Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P9.3B (LO 1, 2) AP Glans Company purchased equipment on account on April 6, 2019, at an invoice price of $442.000. On April 7, 2019,

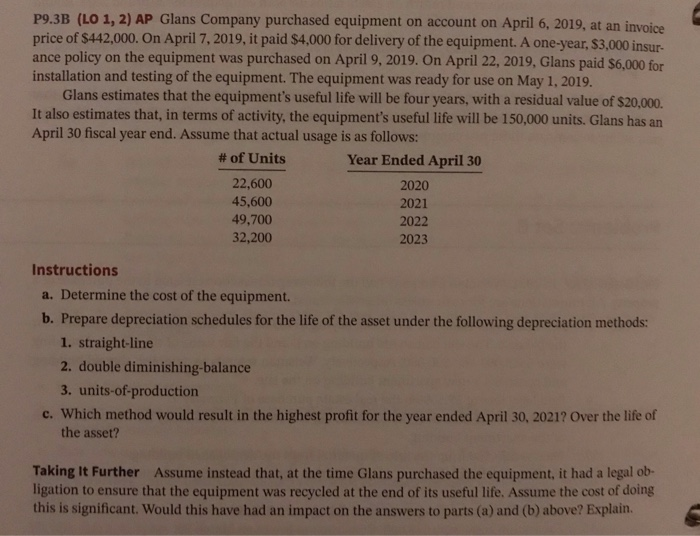

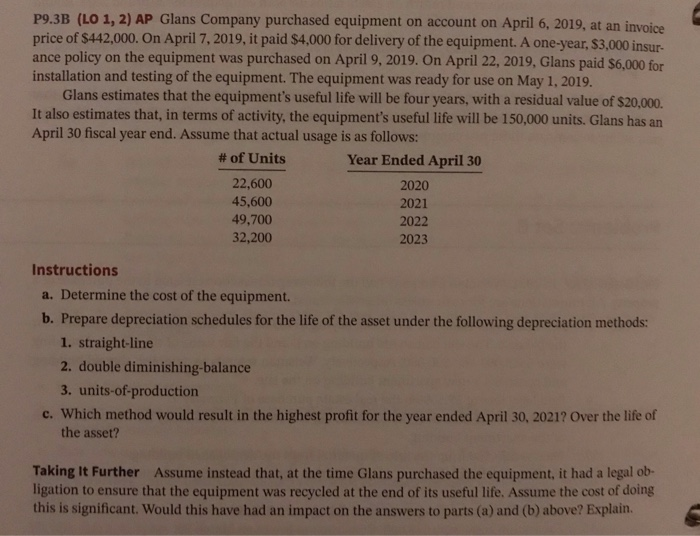

P9.3B (LO 1, 2) AP Glans Company purchased equipment on account on April 6, 2019, at an invoice price of $442.000. On April 7, 2019, it paid $4,000 for delivery of the equipment. A one-year, $3,000 insur ance policy on the equipment was purchased on April 9, 2019. On April 22, 2019, Glans paid $6,000 for installation and testing of the equipment. The equipment was ready for use on May 1, 2019. Glans estimates that the equipment's useful life will be four years, with a residual value of $20,000. It also estimates that, in terms of activity, the equipment's useful life will be 150,000 units. Glans has an April 30 fiscal year end. Assume that actual usage is as follows: # of Units Year Ended April 30 22,600 2020 45,600 2021 49,700 2022 32,200 2023 Instructions a. Determine the cost of the equipment. b. Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. straight-line 2. double diminishing-balance 3. units-of-production c. Which method would result in the highest profit for the year ended April 30, 2021? Over the life of the asset? Taking It Further Assume instead that, at the time Glans purchased the equipment, it had a legal ob- ligation to ensure that the equipment was recycled at the end of its useful life. Assume the cost of doing this is significant. Would this have had an impact on the answers to parts (a) and (b) above? Explain

P9.3B (LO 1, 2) AP Glans Company purchased equipment on account on April 6, 2019, at an invoice price of $442.000. On April 7, 2019, it paid $4,000 for delivery of the equipment. A one-year, $3,000 insur ance policy on the equipment was purchased on April 9, 2019. On April 22, 2019, Glans paid $6,000 for installation and testing of the equipment. The equipment was ready for use on May 1, 2019. Glans estimates that the equipment's useful life will be four years, with a residual value of $20,000. It also estimates that, in terms of activity, the equipment's useful life will be 150,000 units. Glans has an April 30 fiscal year end. Assume that actual usage is as follows: # of Units Year Ended April 30 22,600 2020 45,600 2021 49,700 2022 32,200 2023 Instructions a. Determine the cost of the equipment. b. Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. straight-line 2. double diminishing-balance 3. units-of-production c. Which method would result in the highest profit for the year ended April 30, 2021? Over the life of the asset? Taking It Further Assume instead that, at the time Glans purchased the equipment, it had a legal ob- ligation to ensure that the equipment was recycled at the end of its useful life. Assume the cost of doing this is significant. Would this have had an impact on the answers to parts (a) and (b) above? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started