page 115 from the book is attached too

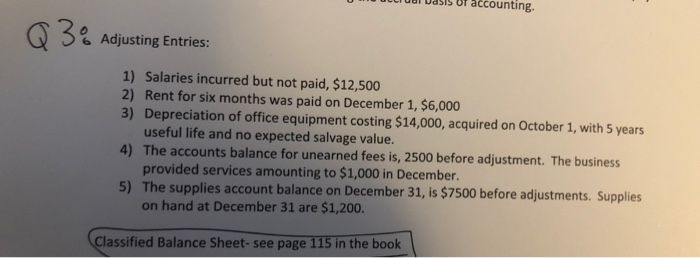

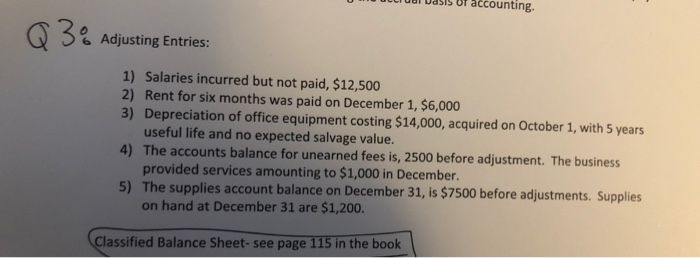

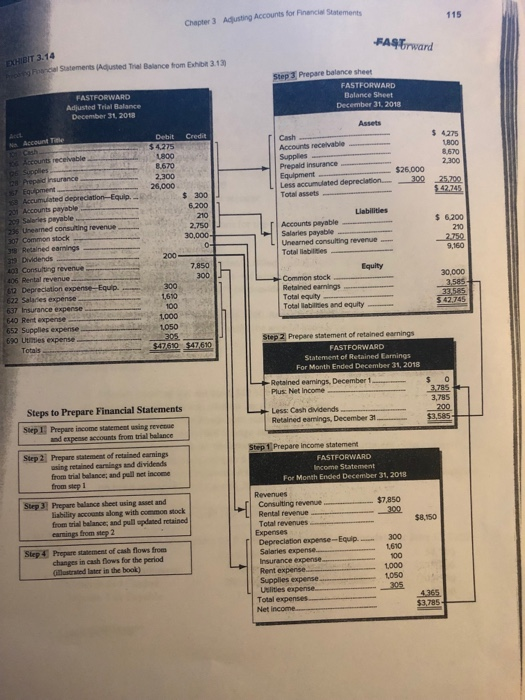

uul Dasis of accounting. 32 Adjusting Entries: 1) 2) 3) Salaries incurred but not paid, $12,500 Rent for six months was paid on December 1, $6,000 Depreciation of office equipment costing $14,000, acquired on October 1, with 5 years useful life and no expected salvage value. 4) The accounts balance for unearned fees is, 2500 before adjustment. The business provided services amounting to $1,000 in December. The supplies account balance on December 31, is $7500 before adjustments. Supplies on hand at December 31 are $1,200. 5) assified Balance Sheet-see page 115 in the boolk Adjusting Accounts for Finencil Accounts for Finenciel Statements Chapter 3 FASTrward Forca" Statements (Aanted Thal Balance tom Exho 3 Step 3 Prepare balance sheet FASTFORWARD Adjusted Trial Balance December 31, 2018 FASTFORWARD Balance Sheet December 31, 2018 Debit Credit 1800 8.670 Cash Accourts receivable s 4275 $ 4,275 8,670 Prepaid insurance $ 300 Total assets 6200 210 235 Unearmed consulting revenue 2,750 30,000 Accounts payable Salaries payable Common stock Unearned consulting revenue Total labilses 200 9,160 403 Consulting revenue 7,850 Rental revenue 30,000 12 Depreciation expense Equip.300 ,610 100 1,000 652 Supplies experise1.050 Common stock Retained earnings Tetal equity Total labilres and equity Salarfes expense 637 Insurance expense 640 Rent expense 42,745 690 Utiies expense Step 2 Prepare statement of retained earnings Totals FASTFORWARD Statement of Retained Earnings For Month Ended Dec ember 31, 2018 Retained earmings, December1$0 Plus: Net Income 3,785 Steps to Prepare Financial Statements Step I Prepare income stasement using reveue Less: Cash dividends Retained eamings, December 31 and ex accounts from trial balance Step 1 Prepare income statement Step 2 Prepare statement of retained eanings retaned earings and dividends from trial balance; and pall net incoene from step 1 ncome Statement For Month Ended December 31, 2018 Step 3 Prepare balance sheet using asset and Consulting revenue Rental revenue Total revenues $7,850 liability accounts along with common stock from trial balance; and pull apdated retained $8,150 earnings from step 2 Expenses 300 1610 100 Depreclation expense- Equip. Step 4 Prepare statement of cash flows froes changes in cash flows for the period lustrated later in the book) Rent expense Supplies expense Uclities expense Net income