Question

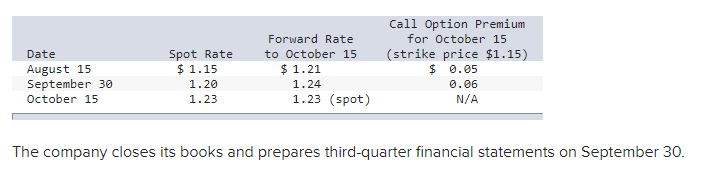

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,300 cases of Oktoberfest-style beer from a German supplier for 299,000euros. Relevant U.S. dollar exchange

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,300 cases of Oktoberfest-style beer from a German supplier for 299,000euros. Relevant U.S. dollar exchange rates for the euro are as follows:

Assume that, on August 15, the company forecasted the purchase of beer on October 15. On August 15, the company acquired a two-month call option on 299,000 euros. The company designated the option as a cash value hedge of a forecasted foreign currency transaction. The time value of the option is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income over the life of the option. Prepare journal entries to account for the foreign currency option and import purchase. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)

- Record the gain or loss on the foreign currency euro call option with a premium of $0.050 per Euro at a strike price of $1.15 and an exercise date of October 15.

- Record the gain or loss on the foreign currency euro call option with a premium of $0.060.

- Record the transfer of gain or loss to the cost of goods sold.

- Record the entry for changes in the fair value of Euro call option.

- Record the transfer of gain or loss to the cost of goods sold.

- Record purchase of foreign currency for settling the accounts payable.

- Record purchase of inventory from the German supplier.

- Record the transfer of inventory to cost of goods sold.

- Record the adjustment of cost of goods sold to the extent of Other Comprehensive Income.

The company closes its books and prepares third-quarter financial statements on September 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started