Answered step by step

Verified Expert Solution

Question

1 Approved Answer

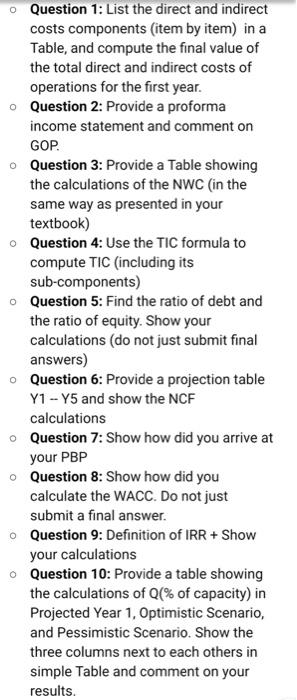

Pages 1-6 provide context and questions are listed on photo 7. Thank you. This is a case study. pages 1-6 offer the context and page

Pages 1-6 provide context and questions are listed on photo 7.

Thank you.

This is a case study. pages 1-6 offer the context and page 7 questions pertaining to the case.

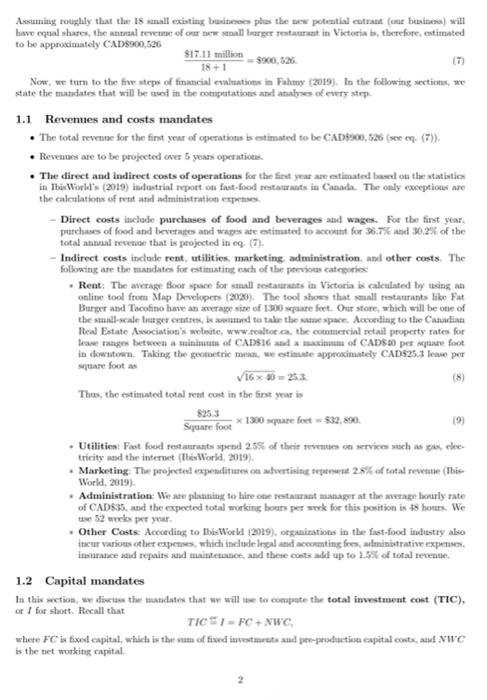

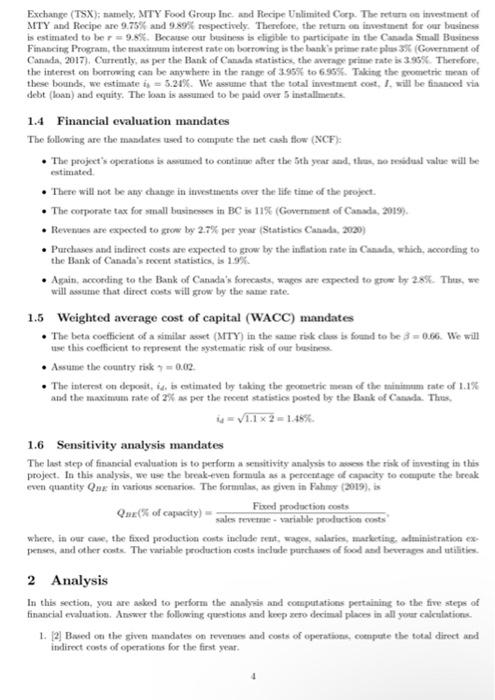

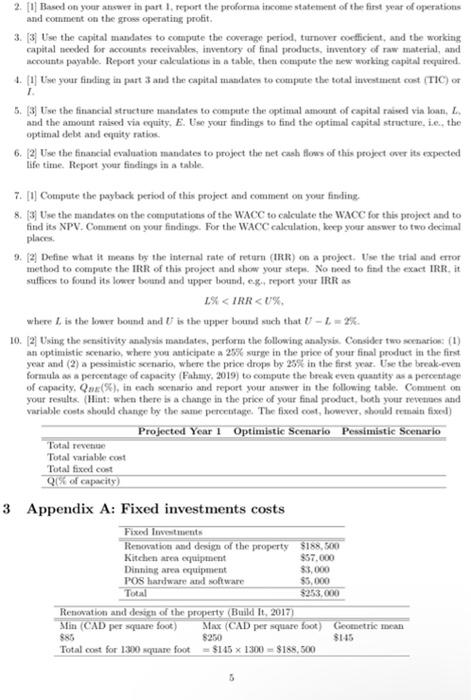

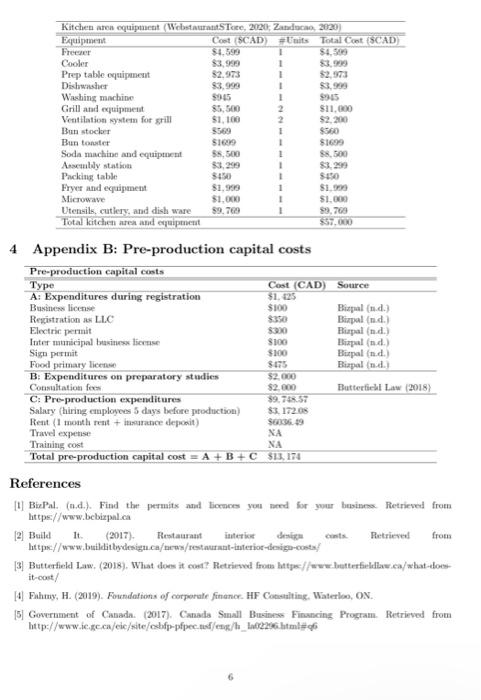

1 Background and mandates In this project, we intend to analyze the financial feasibility of opening a new small burger restaurant in downtown Victoria, British Columbia (BC). Burger restaurants are part of the fast-food industry. They are classified under limited-service cating places. Companies in this classification operate under conditions of monopolistic competition; that is, players compete with each other while acting as monopolists in their own segment. The monopoly power is justified by the player's competitive advantage, which could be a characteristic of the product or service, quality, taste, efficiency, or any other key aspect of the service provided. In this industry, the level of competition is high whereas the market concentration and the barriers to entry are low. According to Statistics Canada (2018), in BC, there are nearly 11,000 food and drinking places, and 41.2% of these places are limited-service restaurants. This data validates the monopolistic competitive structure of the industry. We begin by estimating the market share of this new business. In 2019, the total revenue of limited- service restanrants in BC was CAD$5.07 billion (Statistics Canada 2019). 27.7% of this total reverme is the market share of the major players in the industry (IbisWorld. 2019). Thus, the total revente of small limited-service eating places for minor players, i.e., for businesses similar to ours, is approximately CAD$3.7 billion: $5.07 billion x 72.3% = $ 3.7 billion. (1) According to Statistics Canada (2017), the total population in BC is 4,648,055 and the total population in Victoria is 85,792. Thus, the ratio of the population of Victoria to BC is 85,792 (2) 4,648, 053 * 100% = 185%. Taking this ratio and applying it to the total revenue of small limited-service eating places for minor players in BC, one can project the total revenue of small limited-service restaurants in Victoria to be approximately CADS 68.45 million: $3.7 billion x 1.85% = $68.45 million. (3) Now, since we have estimated the total revenue for this industry in Victoria, our next task is to estimate the total revenue of one small burger restaurant in the city. In Vancouver Island, the number of small food and drinking places per 100.000 persons is 202 Statistics Canada, 2017b). Thus, in Victoria, with a total population of 85,792, the number of small food and drinking places ought to be 173 restaurants; that is, 85.792 202 restaurants 100,000 173 restaurants. This number, however, includes all types of restaurants in the region. But, according to Statistics Canada (2018), 41.2% of eating places in BC are limited-service restaurants. Thus, the estimated number of small limited-service restaurants in Victoria is approximately 71 restaurants 173 restaurants x 41.2% 71 restaurants Next, we seek to narrow this number down to account for burger restaurants only. A quick Yellow Pages search yields 24 burger restaurants in Victoria; 6 are major players and 18 are small players. Thus, 18/71 25% of small fast-food places in Victoria are burger restaurants. Since the total revenue of small limited- service restaurants in Victoria was found to be approximately CADS 68.45 million (see eq. (3)), then 25% of that revenue ought to be a good estimate of the total revenue of small burger restaurants in Victoria. This gives approximately CAD$17.11 million: $68.45 million x 0.25 = $17.11 million. (6) Astutning roughly that the 18 small existing buitos plies the new potential entrat (car business) will have equal shares, the annual revetne of our new all barger restaurant in Victoria is, therefore, estimated to be approximately CAD8900,626 $17.11 million 18+1 (7) 300,526 Now, we turn to the five steps of financial evaluations in Fahmy (2013). In the following sections, we state the mandates that will be used in the computations and analyses of every step 1.1 Revemies and costs mandates The total revenue for the fint year of operations is estimated to be CAD9900,526 (see eq (7)). Revetatoes are to be projected over 5 years operations . The direct and indirect costs of operations for the first year estimated based on the statistics in Thi World* (2019) industrial report on fast-food restaurants in Canada. The only exceptions are the calculations of of rent and administration expertise Direct costs include purchases of food and beverages and wages. For the first year, purchases of food and beverages and wages ate estimated to account for 36.7% and 30.2% of the total annual revention that is projected in eo (7). Indirect costs include rent, utilities, marketing, administration, and other costs. The following are the mandates for estimatitu enth of the previous categories Rent: The average door space for small restaurants in Victoria is calculated by tsing an online tool from Map Developers (3020). The tool shows that small restaurants like Fat Burger and Tacofino bave an average ste of 1300 are feet. Our store, which will be one of the small-scale burger centre, is and to take the same space. According to the Canadiats Real Estate Association's website www.calteca, the commercial retail property rates for leave ranges between a minimum of CAD$16 and a maximum of CAD$30 per square foot in downtown. Tiking the geometric mean, we estimate approximately CAD$25.3 per square foot as VIGX 30 = 25.3. (8) Thus, the estimated total sent cost in the first year is Square foot (9) * 1300 square feet $32,890. Utilities Fast food restaurants spend 25% of their treaca setvices stach as gas, elec tricity and the internet (The World 2019) Marketing. The projected expenditures de avertising pee 28% of total revenue (This World 2019) Administration: We are planning to hire te restaurant manager at the age hourly rate of CADS35, and the expected total working houts per week for this position is 48 hours. We 1 52 weeks per year Other Costs According to the World (2019), organizations in the fast-food industry also incur various other expenses, which include Irgal and accounting for alministrative expenses istance and repairs and maintenance, and d these costs at up to 25% of total 1.2 Capital mandates In this section with matulates that we will to compute the total investment cost (TIC), of 1 for short. Recall that TICI - FC+NWC, where FC is fixed capital, which is the sum of fixed investments and per-productions capital costs, and NWC is the networking capital Fixed Capital consists of fixed investments and pro-production capital costs. The fixed invest ments in our project consists of a categories: renovation and design of the property, kitchen ara equipment, dimning are equipment, and a retail point of sale (POS) system. The rebovation and design of the property costs a minimum of CAD$85 per square foot and a maximum of CAD$250 per square foot (Build it. 2017). The geometric mean is SCAD145 per square foot approacimately, that is V85 X 250 $145. Total renowntion and design of the property ta, therefore, $145 per square foot x 1300 feet = $188,500 The projections of all other items in fixed investments are explained in Appendix A. Below is a timmary of the fixed investments costs. Fixed Investments Renovation and design of the properts $188,500 Kitchen area equipment $57.000 Dinning are equipment $2,500 POS hardware and software 85,000 Total $253,000 Pre-production capital costs include expenditures during registration and formation, expenditure for preparatory studies, and pre-production expenditures. For opening a small burger restaurant in BC, we need several licences and registration fees Limited Liability Company (LLC) registration, electric permit, municipal business licence, and other pre-production expenses. The total of all these expenditures is CAD$13, 174 (see Appendix B). As for the estimation of the net working capital, we entertain the following assumptions. In the retail bure, the main payment methods are cash, debitul credit cards. According to a recent report issued by the Bank of Canada (Henry et al., 2018), approximately 67% of the total value of transactions are paid by credit card in BC. We will use this estimate to project the percentage of total revenue in eq. (7) that is paid by credit cards. This value is to be taken as the annual cost of operations in the net working capital calculations. Credit card payment create accounts receivables, which cover the gap between selling products and receiving funds from the bank. The coverage period for credit card payments varies between two or three basiese dans. In this project, we will assume 3 days as the coverage period for account receivables. We will entertain the assumption that the fast-food industry follows the make-to-order production strategy, This implies that companies in this industry do not bokd inventory and therefore, no capital is needed to finance inventory of final products. As for the inventory of raw materials, because most of the food items are perishable goods, we will sal week coverage period for inventory of raw materials. The annual cost of raw materials is assumed to be 30% of total revetme. Finally, we estime 1 month coverage period for accounts payable 1.3 Financial structure mandates Using the notation in Section 5. Chapter 8 in Fahmy (2019), we have the following variables pertaining to the financial structure of the project: 1 = total investment cost (TIC). = return on investment L = loan, R = repayment of the loan in = interest rate on borrowings, $ = trumber of installments The following are the sumption used to compute the optimal capital structure. The rate of return, r, is estimated by taking the average rate of return on investment of two similar sits from the Toronto Stock 3 Exchange (TSX); namely, MTY Food Group Inc. and Recipe Unlimited Corp. The return on investment of MTY and Recipe are 9.75% and 989% respectively. Therefore, the return on investment for our business is estimated to be r=9.5%. Because our business is cipible to participate in the Canada Small Business Financing Program, the maximum interest rate on borrowing is the bank's prime rate plus 3 (Government of Canada, 2017). Currently, as per the Bank of Canada statistics the average peiterate 3.866. Therefore, the interest on borrowing can be anywhere in the range of 3.95% to 6:95%. Taking the geometric mean of these bounds, we estimate is = 5.21%. We are that the total investment cost, I will be financed sin debt (loan) and equity. The loan is assumed to be paid over 5 installmente 1.4 Financial evaluation mandates The following are the mandates used to compute the tit cash flow (NCF): The projets operation is asumed to continue after the 5th year and te reodal value will be estimated There will not be any change in itsvestments over the life time of the project The corporate tax for small businesses in BC is 11% (Government of Canada, 2019). Reventes are expected to grow by 2.7% per yeur Statistics Canada. 20:20 Purchases and indirect costs are expected to grow by the inflation rate in Canada, which, according to the Bank of Canada's recent statistics, is 1.9% Again, according to the Bank of Canada's forecasts, wages are expected to grow by 28%. Thes, we will assume that direct costs will grow by the same rate. 1.5 Weighted average cost of capital (WACC) mandates The beta coefficient of a similar at (MTY) in the same risk cle is found to be 3 = 0.66. We will use this coefficient to represent the systematic risk of our business Assume the country risk = 0.02 The interest on deposit, te is estimated by taking the geometric mean of the minimum tute of 1.1% and the maximum rate of 2% as per the recent statistics posted by the Bank of Canada. This =V1.1X2=1.48% 1.6 Sensitivity analysis mandates The last step of financial evaluation is to perform a sensitivity analysis to me the risk of investing in this project. In this analysis, we use the break-even formula as a percentage of capacity to compute the break exen quantity One in various scenarios. The formas, as given in Fahmy (2019).is Qur(% of capacity) Fised production costs sales tevetne variable production cents where in our cu, the fixed production costs include stage salaries, marketing, administration ex puses, and other costs. The variable production costs include purchases o food and beverages and utilities 2 Analysis In this section, you are asked to perform the analysis and computations pertaining to the five steps of financial evaluation. Answer the following questions and keep sero decimal places in all your enleulations 1. [2] Bed on the given mandate on revenue and costs of operations, compete the total direct and itedirect costs of operations for the first year 2. [1] Based on your atuwer in part report the proforma income statement of the first year of operations and comment on the gross operating profit. 3.3 Use the capital mandates to compute the coverage period, turnover coefficient, and the working capital needed for accounts receivables, inventory of final products, inventory of raw material, and accounts payabile. Report your calculations in a table, then compute the new working capital required. 4. flise your finding in part 3 and the capital mandates to compute the total investment cont (TIC) or 1 5. [3] Use the financial structure mandates to compute the optimal amount of capital raised via loan, L. and the amount raised via equity. E. Use your finding to find the optimal capital structure, i.e. the optimal debt and equity ratios 6. [2] Use the financial evaluation mandates to project the net cash flows of this project over its expected life time. Report your findings in a table. 7. [1] Compute the payback period of this project and comment on your finding, 8. [3] Use the mandates on the computations of the WACC to calculate the WACC for this project and to find its NPV. Content on your findings. For the WACC calculation, loep your answer to two decimal places 9. [2Define what it means by the internal rate of return (IRR) on a project. Use the trial and error method to compute the IRR of this project and show your step. No need to find the exact IRR. it suffices to found its lower bound and upper bound, e... report your IRR as EX Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started