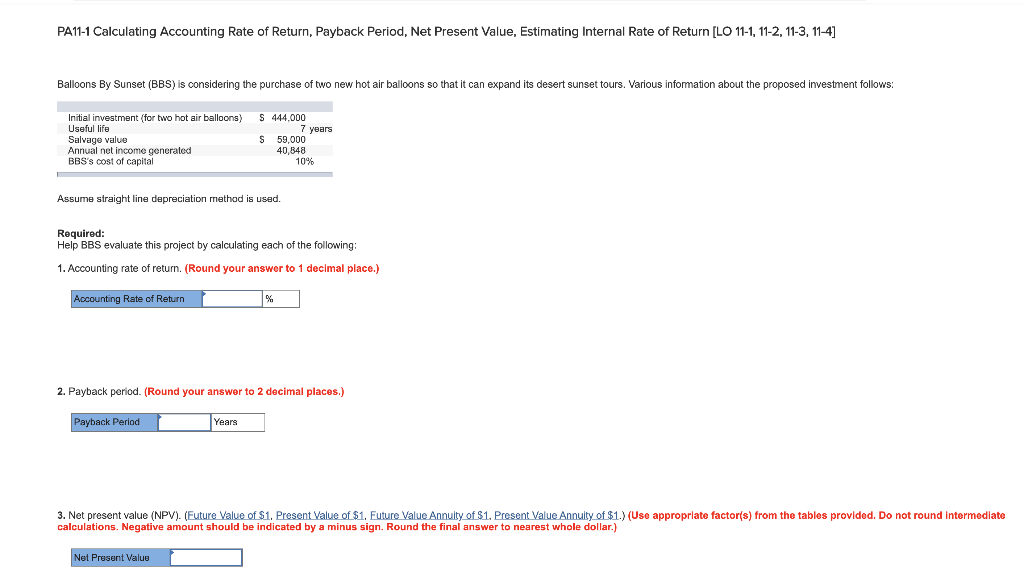

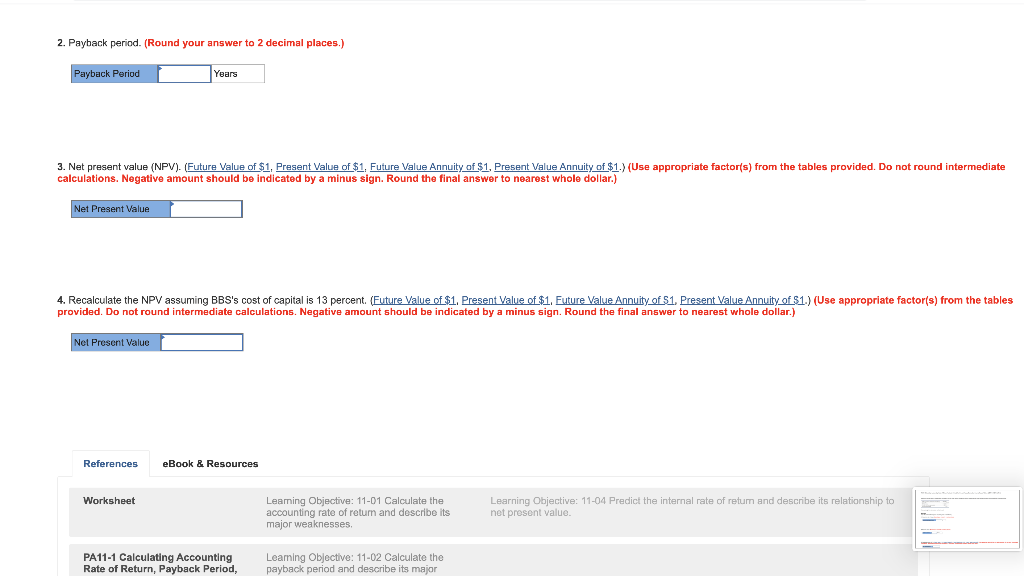

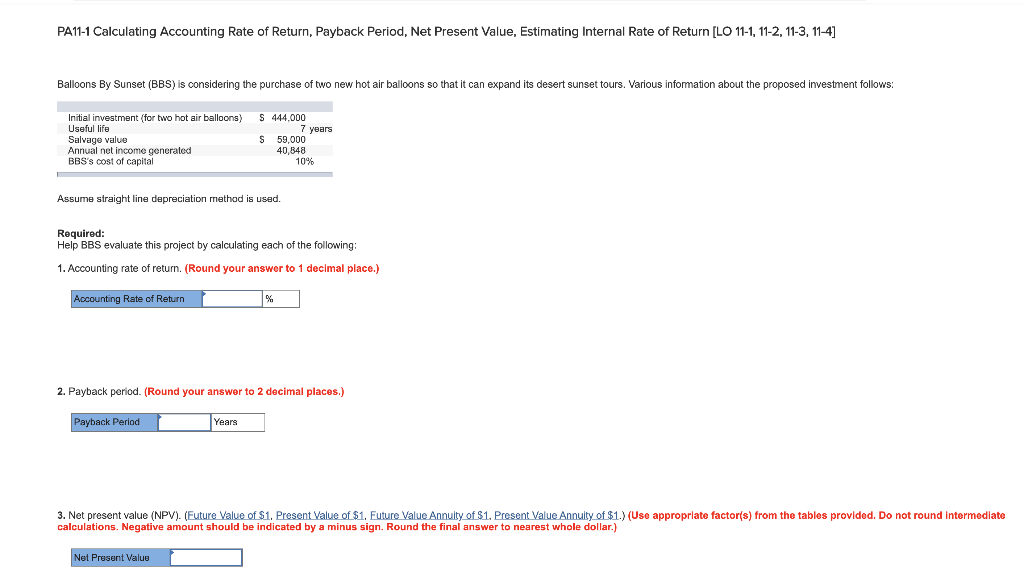

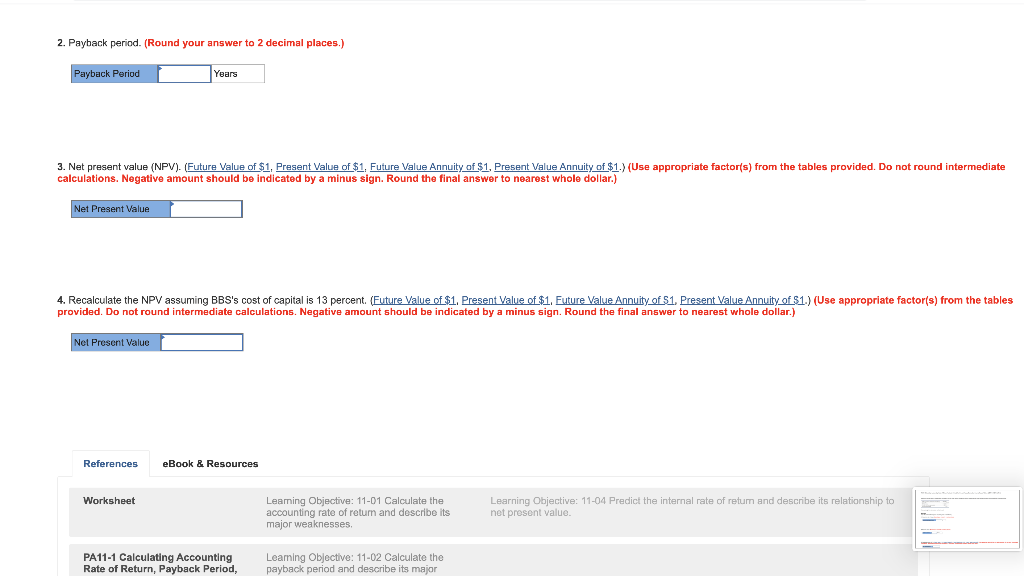

PA11-1 Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: Initial investment for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital S 444.000 7 years $ 59,000 40,848 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return. (Round your answer to 1 decimal place.) Accounting Rate of Return 2. Payback period. (Round your answer to 2 decimal places.) Payback Period Years 3. Net present value (NPV). (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round Intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) Net Present Value Net Present Value 2. Payback period. (Round your answer to 2 decimal places.) Payback Period Years 3. Net present value (NPV). (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) Net Present Value 4. Recalculate the NPV assuming BBS's cost of capital is 13 percent. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) Net Present Value References eBook & Resources Worksheet Leaming Objective: 11-01 Calculate the accounting rate of return and describe its major weaknesses. Learning Objective: 11-04 Predict the internal rate of return and describe its relationship to net present value. PA11-1 Calculating Accounting Rate of Return, Payback Period, Leaming Objective: 11-02 Calculate the payback period and describe its major