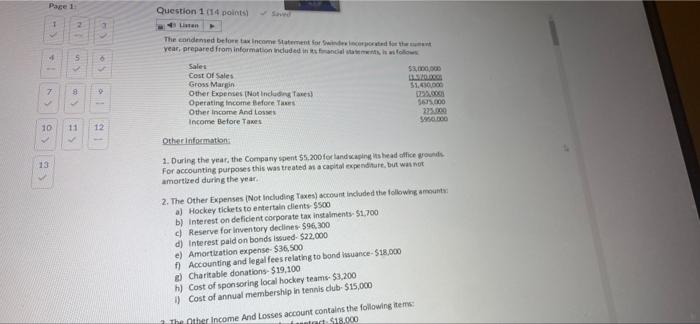

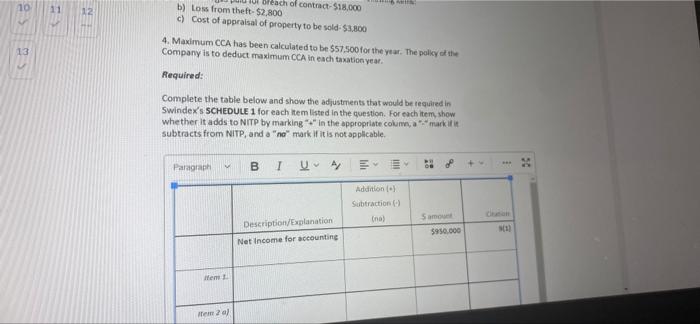

Page 1 Question 1014 points 1 2 5 The condensed before tax income Statement for word for the year, prepared from information included in two Sales 53.000.00 Cost Of Sales Gross Margin 51.450.00 Other Expenses Not Including Taxes) Operating Income Before TR 30.000 Other Income And Loss 22.000 Income Before Tanes 950.000 7 . 10 11 12 13 Other information 1. During the year, the Company spent $5.200 for landscaping its head office grounds For accounting purposes this was treated as a capital expenditure, but was not amortized during the year 2. The Other Expenses (Not including exe) account included the following amount a) Hockey tickets to entertain dients $500 b) Interest on deficient corporate tax instalments $1,700 Reserve for Inventory declines 596,300 d) Interest paid on bonds issued $22.000 e) Amortization expense-$36.500 Accounting and legal fees relating to bond lance-518.000 Charitable donations- $19,100 h) Cost of sponsoring local hockey team- $3,200 1) Cost of annual membership in tennis club $15,000 The Other Income And Losses account contains the following items $18.000 10 11 12 breach of contract-$18.000 b) Loss from theft-$2,800 c) Cost of appraisal of property to be sold-53.800 4. Maximum CCA has been calculated to be $57.500 for the year. The policy of the Company is to deduct maximum CCA in each tastinyen. 13 Required: Complete the table below and show the adjustments that would be required in Swindex's SCHEDULE 1 for each itemlisted in the question. For each item, show whether it adds to NITP by marking in the appropriate colum, a market subtracts from NITP, and a "no" mark if it is not applicable 50 Paragraph BIVA Addition) Subtraction Inal Description/Explanation Net Income for accounting Samo 5950.000 Hent Item2a) Page 1 Question 1014 points 1 2 5 The condensed before tax income Statement for word for the year, prepared from information included in two Sales 53.000.00 Cost Of Sales Gross Margin 51.450.00 Other Expenses Not Including Taxes) Operating Income Before TR 30.000 Other Income And Loss 22.000 Income Before Tanes 950.000 7 . 10 11 12 13 Other information 1. During the year, the Company spent $5.200 for landscaping its head office grounds For accounting purposes this was treated as a capital expenditure, but was not amortized during the year 2. The Other Expenses (Not including exe) account included the following amount a) Hockey tickets to entertain dients $500 b) Interest on deficient corporate tax instalments $1,700 Reserve for Inventory declines 596,300 d) Interest paid on bonds issued $22.000 e) Amortization expense-$36.500 Accounting and legal fees relating to bond lance-518.000 Charitable donations- $19,100 h) Cost of sponsoring local hockey team- $3,200 1) Cost of annual membership in tennis club $15,000 The Other Income And Losses account contains the following items $18.000 10 11 12 breach of contract-$18.000 b) Loss from theft-$2,800 c) Cost of appraisal of property to be sold-53.800 4. Maximum CCA has been calculated to be $57.500 for the year. The policy of the Company is to deduct maximum CCA in each tastinyen. 13 Required: Complete the table below and show the adjustments that would be required in Swindex's SCHEDULE 1 for each itemlisted in the question. For each item, show whether it adds to NITP by marking in the appropriate colum, a market subtracts from NITP, and a "no" mark if it is not applicable 50 Paragraph BIVA Addition) Subtraction Inal Description/Explanation Net Income for accounting Samo 5950.000 Hent Item2a)