Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P8-3 Recording and Reporting Accrued Liabilities and Deferred Revenue and Financial Statement Effects with Discussion LO8-1 During its first year of operations, Riverside Company completed

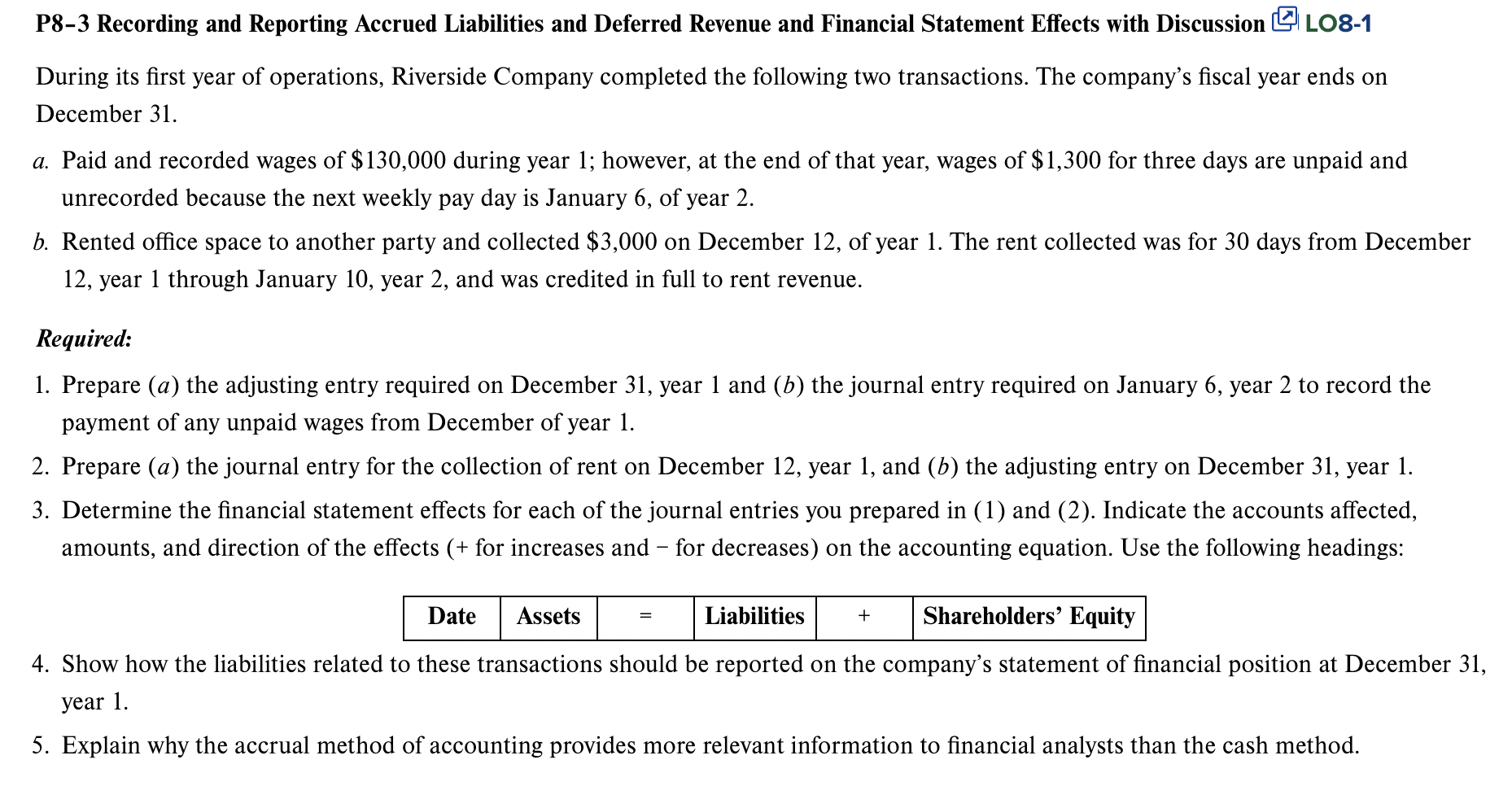

P8-3 Recording and Reporting Accrued Liabilities and Deferred Revenue and Financial Statement Effects with Discussion LO8-1 During its first year of operations, Riverside Company completed the following two transactions. The company's fiscal year ends on December 31 . a. Paid and recorded wages of $130,000 during year 1; however, at the end of that year, wages of $1,300 for three days are unpaid and unrecorded because the next weekly pay day is January 6 , of year 2 . b. Rented office space to another party and collected $3,000 on December 12 , of year 1 . The rent collected was for 30 days from December 12 , year 1 through January 10 , year 2, and was credited in full to rent revenue. Required: 1. Prepare (a) the adjusting entry required on December 31, year 1 and (b) the journal entry required on January 6 , year 2 to record the payment of any unpaid wages from December of year 1. 2. Prepare (a) the journal entry for the collection of rent on December 12, year 1, and (b) the adjusting entry on December 31 , year 1. 3. Determine the financial statement effects for each of the journal entries you prepared in (1) and (2). Indicate the accounts affected, amounts, and direction of the effects (+ for increases and - for decreases) on the accounting equation. Use the following headings: 4. Show how the liabilities related to these transactions should be reported on the company's statement of financial position at December 3 year 1. 5. Explain why the accrual method of accounting provides more relevant information to financial analysts than the cash method

P8-3 Recording and Reporting Accrued Liabilities and Deferred Revenue and Financial Statement Effects with Discussion LO8-1 During its first year of operations, Riverside Company completed the following two transactions. The company's fiscal year ends on December 31 . a. Paid and recorded wages of $130,000 during year 1; however, at the end of that year, wages of $1,300 for three days are unpaid and unrecorded because the next weekly pay day is January 6 , of year 2 . b. Rented office space to another party and collected $3,000 on December 12 , of year 1 . The rent collected was for 30 days from December 12 , year 1 through January 10 , year 2, and was credited in full to rent revenue. Required: 1. Prepare (a) the adjusting entry required on December 31, year 1 and (b) the journal entry required on January 6 , year 2 to record the payment of any unpaid wages from December of year 1. 2. Prepare (a) the journal entry for the collection of rent on December 12, year 1, and (b) the adjusting entry on December 31 , year 1. 3. Determine the financial statement effects for each of the journal entries you prepared in (1) and (2). Indicate the accounts affected, amounts, and direction of the effects (+ for increases and - for decreases) on the accounting equation. Use the following headings: 4. Show how the liabilities related to these transactions should be reported on the company's statement of financial position at December 3 year 1. 5. Explain why the accrual method of accounting provides more relevant information to financial analysts than the cash method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started