Answered step by step

Verified Expert Solution

Question

1 Approved Answer

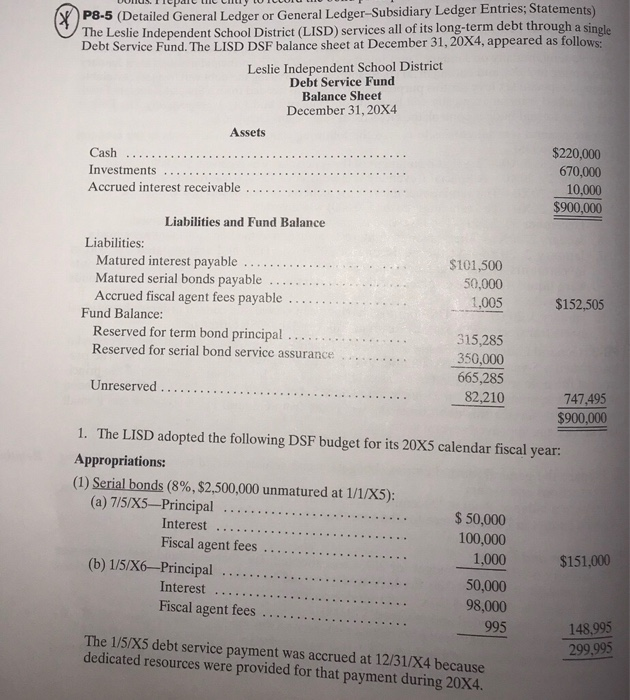

P8-5 (Detailed Geberal Ledger or General Ledger-Subsidiary Ledger Entries; Statements) The Leslie Independent School Distric (LISD) services all of its long-term debt through a single

P8-5 (Detailed Geberal Ledger or General Ledger-Subsidiary Ledger Entries; Statements) The Leslie Independent School Distric (LISD) services all of its long-term debt through a single Debt Service Fund. The LISD balance sheet at December 31, 20x4, appeared as follows:

(a) Prepare the summary journal entries necessary to record these transactions and events in the general Ledger accounts in the General Ledger, Revenues Ledger, and Expenditures Ledger of the Leslie Independent School District during 20X5, including clos- ing entries. Key the entries by date.

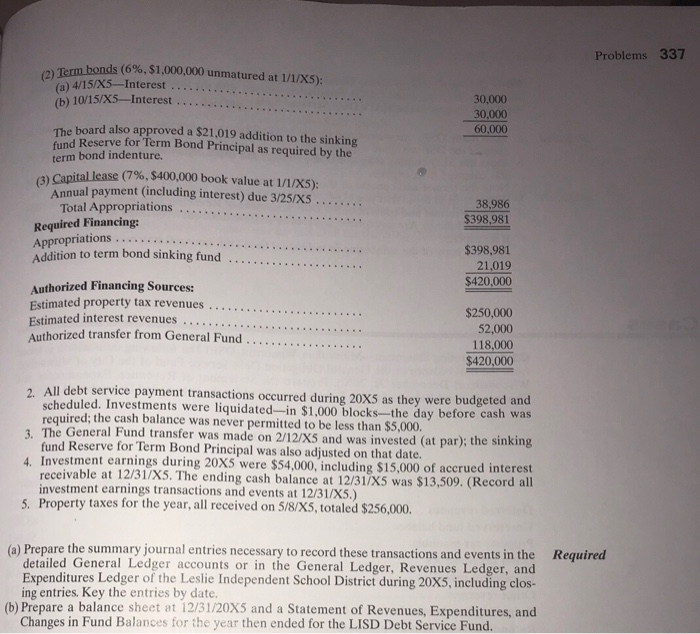

etailed General Ledger or General Ledger-Subsidiary Ledger Entries; Statements) P8-5 (D The Leslie Independent School District (LISD) services all of its long-term debt through a single Debt Service Fund. The LISD DSF balance sheet at December 31, 20X4, appeared as follows Leslie Independent School District Debt Service Fund Balance Sheet December 31,20X4 Assets Cash $220,000 670,000 10,000 $900,000 Liabilities and Fund Balance Liabilities: S101,500 50,000 1,005 Matured serial bonds payable . . . . . . . . . . . . . . . . . Accrued fiscal agent fees payable $152,505 Fund Balance: 315,285 350,000 665,285 82210 Reserved for serial bond service assurance 747.495 $900,000 1. The LISD adopted the following DSF budget for its 20X5 calendar fiscal year: Appropriations: (1) Serial bonds (8%, $2,500,000 unmatured at 1/1/X5): $ 50,000 100,000 1,000 50,000 98,000 995 Fiscal agent fees . . $151,000 Fiscal agent fees . 148,995 299 The 1/5/X5 debt service payment was accrued at 12/31/X4 because dedicated resources were provided for that payment during 20X4. Problems 337 6%, $1,000,000 unmatured at 1/1/X5) (a) 4/15/X5-Interest (b) 10/15/X5-Interest 30,000 30,000 60,000 board also approved a $21,019 addition to the sinkin nd Reserve for Term Bond Principal as required by th term bond indenture. (3) Capital!ease (7%, $400,000 book value at 1/1/X5): Annual payment (including interest) due 3/25/X5 38,986 $398,981 Required Financing: Appropriation Addition to term bond sinking fund $398,981 21,019 $420,000 Authorized Financing Sources: imated property tax revenues.... Estimated Aut $250,000 52,000 118,000 $420,000 2. All debt service payment transactions occurred during 20XS as they were budgeted and 3. The General Fund transfer was made on 2/12/X5 and was invested (at par); the sinking 4. Investment earnings during 20X5 were $54,000, including $15,000 o scheduled. Investments were liquidated-in $1,000 blocks-the day before cash was required; the cash balance was never permitted to be less than $5,000. fund Reserve for Term Bond Principal was also adjusted on that date. ccrued interest receivable at 12/31/X5. The ending cash balance at 12/31/X5 was $13,509. (Record all investment earnings transactions and events at 12/31/X5.) Property taxes for the year, all received on 5/8/X5, totaled $256,000. 5. (a) Prepare the summary journal entries necessary to record these transactions and events in the Required detailed General Ledger accounts or in the General Ledger, Revenues Ledger, and Expenditures Ledger of the Leslie Independent School District during 20X5, including clos- ing entries. Key the entries by date. (b) Prepare a balance sheet at 12/31/20X5 and a Statement of Revenues, Expenditures, and Changes in Fund Balances for the year then ended for the LISD Debt Service Fund. etailed General Ledger or General Ledger-Subsidiary Ledger Entries; Statements) P8-5 (D The Leslie Independent School District (LISD) services all of its long-term debt through a single Debt Service Fund. The LISD DSF balance sheet at December 31, 20X4, appeared as follows Leslie Independent School District Debt Service Fund Balance Sheet December 31,20X4 Assets Cash $220,000 670,000 10,000 $900,000 Liabilities and Fund Balance Liabilities: S101,500 50,000 1,005 Matured serial bonds payable . . . . . . . . . . . . . . . . . Accrued fiscal agent fees payable $152,505 Fund Balance: 315,285 350,000 665,285 82210 Reserved for serial bond service assurance 747.495 $900,000 1. The LISD adopted the following DSF budget for its 20X5 calendar fiscal year: Appropriations: (1) Serial bonds (8%, $2,500,000 unmatured at 1/1/X5): $ 50,000 100,000 1,000 50,000 98,000 995 Fiscal agent fees . . $151,000 Fiscal agent fees . 148,995 299 The 1/5/X5 debt service payment was accrued at 12/31/X4 because dedicated resources were provided for that payment during 20X4. Problems 337 6%, $1,000,000 unmatured at 1/1/X5) (a) 4/15/X5-Interest (b) 10/15/X5-Interest 30,000 30,000 60,000 board also approved a $21,019 addition to the sinkin nd Reserve for Term Bond Principal as required by th term bond indenture. (3) Capital!ease (7%, $400,000 book value at 1/1/X5): Annual payment (including interest) due 3/25/X5 38,986 $398,981 Required Financing: Appropriation Addition to term bond sinking fund $398,981 21,019 $420,000 Authorized Financing Sources: imated property tax revenues.... Estimated Aut $250,000 52,000 118,000 $420,000 2. All debt service payment transactions occurred during 20XS as they were budgeted and 3. The General Fund transfer was made on 2/12/X5 and was invested (at par); the sinking 4. Investment earnings during 20X5 were $54,000, including $15,000 o scheduled. Investments were liquidated-in $1,000 blocks-the day before cash was required; the cash balance was never permitted to be less than $5,000. fund Reserve for Term Bond Principal was also adjusted on that date. ccrued interest receivable at 12/31/X5. The ending cash balance at 12/31/X5 was $13,509. (Record all investment earnings transactions and events at 12/31/X5.) Property taxes for the year, all received on 5/8/X5, totaled $256,000. 5. (a) Prepare the summary journal entries necessary to record these transactions and events in the Required detailed General Ledger accounts or in the General Ledger, Revenues Ledger, and Expenditures Ledger of the Leslie Independent School District during 20X5, including clos- ing entries. Key the entries by date. (b) Prepare a balance sheet at 12/31/20X5 and a Statement of Revenues, Expenditures, and Changes in Fund Balances for the year then ended for the LISD Debt Service Fund (b) Prepare a balance sheet at 12/31 / 20X5 and a Statement of Revenues, Expenditures, and in Fund Balances for the year then

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started