Answered step by step

Verified Expert Solution

Question

1 Approved Answer

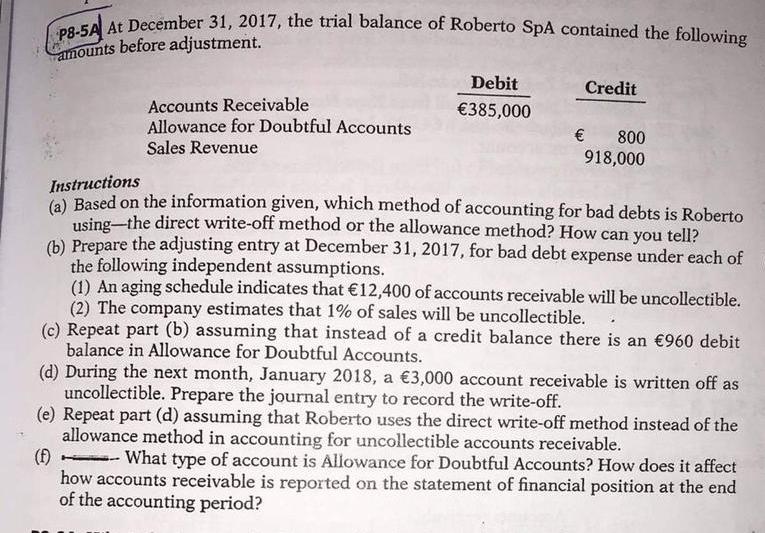

P8-5A At December 31, 2017, the trial balance of Roberto SpA contained the following amounts before adjustment. Debit 385,000 Credit Accounts Receivable Allowance for Doubtful

P8-5A At December 31, 2017, the trial balance of Roberto SpA contained the following amounts before adjustment. Debit 385,000 Credit Accounts Receivable Allowance for Doubtful Accounts Sales Revenue 800 918,000 Instructions (a) Based on the information given, which method of accounting for bad debts is Roberto usingthe direct write-off method or the allowance method? How can you tell? (b) Prepare the adjusting entry at December 31, 2017, for bad debt expense under each of the following independent assumptions. (1) An aging schedule indicates that 12,400 of accounts receivable will be uncollectible. (2) The company estimates that 1% of sales will be uncollectible. (c) Repeat part (b) assuming that instead of a credit balance there is an 960 debit balance in Allowance for Doubtful Accounts. (d) During the next month, January 2018, a 3,000 account receivable is written off as uncollectible. Prepare the journal entry to record the write-off. (e) Repeat part (d) assuming that Roberto uses the direct write-off method instead of the allowance method in accounting for uncollectible accounts receivable. What type of account is Allowance for Doubtful Accounts? How does it affect how accounts receivable is reported on the statement of financial position at the end of the accounting period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started