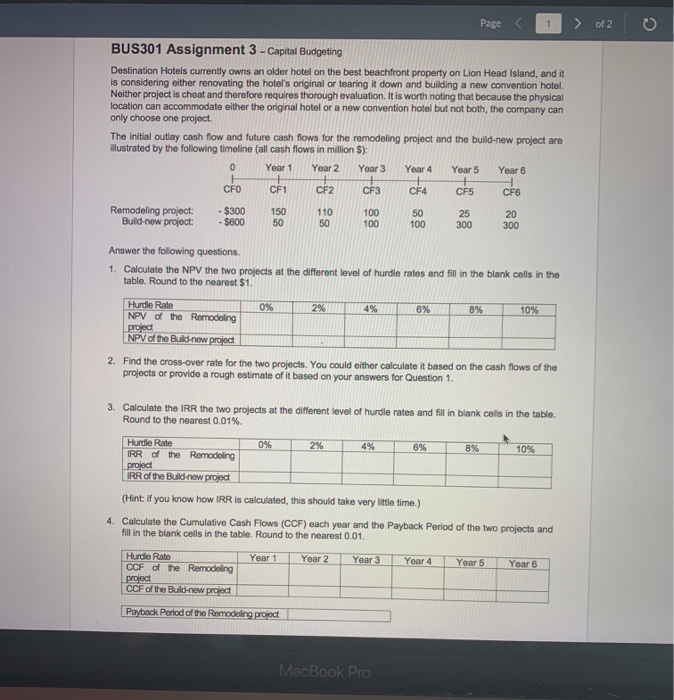

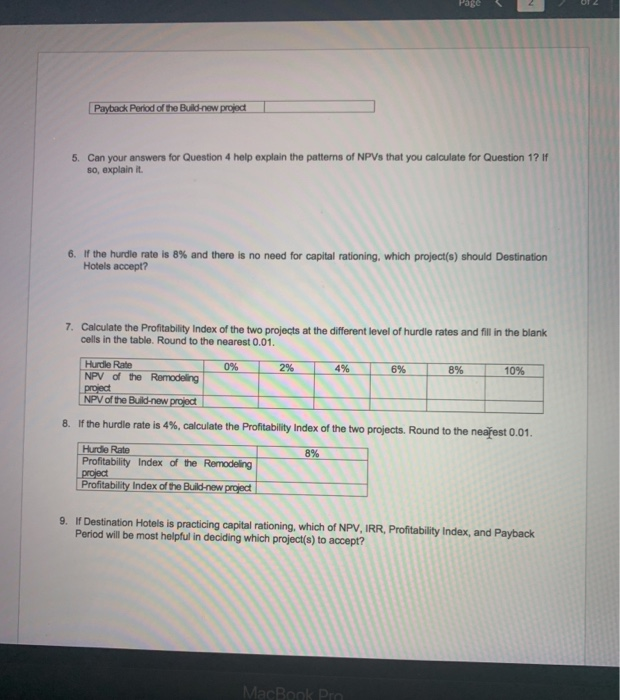

Page of 2 O BUS301 Assignment 3 - Capital Budgeting Destination Hotels currently owns an older hotel on the best beachfront property on Lion Head Island, and it is considering either renovating the hotel's original or tearing it down and building a new convention hotel Neither project is cheat and therefore requires thorough evaluation. It is worth noting that because the physical location can accommodate either the original hotel or a new convention hotel but not both, the company can only choose one project. The initial outlay cash flow and future cash flows for the remodeling project and the build-new project are illustrated by the following timeline (all cash flows in million $): Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 CFO CF CF2 F3 C4 C5 CFS Remodeling project: - $300 150 110 Build-new project: - 5600 50 a 300 Answer the following questions. 1. Calculate the NPV the two projects at the different level of hurdle rates and fill in the blank cells in the table. Round to the nearest $1. 0% 2% 4% E6% 10% Hunde Rate NPV of the Remodeling proiect NPV of the Build new project 2. Find the cross-over rate for the two projects. You could either calculate it based on the cash flows of the projects or provide a rough estimate of it based on your answers for Question 1. 3. Calculate the IRR the two projects at the different level of hurdle rates and fill in blank colis in the table. Round to the nearest 0.01% 0% 2% 4% 6% 8% 10% Hurdle Rate IRR of the Romodeling project IRR of the Build-new project (Hint: if you know how IRR is calculated, this should take very little time.) 4. Calculate the Cumulative Cash Flows (CCF) each year and the Payback period of the two projects and fill in the blank cells in the table. Round to the nearest 0.01 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Hurdle Rate CCF of the Remodeling project CCF of the Build new project Payback Period of the Remodeling project MacBook Pro Page Payback period of the Build-new project 5. Can your answers for Question 4 help explain the patterns of NPVs that you calculate for Question 1? If so, explain it. 6. If the hurdle rate is 8% and there is no need for capital rationing, which project(s) should Destination Hotels accept? 7. Calculate the Profitability Index of the two projects at the different level of hurdle rates and fill in the blank cells in the table. Round to the nearest 0.01. 6% 8% 10% Hurdle Rate NPV of the Remodeling proiect NPV of the Build-new project 8. If the hurdle rate is 4%, calculate the Profitability Index of the two projects. Round to the nearest 0.01 6 Hurde Rate Profitability Index of the Remodeling proiect Profitability Index of the Build-new project / 9. If Destination Hotels is practicing capital rationing, which of NPV, IRR. Profitability Index, and Payback Period will be most helpful in deciding which project(s) to accept? MacBook Pro