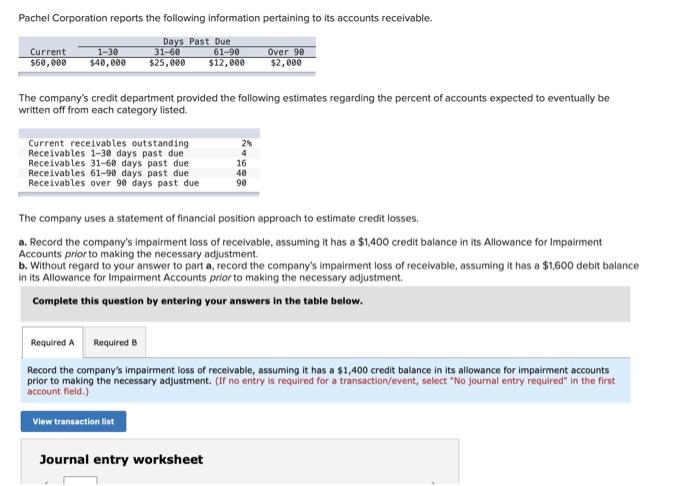

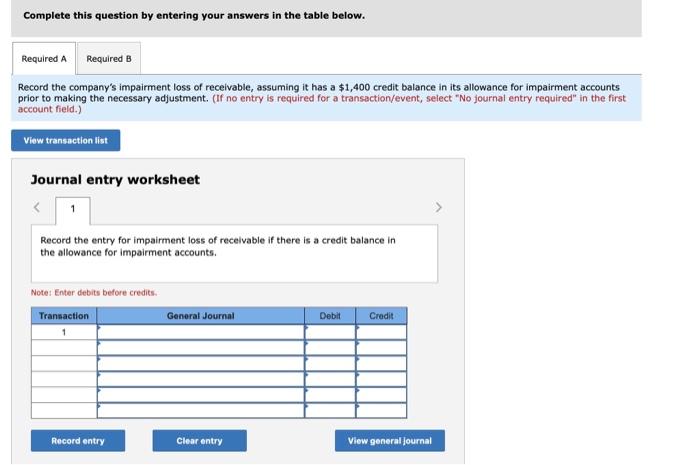

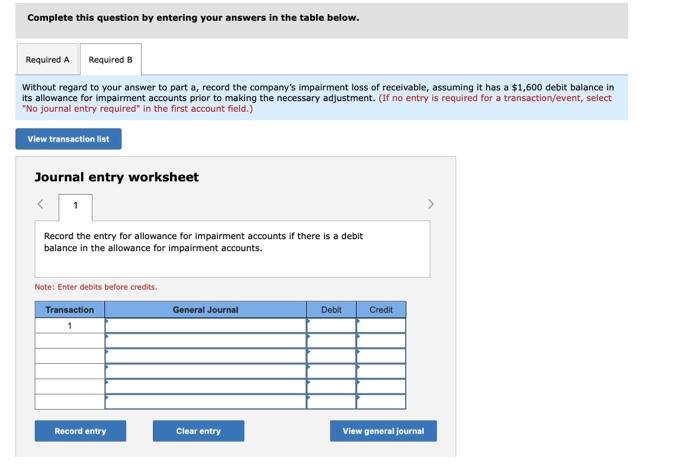

Pachel Corporation reports the following information pertaining to its accounts receivable. The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed. The company uses a statement of financial position approach to estimate credit losses. a. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its Allowance for Impairment Accounts prior to making the necessary adjustment. b. Without regard to your answer to part a, record the company's impairment loss of recelvable, assuming it has a $1,600 debit balance in its Allowance for Impairment Accounts prior to making the necessary adjustment. Complete this question by entering your answers in the table below. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its allowance for impairment accounts prior to making the necessary adjustment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Complete this question by entering your answers in the table below. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its allowance for impairment accounts prior to making the necessary adjustment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for impairment loss of receivable if there is a credit balance in the allowance for impairment accounts. Note: Enter debits before credits. Complete this question by entering your answers in the table below. Without regard to your answer to part a, record the company's impairment loss of receivable, assuming it has a $1,600 debit balance in its allowance for impairment accounts prior to making the necessary adjustment. (If no entry is required for a transaction/event, select. "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for allowance for impairment accounts if there is a debit balance in the allowance for impairment accounts. Rote: Enter debits before credits