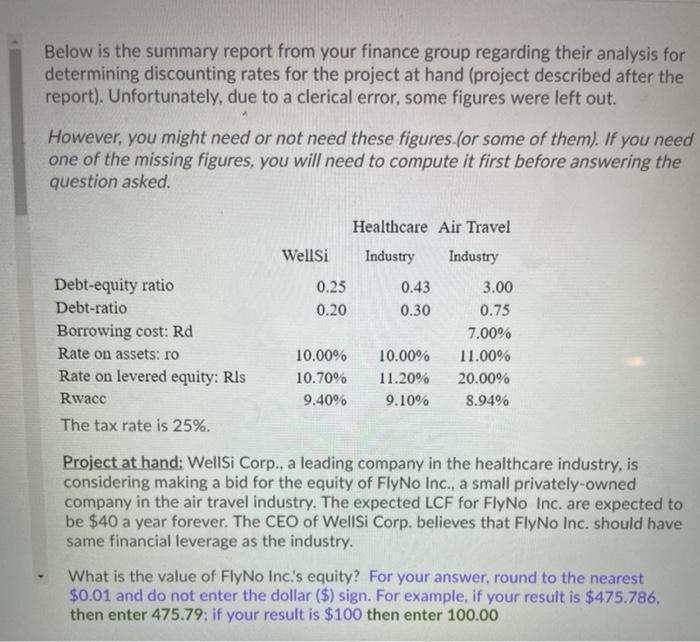

Page 2 |Papad Page 4 Below is the summary report from your finance group regarding their analysis for determining discounting rates for the project at hand project described after the report). Unfortunately, due to a derical error, some figures were left out. However, you might need or not need these figures for some of them. If you need one of the missing figures. You will need to compute it first before answering the question asked Healthcare All Travel Website Debt-equity 0.35 0.43 3.00 Debat 0.20 6.30 0.75 mocow cost Rd 900 Rates 10.00% 10.00 1100 Rite le quity is 10.704 11.209 30.000 R 9.10 The tax rate 25% Protestat hand: Wes Corp. a leading company in the healthcare Industry, considering makin bid for the equity of Flv No Inc., all privately owned company in the travel industry. The expected LCF For No Inc. are expected to be $40 a year forever. The CEO of West Corp believes that Noine should have never the industry What the value of Princ scout for your around to the newest 5001 and do not enter the dollar Force yours $4757 then enter 475.79.fours 5100 then enter 100.00 Pape Below is the summary report from your finance group regarding their analysis for determining discounting rates for the project at hand (project described after the report). Unfortunately, due to a clerical error, some figures were left out. However, you might need or not need these figures.(or some of them). If you need one of the missing figures, you will need to compute it first before answering the question asked. Healthcare Air Travel Wellsi Industry Industry 0.25 0.20 0.43 0.30 Debt-equity ratio Debt-ratio Borrowing cost: Rd Rate on assets: ro Rate on levered equity: Rls Rwacc The tax rate is 25%. 3.00 0.75 7.00% 11.00% 20.00% 8.94% 10.00% 10.70% 9.40% 10.00% 11.20% 9.10% Project at hand: WellSi Corp., a leading company in the healthcare industry, is considering making a bid for the equity of FlyNo Inc., a small privately-owned company in the air travel industry. The expected LCF for FlyNo Inc. are expected to be $40 a year forever. The CEO of Wellsi Corp. believes that FlyNo Inc. should have same financial leverage as the industry. What is the value of FlyNo Inc's equity? For your answer, round to the nearest $0.01 and do not enter the dollar ($) sign. For example, if your result is $475.786, then enter 475.79; if your result is $100 then enter 100.00 Page 2 |Papad Page 4 Below is the summary report from your finance group regarding their analysis for determining discounting rates for the project at hand project described after the report). Unfortunately, due to a derical error, some figures were left out. However, you might need or not need these figures for some of them. If you need one of the missing figures. You will need to compute it first before answering the question asked Healthcare All Travel Website Debt-equity 0.35 0.43 3.00 Debat 0.20 6.30 0.75 mocow cost Rd 900 Rates 10.00% 10.00 1100 Rite le quity is 10.704 11.209 30.000 R 9.10 The tax rate 25% Protestat hand: Wes Corp. a leading company in the healthcare Industry, considering makin bid for the equity of Flv No Inc., all privately owned company in the travel industry. The expected LCF For No Inc. are expected to be $40 a year forever. The CEO of West Corp believes that Noine should have never the industry What the value of Princ scout for your around to the newest 5001 and do not enter the dollar Force yours $4757 then enter 475.79.fours 5100 then enter 100.00 Pape Below is the summary report from your finance group regarding their analysis for determining discounting rates for the project at hand (project described after the report). Unfortunately, due to a clerical error, some figures were left out. However, you might need or not need these figures.(or some of them). If you need one of the missing figures, you will need to compute it first before answering the question asked. Healthcare Air Travel Wellsi Industry Industry 0.25 0.20 0.43 0.30 Debt-equity ratio Debt-ratio Borrowing cost: Rd Rate on assets: ro Rate on levered equity: Rls Rwacc The tax rate is 25%. 3.00 0.75 7.00% 11.00% 20.00% 8.94% 10.00% 10.70% 9.40% 10.00% 11.20% 9.10% Project at hand: WellSi Corp., a leading company in the healthcare industry, is considering making a bid for the equity of FlyNo Inc., a small privately-owned company in the air travel industry. The expected LCF for FlyNo Inc. are expected to be $40 a year forever. The CEO of Wellsi Corp. believes that FlyNo Inc. should have same financial leverage as the industry. What is the value of FlyNo Inc's equity? For your answer, round to the nearest $0.01 and do not enter the dollar ($) sign. For example, if your result is $475.786, then enter 475.79; if your result is $100 then enter 100.00