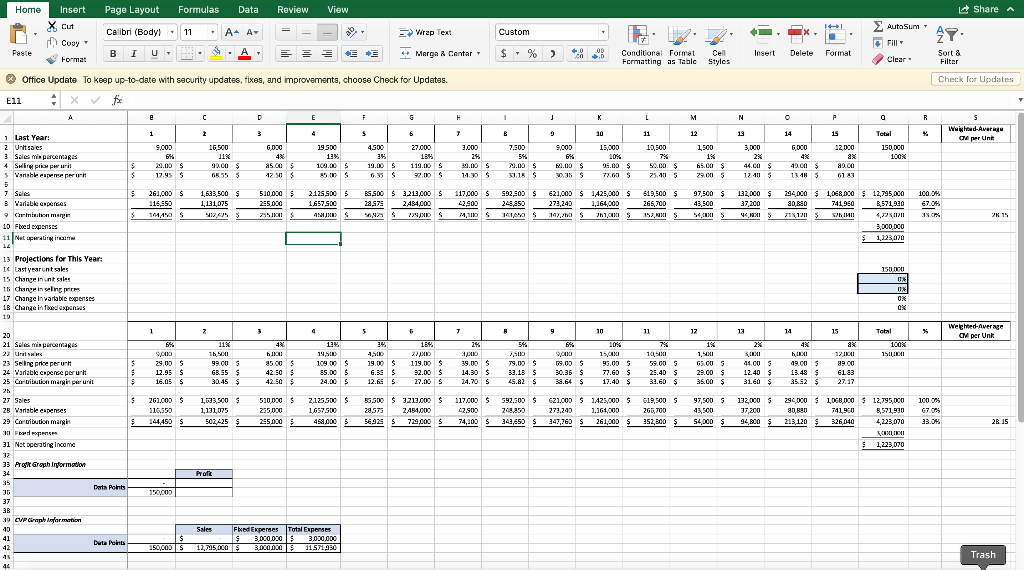

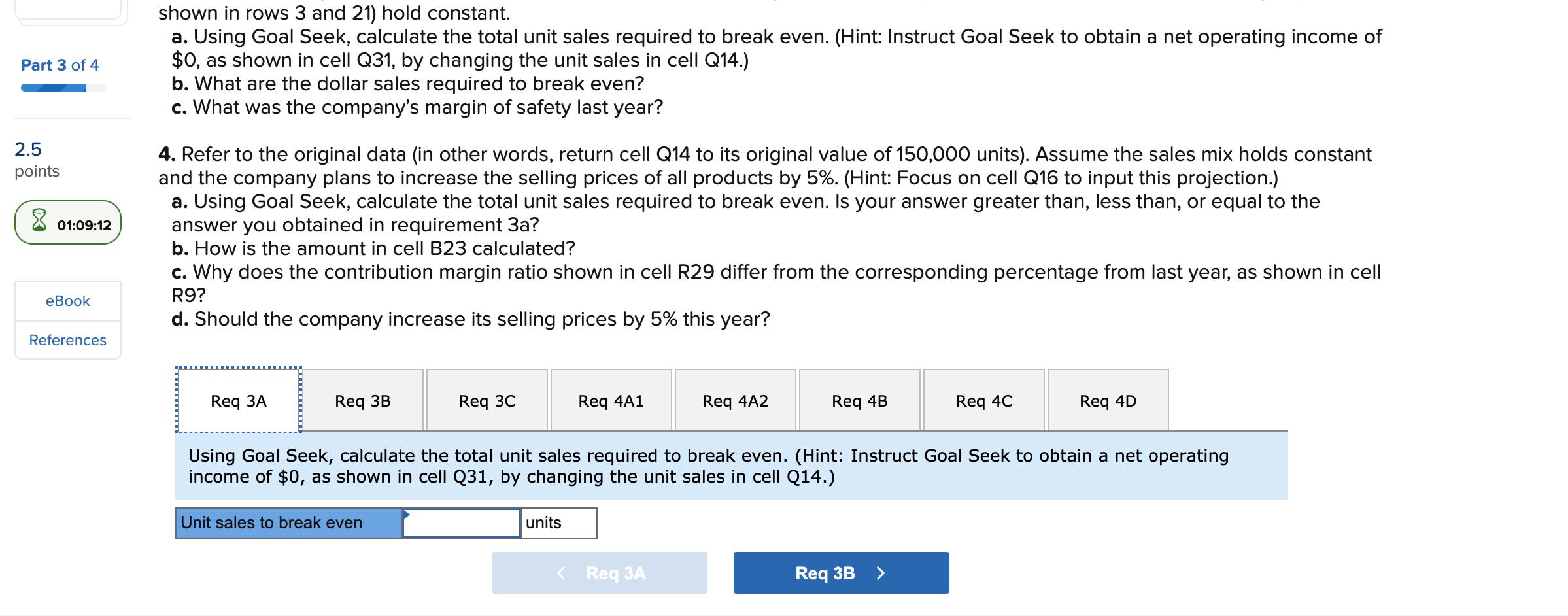

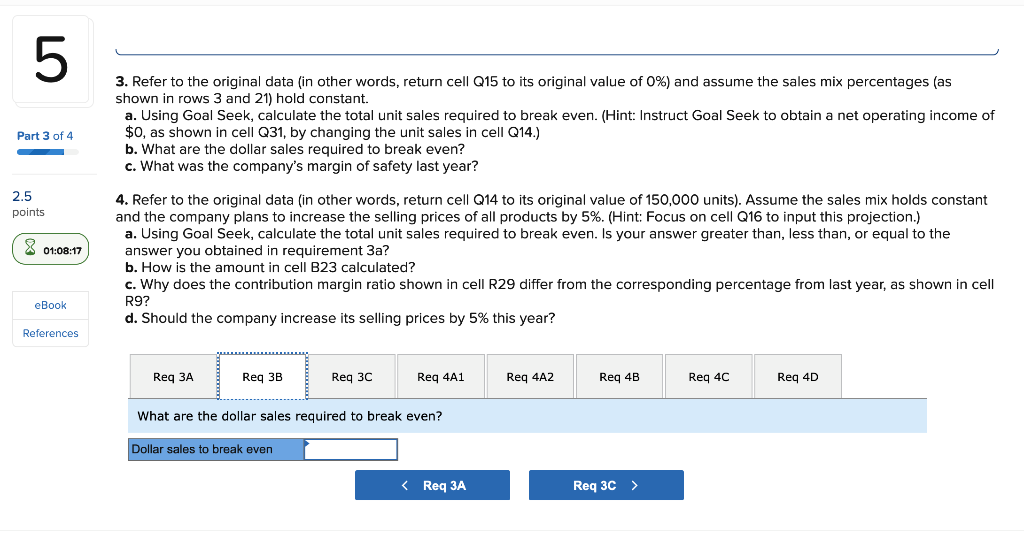

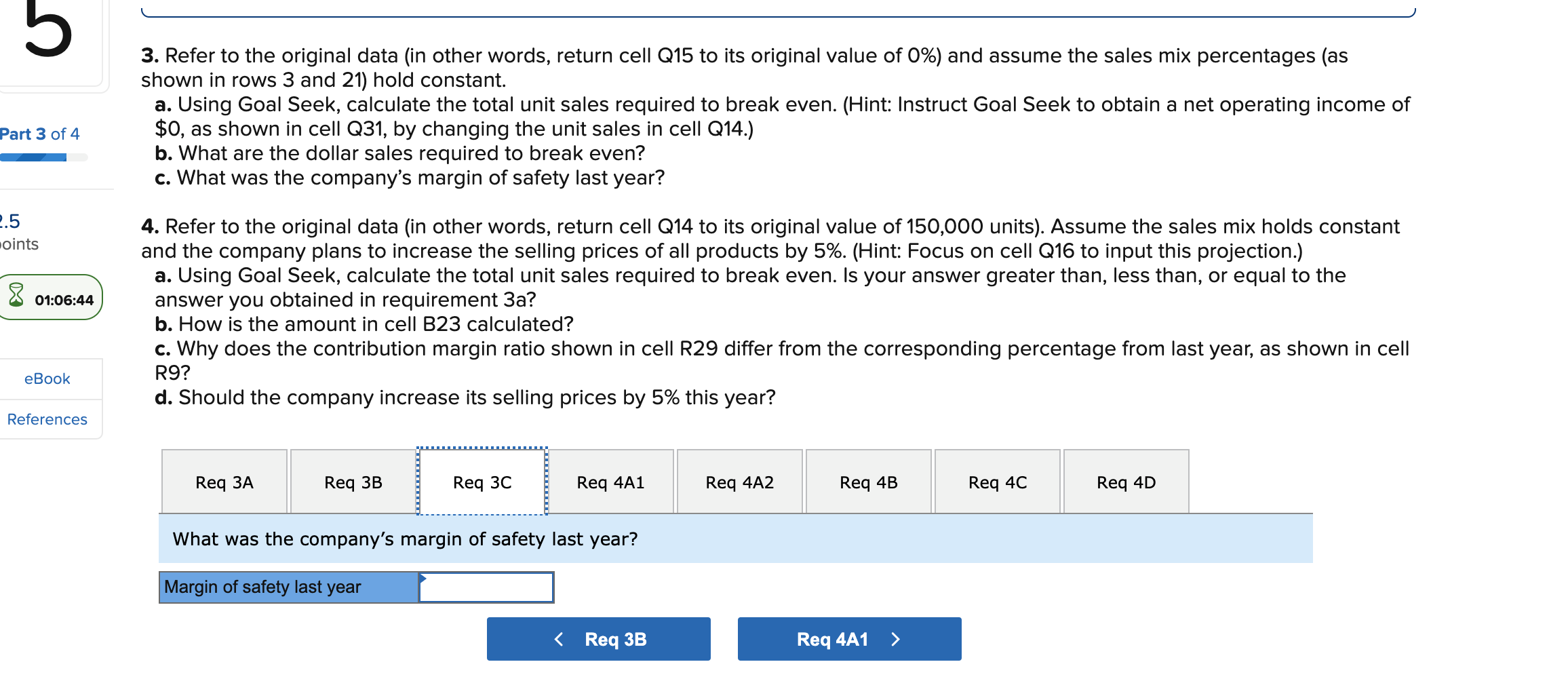

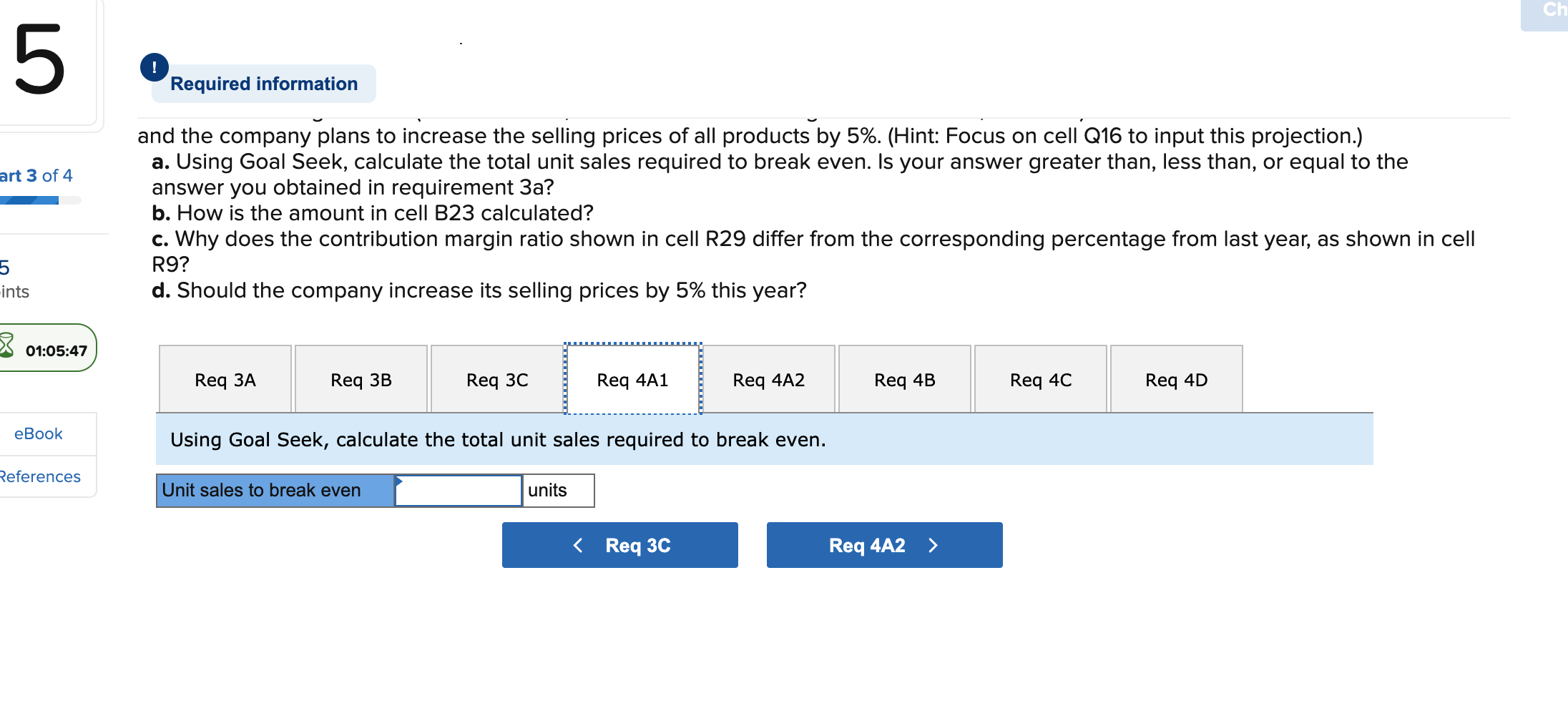

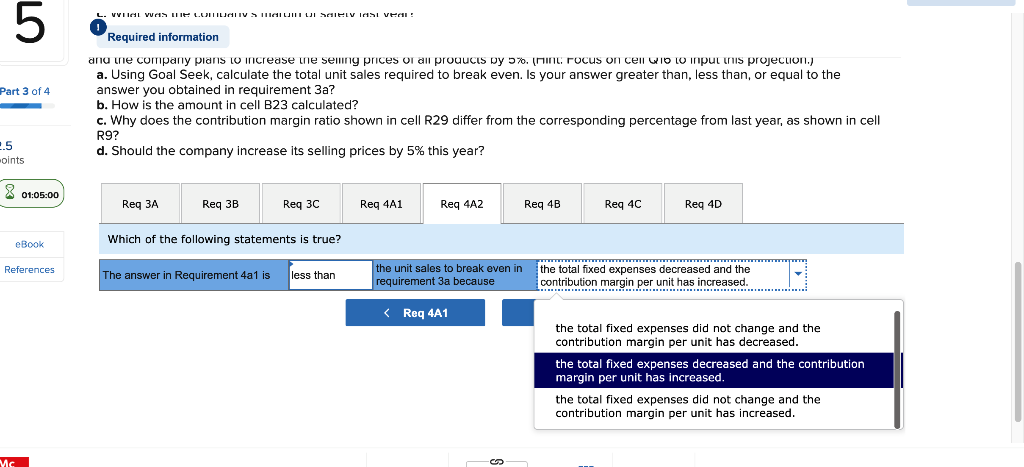

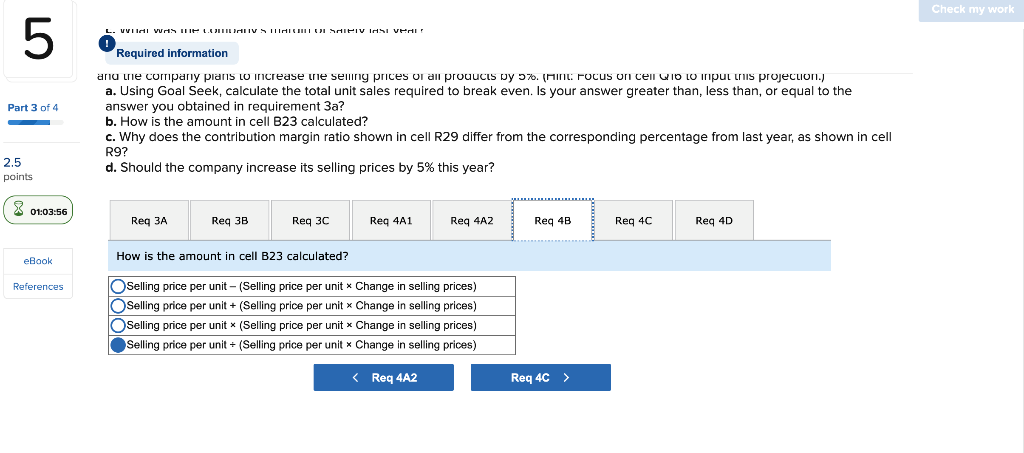

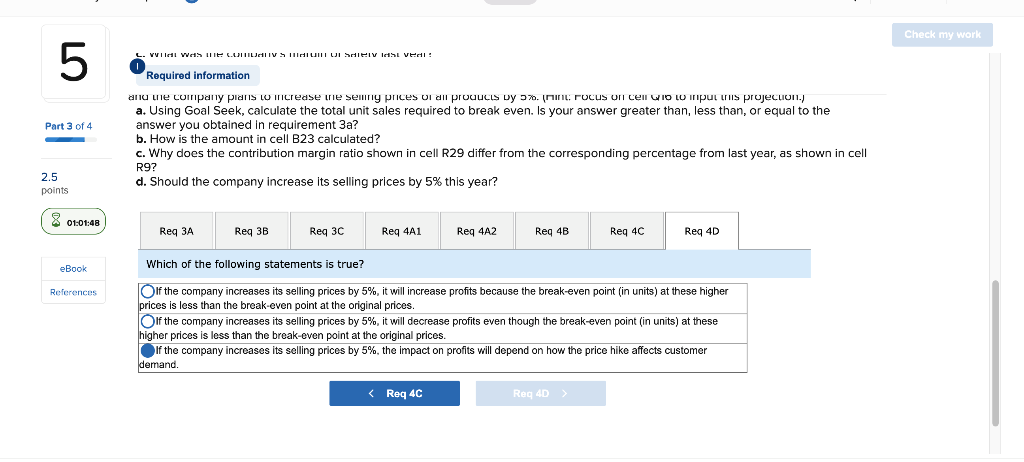

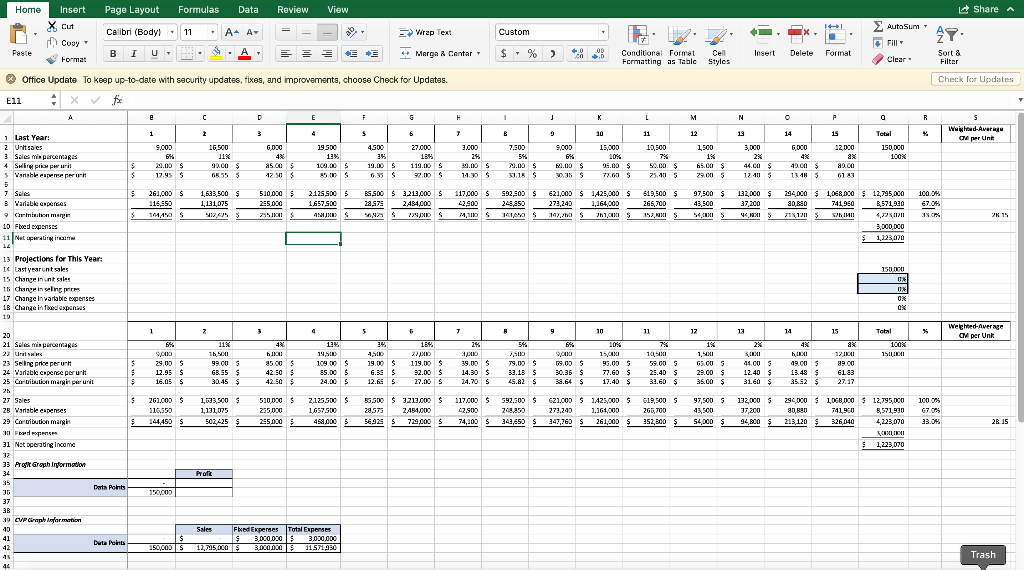

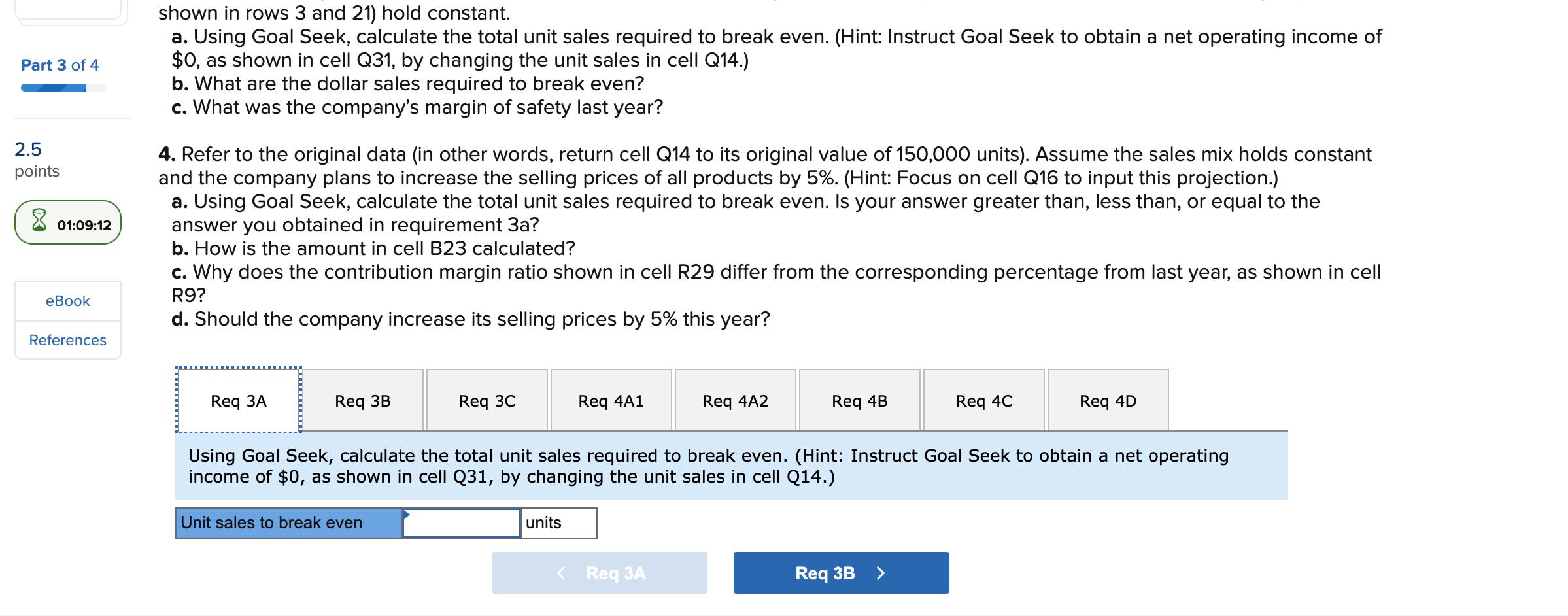

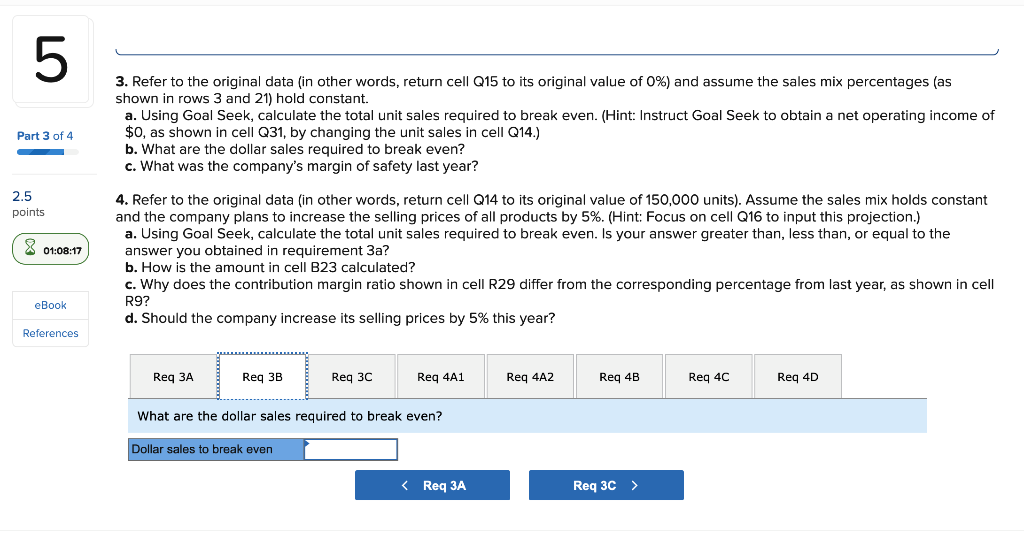

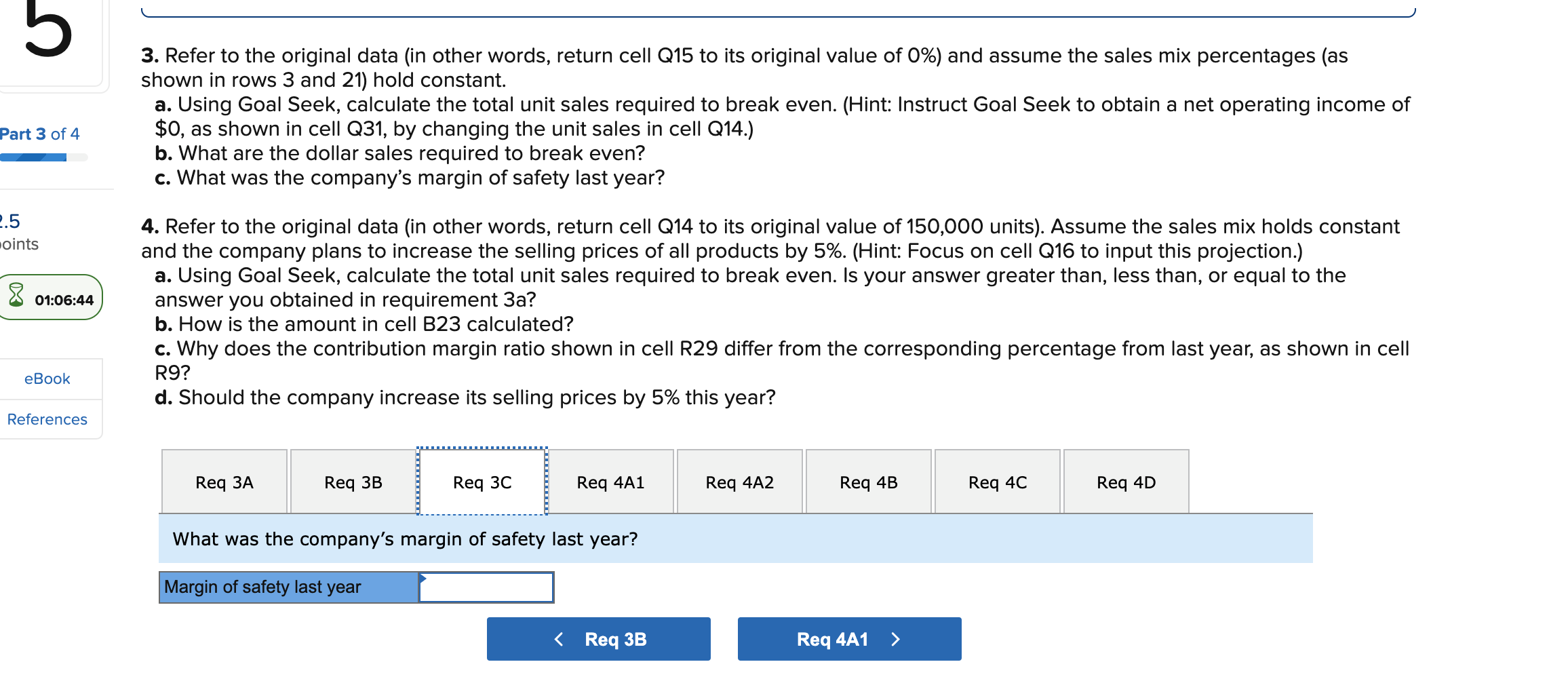

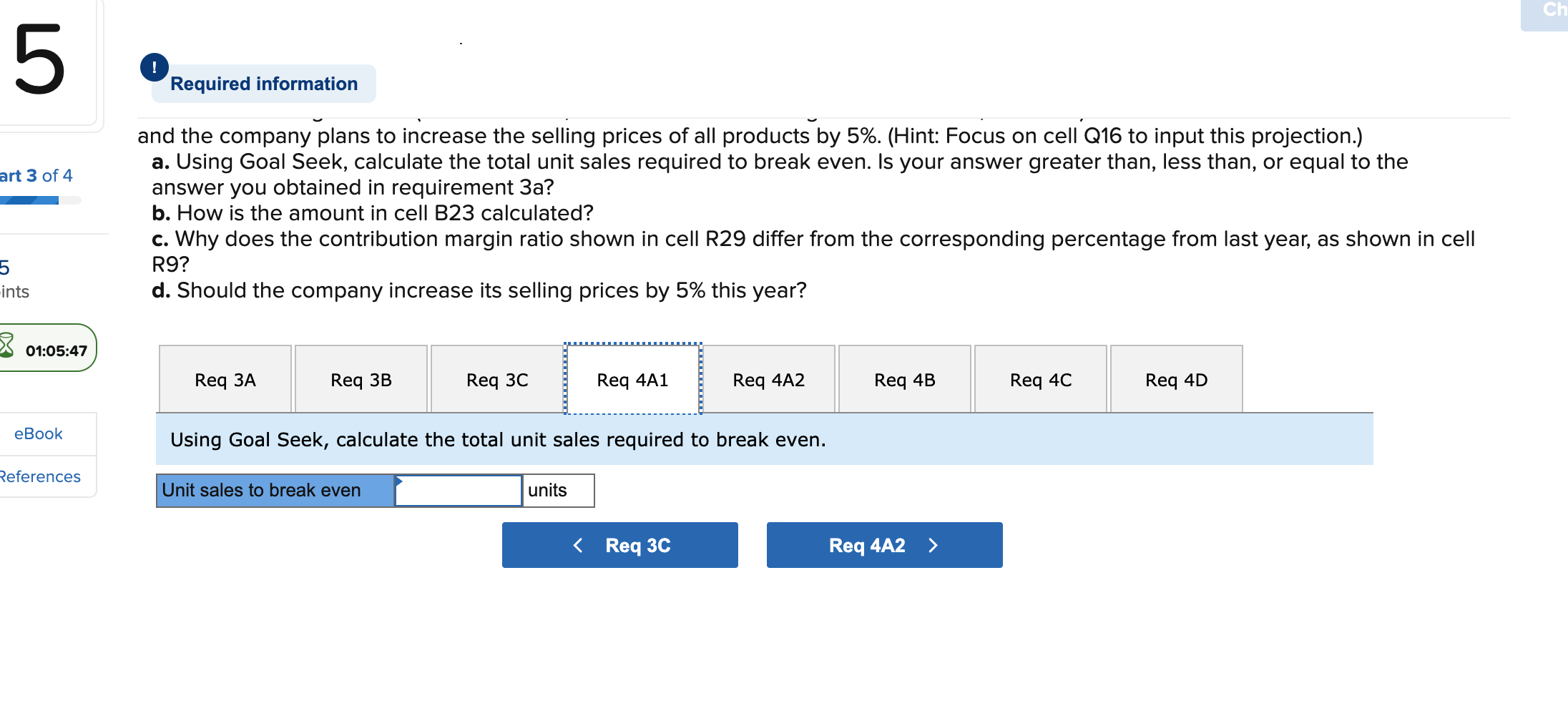

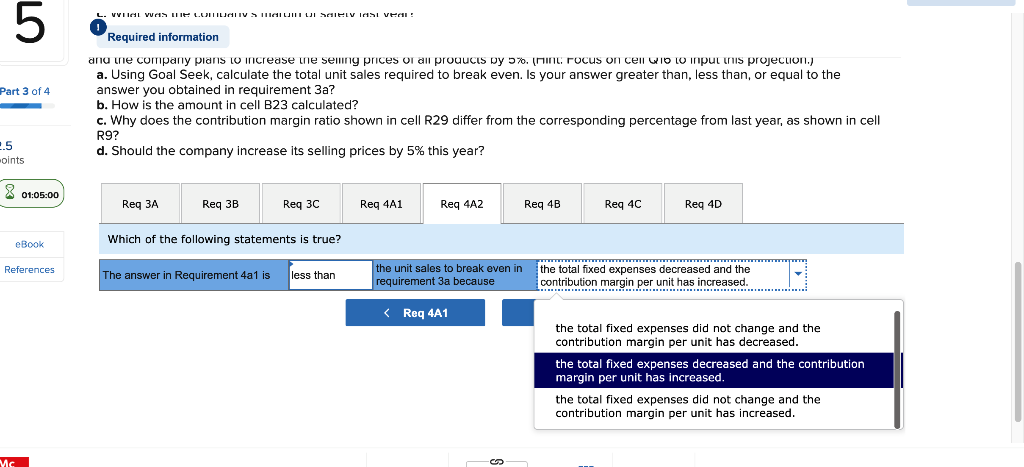

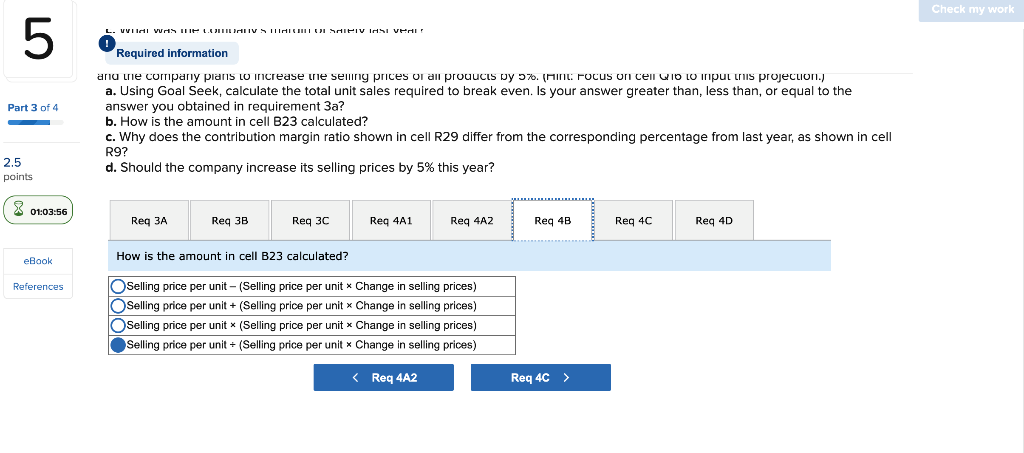

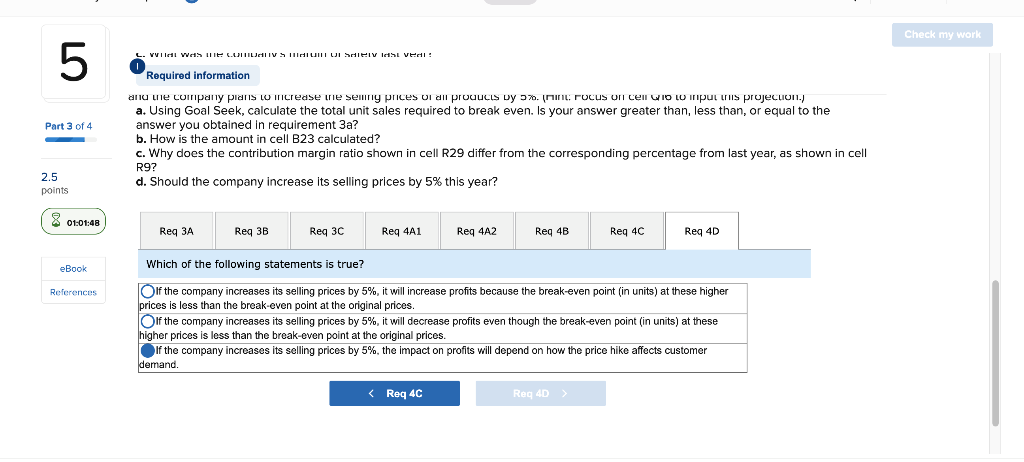

Page Layout Formulas Data Review View Share Home Insert X X Cut Cooy - . AA- => Wrap Text Custom Auta Sum X - Calibri (Bodyl . 11 Biu 29 & = $ %) 0 .co + Marga A Centar 00 Insert Delete Format Format Conditional Format Formatting as Table Sort & Filter Clear Styles Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates E11 A e E F & 1 K L M N P Q S 1 4 5 6 7 B E 10 12 19 15 Total Y 11 10,500 14 Good G DOO Weighted-Avery CM per un 9.000 6.000 3.000 3,000 12 DOO 19.500 13% 109.00 $ 4.500 24 19.00 150,000 100 16,500 11% 92.00 $ 65555 27.000 154 119.00 S 92.00 9 9.000 6% 129.00 $ V.15 S $ 5 2.00 5 12.95 S 7,500 54 9.00 $ 12.15 S 15,000 10% 95.00 $ 77.00 5 1,500 19 65.00 $ 29.00 5 85.005 1250 S $ $ 30.00 $ 14.30 S 52.00 $ 25.40 5 44.00 $ 12.10 5 42.00 1318 $ 5 89.00 61 27 5 261,000 $ 116,552 144.10 $ 1,573,500 $ 1,131,075 487.425 510.000 $ 255.000 2.125.500 5 5 1.657500 ANJE 2,500 $ 3.23,000 $ 117,000 $ 592,500 $ 621,000 $1,425,000 $ 287s 2.484,000 42,900 248,850 272,240 1,164,000 0923 $ 2ND 14.1110 JANOS 34. S 251.00 619,500 $ 265,700 153.XI 97,500 $ 43,500 54.XIS 132,000 $ 37,200 44, XI $ 100.0% 67.04 5 735 294,000 $ 1,068,000 $12.795,000 80,890 741,960 8,571,930 711211 III 3,000,000 $ 1,223,070 J.CR 1 Last Year: 2 Unitsa es 3 Sales i percentages 4 Swili pre pour 5 Variable are per un 5 7 Sale 3 Varak cuestes Chritten menn 10 bed expenses 11 Naturali 12 13 Projections for This Year: 14 Last yearunt sales 15 Change inuntale, 16 change inseling prices 17 Change invariable expenses 1B Change independs 19 2015 1501100 0 0 08 1 z 3 d 5 7 10 12 13 14 15 Total X Welehed Average av per Unt 34. 45 . 100% 15UIRI 64 9000 29.00 $ 12.95 $ 16.05 S 11% th, AI 99.00 5 68.95 $ 30.45$ $ $ $ he and S 42.50 $ 42.50 $ 5 134 22 pm 119.00 $ 92.00 $ 27.00 $ 134 19,500 109.00 $ 85.00 $ $ 24.00 $ 24 . po 39.00 $ 14.30 $ 24.70 5 19.00 S 6.39 $ $ 12.655 11 11 7% 1060 19.500 59.00 5 25.40 $ 33.60 $ 1,500 79,00 33.13 $ $ 45.82 $ 6% 9000 09.00 5 30.35 $ 4.64 $ 10% 16. 15,000 95.00 $ 77.60 $ 17.40 $ 1% 1,521 G5.00 5 29.00 $ 35.00 $ 2% SA 41.00 5 12.40 $ 31.60 $ 4x h 49.00 $ 13.48 $ 35.52 $ 121124 99.00 61 83 27.17 $ 261,000 $ 116,550 144450 144,450 $ 1,633,500$ 1,131,075 502425$ 510 000 $ 255,000 295.000 $ 2.125,500 $ 1657.500 458.000 $ 55.500 $ 3.213.000 $ 28.57% 245.000 5694 729,000 $ 117.000 $ (2.900 74,100 592,500 $ 621.000 $ 1.425,000 $ 200950 273,249 1.164,000 243,650 $347,760 261,000 $ 619,500 5 97,500 5 5 132,000 5 266,700 43,500 37,200 252,300 $ $ 54,000 $ $ 94,900 94, 2009 100.0% 67.00 33.04 $ 294000 1,068,00 $ 12,795,000 20,890 741900 8.571.930 213.120 $ $326,040 4,223,070 KOLE $ $1,223,070 20 21 Sales in percentages 22 UNS 23 Selling price per unit 24 Variable coperca per url 25 Cartribution margin perunt 25 27 Sales 28 Variable esperes 29 Corbution market 330d expens 31 Nst operating income 32 33 Prolt Graph Information 34 35 Data Point 35 37 3R 39 CVP Graph information 40 41 Duta Points 28.15 Prolt 150,000 Sales Feed Experies Total Expenses $ $ 3,000,000 $3,000,000 150,000 $ 12,795,200 115/1990 $ Trash 45 44 Part 3 of 4 shown in rows 3 and 21) hold constant. a. Using Goal Seek, calculate the total unit sales required to break even. (Hint: Instruct Goal Seek to obtain a net operating income of $0, as shown in cell Q31, by changing the unit sales in cell Q14.) b. What are the dollar sales required to break even? c. What was the company's margin of safety last year? 2.5 points 01:09:12 4. Refer to the original data (in other words, return cell Q14 to its original value of 150,000 units). Assume the sales mix holds constant and the company plans to increase the selling prices of all products by 5%. (Hint: Focus on cell Q16 to input this projection.) a. Using Goal Seek, calculate the total unit sales required to break even. Is your answer greater than, less than, or equal to the answer you obtained in requirement 3a? b. How is the amount in cell B23 calculated? c. Why does the contribution margin ratio shown in cell R29 differ from the corresponding percentage from last year, as shown in cell R9? d. Should the company increase its selling prices by 5% this year? eBook References Req Req 3B Req 30 Req 4A1 Req 4A2 Req 4B Req 4C Req 4D Using Goal Seek, calculate the total unit sales required to break even. (Hint: Instruct Goal Seek to obtain a net operating income of $0, as shown in cell Q31, by changing the unit sales in cell Q14.) Unit sales to break even units 5 3. Refer to the original data (in other words, return cell Q15 to its original value of 0%) and assume the sales mix percentages (as shown in rows 3 and 21) hold constant. a. Using Goal Seek, calculate the total unit sales required to break even. (Hint: Instruct Goal Seek to obtain a net operating income of $0, as shown in cell Q31, by changing the unit sales in cell Q14.) b. What are the dollar sales required to break even? c. What was the company's margin of safety last year? Part 3 of 4 2.5 oints 01:06:44 4. Refer to the original data (in other words, return cell Q14 to its original value of 150,000 units). Assume the sales mix holds constant and the company plans to increase the selling prices of all products by 5%. (Hint: Focus on cell Q16 to input this projection.) a. Using Goal Seek, calculate the total unit sales required to break even. Is your answer greater than, less than, or equal to the answer you obtained in requirement 3a? b. How is the amount in cell B23 calculated? c. Why does the contribution margin ratio shown in cell R29 differ from the corresponding percentage from last year, as shown in cell R9? d. Should the company increase its selling prices by 5% this year? eBook References Req Req 3B Req 3C Req 4A1 Req 4A2 Req 4B Req 40 Req 4D What was the company's margin of safety last year? Margin of safety last year Check my work viel Waste LIVSMAILI UISHEV ISL Ved 5 Required information Part 3 of 4 and the company plans to increase me sening prices oi ani pruuucts by 57. nncrocus on cell Vio lo put this projection) a. Using Goal Seek, calculate the total unit sales required to break even. Is your answer greater than, less than, or equal to the answer you obtained in requirement 3a? b. How is the amount in cell B23 calculated? c. Why does the contribution margin ratio shown in cell R29 differ from the corresponding percentage from last year, as shown in cell R9? d. Should the company increase its selling prices by 5% this year? 2.5 points X 01:01:48 Req 3A Reg 3B Req 3C Req 4A1 Req 4A2 Reg 4B Reg 4C Req 4D eBook Which of the following statements is true? References Of the company increases its selling prices by 5%, it will increase profits because the break-even point (in units) at these higher prices is less than the break-even point at the original prices. If the company increases its selling prices by 5%, it will decrease profits even though the break-even point (in units) at these higher prices is less than the break-even point at the original prices. If the company increases its selling prices by 5%, the impact on profits will depend on how the price hike affects customer demand. Wrap Text Custom Auta Sum X - Calibri (Bodyl . 11 Biu 29 & = $ %) 0 .co + Marga A Centar 00 Insert Delete Format Format Conditional Format Formatting as Table Sort & Filter Clear Styles Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates E11 A e E F & 1 K L M N P Q S 1 4 5 6 7 B E 10 12 19 15 Total Y 11 10,500 14 Good G DOO Weighted-Avery CM per un 9.000 6.000 3.000 3,000 12 DOO 19.500 13% 109.00 $ 4.500 24 19.00 150,000 100 16,500 11% 92.00 $ 65555 27.000 154 119.00 S 92.00 9 9.000 6% 129.00 $ V.15 S $ 5 2.00 5 12.95 S 7,500 54 9.00 $ 12.15 S 15,000 10% 95.00 $ 77.00 5 1,500 19 65.00 $ 29.00 5 85.005 1250 S $ $ 30.00 $ 14.30 S 52.00 $ 25.40 5 44.00 $ 12.10 5 42.00 1318 $ 5 89.00 61 27 5 261,000 $ 116,552 144.10 $ 1,573,500 $ 1,131,075 487.425 510.000 $ 255.000 2.125.500 5 5 1.657500 ANJE 2,500 $ 3.23,000 $ 117,000 $ 592,500 $ 621,000 $1,425,000 $ 287s 2.484,000 42,900 248,850 272,240 1,164,000 0923 $ 2ND 14.1110 JANOS 34. S 251.00 619,500 $ 265,700 153.XI 97,500 $ 43,500 54.XIS 132,000 $ 37,200 44, XI $ 100.0% 67.04 5 735 294,000 $ 1,068,000 $12.795,000 80,890 741,960 8,571,930 711211 III 3,000,000 $ 1,223,070 J.CR 1 Last Year: 2 Unitsa es 3 Sales i percentages 4 Swili pre pour 5 Variable are per un 5 7 Sale 3 Varak cuestes Chritten menn 10 bed expenses 11 Naturali 12 13 Projections for This Year: 14 Last yearunt sales 15 Change inuntale, 16 change inseling prices 17 Change invariable expenses 1B Change independs 19 2015 1501100 0 0 08 1 z 3 d 5 7 10 12 13 14 15 Total X Welehed Average av per Unt 34. 45 . 100% 15UIRI 64 9000 29.00 $ 12.95 $ 16.05 S 11% th, AI 99.00 5 68.95 $ 30.45$ $ $ $ he and S 42.50 $ 42.50 $ 5 134 22 pm 119.00 $ 92.00 $ 27.00 $ 134 19,500 109.00 $ 85.00 $ $ 24.00 $ 24 . po 39.00 $ 14.30 $ 24.70 5 19.00 S 6.39 $ $ 12.655 11 11 7% 1060 19.500 59.00 5 25.40 $ 33.60 $ 1,500 79,00 33.13 $ $ 45.82 $ 6% 9000 09.00 5 30.35 $ 4.64 $ 10% 16. 15,000 95.00 $ 77.60 $ 17.40 $ 1% 1,521 G5.00 5 29.00 $ 35.00 $ 2% SA 41.00 5 12.40 $ 31.60 $ 4x h 49.00 $ 13.48 $ 35.52 $ 121124 99.00 61 83 27.17 $ 261,000 $ 116,550 144450 144,450 $ 1,633,500$ 1,131,075 502425$ 510 000 $ 255,000 295.000 $ 2.125,500 $ 1657.500 458.000 $ 55.500 $ 3.213.000 $ 28.57% 245.000 5694 729,000 $ 117.000 $ (2.900 74,100 592,500 $ 621.000 $ 1.425,000 $ 200950 273,249 1.164,000 243,650 $347,760 261,000 $ 619,500 5 97,500 5 5 132,000 5 266,700 43,500 37,200 252,300 $ $ 54,000 $ $ 94,900 94, 2009 100.0% 67.00 33.04 $ 294000 1,068,00 $ 12,795,000 20,890 741900 8.571.930 213.120 $ $326,040 4,223,070 KOLE $ $1,223,070 20 21 Sales in percentages 22 UNS 23 Selling price per unit 24 Variable coperca per url 25 Cartribution margin perunt 25 27 Sales 28 Variable esperes 29 Corbution market 330d expens 31 Nst operating income 32 33 Prolt Graph Information 34 35 Data Point 35 37 3R 39 CVP Graph information 40 41 Duta Points 28.15 Prolt 150,000 Sales Feed Experies Total Expenses $ $ 3,000,000 $3,000,000 150,000 $ 12,795,200 115/1990 $ Trash 45 44 Part 3 of 4 shown in rows 3 and 21) hold constant. a. Using Goal Seek, calculate the total unit sales required to break even. (Hint: Instruct Goal Seek to obtain a net operating income of $0, as shown in cell Q31, by changing the unit sales in cell Q14.) b. What are the dollar sales required to break even? c. What was the company's margin of safety last year? 2.5 points 01:09:12 4. Refer to the original data (in other words, return cell Q14 to its original value of 150,000 units). Assume the sales mix holds constant and the company plans to increase the selling prices of all products by 5%. (Hint: Focus on cell Q16 to input this projection.) a. Using Goal Seek, calculate the total unit sales required to break even. Is your answer greater than, less than, or equal to the answer you obtained in requirement 3a? b. How is the amount in cell B23 calculated? c. Why does the contribution margin ratio shown in cell R29 differ from the corresponding percentage from last year, as shown in cell R9? d. Should the company increase its selling prices by 5% this year? eBook References Req Req 3B Req 30 Req 4A1 Req 4A2 Req 4B Req 4C Req 4D Using Goal Seek, calculate the total unit sales required to break even. (Hint: Instruct Goal Seek to obtain a net operating income of $0, as shown in cell Q31, by changing the unit sales in cell Q14.) Unit sales to break even units 5 3. Refer to the original data (in other words, return cell Q15 to its original value of 0%) and assume the sales mix percentages (as shown in rows 3 and 21) hold constant. a. Using Goal Seek, calculate the total unit sales required to break even. (Hint: Instruct Goal Seek to obtain a net operating income of $0, as shown in cell Q31, by changing the unit sales in cell Q14.) b. What are the dollar sales required to break even? c. What was the company's margin of safety last year? Part 3 of 4 2.5 oints 01:06:44 4. Refer to the original data (in other words, return cell Q14 to its original value of 150,000 units). Assume the sales mix holds constant and the company plans to increase the selling prices of all products by 5%. (Hint: Focus on cell Q16 to input this projection.) a. Using Goal Seek, calculate the total unit sales required to break even. Is your answer greater than, less than, or equal to the answer you obtained in requirement 3a? b. How is the amount in cell B23 calculated? c. Why does the contribution margin ratio shown in cell R29 differ from the corresponding percentage from last year, as shown in cell R9? d. Should the company increase its selling prices by 5% this year? eBook References Req Req 3B Req 3C Req 4A1 Req 4A2 Req 4B Req 40 Req 4D What was the company's margin of safety last year? Margin of safety last year Check my work viel Waste LIVSMAILI UISHEV ISL Ved 5 Required information Part 3 of 4 and the company plans to increase me sening prices oi ani pruuucts by 57. nncrocus on cell Vio lo put this projection) a. Using Goal Seek, calculate the total unit sales required to break even. Is your answer greater than, less than, or equal to the answer you obtained in requirement 3a? b. How is the amount in cell B23 calculated? c. Why does the contribution margin ratio shown in cell R29 differ from the corresponding percentage from last year, as shown in cell R9? d. Should the company increase its selling prices by 5% this year? 2.5 points X 01:01:48 Req 3A Reg 3B Req 3C Req 4A1 Req 4A2 Reg 4B Reg 4C Req 4D eBook Which of the following statements is true? References Of the company increases its selling prices by 5%, it will increase profits because the break-even point (in units) at these higher prices is less than the break-even point at the original prices. If the company increases its selling prices by 5%, it will decrease profits even though the break-even point (in units) at these higher prices is less than the break-even point at the original prices. If the company increases its selling prices by 5%, the impact on profits will depend on how the price hike affects customer demand.