Answered step by step

Verified Expert Solution

Question

1 Approved Answer

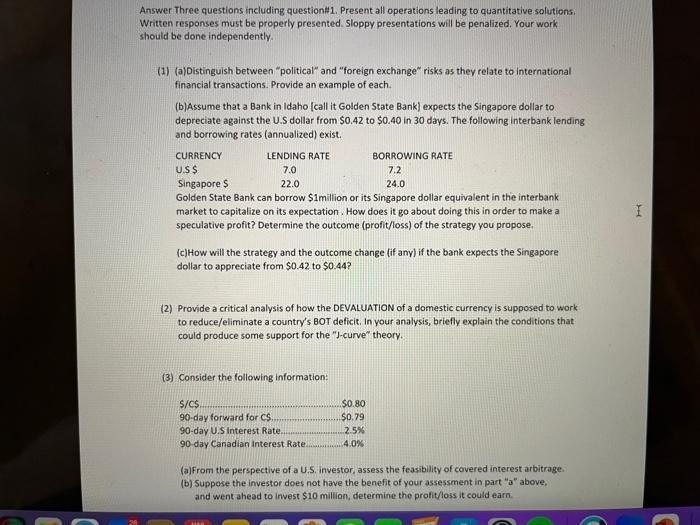

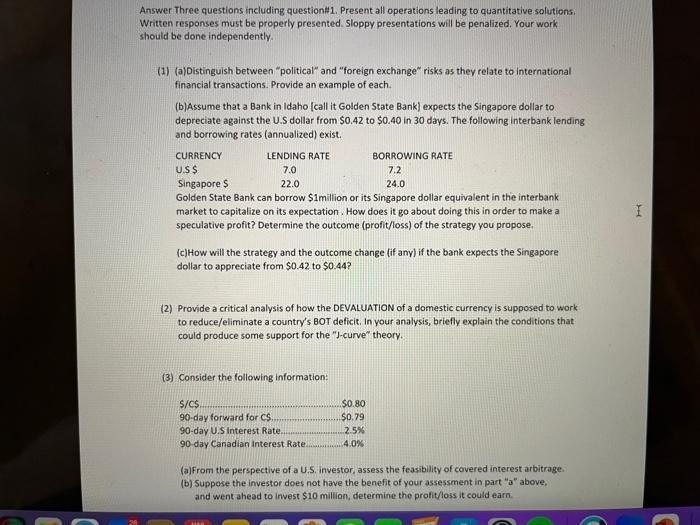

pages 1 and 2 finance Answer Three questions including question H1. Present all operations leading to quantitative solutions. Written responses must be properly presented. Sloppy

pages 1 and 2 finance

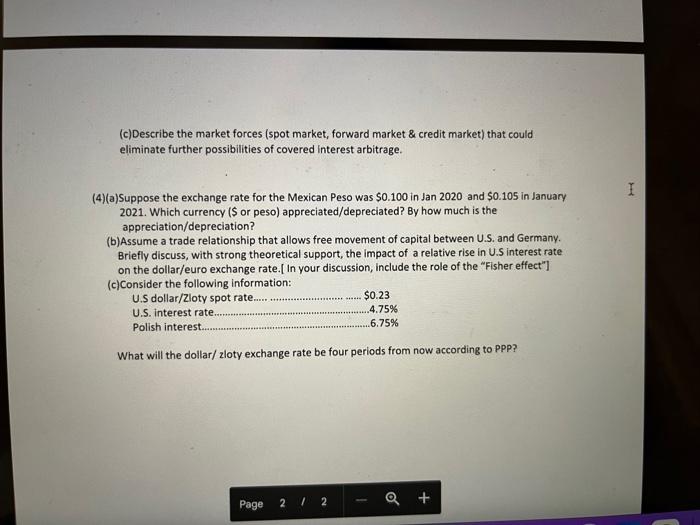

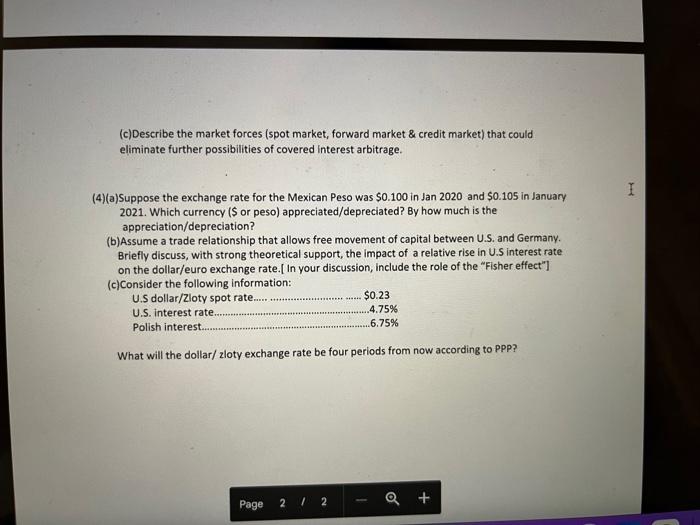

Answer Three questions including question H1. Present all operations leading to quantitative solutions. Written responses must be properly presented. Sloppy presentations will be penalized. Your work should be done independently. (1) (a)Distinguish between "political" and "foreign exchange" risks as they relate to international financial transactions. Provide an example of each. (b)Assume that a Bank in Idaho [call it Golden State Bank] expects the Singapore dollar to depreciate against the U.S dollar from $0.42 to $0.40 in 30 days. The following interbank lending and borrowing rates (annualized) exist. Golden State Bank can borrow \$1milion or its Singapore dollar equivalent in the interbank market to capitalize on its expectation. How does it go about doing this in order to make a speculative profit? Determine the outcome (profit/loss) of the strategy you propose, (c)How will the strategy and the outcome change (if any) if the bank expects the Singapore dollar to appreciate from $0.42 to $0.44 ? (2) Provide a critical analysis of how the DEVALUATION of a domestic currency is supposed to work to reduce/eliminate a country's BOT deficit, In your analysis, briefly explain the conditions that: could produce some support for the "J-curve" theory. (3) Consider the following information: (a)From the perspective of a U.S. investor, assess the feasibility of covered interest arbitrage. (b) Suppose the investor does not have the benefit of your assessment in part "a" above, and went ahead to invest $10 million, determine the profit/loss it could earn. (c)Describe the market forces (spot market, forward market \& credit market) that could eliminate further possibilities of covered interest arbitrage. (4)(a)Suppose the exchange rate for the Mexican Peso was $0.100 in Jan 2020 and $0.105 in January 2021. Which currency ( $ or peso) appreciated/depreciated? By how much is the appreciation/depreciation? (b)Assume a trade relationship that allows free movement of capital between U.S. and Germany. Briefly discuss, with strong theoretical support, the impact of a relative rise in U.S interest rate on the dollar/euro exchange rate.[ In your discussion, include the role of the "Fisher effect"] What will the dollar/ zloty exchange rate be four periods from now according to PPP? Answer Three questions including question H1. Present all operations leading to quantitative solutions. Written responses must be properly presented. Sloppy presentations will be penalized. Your work should be done independently. (1) (a)Distinguish between "political" and "foreign exchange" risks as they relate to international financial transactions. Provide an example of each. (b)Assume that a Bank in Idaho [call it Golden State Bank] expects the Singapore dollar to depreciate against the U.S dollar from $0.42 to $0.40 in 30 days. The following interbank lending and borrowing rates (annualized) exist. Golden State Bank can borrow \$1milion or its Singapore dollar equivalent in the interbank market to capitalize on its expectation. How does it go about doing this in order to make a speculative profit? Determine the outcome (profit/loss) of the strategy you propose, (c)How will the strategy and the outcome change (if any) if the bank expects the Singapore dollar to appreciate from $0.42 to $0.44 ? (2) Provide a critical analysis of how the DEVALUATION of a domestic currency is supposed to work to reduce/eliminate a country's BOT deficit, In your analysis, briefly explain the conditions that: could produce some support for the "J-curve" theory. (3) Consider the following information: (a)From the perspective of a U.S. investor, assess the feasibility of covered interest arbitrage. (b) Suppose the investor does not have the benefit of your assessment in part "a" above, and went ahead to invest $10 million, determine the profit/loss it could earn. (c)Describe the market forces (spot market, forward market \& credit market) that could eliminate further possibilities of covered interest arbitrage. (4)(a)Suppose the exchange rate for the Mexican Peso was $0.100 in Jan 2020 and $0.105 in January 2021. Which currency ( $ or peso) appreciated/depreciated? By how much is the appreciation/depreciation? (b)Assume a trade relationship that allows free movement of capital between U.S. and Germany. Briefly discuss, with strong theoretical support, the impact of a relative rise in U.S interest rate on the dollar/euro exchange rate.[ In your discussion, include the role of the "Fisher effect"] What will the dollar/ zloty exchange rate be four periods from now according to PPP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started