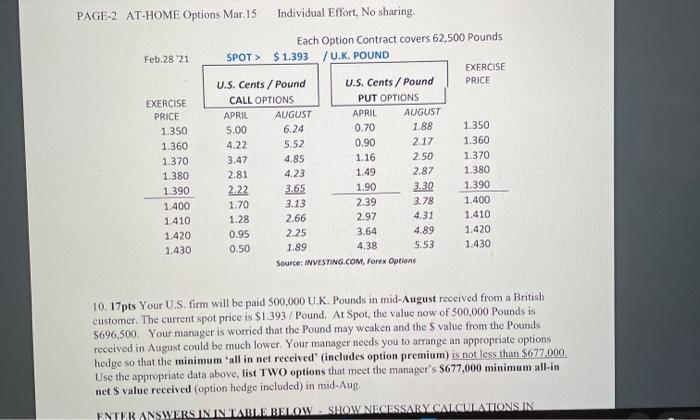

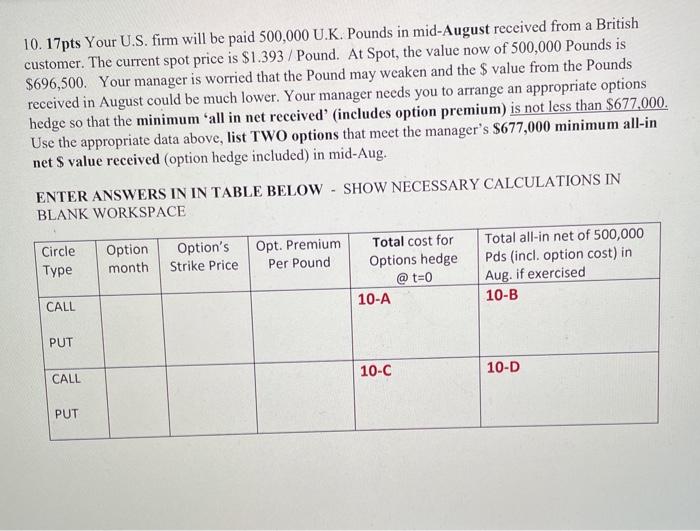

PAGE-2 AT-HOME Options Mar 15 Individual Effort, No sharing Each Option Contract covers 62,500 Pounds Feb.28 21 SPOT> $ 1.393 / U.K. POUND EXERCISE U.S. Cents / Pound U.S. Cents / Pound PRICE EXERCISE CALL OPTIONS PUT OPTIONS PRICE APRIL AUGUST APRIL AUGUST 1.350 5.00 6.24 0.70 1.88 1.350 1.360 4.22 5.52 0.90 2.17 1.360 1.370 3.47 4.85 1.16 2.50 1370 1.380 2.81 4.23 1.49 2.87 1.380 1.390 2.22 3.65 1.90 3.30 1.390 1.400 1.70 3.13 2.39 3.78 1.400 1.410 1.28 2.66 2.97 4.31 1.410 1.420 0.95 2.25 3.64 4.89 1.420 1.430 0.50 1.89 4.38 5.53 1.430 Source: INVESTING.COM, Forex Options 10.17pts Your U.S. firm will be paid 500,000 U.K. Pounds in mid-August received from a British customer. The current spot price is $1.393 / Pound. At Spot, the value now of 500.000 Pounds is $696,500. Your manager is worried that the Pound may weaken and the value from the Pounds received in August could be much lower. Your manager needs you to arrange an appropriate options hodge so that the minimum all in net received" (includes option premium) is not less than $677.000. Use the appropriate data above, list TWO options that meet the manager's $677.000 minimum all-in net S value received option hedge included) in mid-Aug ENTER ANSWERS IN IN TABLE BELOW. SHOW NECESSARY CALCULATIONS IN 10.17pts Your U.S. firm will be paid 500,000 U.K. Pounds in mid-August received from a British customer. The current spot price is $1.393 / Pound. At Spot, the value now of 500,000 Pounds is $696,500. Your manager is worried that the Pound may weaken and the value from the Pounds received in August could be much lower. Your manager needs you to arrange an appropriate options hedge so that the minimum 'all in net received' (includes option premium) is not less than $677,000. Use the appropriate data above, list TWO options that meet the manager's $677,000 minimum all-in net S value received (option hedge included) in mid-Aug. ENTER ANSWERS IN IN TABLE BELOW - SHOW NECESSARY CALCULATIONS IN BLANK WORKSPACE Circle Type Option month Option's Strike Price Opt. Premium Per Pound Total cost for Options hedge @t=0 10-A Total all-in net of 500,000 Pds (incl. option cost) in Aug. if exercised 10-B CALL PUT 10-C 10-D CALL PUT PAGE-2 AT-HOME Options Mar 15 Individual Effort, No sharing Each Option Contract covers 62,500 Pounds Feb.28 21 SPOT> $ 1.393 / U.K. POUND EXERCISE U.S. Cents / Pound U.S. Cents / Pound PRICE EXERCISE CALL OPTIONS PUT OPTIONS PRICE APRIL AUGUST APRIL AUGUST 1.350 5.00 6.24 0.70 1.88 1.350 1.360 4.22 5.52 0.90 2.17 1.360 1.370 3.47 4.85 1.16 2.50 1370 1.380 2.81 4.23 1.49 2.87 1.380 1.390 2.22 3.65 1.90 3.30 1.390 1.400 1.70 3.13 2.39 3.78 1.400 1.410 1.28 2.66 2.97 4.31 1.410 1.420 0.95 2.25 3.64 4.89 1.420 1.430 0.50 1.89 4.38 5.53 1.430 Source: INVESTING.COM, Forex Options 10.17pts Your U.S. firm will be paid 500,000 U.K. Pounds in mid-August received from a British customer. The current spot price is $1.393 / Pound. At Spot, the value now of 500.000 Pounds is $696,500. Your manager is worried that the Pound may weaken and the value from the Pounds received in August could be much lower. Your manager needs you to arrange an appropriate options hodge so that the minimum all in net received" (includes option premium) is not less than $677.000. Use the appropriate data above, list TWO options that meet the manager's $677.000 minimum all-in net S value received option hedge included) in mid-Aug ENTER ANSWERS IN IN TABLE BELOW. SHOW NECESSARY CALCULATIONS IN 10.17pts Your U.S. firm will be paid 500,000 U.K. Pounds in mid-August received from a British customer. The current spot price is $1.393 / Pound. At Spot, the value now of 500,000 Pounds is $696,500. Your manager is worried that the Pound may weaken and the value from the Pounds received in August could be much lower. Your manager needs you to arrange an appropriate options hedge so that the minimum 'all in net received' (includes option premium) is not less than $677,000. Use the appropriate data above, list TWO options that meet the manager's $677,000 minimum all-in net S value received (option hedge included) in mid-Aug. ENTER ANSWERS IN IN TABLE BELOW - SHOW NECESSARY CALCULATIONS IN BLANK WORKSPACE Circle Type Option month Option's Strike Price Opt. Premium Per Pound Total cost for Options hedge @t=0 10-A Total all-in net of 500,000 Pds (incl. option cost) in Aug. if exercised 10-B CALL PUT 10-C 10-D CALL PUT