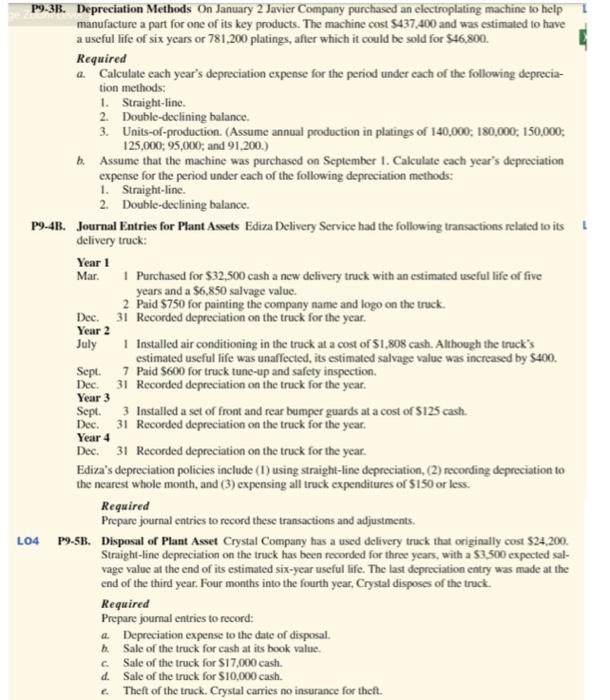

P9-3B. Depreciation Methods On January 2 Javier Company purchased an electroplating machine to help manufacture a part for one of its key products. The machine cost $437.400 and was estimated to have a useful life of six years or 781,200 platings, after which it could be sold for $46,800. Required a. Calculate each year's depreciation expense for the period under cach of the following depreciation methods: 1. Straight-line. 2. Double-declining balance. 3. Units-of-production. (Assume annual production in platings of 140.000;180.000,150.000 : 125,000;95,000; and 91,200. b. Assume that the machine was purchased on September 1. Calculate each year's depreciation expense for the period under each of the following deprociation methods: 1. Straight-line. 2. Double-declining balance. P9-4B. Journal Eintries for Plant Assets Ediza Delivery Service had the following transactions related to its delivery truck: Year 1 Mar. I Purchased for $32,500 cash a new delivery truck with an estimated useful life of five years and a $6,850 salvage value. 2 Paid $750 for painting the company name and logo on the truck. Dec. 31 Recorded depreciation on the truck for the year. Year 2 July I Installed air conditioning in the truck at a cost of $1,808cash. Although the truck's estimated useful life was unaffected, its estimated salvage value was increased by $400. Sept. 7 Paid $600 for truck tune-up and safety inspection. Dec. 31 Recorded depreciation on the truck for the year. Year 3 Sept. 3 Installed a set of front and rear bumper guards at a cost of $125 cash. Dec. 31 Recorded depreciation on the truck for the year. Year 4 Dec. 31 Recorded depreciation on the truck for the year. Ediza's depreciation policies include (1) using straight-line depreciation, (2) fecording depreciation to the nearest whole month, and (3) expensing all truck expenditures of $150 or less. Required Prepare journal entries to record these transactions and adjustments. P9-5B. Disposal of Plant Asset Crystal Company has a used delivery truck that originally cost $24,200. Straight-line depreciation on the truck has been recorded for three years, with a $3,500 expected salvage value at the end of its estimated six-year useful life. The last depreciation entry was made at the end of the third year. Four months into the fourth year, Crystal disposes of the truck. Required