Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Padayappa has now retired after 40 years of employment. He just made an annual deposit to his investment portfolio and realized he has $2,150,000 (not

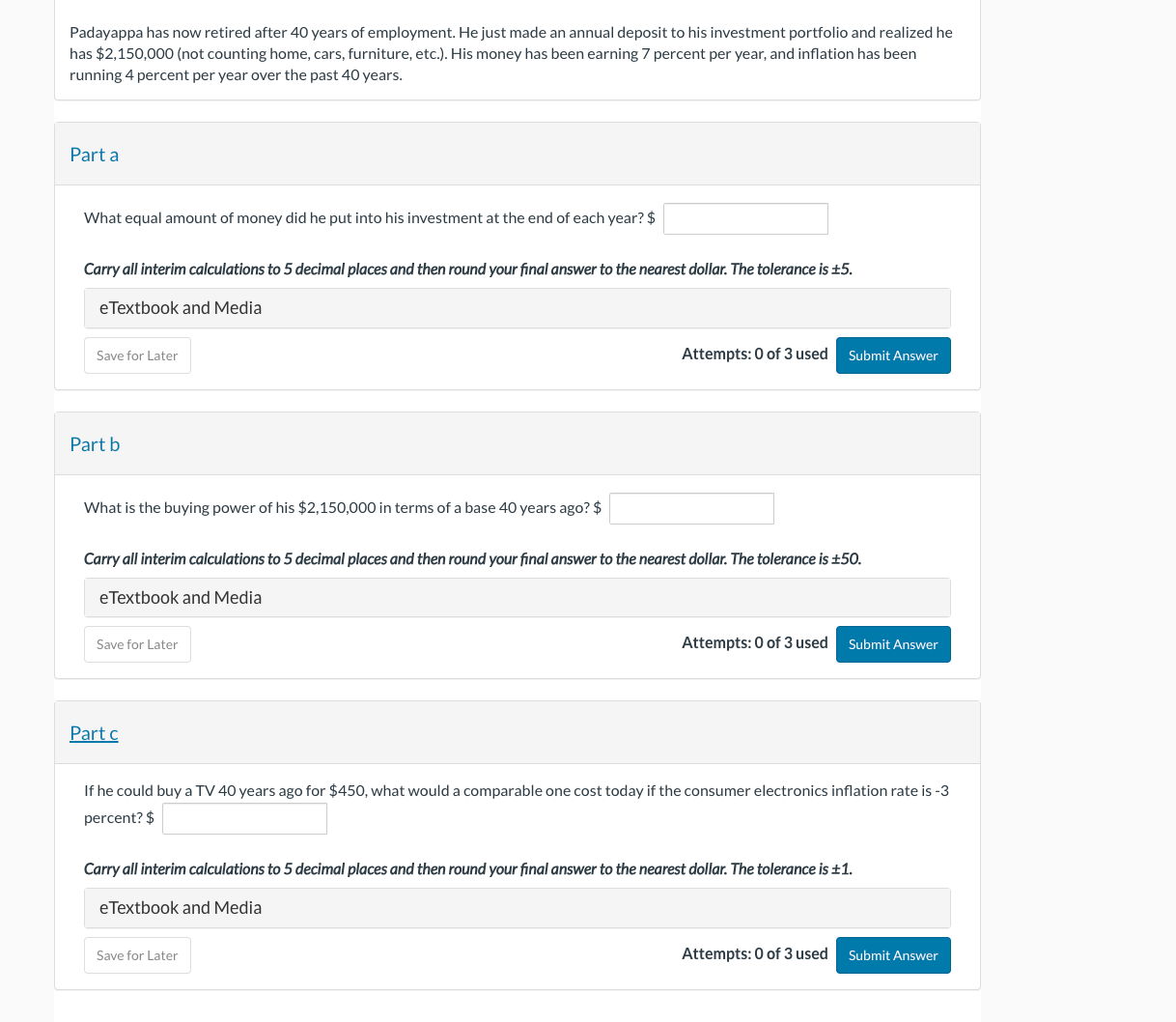

Padayappa has now retired after 40 years of employment. He just made an annual deposit to his investment portfolio and realized he has $2,150,000 (not counting home, cars, furniture, etc.). His money has been earning 7 percent per year, and inflation has been running 4 percent per year over the past 40 years. Part a What equal amount of money did he put into his investment at the end of each year? \$ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is \pm 5 . eTextbook and Media Attempts: 0 of 3 used Part b What is the buying power of his $2,150,000 in terms of a base 40 years ago? $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is \pm 50 . eTextbook and Media Attempts: 0 of 3 used Partc If he could buy a TV 40 years ago for $450, what would a comparable one cost today if the consumer electronics inflation rate is -3 percent? \$

Padayappa has now retired after 40 years of employment. He just made an annual deposit to his investment portfolio and realized he has $2,150,000 (not counting home, cars, furniture, etc.). His money has been earning 7 percent per year, and inflation has been running 4 percent per year over the past 40 years. Part a What equal amount of money did he put into his investment at the end of each year? \$ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is \pm 5 . eTextbook and Media Attempts: 0 of 3 used Part b What is the buying power of his $2,150,000 in terms of a base 40 years ago? $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is \pm 50 . eTextbook and Media Attempts: 0 of 3 used Partc If he could buy a TV 40 years ago for $450, what would a comparable one cost today if the consumer electronics inflation rate is -3 percent? \$ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started