Question

Pablo S.A is a manufacturer of children's shoes, located in Spain. It owns 51% of the voting stock of Stabfoot. A specialty shoe manufacturer located

Pablo S.A is a manufacturer of children's shoes, located in Spain. It owns 51% of the voting stock of Stabfoot. A specialty shoe manufacturer located in Belgium Pablo acquired its interest in Stabfoot several years ago, and has consolidated Stabfoot in its financial statements since the date of acquisition. Per IFRS, Stabfoo's identifiable assets and liabilities were revalued to fair value at the date of acquisition. This process led to recognition of customer and distributor relationships valued at 40 million euros, and goodwill at 120 million euros. Pablo uses the IFRS alternative and does not attribute goodwill to the noncontrolling interest. As of the beginning of the current year, the goodwill and identifiable intangibles are not impaired. Goodwill is impaired by 10 million in the current year. Pablo and stabfoot engage in intercompany transfers of merchandise. Below is information on these transactions;

Pablo sells merchandise to Stabfoot at a markup of 20% on price

Stabfoot sells merchandise to Pablo at a markup of 20% on cost

Balance in Pablo's beginning inventory purchased from Stabfoot 24 million euros

Balance in Pablo's ending inventory purchased from Stabfoot 26.4 million euros

Total sales from Stabfoot to Pablo at the price changed to Pablo 125 million euros

Balance in Stabfoot's beginning inventory purchased from Pablo 22.5 million euros

Balance in Stabfoot's ending inventory purchased from Pablo 25 million euros

Total sales from Pablo to Stabfoot at the price charged to Stabfoot 130 million euros

Required:

A) Calculate Pablo's equity in net loss and the noncontrolling interest in net income for the current year.

B) Prepare working paper to consolidate the trial balances of Pablo and Stabfoot. Label you eliminating entries (C) (I) (E) (R) (O) and (N)

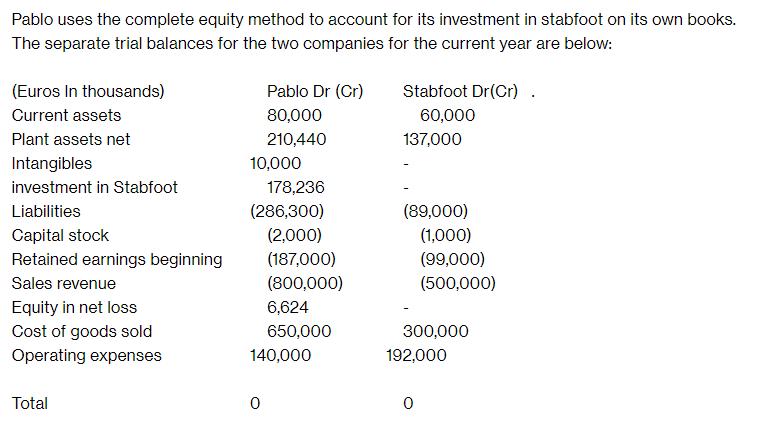

Pablo uses the complete equity method to account for its investment in stabfoot on its own books. The separate trial balances for the two companies for the current year are below: (Euros In thousands) Current assets Plant assets net Intangibles investment in Stabfoot Liabilities Capital stock Retained earnings beginning Sales revenue Equity in net loss Cost of goods sold Operating expenses Total Pablo Dr (Cr) 80,000 210,440 10,000 178,236 (286,300) (2,000) 0 (187,000) (800,000) 6,624 650,000 140,000 Stabfoot Dr(Cr). 60,000 137,000 (89,000) (1,000) (99,000) (500,000) 300,000 192,000 0

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A Stabfoots net loss for the year Sales revenue 500000 Cost of goods sold 392000 Operating expenses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started