Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pages 1and 2 Anowect thee quenions induand questionti. Fhenent al mpetanno leadne ts quartitatiot idetioci Whaten responses mast be properly preiettad Sloppy protentationi will be

pages 1and 2

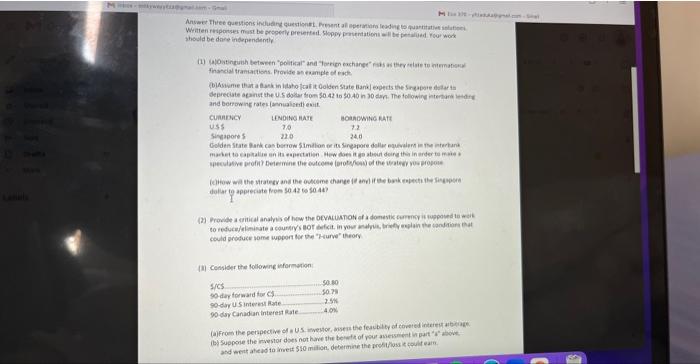

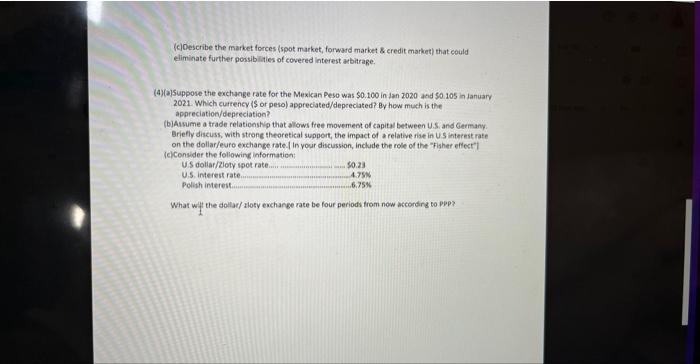

Anowect thee quenions induand questionti. Fhenent al mpetanno leadne ts quartitatiot idetioci Whaten responses mast be properly preiettad Sloppy protentationi will be petalied Four wos should be dare independentle (1) ialoatingubh between "polikat" ana Terien exchance" fas as ther intaie to nimaboud Fhaneial trantactions. Provide as example of este (b)Aowme ifan a buek in idsto frat it Qolden state Bankj eopects the Sngapore dolar ia ane berrowing ratel (amnuabert) enit Colden state Bark cas berrow Simdlon we its sineapoce dolle eviedim io fer eterkant yeculative profin? bereimene the eutcoes (arotspese of the Wated voe pogose doliar to apperate from so 42605044 ? (2) Frovide a ditical analvis of how the bevaluanot of a donavic cermey is tuppoued to wak could prostuce nome wpoper tor the "Hurve" theory (ii) Censiber the followeng ivormoton (a) From the perapective of in US iewestor, bisen the feackity of toveted intereh abiciag. IBS Suppove the investor does not have the bew'th of pour asessent in part "s" above. atd eent athead to imeit 510 mition, determine the prohthoss e geult eait. (c)oescribe the market forces (spot market, forward market & eredit market) that could eliminate further possiblities of covered interest abbitrage. (4)(ajsuppose the exchange rate for the Mexican Peso was $0.100 in jan2020 and 50.105 in lanuary 2021. Which currency (\$ or peto) appreciated/depreclated? By how much is the appreciation/depreciation? (b)Assume a trade relationship that alows free movement of capital between U.S. and Germany. Briefly discuss, with strone theoretical support, the impact of a relative rise in US interest rate on the dollarfeuro exchange rate. I In your discussion, include the role of the "Figher effect" (c) Consider the followind information: What wit the dollac/ aloty exchange rate be four periods from now accordirg to PP ? Anowect thee quenions induand questionti. Fhenent al mpetanno leadne ts quartitatiot idetioci Whaten responses mast be properly preiettad Sloppy protentationi will be petalied Four wos should be dare independentle (1) ialoatingubh between "polikat" ana Terien exchance" fas as ther intaie to nimaboud Fhaneial trantactions. Provide as example of este (b)Aowme ifan a buek in idsto frat it Qolden state Bankj eopects the Sngapore dolar ia ane berrowing ratel (amnuabert) enit Colden state Bark cas berrow Simdlon we its sineapoce dolle eviedim io fer eterkant yeculative profin? bereimene the eutcoes (arotspese of the Wated voe pogose doliar to apperate from so 42605044 ? (2) Frovide a ditical analvis of how the bevaluanot of a donavic cermey is tuppoued to wak could prostuce nome wpoper tor the "Hurve" theory (ii) Censiber the followeng ivormoton (a) From the perapective of in US iewestor, bisen the feackity of toveted intereh abiciag. IBS Suppove the investor does not have the bew'th of pour asessent in part "s" above. atd eent athead to imeit 510 mition, determine the prohthoss e geult eait. (c)oescribe the market forces (spot market, forward market & eredit market) that could eliminate further possiblities of covered interest abbitrage. (4)(ajsuppose the exchange rate for the Mexican Peso was $0.100 in jan2020 and 50.105 in lanuary 2021. Which currency (\$ or peto) appreciated/depreclated? By how much is the appreciation/depreciation? (b)Assume a trade relationship that alows free movement of capital between U.S. and Germany. Briefly discuss, with strone theoretical support, the impact of a relative rise in US interest rate on the dollarfeuro exchange rate. I In your discussion, include the role of the "Figher effect" (c) Consider the followind information: What wit the dollac/ aloty exchange rate be four periods from now accordirg to PP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started