Answered step by step

Verified Expert Solution

Question

1 Approved Answer

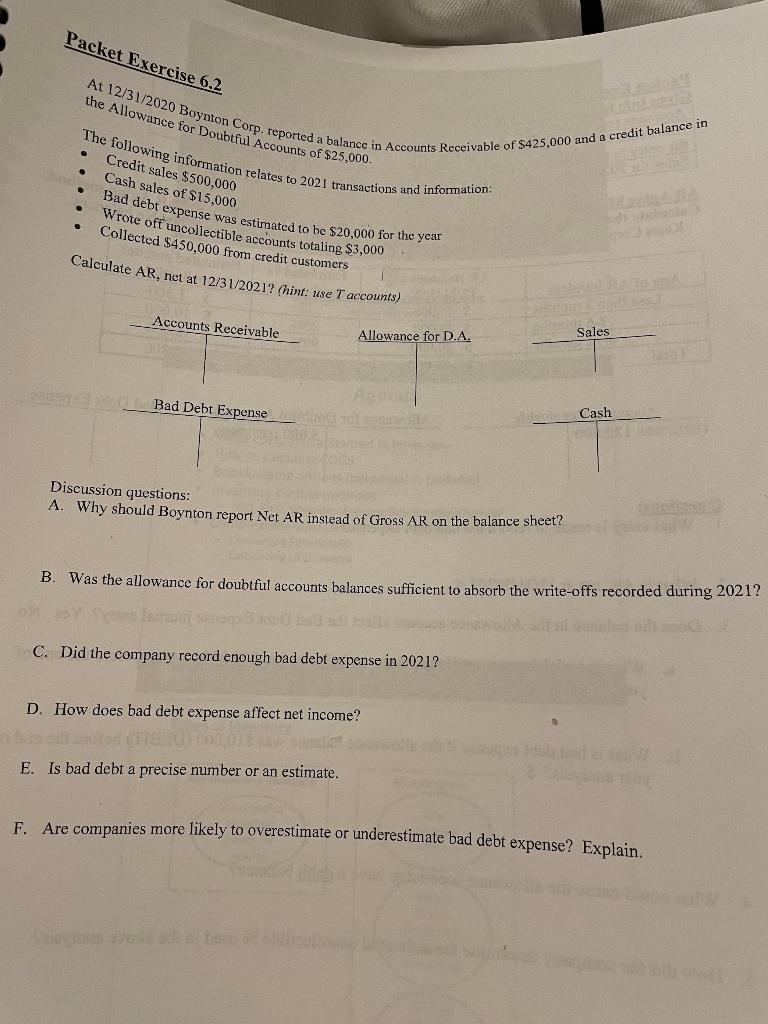

Packet Exercise 6.2 the Allowance for Doubtful Accounts of $25,000. At 12/31/2020 Boynton Corp. reported a balance in Accounts Receivable of $425,000 and a

Packet Exercise 6.2 the Allowance for Doubtful Accounts of $25,000. At 12/31/2020 Boynton Corp. reported a balance in Accounts Receivable of $425,000 and a credit balance in The following information relates to 2021 transactions and information: Credit sales $500,000 Cash sales of $15,000 Bad debt expense was estimated to be $20,000 for the year Wrote off uncollectible accounts totaling $3,000 Collected $450,000 from credit customers Calculate AR, net at 12/31/2021? (hint: use T accounts) . Accounts Receivable partered ideBad Debt Expense Allowance for D.A. Discussion questions: A. Why should Boynton report Net AR instead of Gross AR on the balance sheet? C. Did the company record enough bad debt expense in 2021? B. Was the allowance for doubtful accounts balances sufficient to absorb the write-offs recorded during 2021? D. How does bad debt expense affect net income? 000,012 E. Is bad debt a precise number or an estimate. Sales: B Cash Toby F. Are companies more likely to overestimate or underestimate bad debt expense? Explain.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Net AR According to the aforementioned ledger accounts gross AR 475000 however it cannot be shown ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started