Answered step by step

Verified Expert Solution

Question

1 Approved Answer

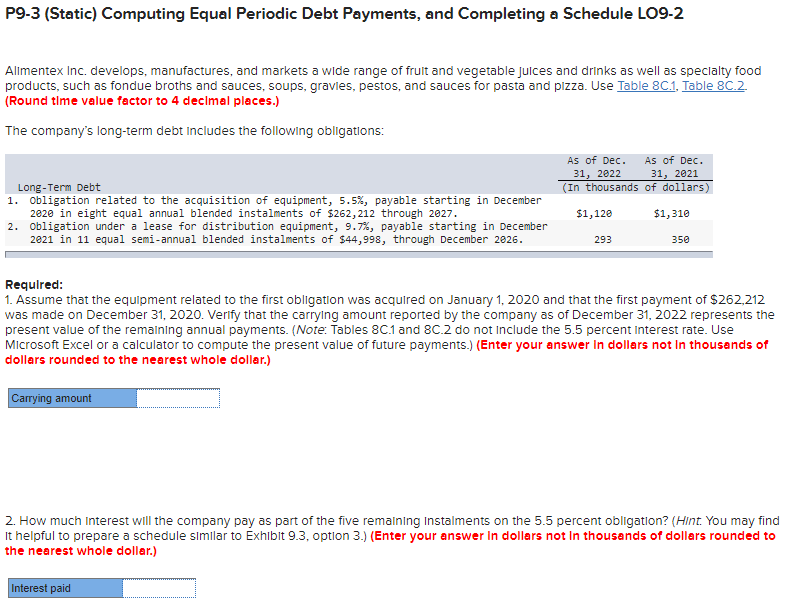

P9-3 (Static) Computing Equal Periodic Debt Payments, and Completing a Schedule LO9-2 Alimentex Inc. develops, manufactures, and markets a wide range of fruit and

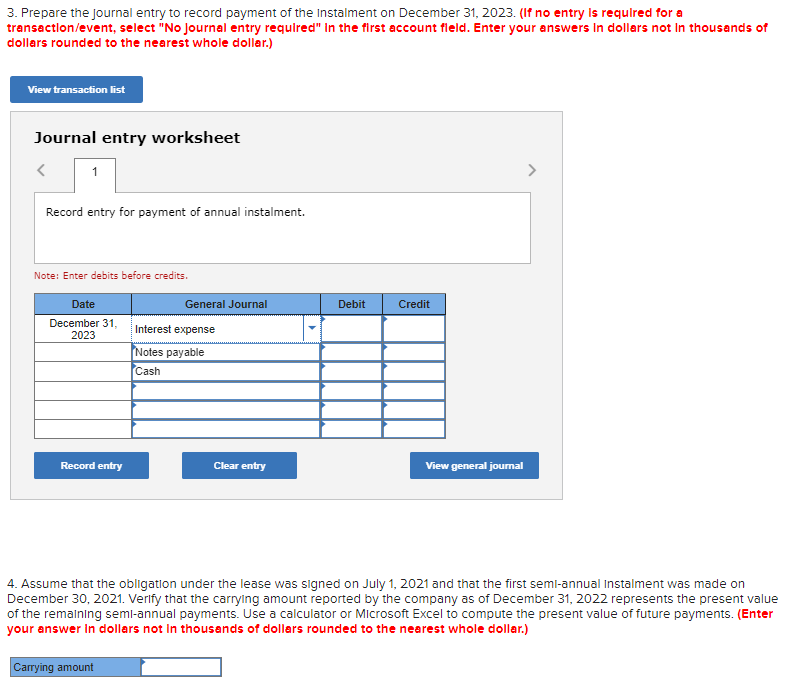

P9-3 (Static) Computing Equal Periodic Debt Payments, and Completing a Schedule LO9-2 Alimentex Inc. develops, manufactures, and markets a wide range of fruit and vegetable juices and drinks as well as specialty food products, such as fondue broths and sauces, soups, gravies, pestos, and sauces for pasta and pizza. Use Table 8C.1, Table 8C.2. (Round time value factor to 4 decimal places.) The company's long-term debt includes the following obligations: Long-Term Debt 1. Obligation related to the acquisition of equipment, 5.5%, payable starting in December 2020 in eight equal annual blended instalments of $262,212 through 2027. 2. Obligation under a lease for distribution equipment, 9.7%, payable starting in December 2821 in 11 equal semi-annual blended instalments of $44,998, through December 2026. Required: As of Dec. As of Dec. 31, 2022 31, 2021 (In thousands of dollars) $1,120 $1,310 293 350 1. Assume that the equipment related to the first obligation was acquired on January 1, 2020 and that the first payment of $262,212 was made on December 31, 2020. Verify that the carrying amount reported by the company as of December 31, 2022 represents the present value of the remaining annual payments. (Note: Tables 8C1 and 8C.2 do not include the 5.5 percent Interest rate. Use Microsoft Excel or a calculator to compute the present value of future payments.) (Enter your answer in dollars not in thousands of dollars rounded to the nearest whole dollar.) Carrying amount 2. How much Interest will the company pay as part of the five remaining Instalments on the 5.5 percent obligation? (Hint. You may find It helpful to prepare a schedule similar to Exhibit 9.3, option 3.) (Enter your answer in dollars not in thousands of dollars rounded to the nearest whole dollar.) Interest paid 3. Prepare the journal entry to record payment of the Instalment on December 31, 2023. (If no entry is required for a transaction/event, select "No journal entry required" In the first account field. Enter your answers in dollars not in thousands of dollars rounded to the nearest whole dollar.) View transaction list Journal entry worksheet < 1 Record entry for payment of annual instalment. Note: Enter debits before credits. Date December 31, 2023 General Journal Debit Credit Interest expense Notes payable Cash Record entry Clear entry View general journal 4. Assume that the obligation under the lease was signed on July 1, 2021 and that the first semi-annual Instalment was made on December 30, 2021. Verify that the carrying amount reported by the company as of December 31, 2022 represents the present value of the remaining semi-annual payments. Use a calculator or Microsoft Excel to compute the present value of future payments. (Enter your answer in dollars not in thousands of dollars rounded to the nearest whole dollar.) Carrying amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started