Answered step by step

Verified Expert Solution

Question

1 Approved Answer

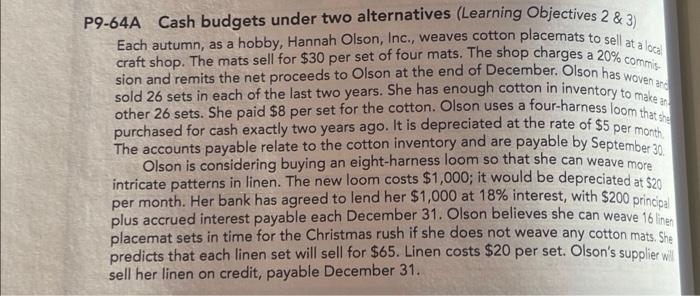

P9-64A Cash budgets under two alternatives (Learning Objectives 2 & 3) Each autumn, as a hobby, Hannah Olson, Inc., weaves cotton placemats to sell at

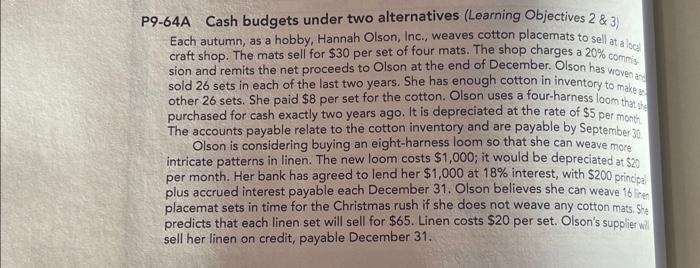

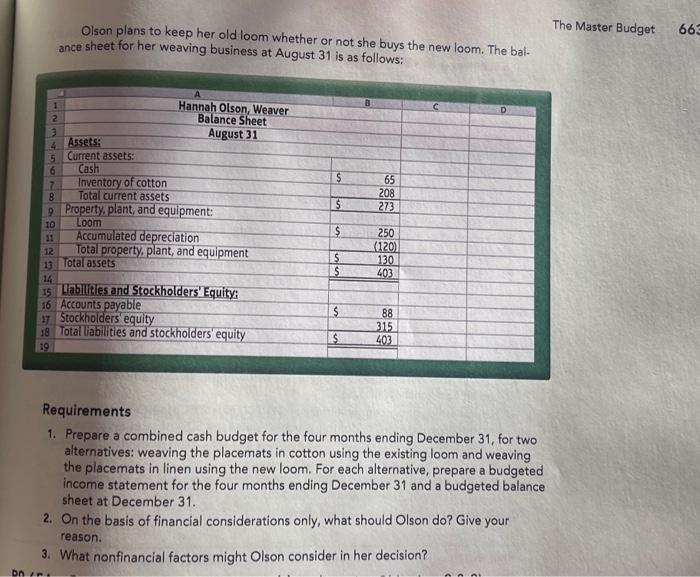

P9-64A Cash budgets under two alternatives (Learning Objectives 2 & 3) Each autumn, as a hobby, Hannah Olson, Inc., weaves cotton placemats to sell at a local craft shop. The mats sell for $30 per set of four mats. The shop charges a 20% commis- sion and remits the net proceeds to Olson at the end of December. Olson has woven and sold 26 sets in each of the last two years. She has enough cotton in inventory to make an other 26 sets. She paid $8 per set for the cotton. Olson uses a four-harness loom that she purchased for cash exactly two years ago. It is depreciated at the rate of $5 per month. The accounts payable relate to the cotton inventory and are payable by September 30 Olson is considering buying an eight-harness loom so that she can weave more intricate patterns in linen. The new loom costs $1,000; it would be depreciated at $20 per month. Her bank has agreed to lend her $1,000 at 18% interest, with $200 principal plus accrued interest payable each December 31. Olson believes she can weave 16 linen placemat sets in time for the Christmas rush if she does not weave any cotton mats. She predicts that each linen set will sell for $65. Linen costs $20 per set. Olson's supplier will sell her linen on credit, payable December 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started