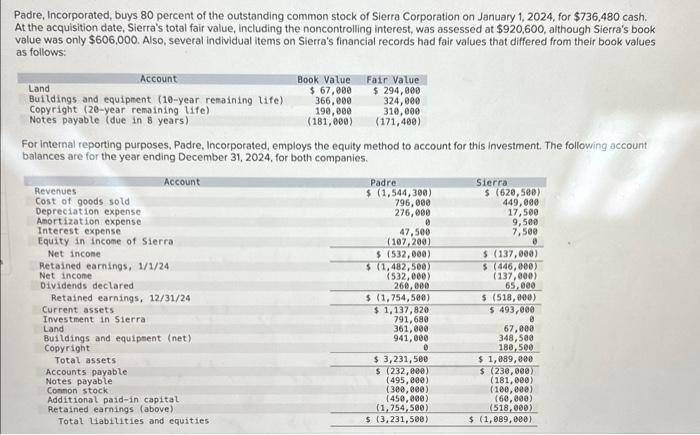

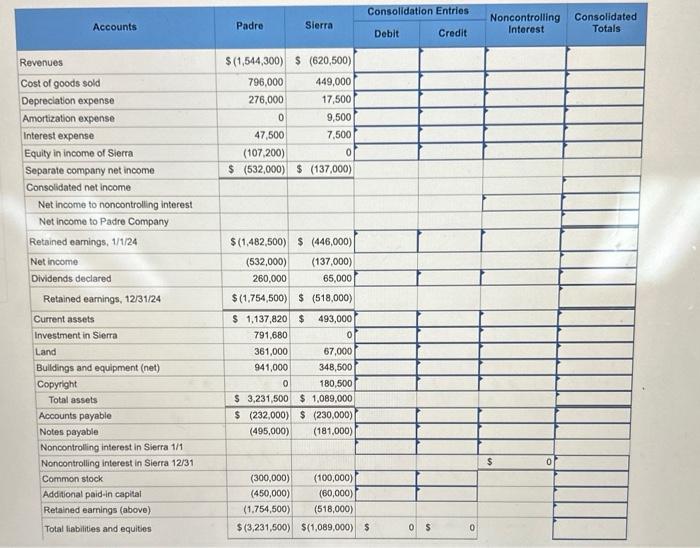

Padre, Incorporated, buys 80 percent of the outstanding common stock of Sierra Corporation on January 1,2024, for $736,480 cash. At the acquisition date, Sierra's total fair value, Including the noncontrolling interest, was assessed at $920,600, although Sierra's book value was only $606,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values as follows: For internal reporting purposes, Padre, Incorporated, employs the equity method to account for this investment. The following account balances are for the year ending December 31,2024 , for both companies. \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Accounts } & \multirow{2}{*}{ Padre } & \multirow{2}{*}{ Sierra } & \multicolumn{2}{|c|}{ Consolidation Entries } & \multirow{2}{*}{\begin{tabular}{c} Noncontrolling \\ Interest \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} Consolidated \\ Totals \end{tabular}} \\ \hline & & & Debit & Credit & & \\ \hline Revenues & $(1,544,300) & $(620,500) & & & & \\ \hline Cost of goods sold & 796,000 & 449,000 & & & & \\ \hline Depreciation expense & 276,000 & 17,5001 & & & & \\ \hline Amortization expense & 0 & 9,500 & & & & \\ \hline Interest expense & 47,500 & 7,5003 & & & & \\ \hline Equity in income of Slerra & (107,200) & 0 & & & & \\ \hline Separate company net income & $(532,000) & $(137,000) & & & & \\ \hline \multicolumn{7}{|l|}{ Consolidated net income } \\ \hline \multicolumn{7}{|l|}{ Net income to noncontrolling interest } \\ \hline \multicolumn{7}{|l|}{ Net income to Padre Company } \\ \hline Retained earnings, 1/1/24 & $(1,482,500) & $(446,000) & & & & 4 \\ \hline Net income & (532,000) & (137,000) & & & & \\ \hline Dividends declared & 260,000 & 65,000 & & & & \\ \hline Retained earnings, 12/31/24 & $(1,754,500) & $(518,000) & & & & \\ \hline Current assets & \$ 1,137,820 & $493,000 & & & & + \\ \hline Investment in Sierra & 791,680 & 0 & & & & \\ \hline Land & 361,000 & 67,000 & & & & \\ \hline Bulldings and equipment (net) & 941,000 & 348,500 & & & & \\ \hline Copyright & 0 & 180,500 & & & & \\ \hline Total assets & $3,231,500 & $1,089,000 & & & & \\ \hline Accounts payable & $(232,000) & $(230,000) & & & & \\ \hline Notes payable & (495,000) & (181,000) & & & & \\ \hline \multicolumn{7}{|l|}{ Noncontrolling interest in Sierra 1/1} \\ \hline Noncontrolling interest in Sierra 12/31 & & & & & 0 & \\ \hline Common stock & (300,000) & (100,000) & & & & \\ \hline Additional paid-in capital & (450,000) & (60,000)} & & & & \\ \hline Retained eamings (above) & (1,754,500) & (518,000) & & & & \\ \hline Total liabilities and equities & $(3,231,500) & $(1,089,000) & $ & $ & & \\ \hline \end{tabular} Padre, Incorporated, buys 80 percent of the outstanding common stock of Sierra Corporation on January 1,2024, for $736,480 cash. At the acquisition date, Sierra's total fair value, Including the noncontrolling interest, was assessed at $920,600, although Sierra's book value was only $606,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values as follows: For internal reporting purposes, Padre, Incorporated, employs the equity method to account for this investment. The following account balances are for the year ending December 31,2024 , for both companies. \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Accounts } & \multirow{2}{*}{ Padre } & \multirow{2}{*}{ Sierra } & \multicolumn{2}{|c|}{ Consolidation Entries } & \multirow{2}{*}{\begin{tabular}{c} Noncontrolling \\ Interest \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} Consolidated \\ Totals \end{tabular}} \\ \hline & & & Debit & Credit & & \\ \hline Revenues & $(1,544,300) & $(620,500) & & & & \\ \hline Cost of goods sold & 796,000 & 449,000 & & & & \\ \hline Depreciation expense & 276,000 & 17,5001 & & & & \\ \hline Amortization expense & 0 & 9,500 & & & & \\ \hline Interest expense & 47,500 & 7,5003 & & & & \\ \hline Equity in income of Slerra & (107,200) & 0 & & & & \\ \hline Separate company net income & $(532,000) & $(137,000) & & & & \\ \hline \multicolumn{7}{|l|}{ Consolidated net income } \\ \hline \multicolumn{7}{|l|}{ Net income to noncontrolling interest } \\ \hline \multicolumn{7}{|l|}{ Net income to Padre Company } \\ \hline Retained earnings, 1/1/24 & $(1,482,500) & $(446,000) & & & & 4 \\ \hline Net income & (532,000) & (137,000) & & & & \\ \hline Dividends declared & 260,000 & 65,000 & & & & \\ \hline Retained earnings, 12/31/24 & $(1,754,500) & $(518,000) & & & & \\ \hline Current assets & \$ 1,137,820 & $493,000 & & & & + \\ \hline Investment in Sierra & 791,680 & 0 & & & & \\ \hline Land & 361,000 & 67,000 & & & & \\ \hline Bulldings and equipment (net) & 941,000 & 348,500 & & & & \\ \hline Copyright & 0 & 180,500 & & & & \\ \hline Total assets & $3,231,500 & $1,089,000 & & & & \\ \hline Accounts payable & $(232,000) & $(230,000) & & & & \\ \hline Notes payable & (495,000) & (181,000) & & & & \\ \hline \multicolumn{7}{|l|}{ Noncontrolling interest in Sierra 1/1} \\ \hline Noncontrolling interest in Sierra 12/31 & & & & & 0 & \\ \hline Common stock & (300,000) & (100,000) & & & & \\ \hline Additional paid-in capital & (450,000) & (60,000)} & & & & \\ \hline Retained eamings (above) & (1,754,500) & (518,000) & & & & \\ \hline Total liabilities and equities & $(3,231,500) & $(1,089,000) & $ & $ & & \\ \hline \end{tabular}