Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P8-7A. I need to know part a and b allow anee a 31 Made the appropriate adjusting entries fl Required Record the foregoing transactions and

P8-7A. I need to know part a and b

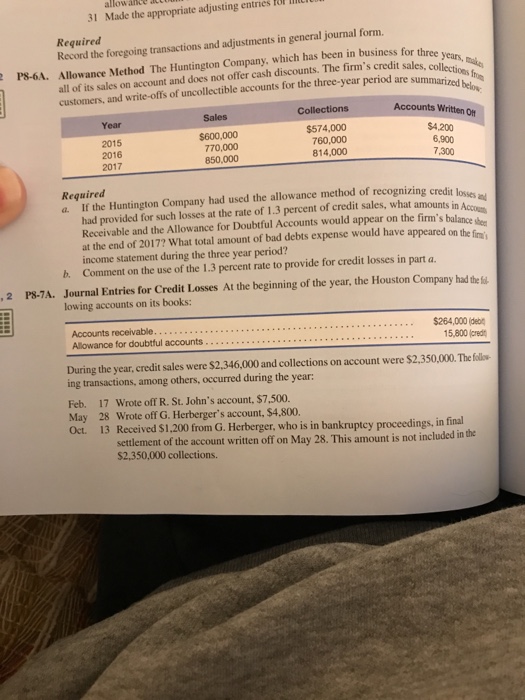

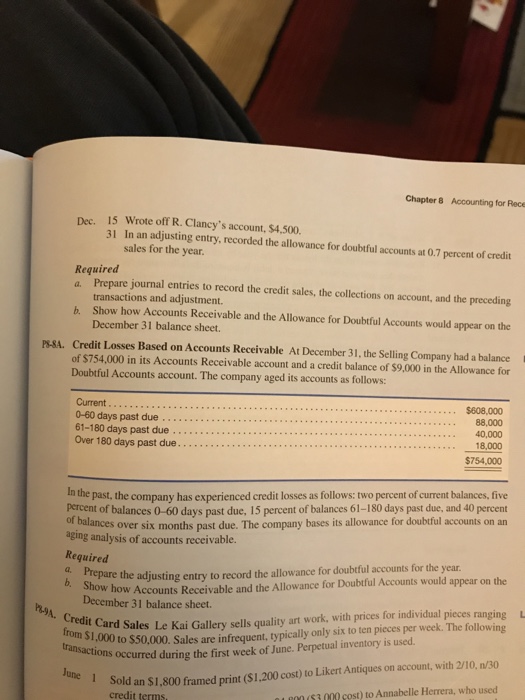

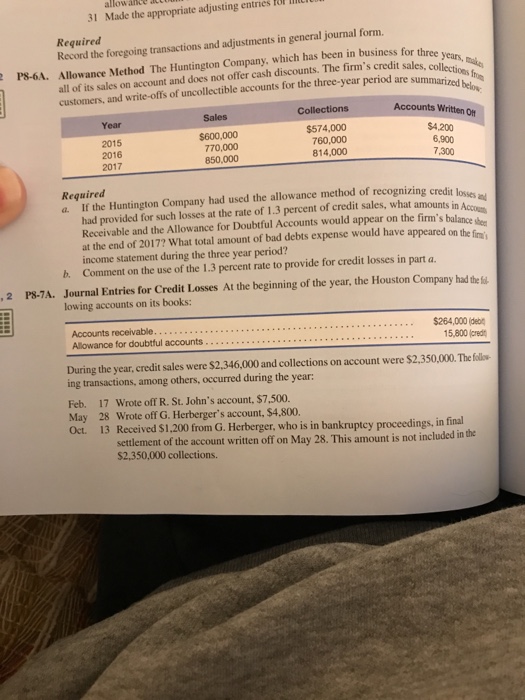

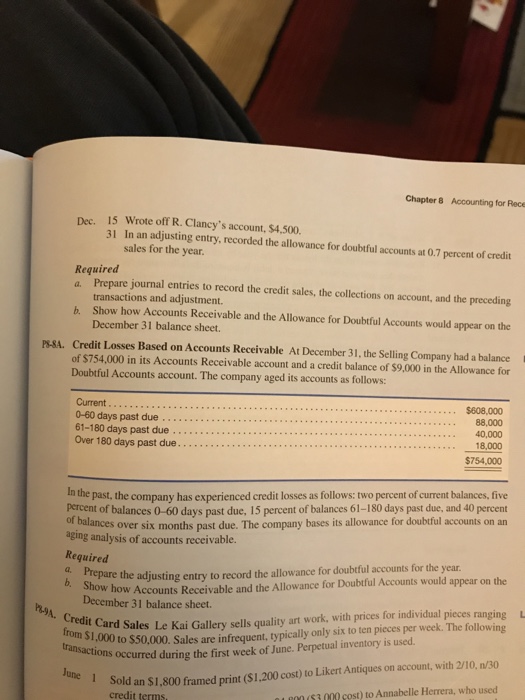

allow anee a 31 Made the appropriate adjusting entries fl Required Record the foregoing transactions and adjustments in general journal form. Allowance Method The Huntington Company, which has been in business for three all of its sales on account and does not offer cash discounts. The firm's credit sales P8-6A. are su customers, and write-offs of uncollectible accounts for the three-year period Collections Accounts Written Off Sales Year 2015 2016 2017 $600,000 770,000 850,000 $574,000 760,000 814,000 $4,200 6,900 7,300 Required a. If the Huntington Company had used the allowance method of recognizing credit lose had provided for such losses at the rate of 1.3 percent of credit sales, what amounts in Receivable and the Allowance for Doubtful Accounts would appear on the firm's balance do at the end of 2017? What total amount of bad debts expense would have appeared on the fim income statement during the three year period? b. Comment on the use of the 1.3 percent rate to provide for credit losses in part a ,2 P8-7A. Journal Entries for Credit Losses At the beginning of the year, the Houston Company had the f lowing accounts on its books: Accounts receivable Allowance for doubtful accounts 5,800 (credt During the year, credit sales were $2,346,000 and collections on account were $2,350,000. The follo ing transactions, among others, occurred during the year: Feb. 17 Wrote off R. St. John's account, $7,500. May 28 Wrote off G. Herberger's account, $4,800. Oct. 13 Received $1,200 from G. Herberger, who is in bankruptey proceedings, in final settlement of the account written off on May 28. This amount is not included in the $2,350,000 collections

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started