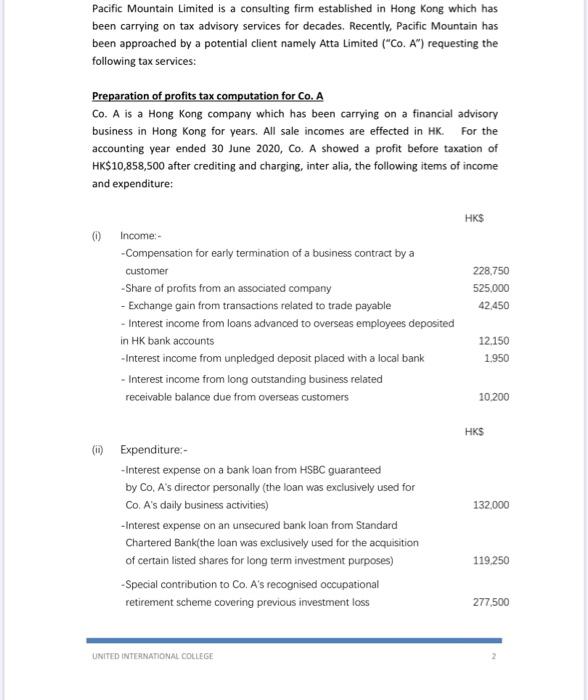

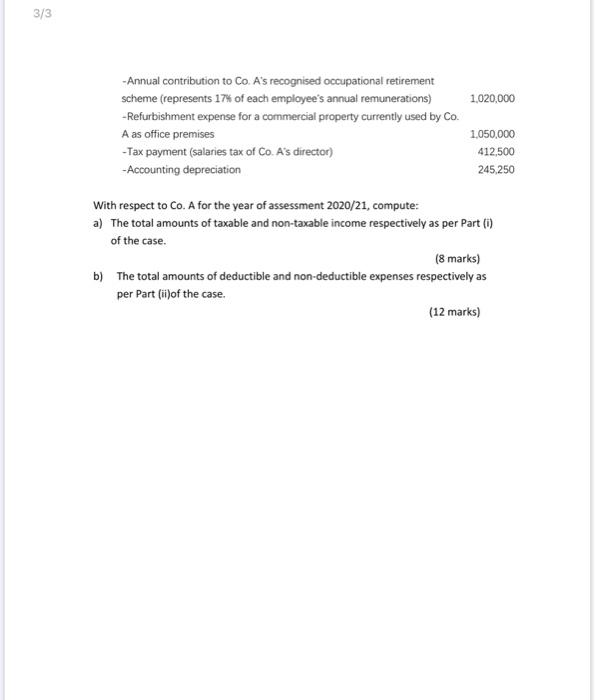

Pacific Mountain Limited is a consulting firm established in Hong Kong which has been carrying on tax advisory services for decades. Recently, Pacific Mountain has been approached by a potential client namely Atta Limited ("Co. A") requesting the following tax services: Preparation of profits tax computation for Co. A Co. A is a Hong Kong company which has been carrying on a financial advisory business in Hong Kong for years. All sale incomes are effected in HK. For the accounting year ended 30 June 2020, Co. A showed a profit before taxation of HK$10,858,500 after crediting and charging, inter alia, the following items of income and expenditure: HK$ 0 228,750 525,000 42.450 Income:- - Compensation for early termination of a business contract by a customer - Share of profits from an associated company - Exchange gain from transactions related to trade payable - Interest income from loans advanced to overseas employees deposited in HK bank accounts -Interest income from unpledged deposit placed with a local bank - Interest income from long outstanding business related receivable balance due from overseas customers 12.150 1.950 10.200 HKS 132,000 Expenditure - -Interest expense on a bank loan from HSBC guaranteed by Co, A's director personally (the loan was exclusively used for Co. A's daily business activities) -Interest expense on an unsecured bank loan from Standard Chartered Bank(the loan was exclusively used for the acquisition of certain listed shares for long term investment purposes) -Special contribution to Co. A's recognised occupational retirement scheme covering previous investment loss 119.250 277.500 UNITED INTERNATIONAL COLLEGE 3/3 1,020,000 -Annual contribution to Co. A's recognised occupational retirement scheme (represents 17% of each employee's annual remunerations) -Refurbishment expense for a commercial property currently used by Co. A as office premises -Tax payment (salaries tax of Co. A's director) -Accounting depreciation 1,050,000 412,500 245,250 With respect to Co. A for the year of assessment 2020/21, compute: a) The total amounts of taxable and non-taxable income respectively as per Part (0) of the case. (8 marks) b) The total amounts of deductible and non-deductible expenses respectively as per Part (ii)of the case. (12 marks)