Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page 212: What's the impact of page 195 on the slope of ordering costs in Figure 7-8? page 212 page 195 Part 3 Working Capital

Page 212: What's the impact of page 195 on the slope of ordering costs in Figure 7-8?

page 212

page 195

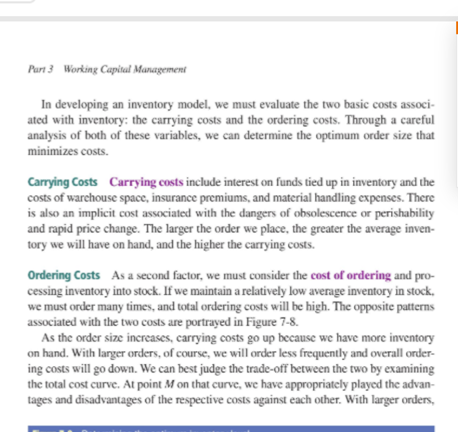

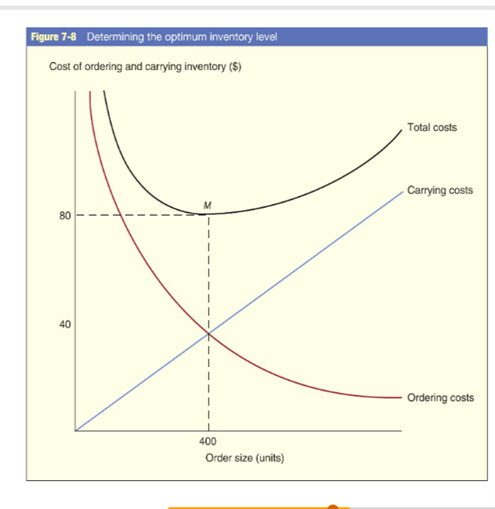

Part 3 Working Capital Management In developing an inventory model, we must evaluate the two basic costs associ- ated with inventory: the carrying costs and the ordering costs. Through a careful analysis of both of these variables, we can determine the optimum order size that minimizes costs. Carrying Costs Carrying costs include interest on funds tied up in inventory and the costs of warchouse space, insurance premiums, and material handling expenses. There is also an implicit cost associated with the dangers of obsolescence or perishability and rapid price change. The larger the order we place, the greater the average inven- tory we will have on hand, and the higher the carrying costs. Ordering Costs As a second factor, we must consider the cost of ordering and pro- cessing inventory into stock. If we maintain a relatively low average inventory in stock. we must order many times, and total ordering costs will be high. The opposite patterns associated with the two costs are portrayed in Figure 7-8 As the order size increases, carrying costs go up because we have more inventory on hand. With larger orders, of course, we will order less frequently and overall order- ing costs will go down. We can best judge the trade-off between the two by examining the total cost curve. At point Mon that curve, we have appropriately played the advan- tages and disadvantages of the respective costs against each other. With larger orders, Figure 7-8 Determining the optimum inventory level Cost of ordering and carrying inventory (5) Total costs Carrying costs 80 40 Ordering costs 1 400 Order size (units) Information technology has a significant effect as Perfect Commerce (www.perfect.com) and on the way companies manage the purchase Ariba (www.ariba.com). of their inventory, the way they sell their goods, Ariba got into the business in 2003 by how they collect their money, and how they acquiring FreeMarkets, a pioneer in the online manage their cash. Electronic funds transfer auction market for industry. FreeMarkets systems, discussed later in the chapter, have developed specialties and qualified buyers been around for over 20 years, although their and suppliers for more than 70 product cat- growth has accelerated in the last several years. egories such as coal, injection molded plastic Two major trends will affect corporate parts, metal fabrications, chemicals, printed practices and profitability for decades to circuit boards, and more. Ariba is now part come. The first trend is the creation and use of SAP AG of Germany, an international tech- of business-to-business (B2B) industry sup nology, software, and consulting company. ply exchanges usually initiated by the "old" By the end of 2014. Ariba connected with over economy companies. The second trend is the 1.6 million companies in more than 190 coun- use of auction markets, which have been cre tries. Its network executed over $1.64 billion ated by "new economy companies to allow in transactions caily, and the firm estimates businesses to buy and sell goods among that it saves customers $82 million in supply themselves. costs daily There are several examples of supply Perfect Commerce started out as a B2B exchanges that will have a major impact on auction site but like the others has broadened the industry. Covisint (www.covisint.com) is its scope to include what has developed into one of the highest-profile B2B exchanges the word 'spend policy." In other words, and was launched in 1999. It is an industry these companies help other companies specific exchange supported by five of the spend their money wisely and efficiently largest automobile manufacturers in the world, through the use of e-commerce technol- including founders Ford, General Motors, ogy. Perfect Commerce has a stellar client Chrysler, Nissan, and Renault Covisint stands list that includes IBM. Hitachi, UCLA East- for cooperation, vision, and integration, and is man Chemical, Marathon Oil, Duke Energy. an online marketplace where original equip Peterbilt, l'Oreal, and others. It serves over ment manufacturers (OEMs) and suppliers 1.3 million users and 500,000 suppliers in come together to do business in a single busi 100 countries and works with major indus- ness environment using the same tools and tries like chemical, energy, food products, user interface. It was created to reduce costs hospitality, technology, education, retail, and increase efficiencies through its purchas- financial services, medical, manufacturing ing and bidding system. transportation, and more. At the beginning of 2015, Covisint, a divi The advantage of these auction sites is that sion of Compuware Corporation, had over 500 they eliminate geographical barriers and allow global customers with more than 25 million suppliers from all over the world to bid on users and accounted for over $1 trillion with business that they would never have thought more than 212,000 clients. Covisint's custom of soliciting before the Internet. The bidding ers included global automotive, health care. processes have a time limit, which can be oil and gas, manufacturing, life sciences, and several hours or days. Just like any other auc- food and beverage industries. tion, the participants get feedback on the bids The second trend in working capital man made ind can compete on price. The sup- agement is the use of online auction compa pliers are prequalified so that they meet the nies for business-to-business markets such manufacturing standards of the purchaser. Part 3 Working Capital Management In developing an inventory model, we must evaluate the two basic costs associ- ated with inventory: the carrying costs and the ordering costs. Through a careful analysis of both of these variables, we can determine the optimum order size that minimizes costs. Carrying Costs Carrying costs include interest on funds tied up in inventory and the costs of warchouse space, insurance premiums, and material handling expenses. There is also an implicit cost associated with the dangers of obsolescence or perishability and rapid price change. The larger the order we place, the greater the average inven- tory we will have on hand, and the higher the carrying costs. Ordering Costs As a second factor, we must consider the cost of ordering and pro- cessing inventory into stock. If we maintain a relatively low average inventory in stock. we must order many times, and total ordering costs will be high. The opposite patterns associated with the two costs are portrayed in Figure 7-8 As the order size increases, carrying costs go up because we have more inventory on hand. With larger orders, of course, we will order less frequently and overall order- ing costs will go down. We can best judge the trade-off between the two by examining the total cost curve. At point Mon that curve, we have appropriately played the advan- tages and disadvantages of the respective costs against each other. With larger orders, Figure 7-8 Determining the optimum inventory level Cost of ordering and carrying inventory (5) Total costs Carrying costs 80 40 Ordering costs 1 400 Order size (units) Information technology has a significant effect as Perfect Commerce (www.perfect.com) and on the way companies manage the purchase Ariba (www.ariba.com). of their inventory, the way they sell their goods, Ariba got into the business in 2003 by how they collect their money, and how they acquiring FreeMarkets, a pioneer in the online manage their cash. Electronic funds transfer auction market for industry. FreeMarkets systems, discussed later in the chapter, have developed specialties and qualified buyers been around for over 20 years, although their and suppliers for more than 70 product cat- growth has accelerated in the last several years. egories such as coal, injection molded plastic Two major trends will affect corporate parts, metal fabrications, chemicals, printed practices and profitability for decades to circuit boards, and more. Ariba is now part come. The first trend is the creation and use of SAP AG of Germany, an international tech- of business-to-business (B2B) industry sup nology, software, and consulting company. ply exchanges usually initiated by the "old" By the end of 2014. Ariba connected with over economy companies. The second trend is the 1.6 million companies in more than 190 coun- use of auction markets, which have been cre tries. Its network executed over $1.64 billion ated by "new economy companies to allow in transactions caily, and the firm estimates businesses to buy and sell goods among that it saves customers $82 million in supply themselves. costs daily There are several examples of supply Perfect Commerce started out as a B2B exchanges that will have a major impact on auction site but like the others has broadened the industry. Covisint (www.covisint.com) is its scope to include what has developed into one of the highest-profile B2B exchanges the word 'spend policy." In other words, and was launched in 1999. It is an industry these companies help other companies specific exchange supported by five of the spend their money wisely and efficiently largest automobile manufacturers in the world, through the use of e-commerce technol- including founders Ford, General Motors, ogy. Perfect Commerce has a stellar client Chrysler, Nissan, and Renault Covisint stands list that includes IBM. Hitachi, UCLA East- for cooperation, vision, and integration, and is man Chemical, Marathon Oil, Duke Energy. an online marketplace where original equip Peterbilt, l'Oreal, and others. It serves over ment manufacturers (OEMs) and suppliers 1.3 million users and 500,000 suppliers in come together to do business in a single busi 100 countries and works with major indus- ness environment using the same tools and tries like chemical, energy, food products, user interface. It was created to reduce costs hospitality, technology, education, retail, and increase efficiencies through its purchas- financial services, medical, manufacturing ing and bidding system. transportation, and more. At the beginning of 2015, Covisint, a divi The advantage of these auction sites is that sion of Compuware Corporation, had over 500 they eliminate geographical barriers and allow global customers with more than 25 million suppliers from all over the world to bid on users and accounted for over $1 trillion with business that they would never have thought more than 212,000 clients. Covisint's custom of soliciting before the Internet. The bidding ers included global automotive, health care. processes have a time limit, which can be oil and gas, manufacturing, life sciences, and several hours or days. Just like any other auc- food and beverage industries. tion, the participants get feedback on the bids The second trend in working capital man made ind can compete on price. The sup- agement is the use of online auction compa pliers are prequalified so that they meet the nies for business-to-business markets such manufacturing standards of the purchaser

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started