Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Page 1/2 Your Client is an experienced real estate developer with a diverse portfolio of assets. The Client's Asset Management team oversees the portfolio

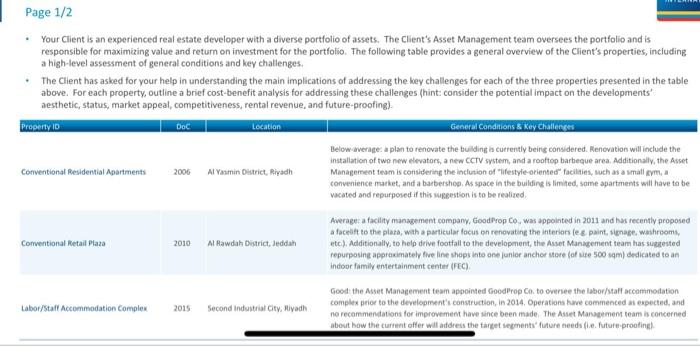

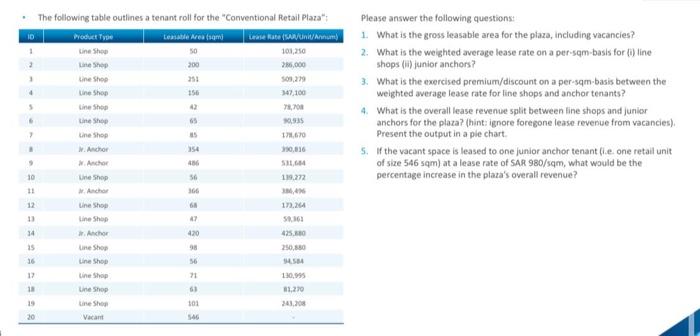

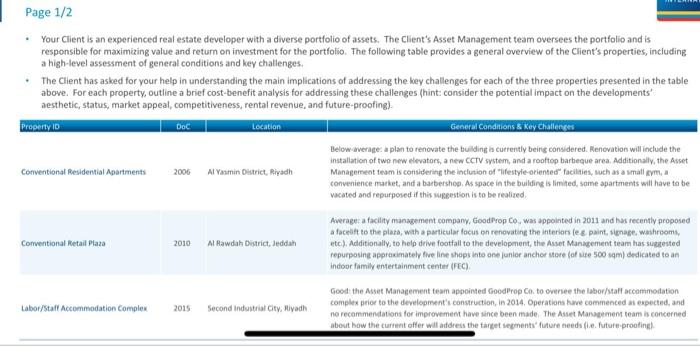

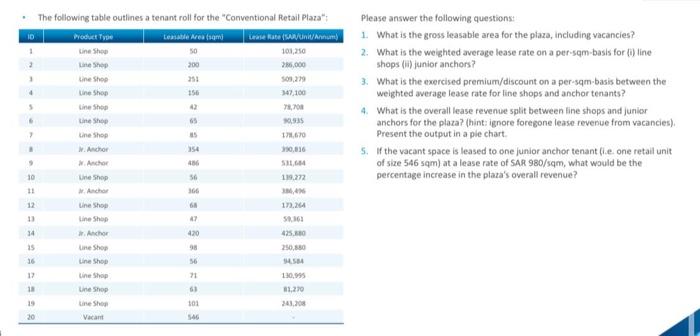

- Page 1/2 Your Client is an experienced real estate developer with a diverse portfolio of assets. The Client's Asset Management team oversees the portfolio and is responsible for maximizing value and return on investment for the portfolio. The following table provides a general overview of the Client's properties, including a high-level assessment of general conditions and key challenges. The Client has asked for your help in understanding the main implications of addressing the key challenges for each of the three properties presented in the table above. For each property, outline a brief cost-benefit analysis for addressing these challenges (hint: consider the potential impact on the developments' aesthetic, status, market appeal, competitiveness, rental revenue and future-prooting) Property ID Doc Location General Conditions & Key Challenges Below average a plan to renovate the building a currently being considered. Renovation will include the installation of two new elevators, a new CCTV system, and a rooftop barbeque area. Additionally, the Asset Conventional Residential Apartments Al Yasmin District, Riyadh Management team is considering the inclusion of lifestyle-oriented facilities, such as a small gym, a convenience market, and a barbershop. As space in the building is limited some apartments will have to be vacated and repurposed if this sugestion is to be realized Conventional Retail Plaza 2010 Al Rawdah District, Jeddah Average a facility management company, GoodProp Co. was appointed in 2011 and has recently proposed a facelift to the plata, with a particular focus on renovating the interiors leg paint signage, washrooms, etc). Additionally, to help drive footfall to the development, the Asset Management team has suggested repurposine approximately five line shops into one junior anchor store for site 500 sqm) dedicated to an indoor family entertainment center (FEC), Labor/Staff Accommodation Complex 2015 Second Industrial City, Riyadh Good the Asset Management team appointed GoodProp Co to oversee the labor/staff accommodation complex prior to the development's construction, in 2014. Operations have commenced as expected, and no recommendations for improvement have since been made The Asset Management team is concerned about how the current offer wil address the target segments future ends (10. Future-proofing ID 1 2 1 4 Please answer the following questions 1. What is the gross leasable area for the plaza, including vacancies? 2. What is the weighted average lease rate on a perisom-basis for (i) line shops (1) junior anchors? 3. What is the exercised premium/discount on a per-som-basis between the weighted average lease rate for line shops and anchor tenants? 4. What is the overall lease revenue split between line shops and junior anchors for the plaza? (hint: ignore foregone lease revenue from vacancies) Present the output in a ple chart S. If the vacant space is leased to one junior anchor tenant lie one retail unit of size 546 sqm) at a lease rate of SAR 980/sqm, what would be the percentage increase in the plaza's overall revenue? The following table outlines a tenant roll for the "Conventional Retail Plaza": Product Type Lette Areasami Lease Rate (/init/Annum Line Show SO 100,210 Line Shop 200 205,000 Line Shop 25: 50,29 Line Shop 347,100 Line Shop Line Shop 65 Line Shop 17.670 W. Anchor 10.036 436 Une Shop 119.272 Anchor 366 Line Shop 171.24 Line Shop 47 Anchor 420 425.00 Line Shop 98 250,0.80 Line Shop 54 Une Shop 71 130,995 Une Shop 51 1,210 101 Vacant 5 10 11 14 25 50 12 18 - Page 1/2 Your Client is an experienced real estate developer with a diverse portfolio of assets. The Client's Asset Management team oversees the portfolio and is responsible for maximizing value and return on investment for the portfolio. The following table provides a general overview of the Client's properties, including a high-level assessment of general conditions and key challenges. The Client has asked for your help in understanding the main implications of addressing the key challenges for each of the three properties presented in the table above. For each property, outline a brief cost-benefit analysis for addressing these challenges (hint: consider the potential impact on the developments' aesthetic, status, market appeal, competitiveness, rental revenue and future-prooting) Property ID Doc Location General Conditions & Key Challenges Below average a plan to renovate the building a currently being considered. Renovation will include the installation of two new elevators, a new CCTV system, and a rooftop barbeque area. Additionally, the Asset Conventional Residential Apartments Al Yasmin District, Riyadh Management team is considering the inclusion of lifestyle-oriented facilities, such as a small gym, a convenience market, and a barbershop. As space in the building is limited some apartments will have to be vacated and repurposed if this sugestion is to be realized Conventional Retail Plaza 2010 Al Rawdah District, Jeddah Average a facility management company, GoodProp Co. was appointed in 2011 and has recently proposed a facelift to the plata, with a particular focus on renovating the interiors leg paint signage, washrooms, etc). Additionally, to help drive footfall to the development, the Asset Management team has suggested repurposine approximately five line shops into one junior anchor store for site 500 sqm) dedicated to an indoor family entertainment center (FEC), Labor/Staff Accommodation Complex 2015 Second Industrial City, Riyadh Good the Asset Management team appointed GoodProp Co to oversee the labor/staff accommodation complex prior to the development's construction, in 2014. Operations have commenced as expected, and no recommendations for improvement have since been made The Asset Management team is concerned about how the current offer wil address the target segments future ends (10. Future-proofing ID 1 2 1 4 Please answer the following questions 1. What is the gross leasable area for the plaza, including vacancies? 2. What is the weighted average lease rate on a perisom-basis for (i) line shops (1) junior anchors? 3. What is the exercised premium/discount on a per-som-basis between the weighted average lease rate for line shops and anchor tenants? 4. What is the overall lease revenue split between line shops and junior anchors for the plaza? (hint: ignore foregone lease revenue from vacancies) Present the output in a ple chart S. If the vacant space is leased to one junior anchor tenant lie one retail unit of size 546 sqm) at a lease rate of SAR 980/sqm, what would be the percentage increase in the plaza's overall revenue? The following table outlines a tenant roll for the "Conventional Retail Plaza": Product Type Lette Areasami Lease Rate (/init/Annum Line Show SO 100,210 Line Shop 200 205,000 Line Shop 25: 50,29 Line Shop 347,100 Line Shop Line Shop 65 Line Shop 17.670 W. Anchor 10.036 436 Une Shop 119.272 Anchor 366 Line Shop 171.24 Line Shop 47 Anchor 420 425.00 Line Shop 98 250,0.80 Line Shop 54 Une Shop 71 130,995 Une Shop 51 1,210 101 Vacant 5 10 11 14 25 50 12 18

- Page 1/2 Your Client is an experienced real estate developer with a diverse portfolio of assets. The Client's Asset Management team oversees the portfolio and is responsible for maximizing value and return on investment for the portfolio. The following table provides a general overview of the Client's properties, including a high-level assessment of general conditions and key challenges. The Client has asked for your help in understanding the main implications of addressing the key challenges for each of the three properties presented in the table above. For each property, outline a brief cost-benefit analysis for addressing these challenges (hint: consider the potential impact on the developments' aesthetic, status, market appeal, competitiveness, rental revenue and future-prooting) Property ID Doc Location General Conditions & Key Challenges Below average a plan to renovate the building a currently being considered. Renovation will include the installation of two new elevators, a new CCTV system, and a rooftop barbeque area. Additionally, the Asset Conventional Residential Apartments Al Yasmin District, Riyadh Management team is considering the inclusion of lifestyle-oriented facilities, such as a small gym, a convenience market, and a barbershop. As space in the building is limited some apartments will have to be vacated and repurposed if this sugestion is to be realized Conventional Retail Plaza 2010 Al Rawdah District, Jeddah Average a facility management company, GoodProp Co. was appointed in 2011 and has recently proposed a facelift to the plata, with a particular focus on renovating the interiors leg paint signage, washrooms, etc). Additionally, to help drive footfall to the development, the Asset Management team has suggested repurposine approximately five line shops into one junior anchor store for site 500 sqm) dedicated to an indoor family entertainment center (FEC), Labor/Staff Accommodation Complex 2015 Second Industrial City, Riyadh Good the Asset Management team appointed GoodProp Co to oversee the labor/staff accommodation complex prior to the development's construction, in 2014. Operations have commenced as expected, and no recommendations for improvement have since been made The Asset Management team is concerned about how the current offer wil address the target segments future ends (10. Future-proofing ID 1 2 1 4 Please answer the following questions 1. What is the gross leasable area for the plaza, including vacancies? 2. What is the weighted average lease rate on a perisom-basis for (i) line shops (1) junior anchors? 3. What is the exercised premium/discount on a per-som-basis between the weighted average lease rate for line shops and anchor tenants? 4. What is the overall lease revenue split between line shops and junior anchors for the plaza? (hint: ignore foregone lease revenue from vacancies) Present the output in a ple chart S. If the vacant space is leased to one junior anchor tenant lie one retail unit of size 546 sqm) at a lease rate of SAR 980/sqm, what would be the percentage increase in the plaza's overall revenue? The following table outlines a tenant roll for the "Conventional Retail Plaza": Product Type Lette Areasami Lease Rate (/init/Annum Line Show SO 100,210 Line Shop 200 205,000 Line Shop 25: 50,29 Line Shop 347,100 Line Shop Line Shop 65 Line Shop 17.670 W. Anchor 10.036 436 Une Shop 119.272 Anchor 366 Line Shop 171.24 Line Shop 47 Anchor 420 425.00 Line Shop 98 250,0.80 Line Shop 54 Une Shop 71 130,995 Une Shop 51 1,210 101 Vacant 5 10 11 14 25 50 12 18 - Page 1/2 Your Client is an experienced real estate developer with a diverse portfolio of assets. The Client's Asset Management team oversees the portfolio and is responsible for maximizing value and return on investment for the portfolio. The following table provides a general overview of the Client's properties, including a high-level assessment of general conditions and key challenges. The Client has asked for your help in understanding the main implications of addressing the key challenges for each of the three properties presented in the table above. For each property, outline a brief cost-benefit analysis for addressing these challenges (hint: consider the potential impact on the developments' aesthetic, status, market appeal, competitiveness, rental revenue and future-prooting) Property ID Doc Location General Conditions & Key Challenges Below average a plan to renovate the building a currently being considered. Renovation will include the installation of two new elevators, a new CCTV system, and a rooftop barbeque area. Additionally, the Asset Conventional Residential Apartments Al Yasmin District, Riyadh Management team is considering the inclusion of lifestyle-oriented facilities, such as a small gym, a convenience market, and a barbershop. As space in the building is limited some apartments will have to be vacated and repurposed if this sugestion is to be realized Conventional Retail Plaza 2010 Al Rawdah District, Jeddah Average a facility management company, GoodProp Co. was appointed in 2011 and has recently proposed a facelift to the plata, with a particular focus on renovating the interiors leg paint signage, washrooms, etc). Additionally, to help drive footfall to the development, the Asset Management team has suggested repurposine approximately five line shops into one junior anchor store for site 500 sqm) dedicated to an indoor family entertainment center (FEC), Labor/Staff Accommodation Complex 2015 Second Industrial City, Riyadh Good the Asset Management team appointed GoodProp Co to oversee the labor/staff accommodation complex prior to the development's construction, in 2014. Operations have commenced as expected, and no recommendations for improvement have since been made The Asset Management team is concerned about how the current offer wil address the target segments future ends (10. Future-proofing ID 1 2 1 4 Please answer the following questions 1. What is the gross leasable area for the plaza, including vacancies? 2. What is the weighted average lease rate on a perisom-basis for (i) line shops (1) junior anchors? 3. What is the exercised premium/discount on a per-som-basis between the weighted average lease rate for line shops and anchor tenants? 4. What is the overall lease revenue split between line shops and junior anchors for the plaza? (hint: ignore foregone lease revenue from vacancies) Present the output in a ple chart S. If the vacant space is leased to one junior anchor tenant lie one retail unit of size 546 sqm) at a lease rate of SAR 980/sqm, what would be the percentage increase in the plaza's overall revenue? The following table outlines a tenant roll for the "Conventional Retail Plaza": Product Type Lette Areasami Lease Rate (/init/Annum Line Show SO 100,210 Line Shop 200 205,000 Line Shop 25: 50,29 Line Shop 347,100 Line Shop Line Shop 65 Line Shop 17.670 W. Anchor 10.036 436 Une Shop 119.272 Anchor 366 Line Shop 171.24 Line Shop 47 Anchor 420 425.00 Line Shop 98 250,0.80 Line Shop 54 Une Shop 71 130,995 Une Shop 51 1,210 101 Vacant 5 10 11 14 25 50 12 18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started