Question

Pacific Healthcare (A). Review the case, utilize the case model provided by the publisher, and respond to the following questions: To prepare for the meeting,

Pacific Healthcare (A). Review the case, utilize the case model provided by the publisher, and respond to the following questions:

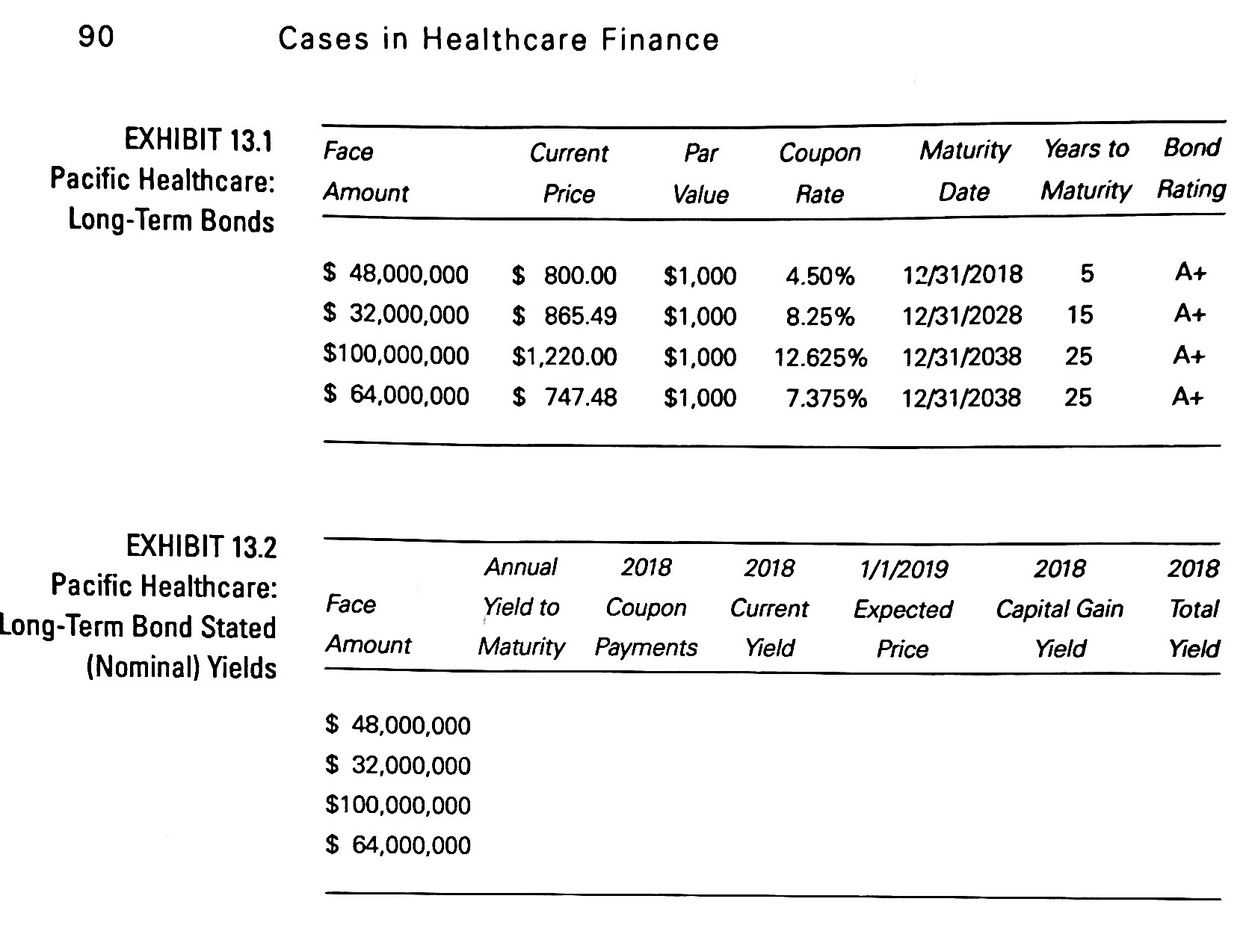

To prepare for the meeting, create a summary of the yields of each bond by completing the table shown in Exhibit 13.2. Remember that the YTM of each bond is assumed to be the required rate of return of each bond and that the semiannual YTM must be multiplied by two to get the stated (nominal) YTM.

The Chair comments that the 15-year and both 25-year bonds are callable five years from today at $1,050 and asks you for the yield-to-call on each of the three bonds.

Finally, the Chair states that most bond market analysts believe that interest rates will remain at the 10 percent level for the next several years. She asks you whether Pacific should consider calling any of its bonds and why.

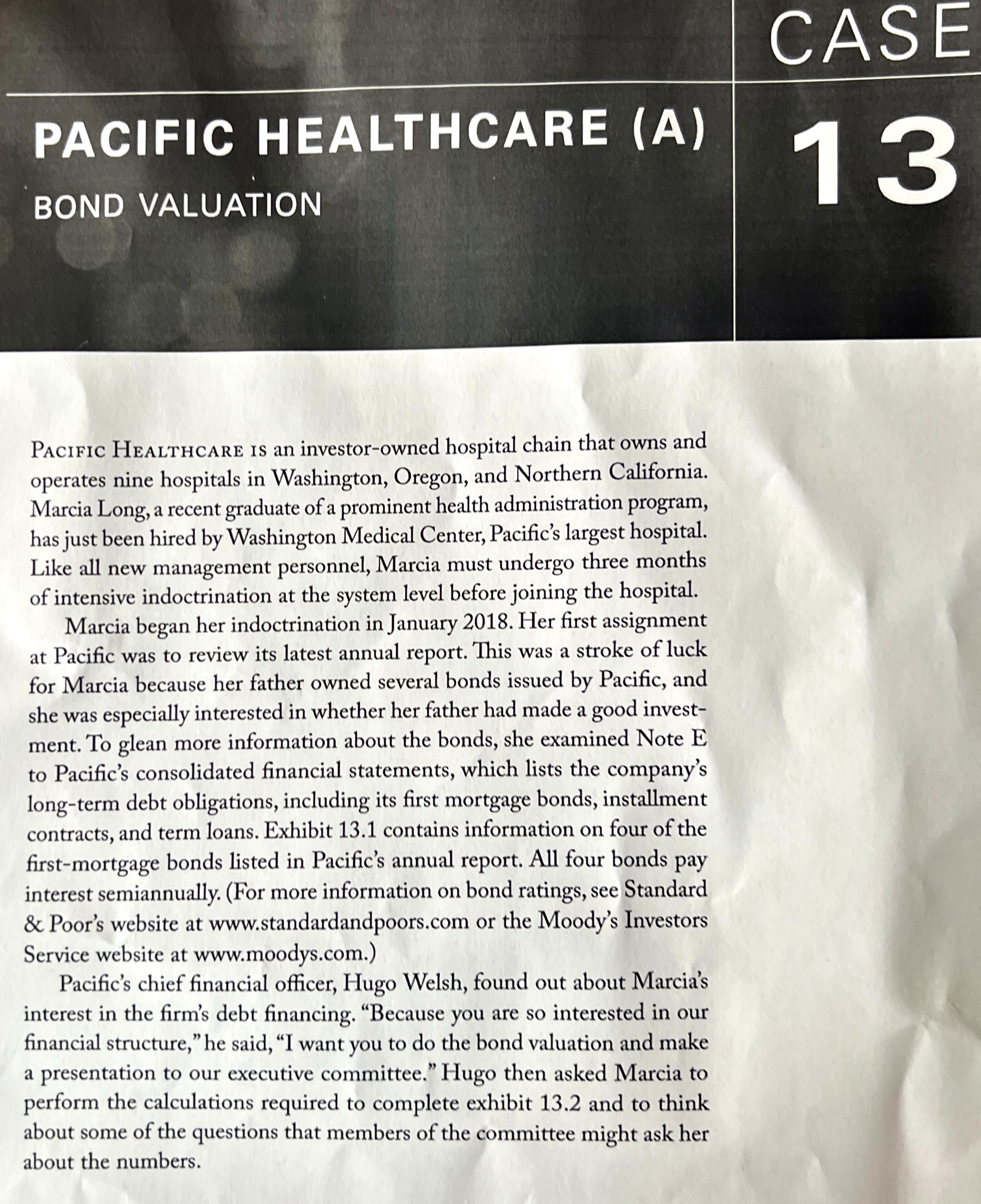

PACIFIC HEALTHCARE (A) BOND VALUATION Pacific Healthcare is an investor-owned hospital chain that owns and operates nine hospitals in Washington, Oregon, and Northern California. Marcia Long, a recent graduate of a prominent health administration program, has just been hired by Washington Medical Center, Pacific's largest hospital. Like all new management personnel, Marcia must undergo three months of intensive indoctrination at the system level before joining the hospital. Marcia began her indoctrination in January 2018. Her first assignment at Pacific was to review its latest annual report. This was a stroke of luck for Marcia because her father owned several bonds issued by Pacific, and she was especially interested in whether her father had made a good investment. To glean more information about the bonds, she examined Note E to Pacific's consolidated financial statements, which lists the company's long-term debt obligations, including its first mortgage bonds, installment contracts, and term loans. Exhibit 13.1 contains information on four of the first-mortgage bonds listed in Pacific's annual report. All four bonds pay interest semiannually. (For more information on bond ratings, see Standard \& Poor's website at www.standardandpoors.com or the Moody's Investors Service website at www.moodys.com.) Pacific's chief financial officer, Hugo Welsh, found out about Marcia's interest in the firm's debt financing. "Because you are so interested in our financial structure," he said, "I want you to do the bond valuation and make a presentation to our executive committee." Hugo then asked Marcia to perform the calculations required to complete exhibit 13.2 and to think about some of the questions that members of the committee might ask her about the numbers. Cases in Healthrare Finance PACIFIC HEALTHCARE (A) BOND VALUATION Pacific Healthcare is an investor-owned hospital chain that owns and operates nine hospitals in Washington, Oregon, and Northern California. Marcia Long, a recent graduate of a prominent health administration program, has just been hired by Washington Medical Center, Pacific's largest hospital. Like all new management personnel, Marcia must undergo three months of intensive indoctrination at the system level before joining the hospital. Marcia began her indoctrination in January 2018. Her first assignment at Pacific was to review its latest annual report. This was a stroke of luck for Marcia because her father owned several bonds issued by Pacific, and she was especially interested in whether her father had made a good investment. To glean more information about the bonds, she examined Note E to Pacific's consolidated financial statements, which lists the company's long-term debt obligations, including its first mortgage bonds, installment contracts, and term loans. Exhibit 13.1 contains information on four of the first-mortgage bonds listed in Pacific's annual report. All four bonds pay interest semiannually. (For more information on bond ratings, see Standard \& Poor's website at www.standardandpoors.com or the Moody's Investors Service website at www.moodys.com.) Pacific's chief financial officer, Hugo Welsh, found out about Marcia's interest in the firm's debt financing. "Because you are so interested in our financial structure," he said, "I want you to do the bond valuation and make a presentation to our executive committee." Hugo then asked Marcia to perform the calculations required to complete exhibit 13.2 and to think about some of the questions that members of the committee might ask her about the numbers. Cases in Healthrare FinanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started