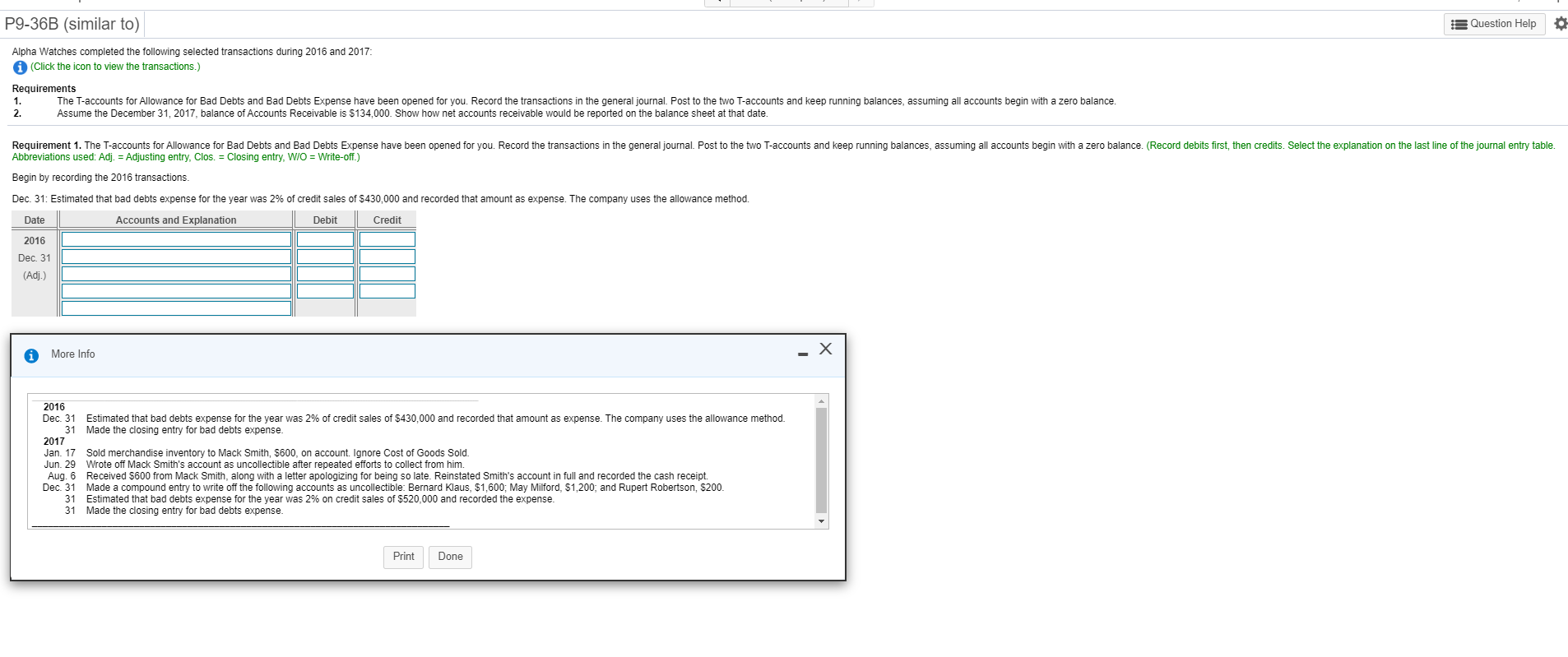

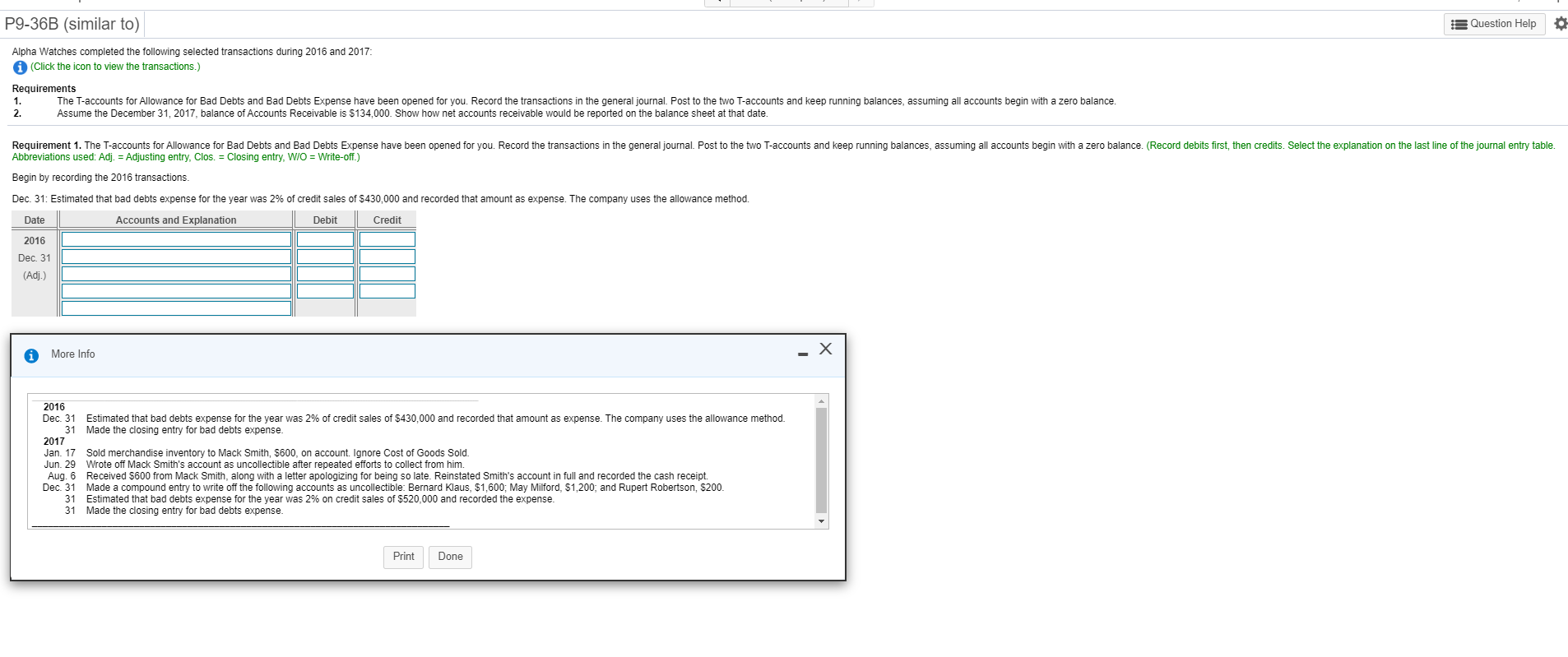

P9-36B (similar to) is Question Help 0 Alpha Watches completed the following selected transactions during 2016 and 2017: (Click the icon to view the transactions.) Requirements 1. The T-accounts for Allowance for Bad Debts and Bad Debts Expense have been opened for you. Record the transactions in the general journal. Post to the two T-accounts and keep running balances, assuming all accounts begin with a zero balance. 2. Assume the December 31, 2017, balance of Accounts Receivable is $134,000. Show how net accounts receivable would be reported on the balance sheet at that date Requirement 1. The T-accounts for Allowance for Bad Debts and Bad Debts Expense have been opened for you. Record the transactions in the general journal. Post to the two T-accounts and keep running balances, assuming all accounts begin with a zero balance. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Abbreviations used: Adj. = Adjusting entry, Clos. = Closing entry, W/O = Write-off.) Begin by recording the 2016 transactions Dec. 31: Estimated that bad debts expense for the year was 2% of credit sales of $430,000 and recorded that amount as expense. The company uses the allowance method. Date Accounts and Explanation Debit Credit 2016 Dec 31 (Adj.) More Info 2016 Dec 31 Estimated that bad debts expense for the year was 2% of credit sales of $430,000 and recorded that amount as expense. The company uses the allowance method. 31 Made the closing entry for bad debts expense. 2017 Jan. 17 Sold merchandise inventory to Mack Smith, $600, on account. Ignore Cost of Goods Sold. Jun. 29 Wrote off Mack Smith's account as uncollectible after repeated efforts to collect from him. Aug. 6 Received $600 from Mack Smith, along with a letter apologizing for being so late. Reinstated Smith's account in full and recorded the cash receipt. Dec 31 Made a compound entry to write off the following accounts as uncollectible: Bernard Klaus, $1,600; May Milford, $1,200, and Rupert Robertson, $200. 31 Estimated that bad debts expense for the year was 2% on credit sales of $520,000 and recorded the expense. 31 Made the closing entry for bad debts expense. Print Done