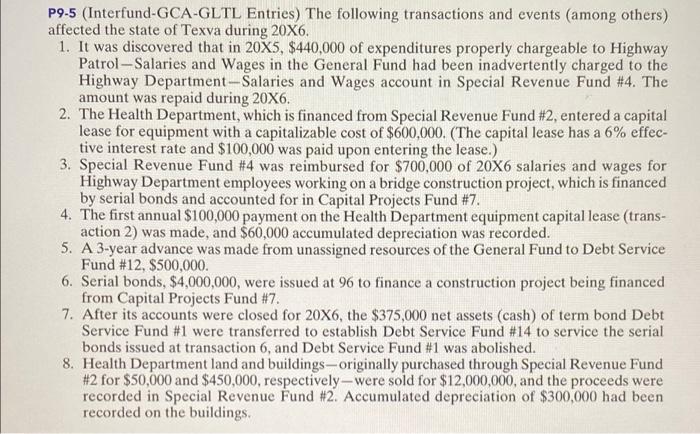

P9-5 (Interfund-GCA-GLTL Entries) The following transactions and events (among others) affected the state of Texva during 20X6. 1. It was discovered that in 20X5, $440,000 of expenditures properly chargeable to Highway Patrol - Salaries and Wages in the General Fund had been inadvertently charged to the Highway Department-Salaries and Wages account in Special Revenue Fund #4. The amount was repaid during 20X6. 2. The Health Department, which is financed from Special Revenue Fund #2, entered a capital lease for equipment with a capitalizable cost of $600,000. (The capital lease has a 6% effec- tive interest rate and $100,000 was paid upon entering the lease.) 3. Special Revenue Fund #4 was reimbursed for $700,000 of 20X6 salaries and wages for Highway Department employees working on a bridge construction project, which is financed by serial bonds and accounted for in Capital Projects Fund #7. 4. The first annual $100,000 payment on the Health Department equipment capital lease (trans- action 2) was made, and $60,000 accumulated depreciation was recorded. 5. A 3-year advance was made from unassigned resources of the General Fund to Debt Service Fund #12, $500,000. 6. Serial bonds, $4,000,000, were issued at 96 to finance a construction project being financed from Capital Projects Fund #7. 7. After its accounts were closed for 20X6, the $375,000 net assets (cash) of term bond Debt Service Fund #1 were transferred to establish Debt Service Fund #14 to service the serial bonds issued at transaction 6, and Debt Service Fund #1 was abolished. 8. Health Department land and buildings-originally purchased through Special Revenue Fund #2 for $50,000 and $450,000, respectively, were sold for $12,000,000, and the proceeds were recorded in Special Revenue Fund #2. Accumulated depreciation of $300,000 had been recorded on the buildings. mds Required Prepare the journal entries to record these transactions and events in the general ledgers of the various governmental funds and GCA GLTL accounts of the state of Texva. Assume that an appropriate series of Revenues, Expenditures, General Capital Assets, and General Long-Term Liabilities accounts is used in each general ledger