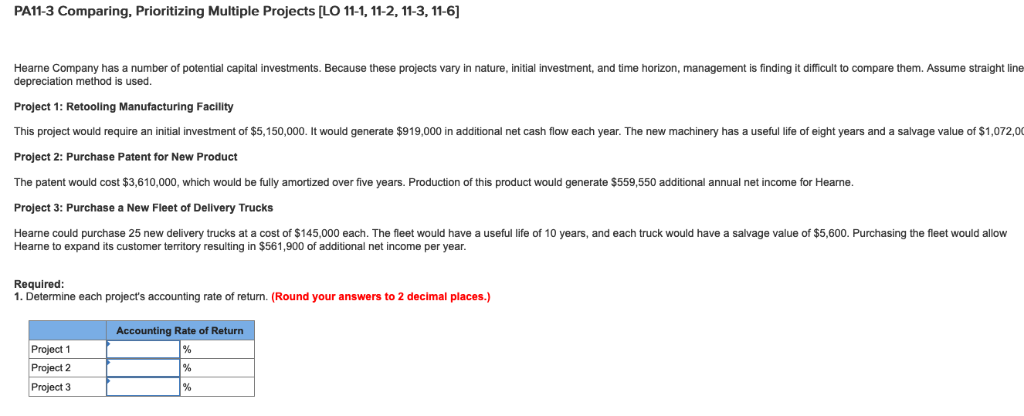

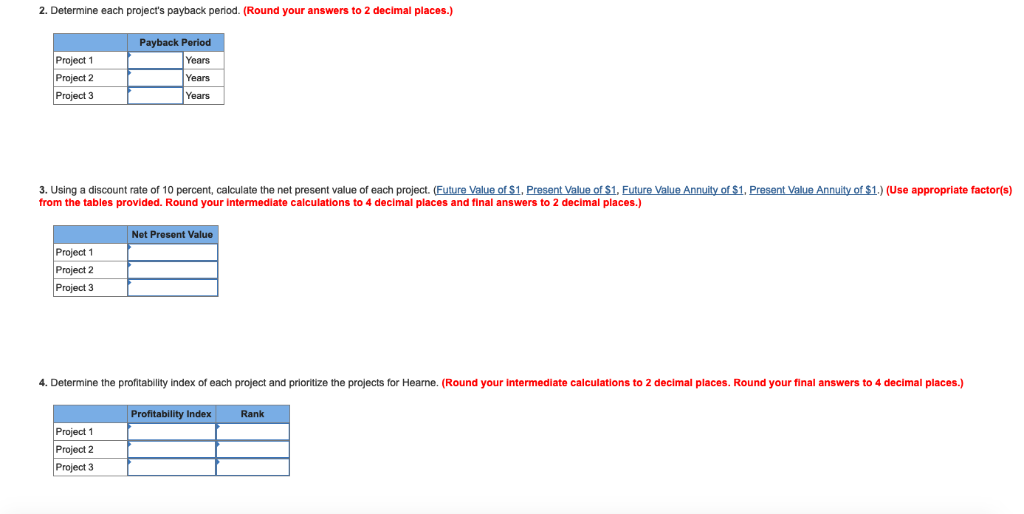

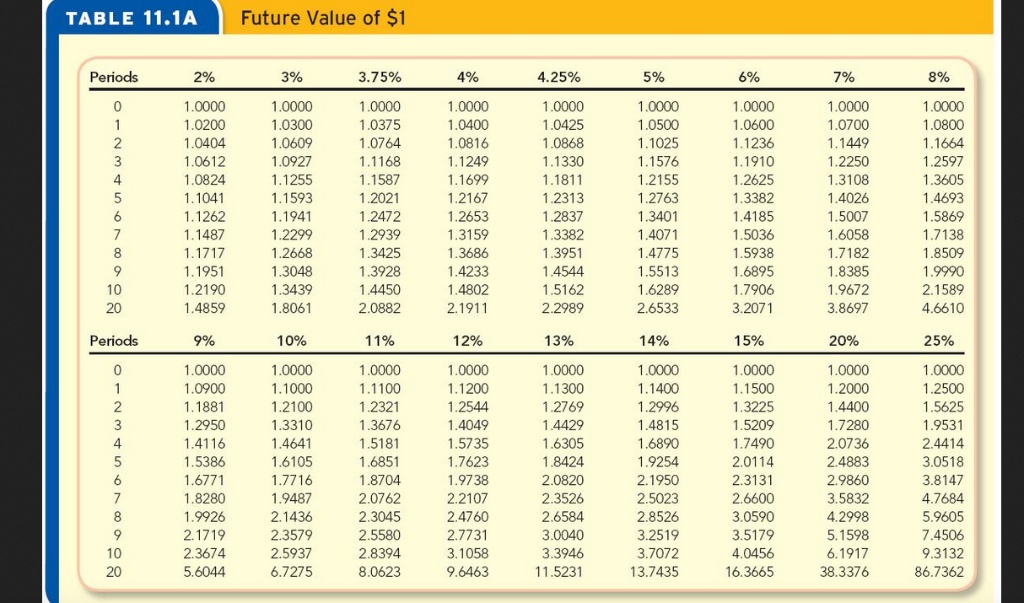

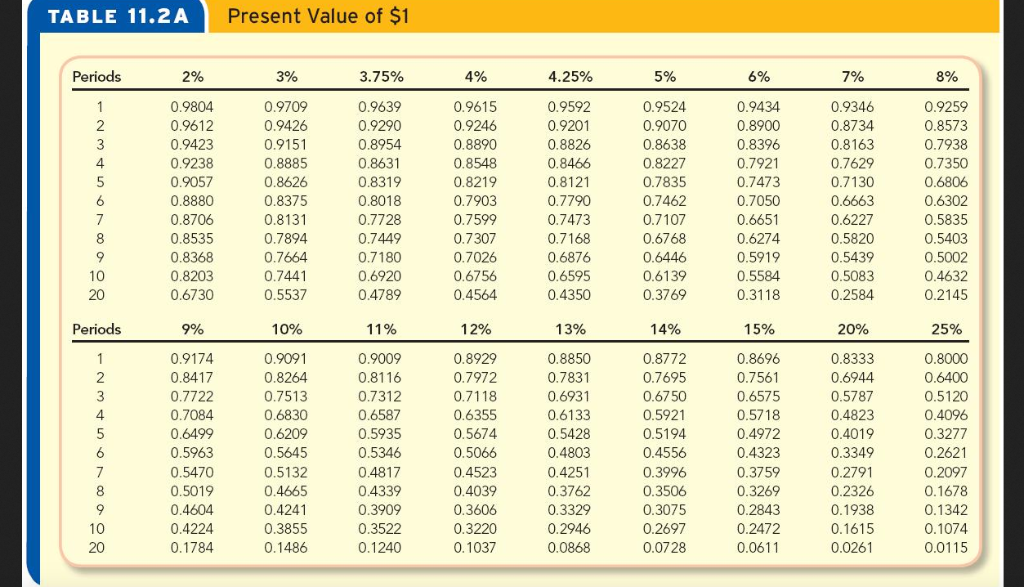

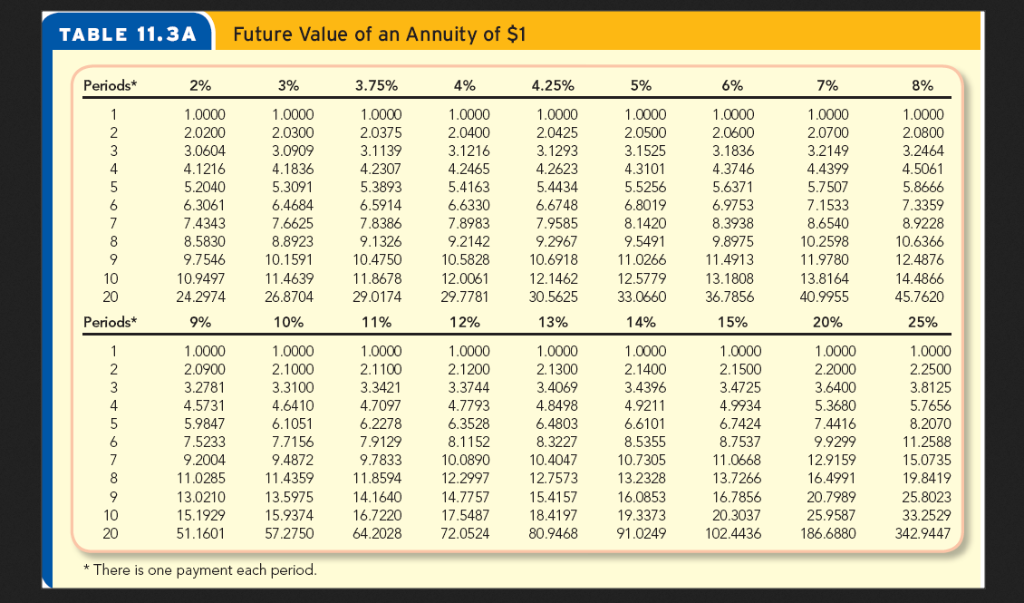

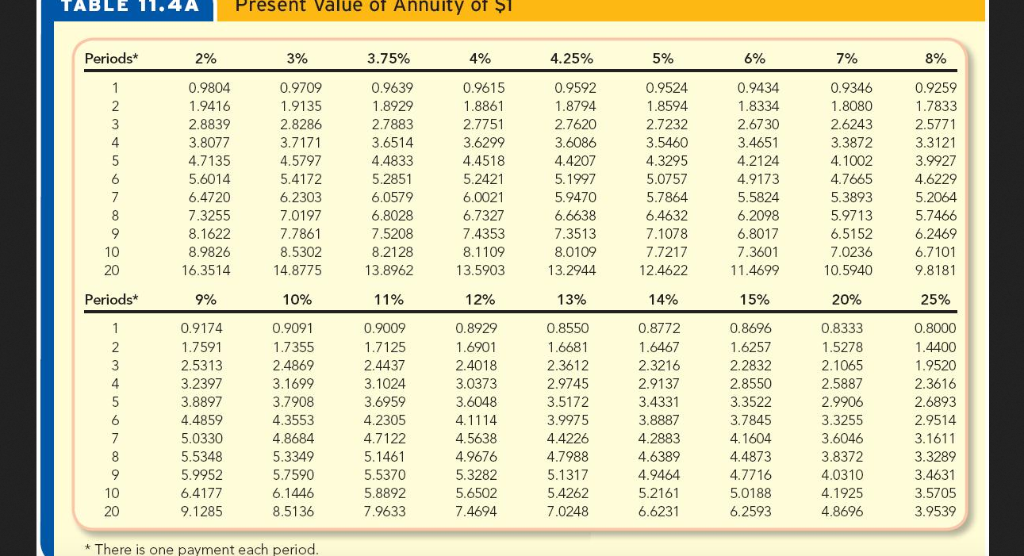

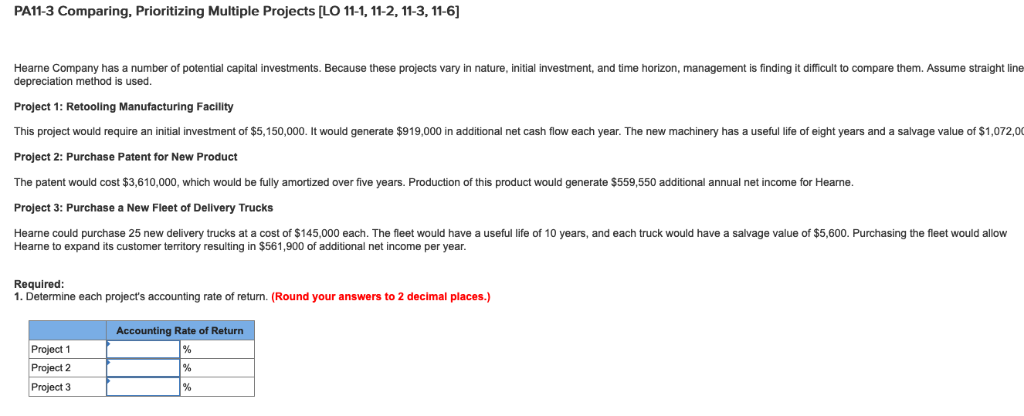

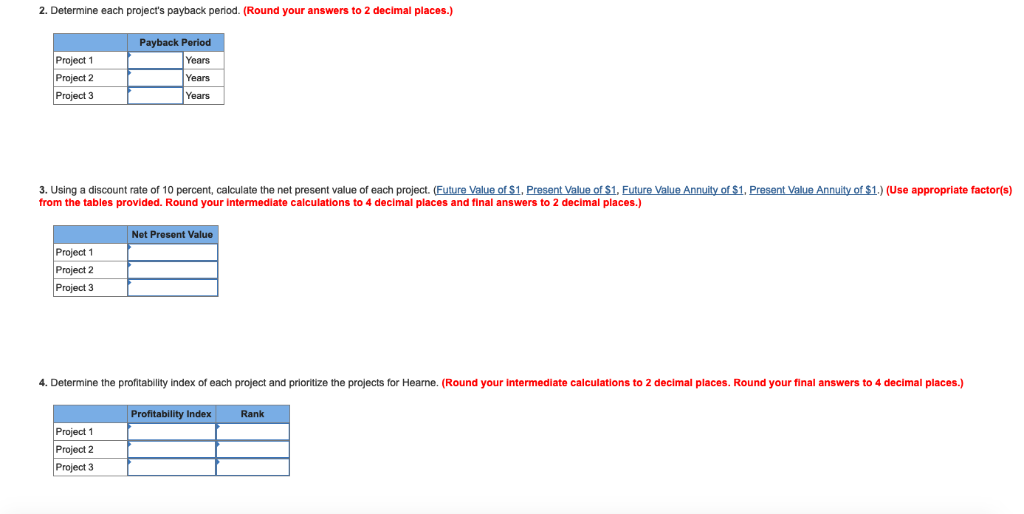

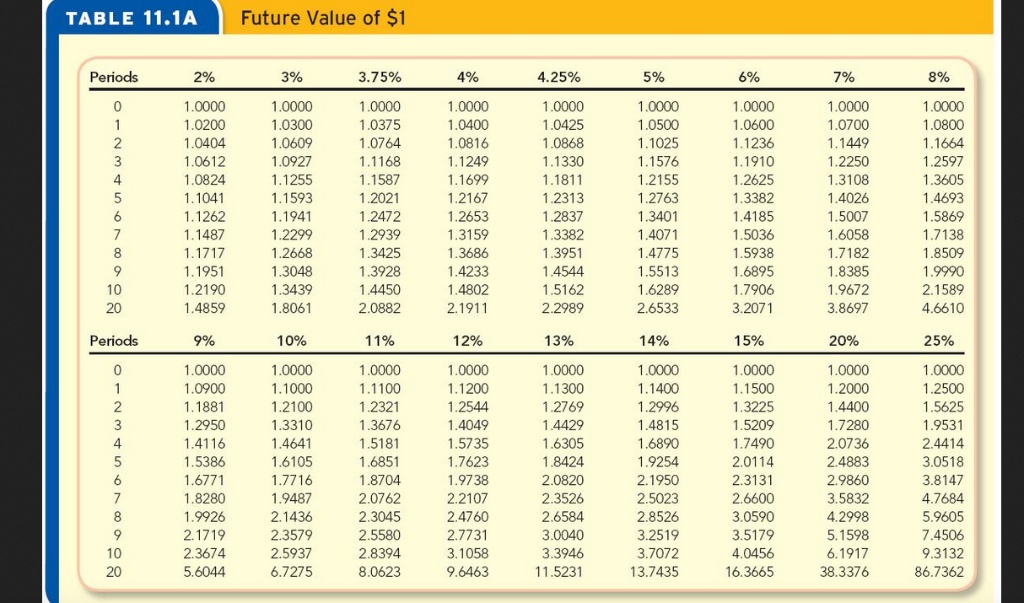

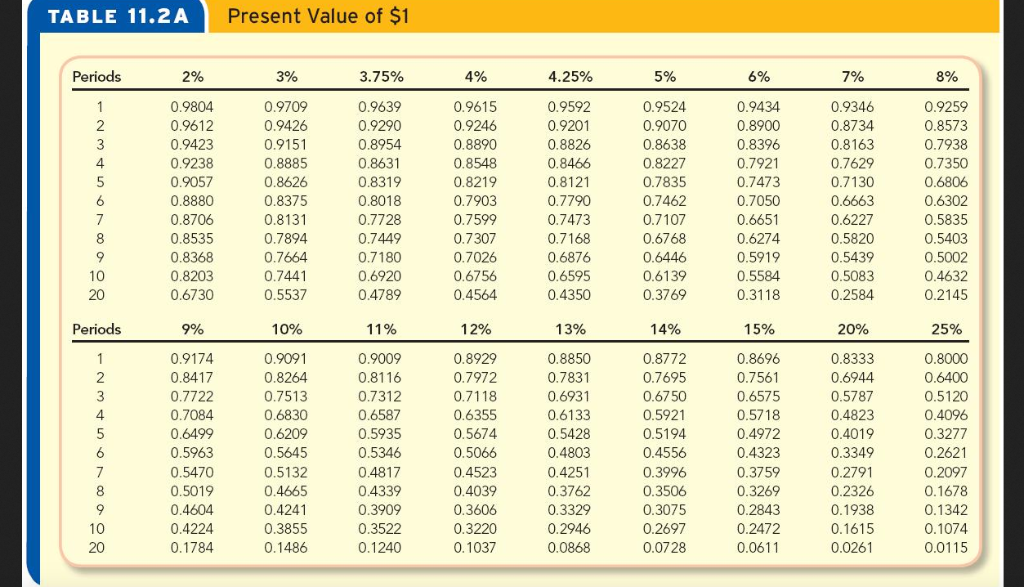

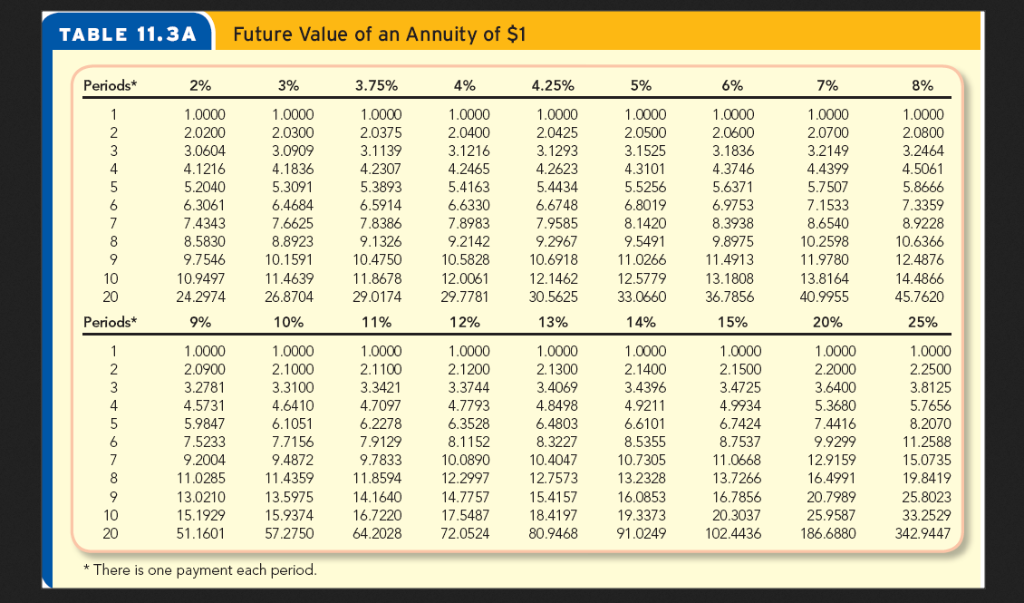

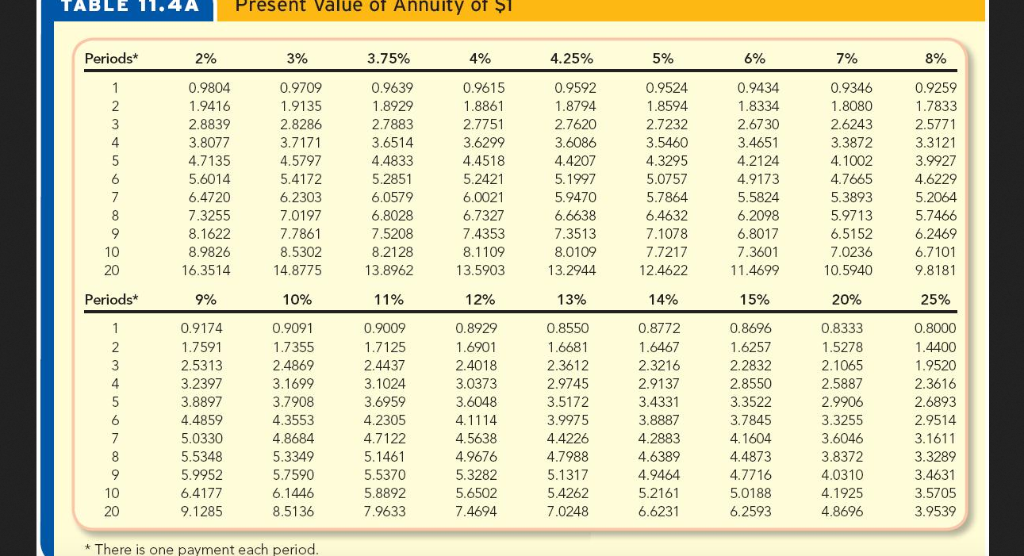

PA11-3 Comparing, Prioritizing Multiple Projects [LO 11-1, 11-2,11-3, 11-6] Hearne Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, management is finding it difficult to compare them. Assume straight line depreciation method is used Project 1: Retooling Manufacturing Facility This project would require an initial investment of $5,150,000. It would generate $919,000 in additional net cash flow each year. The new machinery has a useful life of eight years and a salvage value of $1,072,0 Project 2: Purchase Patent for New Product The patent would cost $3,610,000, which would be fully amortized over five years. Production of this product would generate $559,550 additional annual net income for Hearne. Project 3: Purchase a New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $145,000 each. The fleet would have a useful life of 10 years, and each truck would have a salvage value of $5,600. Purchasing the fleet would allow Hearne to expand its customer territory resulting in $561,900 of additional net income per year Required: 1. Determine each project's accounting rate of return. (Round your answers to 2 decimal places.) Accounting Rate of Return Project 1 Project 2 Project 3 2. Determine each project's payback period. (Round your answers to 2 decimal places.) Payback Period Years Years Years Project 1 Project 2 Project 3 3. Using a discount rate of 10 percent, calculate the net present value of each project. (Future Value of $1, Present Value of S1, from the tables provided. Round your intermediate calculations to 4 decimal places and final answers to 2 decimal places.) Present Value Annuity of $1.) (Use appropriate factor(s) Net Present Value Project 1 Project 2 Project 3 4. Determine the profitability index of each project and prioritize the projects for Hearne. (Round your intermediate calculations to 2 decimal places. Round your final answers to 4 decimal places.) Profitability IndexRank Project 1 Project 2 Project 3 51487 25940879437 8876 2 113 22234563 2 345 247049 7898 0525 5 2 112345567 703 9 36925 2173 1153 5 91 3 11223345 9 739 655 3 2 08 12 16 21 26 31 36 489 29-00 12 25 40 57 76 97 21 47 77 10 71295 4 785 7 1235680 01567 975 4 3 459 7 2 241 2 81 50 16 86 71 80 26 19 74 24791 mo 20 rio 20 01234567890 01234567890 Present Value of $1 TABLE 11.2A Periods 3% 0.9709 0.9426 0.9639 0.9290 0.8954 0.8631 0.8319 0.8018 0.7728 0.7449 0.7180 0.6920 0.4789 0.9615 0.9246 0.8890 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.9434 0.8900 0.8396 0.9804 0.9592 0.9201 0.8826 0.9346 0.8734 0.9259 0.8573 0.7938 0.7350 2 0.9423 0.9238 0.9057 0.8880 0.7629 0.7130 0.6663 0.6227 0.8885 0.8626 0.8375 0.8219 0.7903 0.7599 0.7307 0.8121 0.7790 0.7473 0.7168 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.5835 0.8535 0.7894 0.7664 0.7441 0.5537 0.6768 8 0.5439 0.5083 0.2584 0.4632 0.6595 0.4350 0.3769 20 0.6730 0.4564 0.9174 0.8417 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.1037 0.9091 0.8264 0.7513 0.6830 0.9009 0.8116 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.8772 0.7695 0.6750 0.5921 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 3 0.5120 0.7084 0.6499 0.6587 0.5935 0.5346 0.3277 0.2621 0.4556 0.3996 0.3506 0.3075 0.2697 0.0728 0.4339 0.3909 0.4665 0.4241 0.3329 0.2843 0.2472 0.1342 0.4224 0.0261 20 0.1486 0.0868 0.0115 8 87 8159532 11123 123457802 5 2 1235 1114 1 2 994 2 12357926 24716298 1234578013 676 533 5447 5 7 123468136 14977 4175 1234568913 9 149657203 1234.6 8 0 3 691 135 1234568912 - 533 8578 983 7377 759 7449 8 653 2 7774 9 1-1. 2 3 4 6802472 1234567902 0123581480 ! 97817 - 1234679146 1234567901 577 3937 1361744592 12345678016 | 12346791357 112 1115 2 5091 3 2 595 12345678904 12345791351 1115 123456789 10 io 1 2 3 4 5 6 7 8 9 10 TABLE 11.4A Present value of Annuity of $ 3.75% 0.9639 2.7883 Periods* 0.9709 1.9135 2.8286 0.9524 1.8594 2.7232 0.9615 1.8861 2.7751 0.9592 1.8794 2.7620 0.9259 1.7833 2.5771 3.3121 3.9927 1.8334 2.6730 2.8839 3.8077 2.6243 3.3872 4 4.4833 5.2851 6.0579 4.4518 5.2421 6.0021 6.7327 4.4207 5.1997 5.9470 4.2124 4.9173 5.5824 4.3295 5.0757 4.5797 5.6014 6.4720 7.3255 8.1622 8.9826 4.7665 5.3893 5.9713 6.5152 7.0236 10.5940 6.2303 6.4632 7.1078 7.7217 5.7466 6.2469 6.7101 7.7861 8.5302 14.8775 7.3513 8.0109 13.2944 7.5208 8.2128 13.8962 6.8017 7.3601 11.4699 20 13.5903 Periods* 0.8772 1.6467 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 0.8929 0.8333 1.5278 2.1065 2.5887 0.8550 0.8696 2.4437 3.1024 3.6959 2.5313 3.2397 3.8897 2.3612 2.9745 2.4018 3.0373 3.6048 2.2832 2.8550 3.3522 3.7845 2.3616 2.6893 2.9514 2.9137 3.4331 3.9975 44226 4.7988 5.1317 5.4262 7.0248 3.3255 4.7122 5.0330 5.5348 5.9952 6.4177 9.1285 4.9676 5.3282 5.6502 7 694 4.4873 4.7716 5.0188 6.2593 3.8372 4.0310 4.6389 3.3289 3.4631 3.5705 5.5370 5.8892 7.9633 5.2161 20 * There is one payment each period PA11-3 Comparing, Prioritizing Multiple Projects [LO 11-1, 11-2,11-3, 11-6] Hearne Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, management is finding it difficult to compare them. Assume straight line depreciation method is used Project 1: Retooling Manufacturing Facility This project would require an initial investment of $5,150,000. It would generate $919,000 in additional net cash flow each year. The new machinery has a useful life of eight years and a salvage value of $1,072,0 Project 2: Purchase Patent for New Product The patent would cost $3,610,000, which would be fully amortized over five years. Production of this product would generate $559,550 additional annual net income for Hearne. Project 3: Purchase a New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $145,000 each. The fleet would have a useful life of 10 years, and each truck would have a salvage value of $5,600. Purchasing the fleet would allow Hearne to expand its customer territory resulting in $561,900 of additional net income per year Required: 1. Determine each project's accounting rate of return. (Round your answers to 2 decimal places.) Accounting Rate of Return Project 1 Project 2 Project 3 2. Determine each project's payback period. (Round your answers to 2 decimal places.) Payback Period Years Years Years Project 1 Project 2 Project 3 3. Using a discount rate of 10 percent, calculate the net present value of each project. (Future Value of $1, Present Value of S1, from the tables provided. Round your intermediate calculations to 4 decimal places and final answers to 2 decimal places.) Present Value Annuity of $1.) (Use appropriate factor(s) Net Present Value Project 1 Project 2 Project 3 4. Determine the profitability index of each project and prioritize the projects for Hearne. (Round your intermediate calculations to 2 decimal places. Round your final answers to 4 decimal places.) Profitability IndexRank Project 1 Project 2 Project 3 51487 25940879437 8876 2 113 22234563 2 345 247049 7898 0525 5 2 112345567 703 9 36925 2173 1153 5 91 3 11223345 9 739 655 3 2 08 12 16 21 26 31 36 489 29-00 12 25 40 57 76 97 21 47 77 10 71295 4 785 7 1235680 01567 975 4 3 459 7 2 241 2 81 50 16 86 71 80 26 19 74 24791 mo 20 rio 20 01234567890 01234567890 Present Value of $1 TABLE 11.2A Periods 3% 0.9709 0.9426 0.9639 0.9290 0.8954 0.8631 0.8319 0.8018 0.7728 0.7449 0.7180 0.6920 0.4789 0.9615 0.9246 0.8890 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.9434 0.8900 0.8396 0.9804 0.9592 0.9201 0.8826 0.9346 0.8734 0.9259 0.8573 0.7938 0.7350 2 0.9423 0.9238 0.9057 0.8880 0.7629 0.7130 0.6663 0.6227 0.8885 0.8626 0.8375 0.8219 0.7903 0.7599 0.7307 0.8121 0.7790 0.7473 0.7168 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.5835 0.8535 0.7894 0.7664 0.7441 0.5537 0.6768 8 0.5439 0.5083 0.2584 0.4632 0.6595 0.4350 0.3769 20 0.6730 0.4564 0.9174 0.8417 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.1037 0.9091 0.8264 0.7513 0.6830 0.9009 0.8116 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.8772 0.7695 0.6750 0.5921 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 3 0.5120 0.7084 0.6499 0.6587 0.5935 0.5346 0.3277 0.2621 0.4556 0.3996 0.3506 0.3075 0.2697 0.0728 0.4339 0.3909 0.4665 0.4241 0.3329 0.2843 0.2472 0.1342 0.4224 0.0261 20 0.1486 0.0868 0.0115 8 87 8159532 11123 123457802 5 2 1235 1114 1 2 994 2 12357926 24716298 1234578013 676 533 5447 5 7 123468136 14977 4175 1234568913 9 149657203 1234.6 8 0 3 691 135 1234568912 - 533 8578 983 7377 759 7449 8 653 2 7774 9 1-1. 2 3 4 6802472 1234567902 0123581480 ! 97817 - 1234679146 1234567901 577 3937 1361744592 12345678016 | 12346791357 112 1115 2 5091 3 2 595 12345678904 12345791351 1115 123456789 10 io 1 2 3 4 5 6 7 8 9 10 TABLE 11.4A Present value of Annuity of $ 3.75% 0.9639 2.7883 Periods* 0.9709 1.9135 2.8286 0.9524 1.8594 2.7232 0.9615 1.8861 2.7751 0.9592 1.8794 2.7620 0.9259 1.7833 2.5771 3.3121 3.9927 1.8334 2.6730 2.8839 3.8077 2.6243 3.3872 4 4.4833 5.2851 6.0579 4.4518 5.2421 6.0021 6.7327 4.4207 5.1997 5.9470 4.2124 4.9173 5.5824 4.3295 5.0757 4.5797 5.6014 6.4720 7.3255 8.1622 8.9826 4.7665 5.3893 5.9713 6.5152 7.0236 10.5940 6.2303 6.4632 7.1078 7.7217 5.7466 6.2469 6.7101 7.7861 8.5302 14.8775 7.3513 8.0109 13.2944 7.5208 8.2128 13.8962 6.8017 7.3601 11.4699 20 13.5903 Periods* 0.8772 1.6467 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 0.8929 0.8333 1.5278 2.1065 2.5887 0.8550 0.8696 2.4437 3.1024 3.6959 2.5313 3.2397 3.8897 2.3612 2.9745 2.4018 3.0373 3.6048 2.2832 2.8550 3.3522 3.7845 2.3616 2.6893 2.9514 2.9137 3.4331 3.9975 44226 4.7988 5.1317 5.4262 7.0248 3.3255 4.7122 5.0330 5.5348 5.9952 6.4177 9.1285 4.9676 5.3282 5.6502 7 694 4.4873 4.7716 5.0188 6.2593 3.8372 4.0310 4.6389 3.3289 3.4631 3.5705 5.5370 5.8892 7.9633 5.2161 20 * There is one payment each period