Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page 3 of 4 3 How does U.S. GAAP require the prior service cost related to retirees to be recognized? Amortize over the average remaining

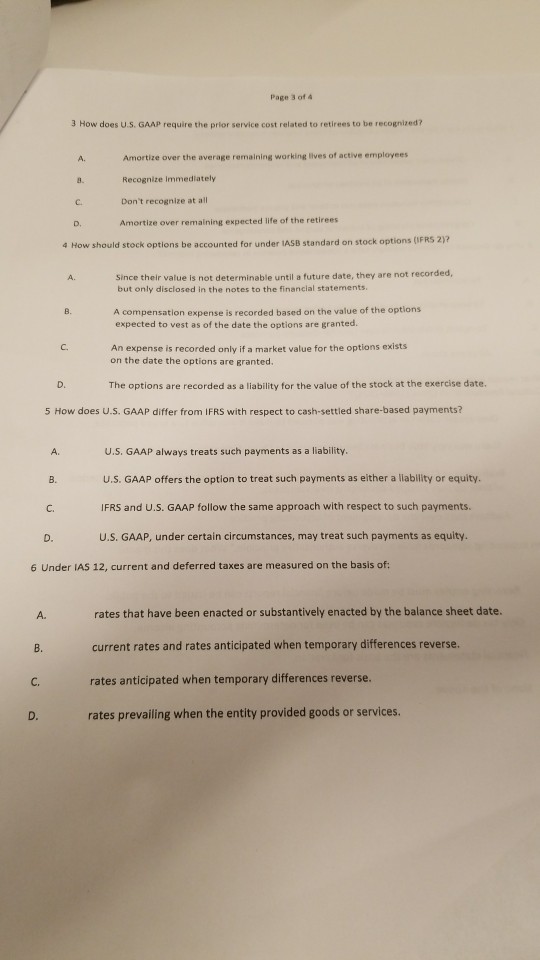

Page 3 of 4 3 How does U.S. GAAP require the prior service cost related to retirees to be recognized? Amortize over the average remaining working lives of active employees Recognize Immediately Don't recognize at all A. C. D, e over remaining expected life of the retirees 4 How should stock options be accounted for under IASB standard on stock options (IFRS 2)? Since their value is not determinable until a future date, they are not r but only disclosed in the notes to the financial statements. 8 A compensation expense is recorded based on the value of the options B. expected to vest as of the date the options are granted. C. An expense is recorded only if a market value for the options exists on the date the options are granted. The options are recorded as a liability for the value of the stock at the exercise date. 5 How does U.S. GAAP differ from IFRS with respect to cash-settled share-based payments? U.S. GAAP always treats such payments as a liability U.S. GAAP offers the option to treat such payments as either a liability or equity IFRS and U.S. GAAP follow the same approach with respect to such payments U.S. GAAP, under certain circumstances, may treat such payments as equity. A. C. D. 6 Under IAS 12, current and deferred taxes are measured on the basis of: rates that have been enacted or substantively enacted by the balance sheet date current rates and rates anticipated when temporary differences reverse. rates anticipated when temporary differences reverse. rates prevailing when the entity provided goods or services. A. B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started