Answered step by step

Verified Expert Solution

Question

1 Approved Answer

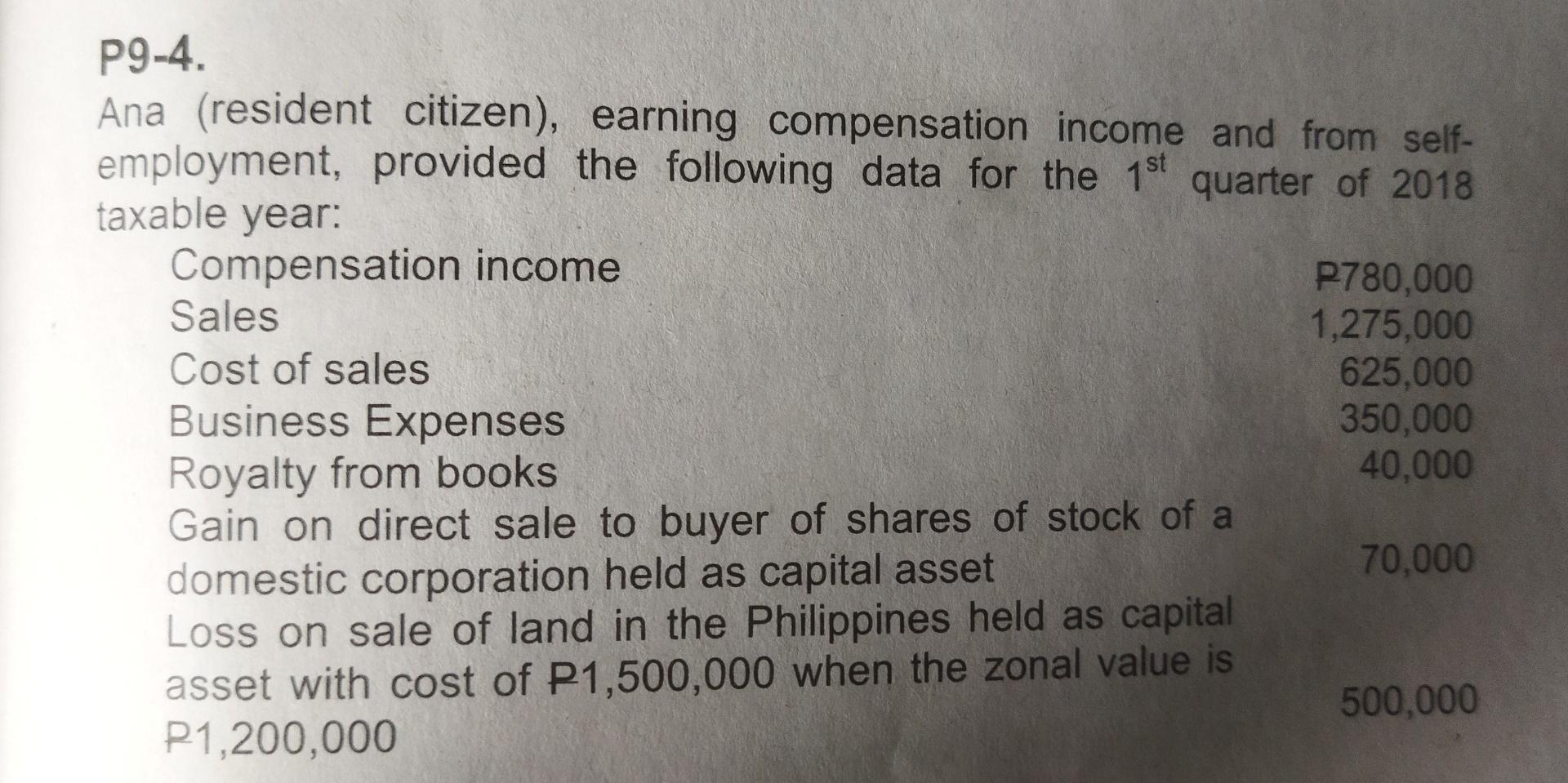

P9-4. Ana (resident citizen), earning compensation income and from self- employment, provided the following data for the 1st quarter of 2018 taxable year: Compensation income

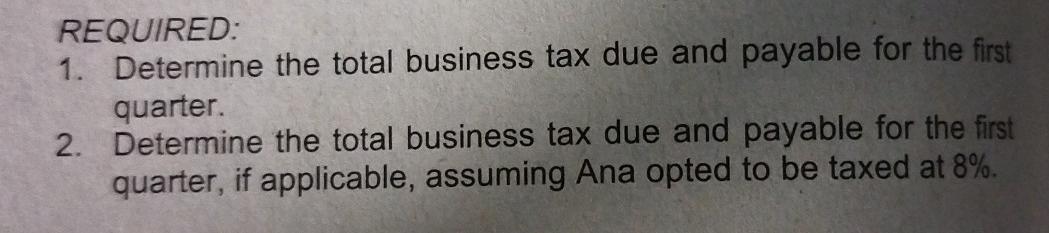

P9-4. Ana (resident citizen), earning compensation income and from self- employment, provided the following data for the 1st quarter of 2018 taxable year: Compensation income P780,000 Sales 1,275,000 Cost of sales 625,000 Business Expenses 350,000 Royalty from books 40,000 Gain on direct sale to buyer of shares of stock of a 70,000 domestic corporation held as capital asset Loss on sale of land in the Philippines held as capital asset with cost of P1,500,000 when the zonal value is 500,000 P1,200,000 REQUIRED: 1. Determine the total business tax due and payable for the first quarter. 2. Determine the total business tax due and payable for the first quarter, if applicable, assuming Ana opted to be taxed at 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started