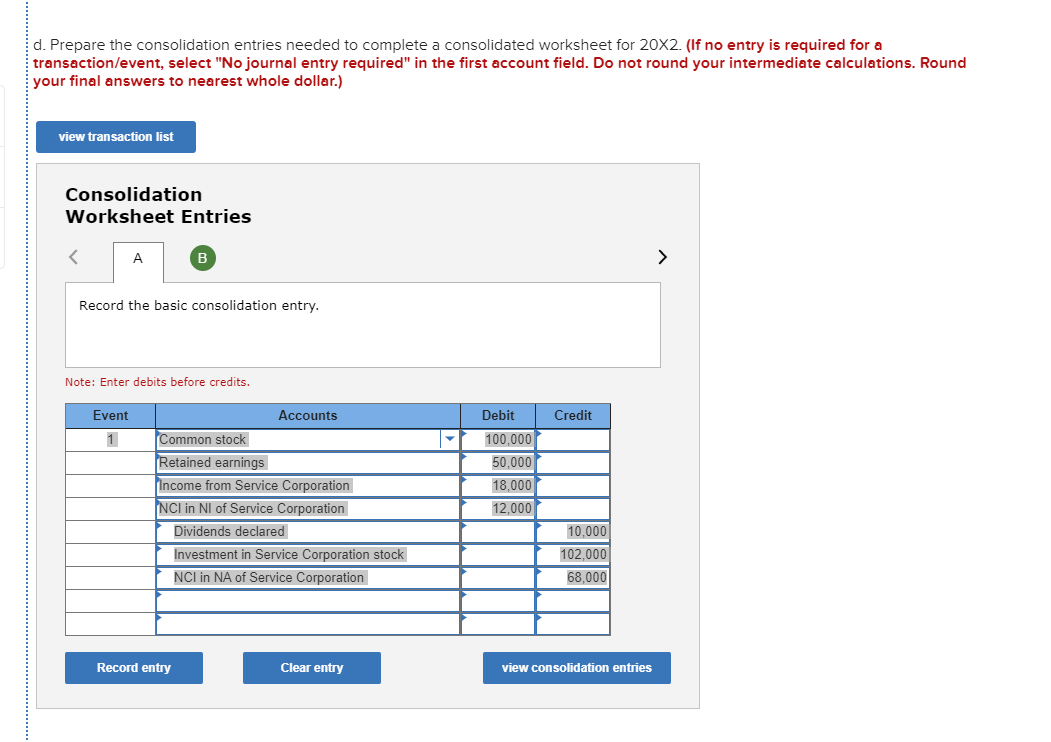

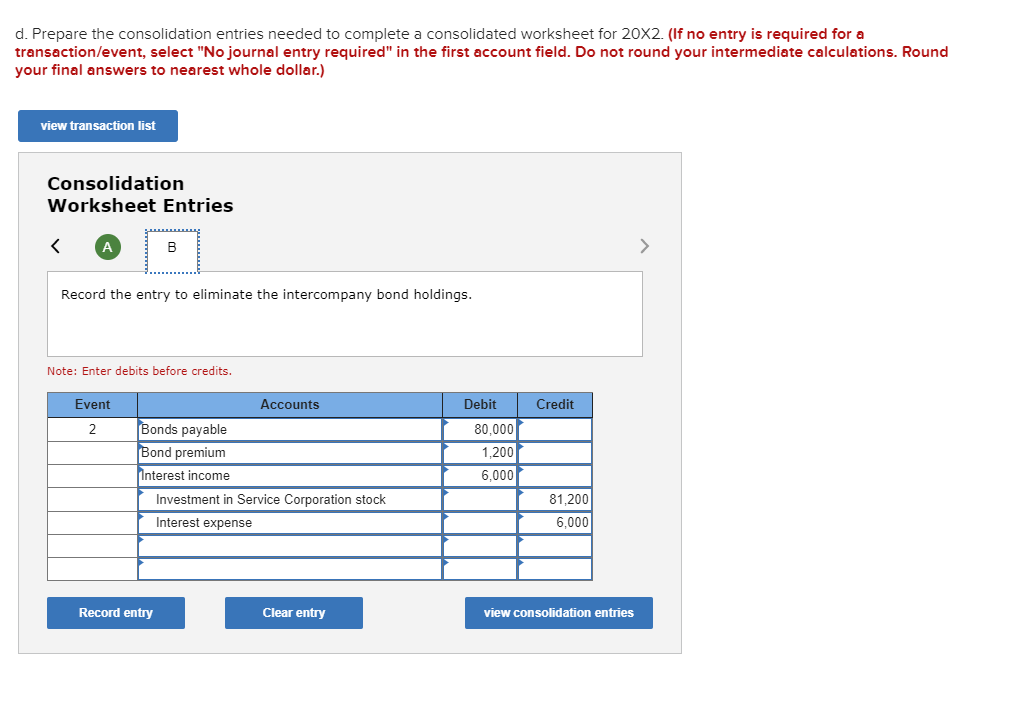

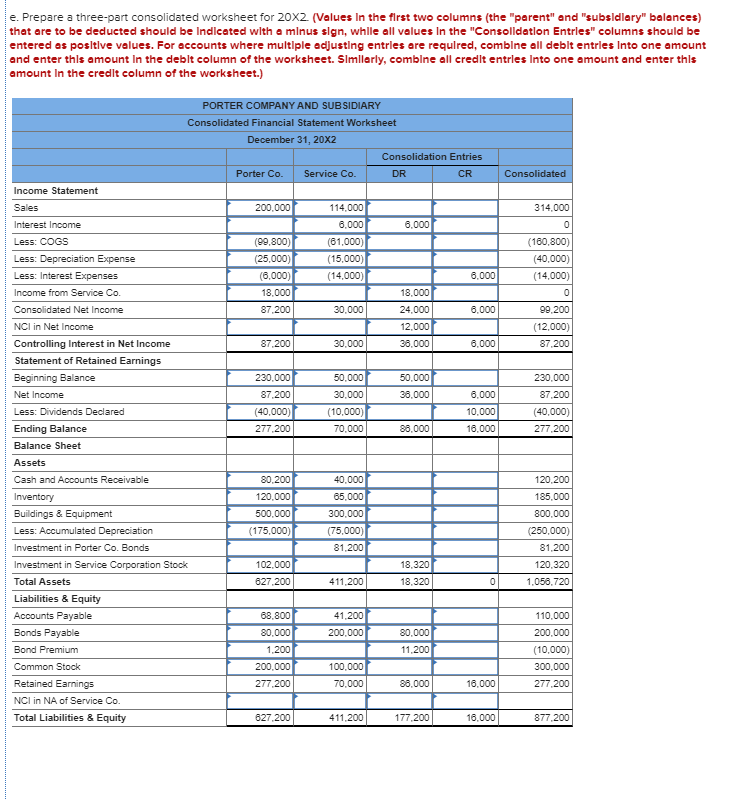

P8-14 Consolidation Worksheet with Sale of Bonds to Subsidiary (Effective Interest Method) LO 8-2 Porter Company purchased 60 percent ownership of Service Corporation on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Service's book value. On January 1, 20X1, Porter sold $80,000 par value, 8 percent, five-year bonds directly to Service when the market interest rate was 7 percent. The bonds pay interest annually on December 31. Porter uses the fully adjusted equity method in accounting for its ownership of Service. On December 31, 20X2, the trial balances of the two companies are as follows: Porter Company Debit Credit $ 81,480 120,000 500,000 101,772 Service Corporation Debit Credit $ 38,720 65,000 300,000 99,800 25,000 5,790 40,000 82,100 61,000 15,000 14,000 10,000 Item Cash & Accounts Receivable Inventory Buildings & Equipment Investment in Service Corporation Stock Investment in Porter Company Bonds Cost of Goods Sold Depreciation Expense Interest Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Bond Premium Common Stock Retained Earnings Sales Interest Income Income from Service Corp. Total $ 75,000 41,200 200,000 $175,000 68,800 80,000 2,100 200,000 230,068 200,000 100,000 49,830 114,000 5,790 17,874 $973, 842 $973.842 $585,820 $585,820 Required: a. Prepare the journal entry or entries for 20x2 on Porter's books related to its investment in Service. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) Journal entry worksheet Record the dividends from Service. Note: Enter debits before credits. Event Credit General Journal Cash Investment in Service Corporation stock Debit 6,000 6,000 Record entry Clear entry View general journal Journal entry worksheet Record the equity-method income. Note: Enter debits before credits. Event Credit General Journal Investment in Service Corporation stock Income from Service Corporation Debit 18,000 18,000 Record entry Clear entry View general journal b. Prepare the journal entry or entries for 20x2 on Porter's books related to its bonds payable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) View transaction list Journal entry worksheet Record the interest payment. Note: Enter debits before credits. Credit Event 1 General Journal Cash Bond premium Interest expense Debit 5,600 800 r 6,400 Record entry Clear entry View general journal c. Prepare the journal entry or entries for 20x2 on Service's books related to its investment in Porter's bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) View transaction list Journal entry worksheet Record the entry for the interest income on the bond investment. Note: Enter debits before credits. Event Credit General Journal Cash Interest income Investment in Service Corporation bonds Debit 6,400 6,000 Record entry Clear entry View general journal d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) view transaction list Consolidation Worksheet Entries Record the basic consolidation entry. Note: Enter debits before credits. Event Credit Accounts Common stock Retained earnings Income from Service Corporation NCI in NI of Service Corporation Dividends declared [ Investment in Service Corporation stock NCI in NA of Service Corporation Debit 100,000 50,000 18,000 12,000 10,000 102,000 68,000 Record entry Clear entry view consolidation entries d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X2. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) view transaction list Consolidation Worksheet Entries