Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page 1 Case 4 Hearts ' R Us Preferred Stock Classification Hearts ' R Us ( Hearts or the Company ) is an

Page

Case Hearts Us Preferred Stock Classification

Hearts R Us Hearts or the "Company" is an earlystage research and development medical device company. Hearts has no current products in the

marketplace but is in the final stages of going to market with the Heart Valve System. All preliminary trials have been approved by the FDA, and the Company

is in the final trial; once the final trial is complete, the Company will present the product to the FDA for final approval. If approved by the FDA, the Heart

Valve System will revolutionize the way medical professionals repair heart valve defects.

Bionic Body Bionic an SEC registrant, is a biological medical device company that focuses on the development of implantable biological devices,

surgical adhesives, and biomaterials. Bionic could benefit from the approval of the Heart Valve System since it has a supplementary device that could be

used in tandem with the Heart Valve System.

As part of a financing strategy to support its operations, Hearts sold Bionic $ million of Series A Preferred Shares the "Shares" of the Company with a

par value of $ per share. The transaction was completed on November As part of the Series A Preferred Stock purchase agreement, Bionic has the

following rights:

Board rights As the holder of the preferred stock, Bionic is entitled to appoint one member to the Company's board of directors the "Board" In

addition, Bionic has the right to appoint an observer to receive all information provided to the Board and to be present at the board meetings.

Mandatory conversion right The Shares will be converted to the Company's common stock upon execution of an initial public offering IPO that nets

at least $ million in proceeds.

Contingent redemption right The Shares will be redeemed for par value on the fifth anniversary of the date of purchase conditioned upon the event that

Hearts has not obtained FDA approval for the Heart Valve System.

Additional protective rights Bionic has the right to limit future equity and debt issuances as well as the right to participate in future funding rounds to

protect its investment percentage.

Page

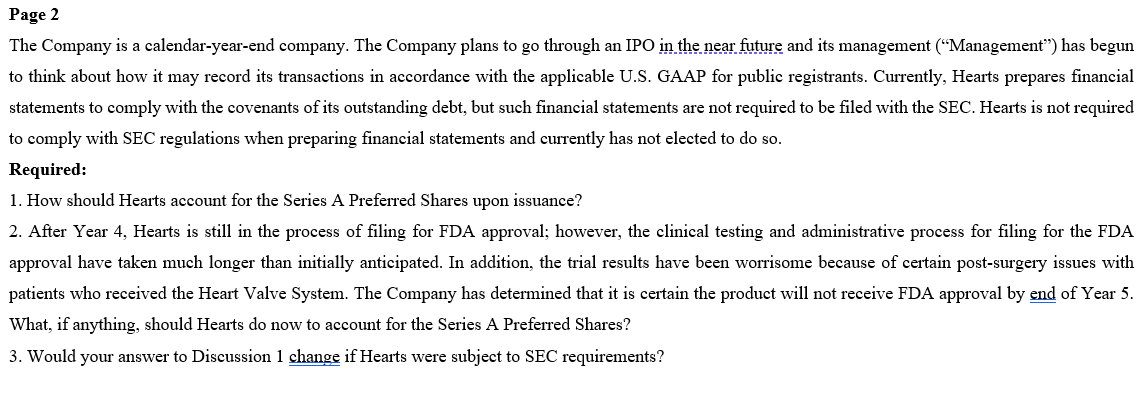

The Company is a calendaryearend company. The Company plans to go through an IPO in the near future and its management Management has begun

to think about how it may record its transactions in accordance with the applicable US GAAP for public registrants. Currently, Hearts prepares financial

statements to comply with the covenants of its outstanding debt, but such financial statements are not required to be filed with the SEC. Hearts is not required

to comply with SEC regulations when preparing financial statements and currently has not elected to do so

Required:

How should Hearts account for the Series A Preferred Shares upon issuance?

After Year Hearts is still in the process of filing for FDA approval; however, the clinical testing and administrative process for filing for the FDA

approval have taken much longer than initially anticipated. In addition, the trial results have been worrisome because of certain postsurgery issues with

patients who received the Heart Valve System. The Company has determined that it is certain the product will not receive FDA approval by end of Year

What, if anything, should Hearts do now to account for the Series A Preferred Shares?

Would your answer to Discussion change if Hearts were subject to SEC requirements?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started