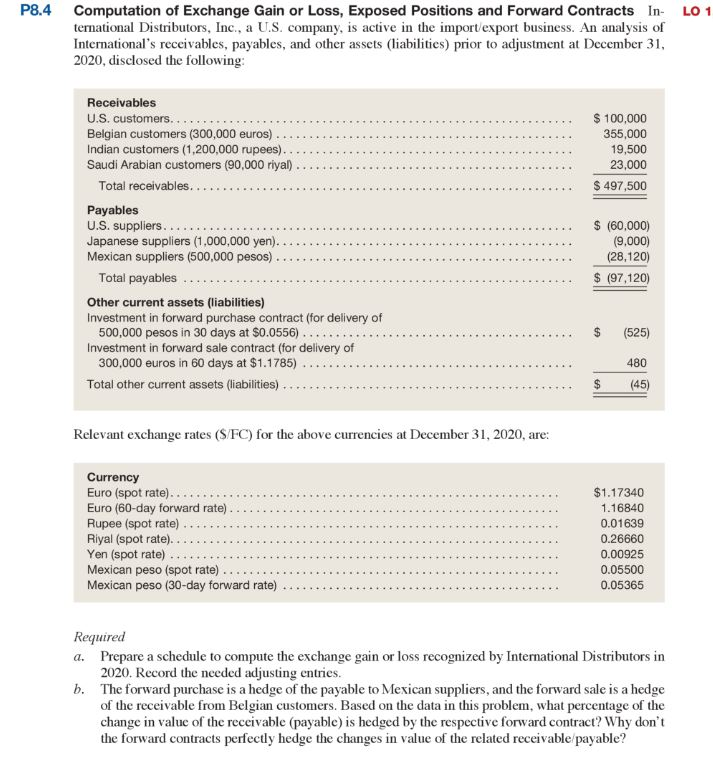

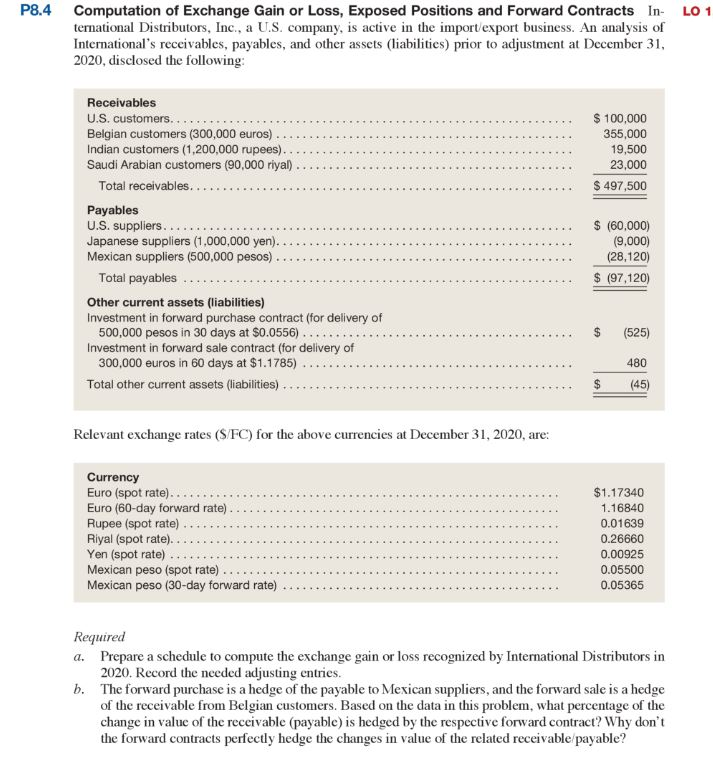

P8.4 Computation of Exchange Gain or Loss, Exposed Positions and Forward Contracts LO 1 ternational Distributors, Inc., a U.S. company, is active in the importexport business. An analysis of International's receivables, payables, and other assets (liabilities) prior to adjustment at December 3 2020, disclosed the following Receivables 100,000 U.S. customers. 19,500 23,000 Payables U.S. suppliers.... Japanese suppliers (1,000,000 yen).... S (60,000 (9,000) (28,120) $ (97,120 Total payables Other current assets (liabilities) Investment in forward purchase contract (for delivery of Investment in forward sale contract (for delivery of 480 Total other current assets (liabilities) . . . . . . . .. .. . . ....(45) Relevant exchange rates (S/FC) for the above currencies at December 31, 2020, are: Currency $1.17340 1.16840 0.01639 0.26660 0.00925 0.05500 0.05365 Euro (60-day forward rate). Rupee (spot rate). . . Yen (spot rate) Required a. Prepare a schedule to compute the exchange gain or loss recognized by International Distributors in 2020. Record the needed adjusting entries The forward purchase is a hedge of the payable to Mexican suppliers, and the forward sale is a hedge of the receivable from Belgian customers. Based on the data in this proble, what percentage of the change in valuc of the receivable (payable) is hedged by the respective forward contract? Why don't the forward contracts perfectly hedge the changes in value of the related receivable payable? b. P8.4 Computation of Exchange Gain or Loss, Exposed Positions and Forward Contracts LO 1 ternational Distributors, Inc., a U.S. company, is active in the importexport business. An analysis of International's receivables, payables, and other assets (liabilities) prior to adjustment at December 3 2020, disclosed the following Receivables 100,000 U.S. customers. 19,500 23,000 Payables U.S. suppliers.... Japanese suppliers (1,000,000 yen).... S (60,000 (9,000) (28,120) $ (97,120 Total payables Other current assets (liabilities) Investment in forward purchase contract (for delivery of Investment in forward sale contract (for delivery of 480 Total other current assets (liabilities) . . . . . . . .. .. . . ....(45) Relevant exchange rates (S/FC) for the above currencies at December 31, 2020, are: Currency $1.17340 1.16840 0.01639 0.26660 0.00925 0.05500 0.05365 Euro (60-day forward rate). Rupee (spot rate). . . Yen (spot rate) Required a. Prepare a schedule to compute the exchange gain or loss recognized by International Distributors in 2020. Record the needed adjusting entries The forward purchase is a hedge of the payable to Mexican suppliers, and the forward sale is a hedge of the receivable from Belgian customers. Based on the data in this proble, what percentage of the change in valuc of the receivable (payable) is hedged by the respective forward contract? Why don't the forward contracts perfectly hedge the changes in value of the related receivable payable? b