Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pacer International makes all heavy duty dumpers, having their assembly plant is in St. Louis Missouri. Pacers purchasing manager John Smith has to choose a

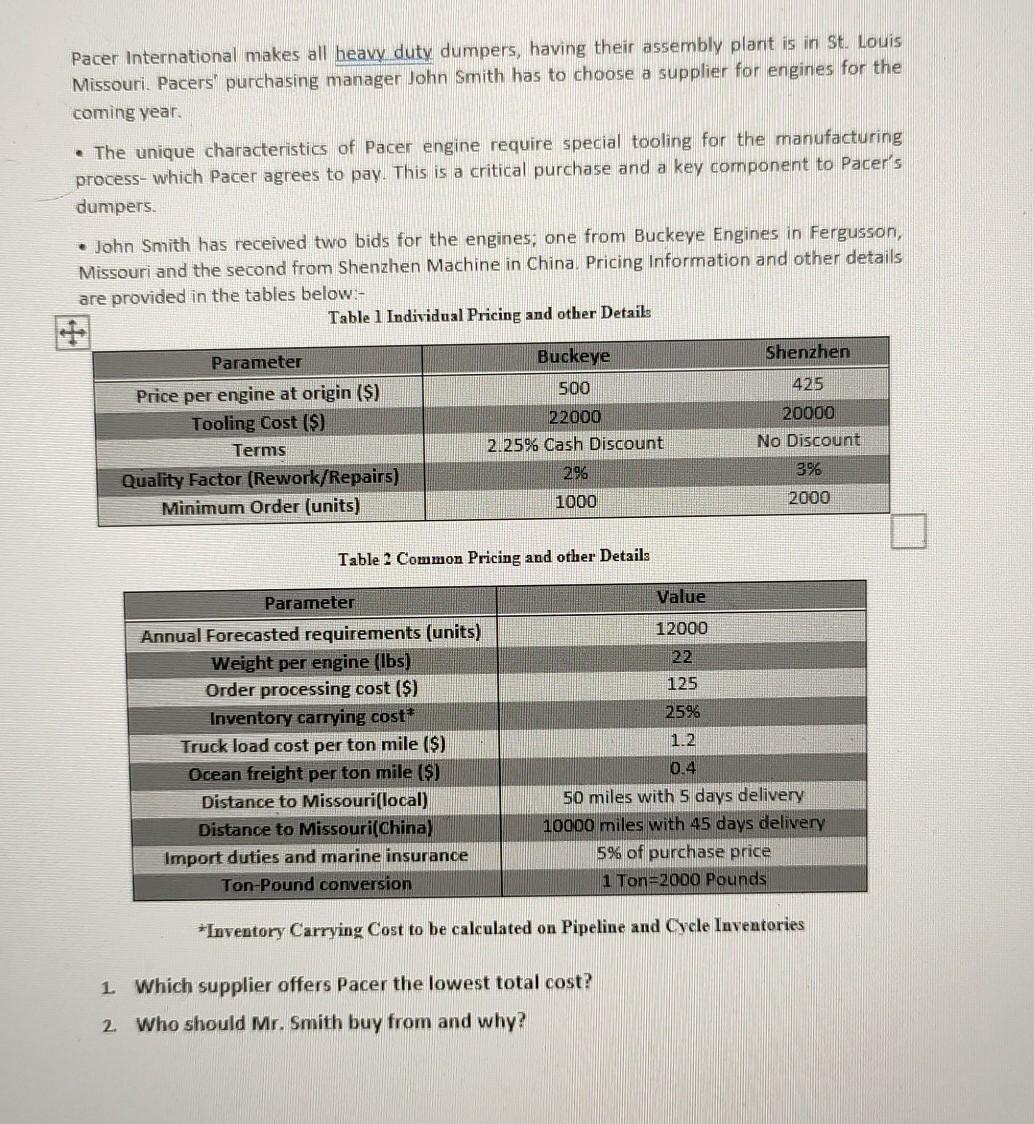

Pacer International makes all heavy duty dumpers, having their assembly plant is in St. Louis Missouri. Pacers purchasing manager John Smith has to choose a supplier for engines for the coming year The unique characteristics of Pacer engine require special tooling for the manufacturing process, which Pacer agrees to pay. This is a critical purchase and a key component to Pacer's dumpers John Smith has received two bids for the engines, one from Buckeye Engines in Fergusson, Missouri and the second from Shenzhen Machine in China. Pricing Information and other details are provided in the tables below:- Table 1 Individual Pricing and other Details Shenzhen 425 Parameter Price per engine at origin ($) Tooling Cost ($) Terms Quality Factor (Rework/Repairs) Minimum Order (units) Buckeye 500 22000 2.25% Cash Discount 296 20000 No Discount 3% 1000 2000 Table ? Common Pricing and other Details Parameter Value 12000 22 125 25% Annual Forecasted requirements (units) Weight per engine (lbs) Order processing cost ($) Inventory carrying cost Truck load cost per ton mile ($) Ocean freight per ton mile ($) Distance to Missouri(local) Distance to Missouri(China) Import duties and marine insurance Ton-Pound conversion 1.2 0.4 50 miles with 5 days delivery 10000 miles with 45 days delivery 5% of purchase price 1 Ton=2000 Pounds *Inventory Carrying Cost to be calculated on Pipeline and Cycle Inventories 1 Which supplier offers Pacer the lowest total cost? 2. Who should Mr. Smith buy from and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started