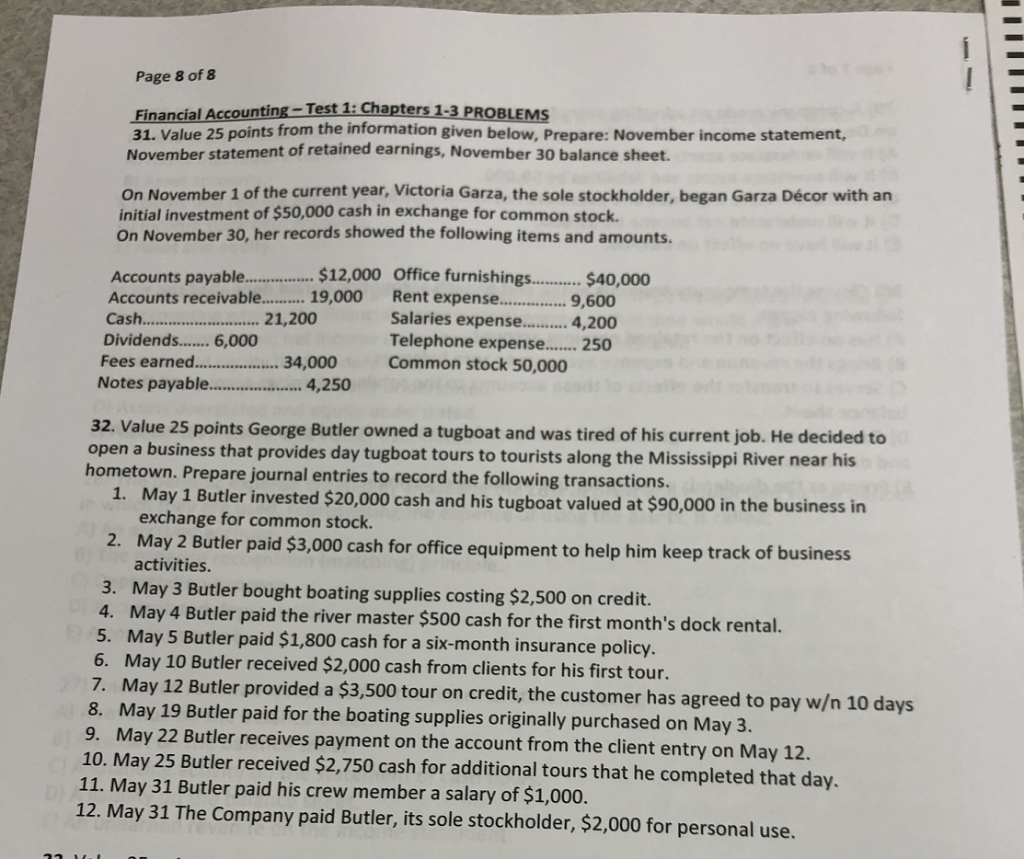

Page 8 of 8 Financial Accounting- Test 1: Chapters 1 31. Value 25 points from the information given below, Prepare: November income statement, BL November statement of retained earnings, November 30 balance sheet. On November 1 of the current year, Victoria Garza, the sole stockholder, began Garza Dcor with an initial investment of $50,000 cash in exchange for common stock On November 30, her records showed the following items and amounts. Accounts payabl.. $12,000 Office furnishing$40,000 19,000 Rent expense... .9,600 Cas. 1,200 Salaries expens.. 4,200 34,000 Common stock 50,000 4,250 32. Value 25 points George Butler owned a tugboat and was tired of his current job. He decided to open a business that provides day tugboat tours to tourists along the Mississippi River near his hometown. Prepare journal entries to record the following transactions. ay 1 Butler invested $20,000 cash and his tugboat valued at $90,000 in the business in exchange for common stock. 2 Butler paid $3,000 cash for office equipment to help him keep track of business activities 3. May 3 Butler bought boating supplies costing $2,500 on credit. 4. May 4 Butler paid the river master $500 cash for the first month's dock rental. 5. May 5 Butler paid $1,800 cash for a six-month insurance policy. 6. May 10 Butler received $2,000 cash from clients for his first tour. 7. May 12 Butler provided a $3,500 tour on credit, the customer has agreed to pay w 10 days 8. May 19 Butler paid for the boating supplies originally purchased on May 3 May 22 Butler receives payment on the account from the client entry on May 12. 10. May 25 Butler received $2,750 cash for additional tours that he completed that day. 11. May 31 Butler paid his crew member a salary of $1,000. 12. May 31 The Company paid Butler, its sole stockholder, $2,000 for personal use. 9. Page 8 of 8 Financial Accounting- Test 1: Chapters 1 31. Value 25 points from the information given below, Prepare: November income statement, BL November statement of retained earnings, November 30 balance sheet. On November 1 of the current year, Victoria Garza, the sole stockholder, began Garza Dcor with an initial investment of $50,000 cash in exchange for common stock On November 30, her records showed the following items and amounts. Accounts payabl.. $12,000 Office furnishing$40,000 19,000 Rent expense... .9,600 Cas. 1,200 Salaries expens.. 4,200 34,000 Common stock 50,000 4,250 32. Value 25 points George Butler owned a tugboat and was tired of his current job. He decided to open a business that provides day tugboat tours to tourists along the Mississippi River near his hometown. Prepare journal entries to record the following transactions. ay 1 Butler invested $20,000 cash and his tugboat valued at $90,000 in the business in exchange for common stock. 2 Butler paid $3,000 cash for office equipment to help him keep track of business activities 3. May 3 Butler bought boating supplies costing $2,500 on credit. 4. May 4 Butler paid the river master $500 cash for the first month's dock rental. 5. May 5 Butler paid $1,800 cash for a six-month insurance policy. 6. May 10 Butler received $2,000 cash from clients for his first tour. 7. May 12 Butler provided a $3,500 tour on credit, the customer has agreed to pay w 10 days 8. May 19 Butler paid for the boating supplies originally purchased on May 3 May 22 Butler receives payment on the account from the client entry on May 12. 10. May 25 Butler received $2,750 cash for additional tours that he completed that day. 11. May 31 Butler paid his crew member a salary of $1,000. 12. May 31 The Company paid Butler, its sole stockholder, $2,000 for personal use. 9