Question

Pacific Healthcare is an investor-owned hospital chain that owns and operates nine hospitals in Washington, Oregon, and northern California. Marcia Long, a recent graduate of

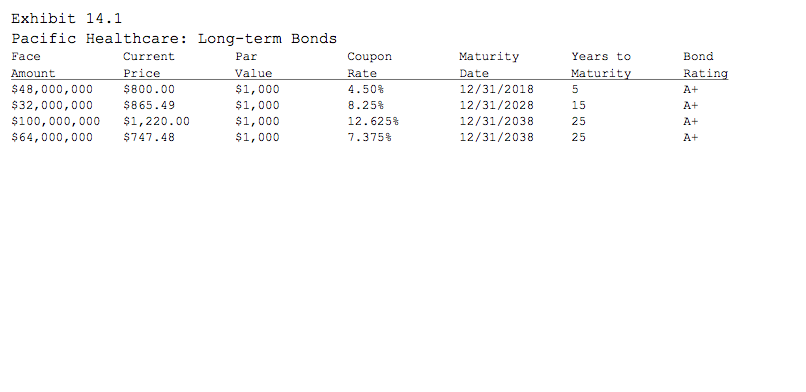

Pacific Healthcare is an investor-owned hospital chain that owns and operates nine hospitals in Washington, Oregon, and northern California. Marcia Long, a recent graduate of a prominent health administration program, has just been hired by Washington Medical Center, Pacific's largest hospital. Like all new management personnel, Marcia must undergo three months of intensive indoctrination at the system level before joining the hospital. Marcia began her indoctrination in January 2014. Her first assignment at Pacific was to review its latest annual report. This was a stroke of luck for Marcia because her father owned several bonds issued by Pacific, and Marcia was especially interested in whether or not her father had made a good investment. To glean more information about the bonds, Marcia examined Note E to Pacific's consolidated financial statements, which lists the company's long-term debt obligations, including its first mortgage bonds, installment contracts, and term loans. Table 14.1 contains information on four of the first mortgage bonds listed in Pacific's annual report. All four bonds pay interest semi-annually. Pacific's chief financial officer, Hugo Welsh, found out about Marcia's interest in the firm's debt financing. Because you are so interested in our financial structure, he said, I want you to do the bond valuation and make a presentation to our executive committee. Hugo then asked Marcia to perform the calculations required to complete Exhibit 14.2 and to think about some of the questions that members of the committee might ask her about the numbers.

Pacific Healthcare: Long-term Bond Stated (Nominal) Yields

| Face Amount | Annual YTM | 2014 Coupon Payments | 2014 Current Yield | 1/1/2015 Expected Price | 2014 Cap Gain Yield | 2014 Total Yield |

| $48,000,000 | 19.26% | $45 | 5.62% | $833 | -16.7% | -12.2% |

| $32,000,000 | 20% | $82.50 | 9.53% | $870 | -13% | -4.57% |

| $100,000,000 | 20.36% | $126.25 | 10.35% | $1218 | 21.8% | 34.42% |

| $64,000,000 | 20.36% | $750 | 9.87% | $750 | -25% | -17.62 |

QUESTION:

The committee chair states that it is important for Pacific to understand the market for its debt. I understand that Pacific's bonds are held primarily by tax-paying investors, so I want to know whether they prefer one of the 25-year bonds over the other and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started