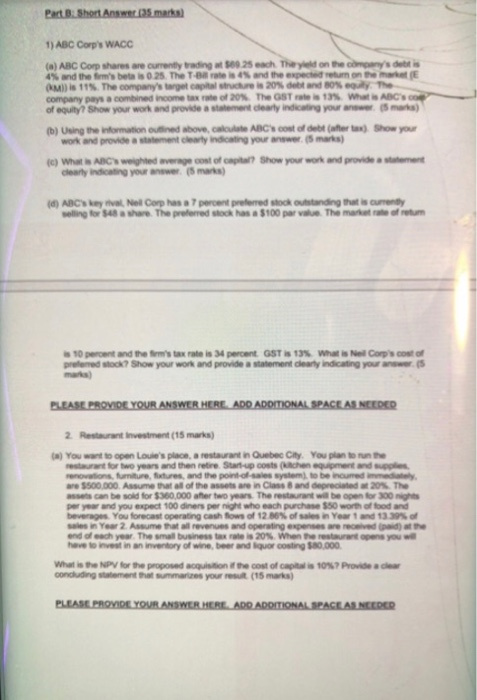

Pact Short Answers marks) 1) ABC Corp's WACC (*) ABC Comp share are current trading 0.25 each The one s and the ' 02. The T rees and the experimente Quis 115. The company' s 20% and The company as a combined income of 20 The OST W ANG of uity Show your work and provide a n early in your b) Ung the worn bove, ABC cost of the show your work and provide a mentary indicating your e mas) What C e werage cost of capital Show your work and provide ABC N for el Corps a percent preferred stock outstanding that is here. The preferred stock has a $100 per The m o retum 10 percent and ther's tax rate is 34 percent GST is 13% What is Nel Corp's cost of preferred stock? Show your work and provide a statement clearly indicating your answers PLEASE PROVIDE YOUR ANSWER HERE ADO ADDITIONAL SPACE AS NEEDED 2 Restaurant investment (15 marks) You want to Louie's place, a restaurant in Quebec City. You plan to the for two years and then rebre S coutschenment and novations, furniture, futures, and the point-of-sales system to be incred are 5500 500. Assume that all of the s a in Class and 2017. The can be sold for $360,000 after two years. The restaurant prywand you expect 100 diners per night who each purchase beverages You forecast operating cash flows of 12 of Year w Year 2 Assume that revenues and operating expenses end of each year. The small business tax is 20%. When the res t on you have in an inventory of wine, beer and liquor costing 500.000 What is the NPV for the proposed to the cost of capital 107 Provide conduingement that summates your (15 mars PLEASE PROVIDE YOUR ANSWER HERE. ADD ADDITIONAL SPACEAS NEEDED Pact Short Answers marks) 1) ABC Corp's WACC (*) ABC Comp share are current trading 0.25 each The one s and the ' 02. The T rees and the experimente Quis 115. The company' s 20% and The company as a combined income of 20 The OST W ANG of uity Show your work and provide a n early in your b) Ung the worn bove, ABC cost of the show your work and provide a mentary indicating your e mas) What C e werage cost of capital Show your work and provide ABC N for el Corps a percent preferred stock outstanding that is here. The preferred stock has a $100 per The m o retum 10 percent and ther's tax rate is 34 percent GST is 13% What is Nel Corp's cost of preferred stock? Show your work and provide a statement clearly indicating your answers PLEASE PROVIDE YOUR ANSWER HERE ADO ADDITIONAL SPACE AS NEEDED 2 Restaurant investment (15 marks) You want to Louie's place, a restaurant in Quebec City. You plan to the for two years and then rebre S coutschenment and novations, furniture, futures, and the point-of-sales system to be incred are 5500 500. Assume that all of the s a in Class and 2017. The can be sold for $360,000 after two years. The restaurant prywand you expect 100 diners per night who each purchase beverages You forecast operating cash flows of 12 of Year w Year 2 Assume that revenues and operating expenses end of each year. The small business tax is 20%. When the res t on you have in an inventory of wine, beer and liquor costing 500.000 What is the NPV for the proposed to the cost of capital 107 Provide conduingement that summates your (15 mars PLEASE PROVIDE YOUR ANSWER HERE. ADD ADDITIONAL SPACEAS NEEDED