Question

PA10-1 (Algo) Calculating Return on Investment, Residual Income, Determining Effect of Changes in Sales, Expenses, Invested Assets, Hurdle Rate on Each [LO 10-4, 10-5] Coolbrook

PA10-1 (Algo) Calculating Return on Investment, Residual Income, Determining Effect of Changes in Sales, Expenses, Invested Assets, Hurdle Rate on Each [LO 10-4, 10-5]

Coolbrook Company has the following information available for the past year:

| River Division | Stream Division | ||||

| Sales revenue | $ | 1,210,000 | $ | 1,817,000 | |

| Cost of goods sold and operating expenses | 898,000 | 1,289,000 | |||

| Net operating income | $ | 312,000 | $ | 528,000 | |

| Average invested assets | $ | 1,110,000 | $ | 1,430,000 | |

The companys hurdle rate is 6.51 percent.

Required:

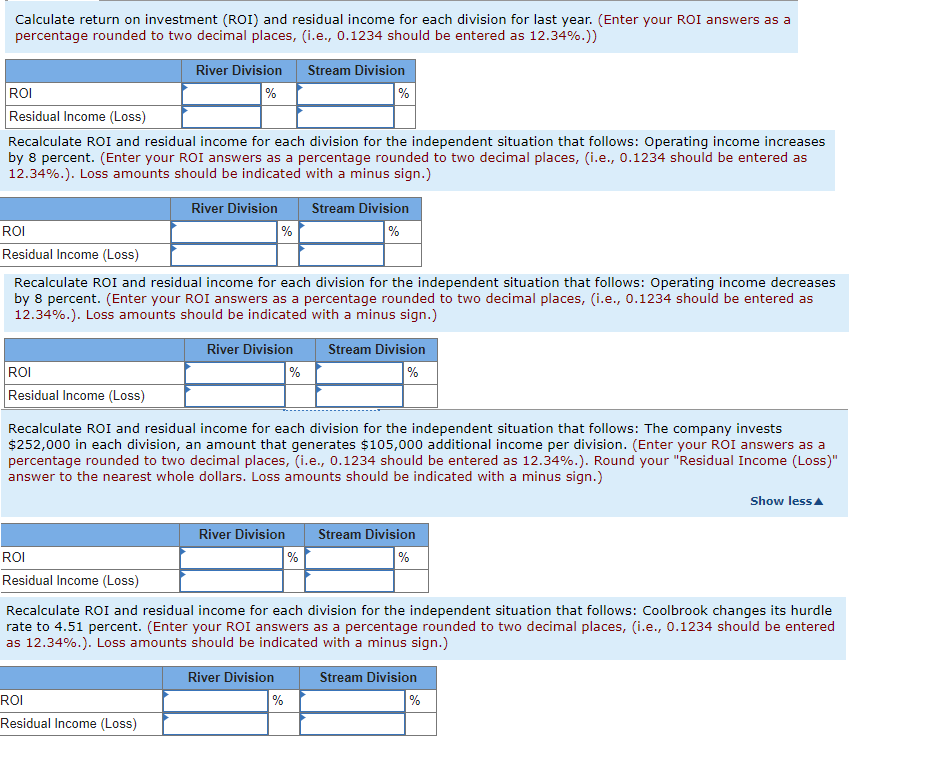

1. Calculate return on investment (ROI) and residual income for each division for last year.

2. Recalculate ROI and residual income for the division for each independent situation that follows:

a. Operating income increases by 8 percent.

b. Operating income decreases by 8 percent.

c. The company invests $252,000 in each division, an amount that generates $105,000 additional income per division.

d. Coolbrook changes its hurdle rate to 4.51 percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started