Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PAGE 2 OF 2 Arrangon's manufacturing process is highly automated, but also requires highly skilled labour. Employees are paid at an average rate of $

PAGE OF

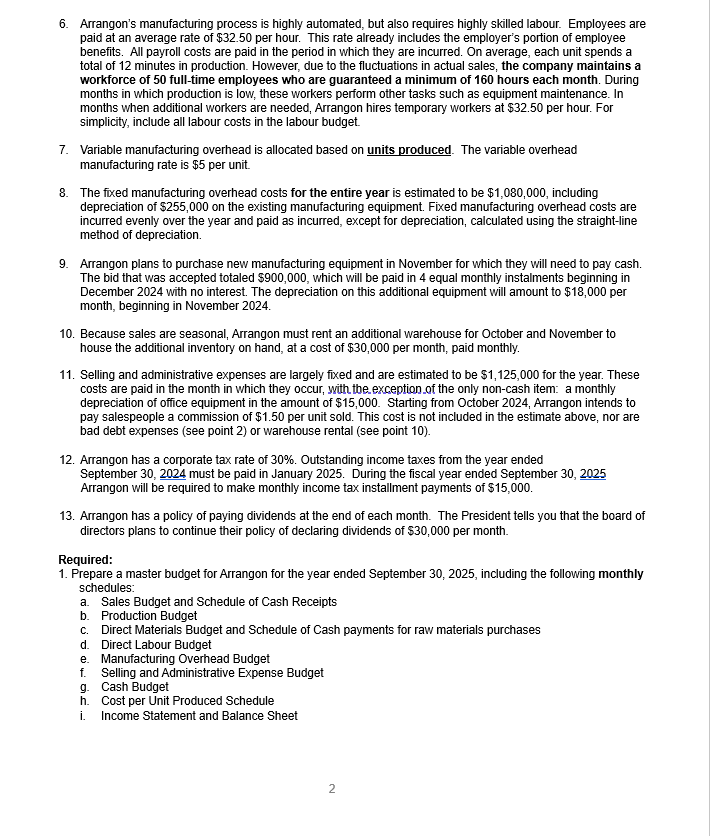

Arrangon's manufacturing process is highly automated, but also requires highly skilled labour. Employees are

paid at an average rate of $ per hour. This rate already includes the employer's portion of employee

benefits. All payroll costs are paid in the period in which they are incurred. On average, each unit spends a

total of minutes in production. However, due to the fluctuations in actual sales, the company maintains a

workforce of fulltime employees who are guaranteed a minimum of hours each month. During

months in which production is low, these workers perform other tasks such as equipment maintenance. In

months when additional workers are needed, Arrangon hires temporary workers at $ per hour. For

simplicity, include all labour costs in the labour budget.

Variable manufacturing overhead is allocated based on units produced. The variable overhead

manufacturing rate is $ per unit.

The fixed manufacturing overhead costs for the entire year is estimated to be $ including

depreciation of $ on the existing manufacturing equipment. Fixed manufacturing overhead costs are

incurred evenly over the year and paid as incurred, except for depreciation, calculated using the straightline

method of depreciation.

Arrangon plans to purchase new manufacturing equipment in November for which they will need to pay cash.

The bid that was accepted totaled $ which will be paid in equal monthly instalments beginning in

December with no interest. The depreciation on this additional equipment will amount to $ per

month, beginning in November

Because sales are seasonal, Arrangon must rent an additional warehouse for October and November to

house the additional inventory on hand, at a cost of $ per month, paid monthly.

Selling and administrative expenses are largely fixed and are estimated to be $ for the year. These

costs are paid in the month in which they occur, with the exception of the only noncash item: a monthly

depreciation of office equipment in the amount of $ Starting from October Arrangon intends to

pay salespeople a commission of $ per unit sold. This cost is not included in the estimate above, nor are

bad debt expenses see point or warehouse rental see point

Arrangon has a corporate tax rate of Outstanding income taxes from the year ended

September must be paid in January During the fiscal year ended September

Arrangon will be required to make monthly income tax installment payments of $

Arrangon has a policy of paying dividends at the end of each month. The President tells you that the board of

directors plans to continue their policy of declaring dividends of $ per month.

Required:

Prepare a master budget for Arrangon for the year ended September including the following monthly

schedules:

a Sales Budget and Schedule of Cash Receipts

b Production Budget

c Direct Materials Budget and Schedule of Cash payments for raw materials purchases

d Direct Labour Budget

e Manufacturing Overhead Budget

f Selling and Administrative Expense Budget

g Cash Budget

h Cost per Unit Produced Schedule

i Income Statement and Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started