Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PaII I OTION PRICING PRINCIPLES The following quotes were for the IBM American options on June 1 of a given year. Use this information to

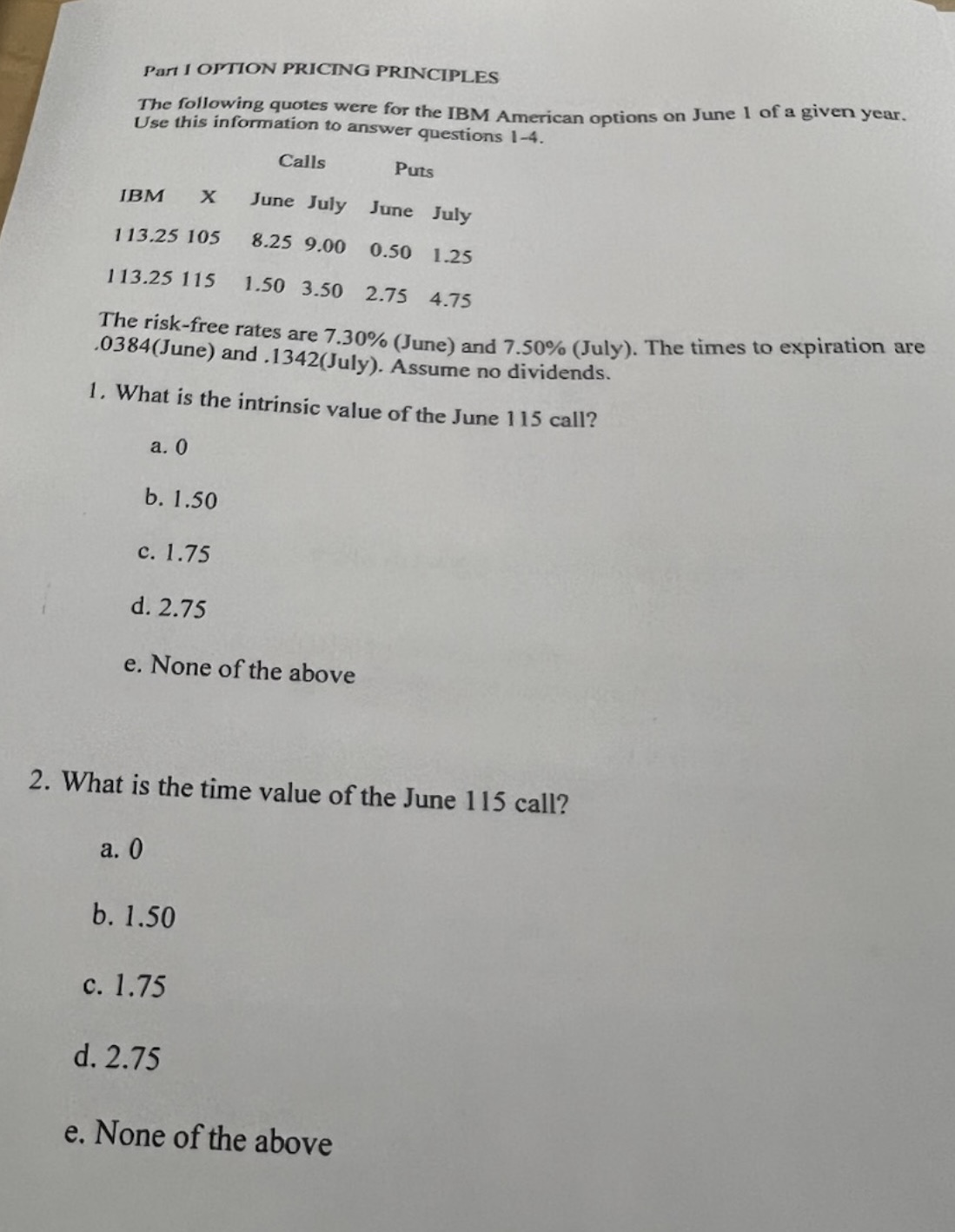

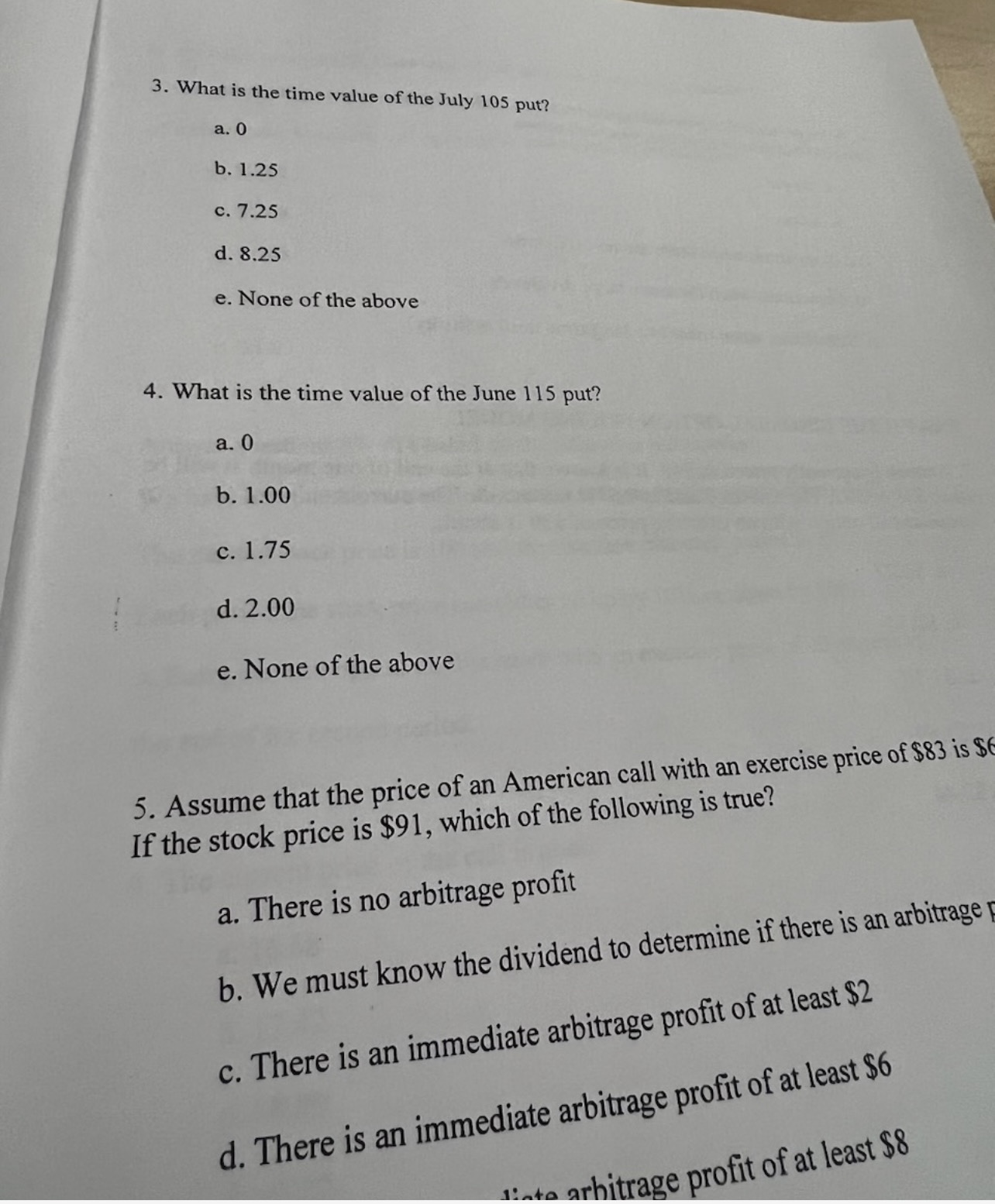

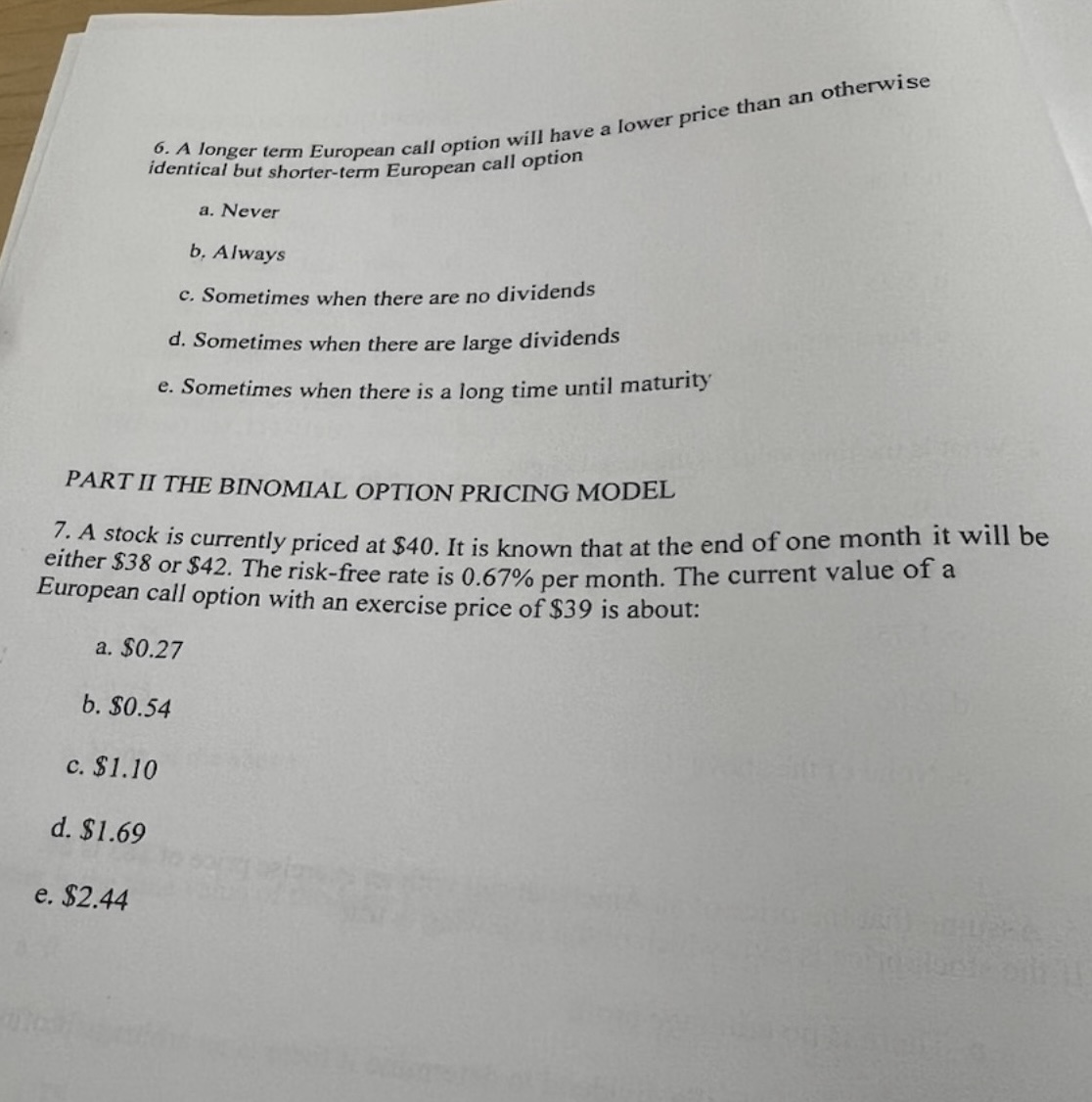

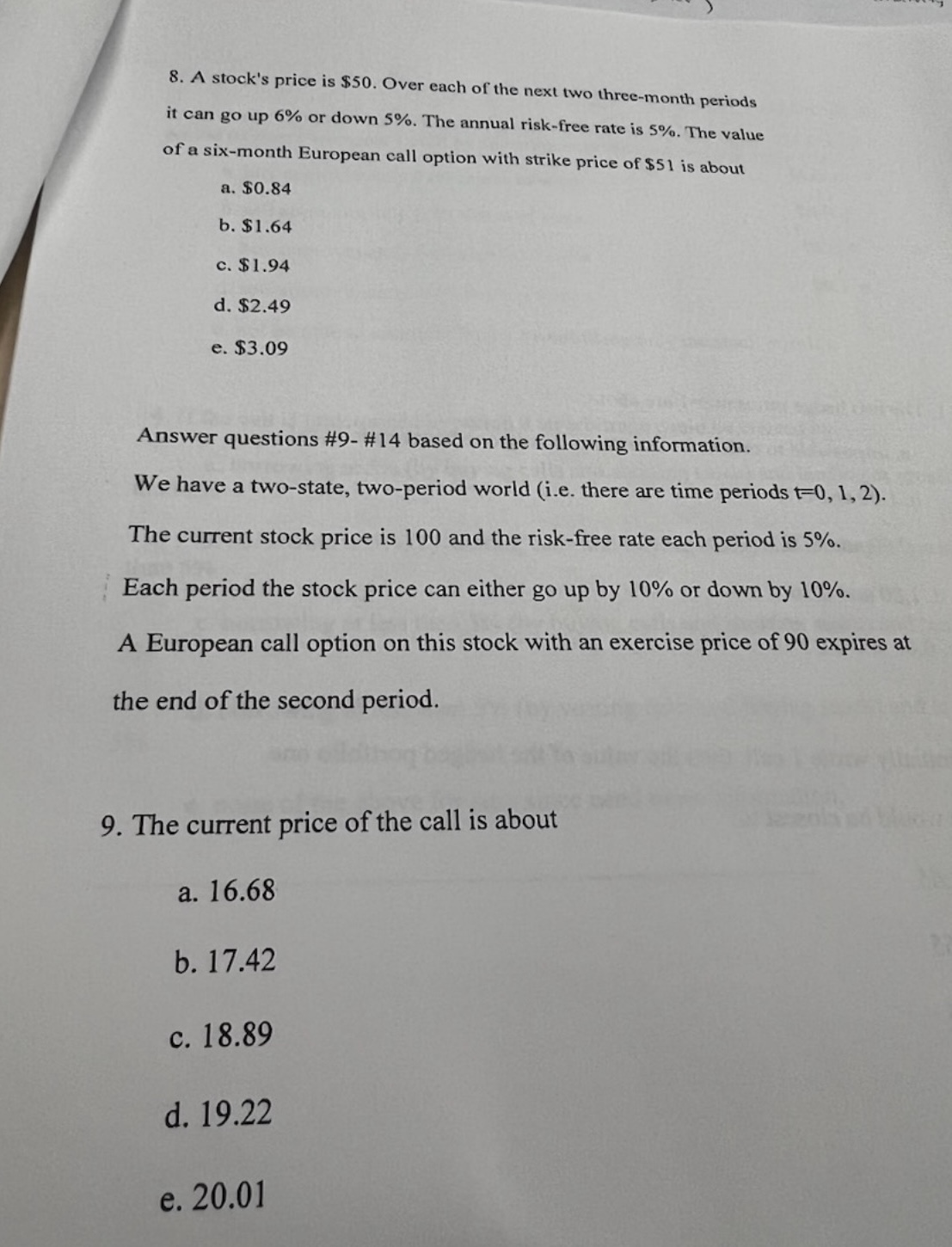

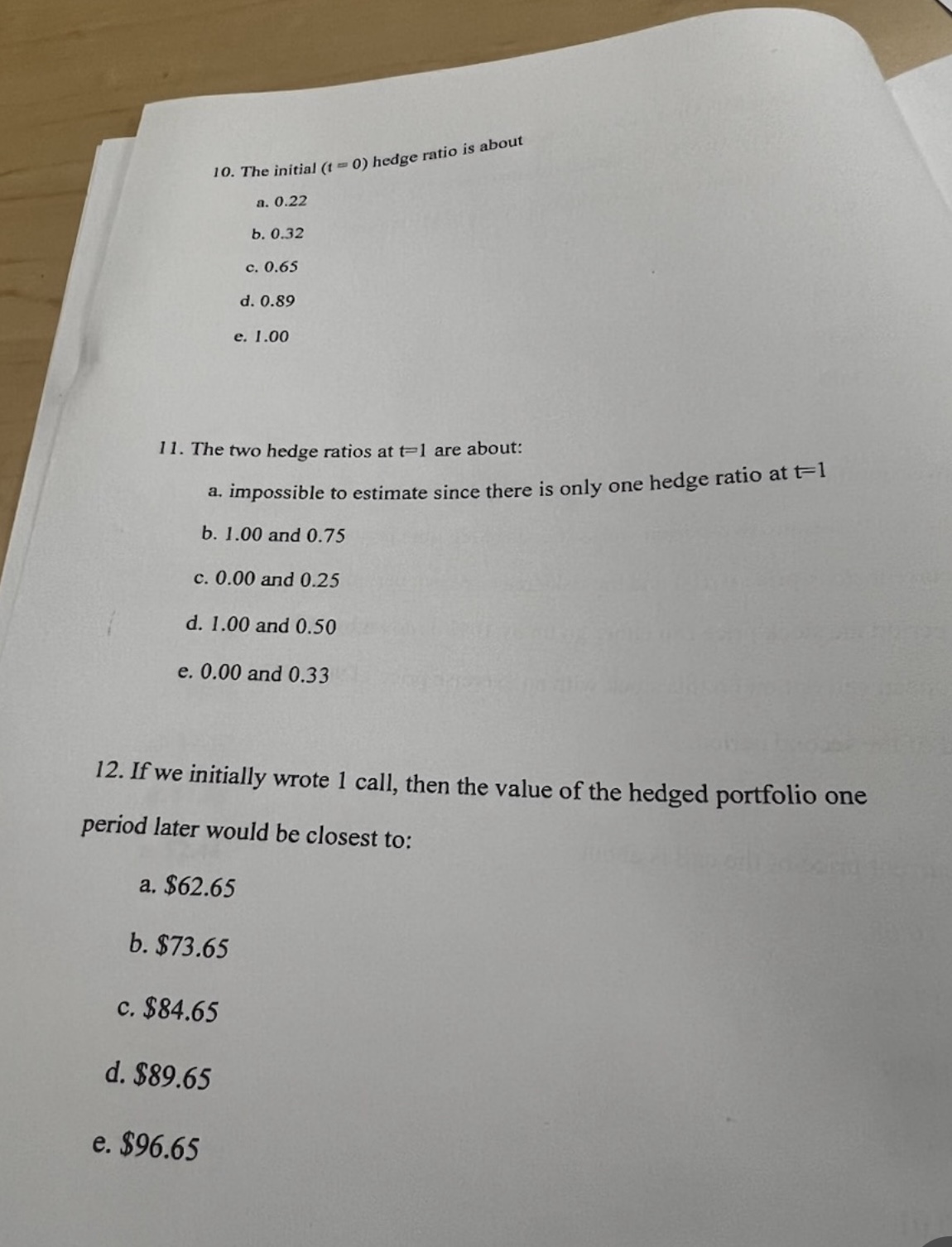

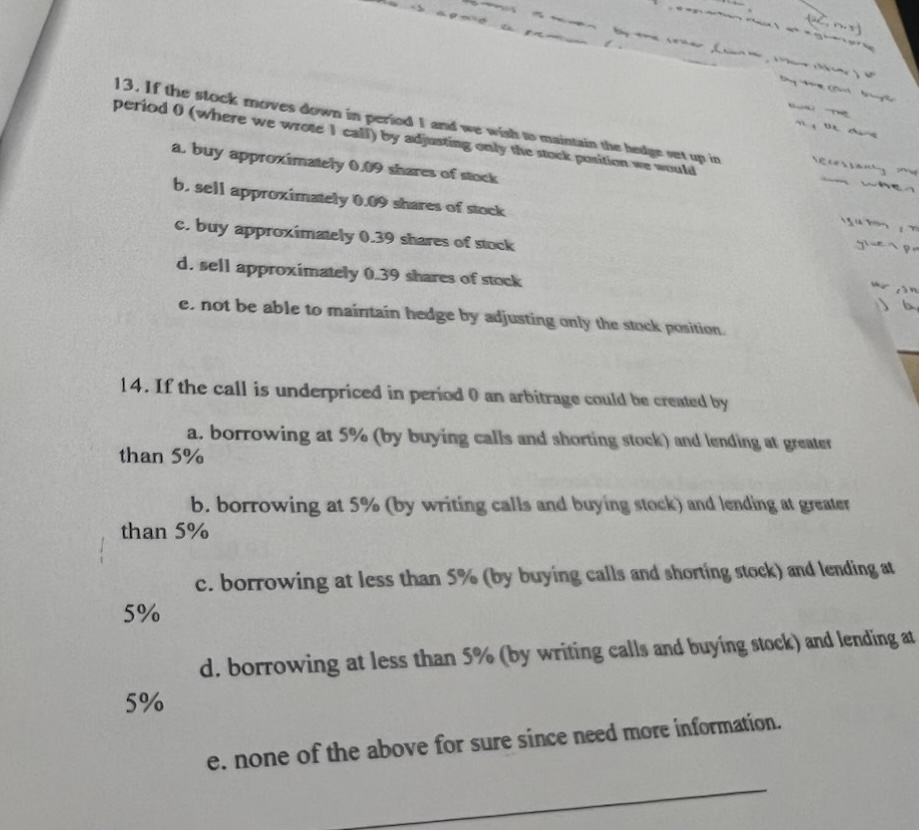

PaII I OTION PRICING PRINCIPLES The following quotes were for the IBM American options on June 1 of a given year. Use this information to answer questions 1-4. 1 he risk-free rates are 7.30% (June) and 7.50% (July). The times to expiration are .0384 (June) and . 1342 (July). Assume no dividends. 1. What is the intrinsic value of the June 115 call? a. 0 b. 1.50 c. 1.75 d. 2.75 e. None of the above 2. What is the time value of the June 115 call? a. 0 b. 1.50 c. 1.75 d. 2.75 e. None of the above 3. What is the time value of the July 105 put? a. 0 b. 1.25 c. 7.25 d. 8.25 e. None of the above 4. What is the time value of the June 115 put? a. 0 b. 1.00 c. 1.75 d. 2.00 e. None of the above 5. Assume that the price of an American call with an exercise price of $83 is $ If the stock price is $91, which of the following is true? a. There is no arbitrage profit b. We must know the dividend to determine if there is an arbitrage c. There is an immediate arbitrage profit of at least $2 d. There is an immediate arbitrage profit of at least $6 6. A longer term European call option will have a lower price than an otherwise identical but shorter-term European call option a. Never b. Always c. Sometimes when there are no dividends d. Sometimes when there are large dividends e. Sometimes when there is a long time until maturity PART II THE BINOMIAL OPTION PRICING MODEL 7. A stock is currently priced at $40. It is known that at the end of one month it will be either $38 or $42. The risk-free rate is 0.67% per month. The current value of a European call option with an exercise price of $39 is about: a. $0.27 b. $0.54 c. $1.10 d. $1.69 e. $2.44 8. A stock's price is $50. Over each of the next two three-month periods it can go up 6% or down 5%. The annual risk-free rate is 5%. The value of a six-month European call option with strike price of $51 is about a. $0.84 b. $1.64 c. $1.94 d. $2.49 e. $3.09 Answer questions \#9- \#14 based on the following information. We have a two-state, two-period world (i.e. there are time periods t=0,1,2 ). The current stock price is 100 and the risk-free rate each period is 5%. Each period the stock price can either go up by 10% or down by 10%. A European call option on this stock with an exercise price of 90 expires at the end of the second period. 9. The current price of the call is about a. 16.68 b. 17.42 c. 18.89 d. 19.22 e. 20.01 10. The initial (t=0) hedge ratio is about a. 0.22 b. 0.32 c. 0.65 d. 0.89 e. 1.00 11. The two hedge ratios at t=1 are about: a. impossible to estimate since there is only one hedge ratio at t=1 b. 1.00 and 0.75 c. 0.00 and 0.25 d. 1.00 and 0.50 e. 0.00 and 0.33 12. If we initially wrote 1 call, then the value of the hedged portfolio one period later would be closest to: a. $62.65 b. $73.65 c. $84.65 d. $89.65 e. $96.65 13. If the stock moves down in period 1 and we with wo maintain the hethe vel up in period 0 (where we wrote 1 call) by adjputing only the stlock poitition me nould a. buy approximatlely 0.09 shares of mock b. sell approximately 0.09 shares of stock c. buy approximanely 0.39 shares of stock d. sell approximately 0.39 shares of stock e. not be able to maintain hedge by adjusting only the stock position. 14. If the call is underpriced in period 0 an arbitrage could be created by a. borrowing at 5\% (by buying calls and shorting stock) and lending at geater than 5% b. borrowing at 5% (by writing calls and buying stock) and lending at geater than 5% c. borrowing at less than 5% (by buying calls and shoning stock) and lending at 5% d. borrowing at less than 5% (by writing calls and buying stock) and lending 5% e. none of the above for sure since need more information

PaII I OTION PRICING PRINCIPLES The following quotes were for the IBM American options on June 1 of a given year. Use this information to answer questions 1-4. 1 he risk-free rates are 7.30% (June) and 7.50% (July). The times to expiration are .0384 (June) and . 1342 (July). Assume no dividends. 1. What is the intrinsic value of the June 115 call? a. 0 b. 1.50 c. 1.75 d. 2.75 e. None of the above 2. What is the time value of the June 115 call? a. 0 b. 1.50 c. 1.75 d. 2.75 e. None of the above 3. What is the time value of the July 105 put? a. 0 b. 1.25 c. 7.25 d. 8.25 e. None of the above 4. What is the time value of the June 115 put? a. 0 b. 1.00 c. 1.75 d. 2.00 e. None of the above 5. Assume that the price of an American call with an exercise price of $83 is $ If the stock price is $91, which of the following is true? a. There is no arbitrage profit b. We must know the dividend to determine if there is an arbitrage c. There is an immediate arbitrage profit of at least $2 d. There is an immediate arbitrage profit of at least $6 6. A longer term European call option will have a lower price than an otherwise identical but shorter-term European call option a. Never b. Always c. Sometimes when there are no dividends d. Sometimes when there are large dividends e. Sometimes when there is a long time until maturity PART II THE BINOMIAL OPTION PRICING MODEL 7. A stock is currently priced at $40. It is known that at the end of one month it will be either $38 or $42. The risk-free rate is 0.67% per month. The current value of a European call option with an exercise price of $39 is about: a. $0.27 b. $0.54 c. $1.10 d. $1.69 e. $2.44 8. A stock's price is $50. Over each of the next two three-month periods it can go up 6% or down 5%. The annual risk-free rate is 5%. The value of a six-month European call option with strike price of $51 is about a. $0.84 b. $1.64 c. $1.94 d. $2.49 e. $3.09 Answer questions \#9- \#14 based on the following information. We have a two-state, two-period world (i.e. there are time periods t=0,1,2 ). The current stock price is 100 and the risk-free rate each period is 5%. Each period the stock price can either go up by 10% or down by 10%. A European call option on this stock with an exercise price of 90 expires at the end of the second period. 9. The current price of the call is about a. 16.68 b. 17.42 c. 18.89 d. 19.22 e. 20.01 10. The initial (t=0) hedge ratio is about a. 0.22 b. 0.32 c. 0.65 d. 0.89 e. 1.00 11. The two hedge ratios at t=1 are about: a. impossible to estimate since there is only one hedge ratio at t=1 b. 1.00 and 0.75 c. 0.00 and 0.25 d. 1.00 and 0.50 e. 0.00 and 0.33 12. If we initially wrote 1 call, then the value of the hedged portfolio one period later would be closest to: a. $62.65 b. $73.65 c. $84.65 d. $89.65 e. $96.65 13. If the stock moves down in period 1 and we with wo maintain the hethe vel up in period 0 (where we wrote 1 call) by adjputing only the stlock poitition me nould a. buy approximatlely 0.09 shares of mock b. sell approximately 0.09 shares of stock c. buy approximanely 0.39 shares of stock d. sell approximately 0.39 shares of stock e. not be able to maintain hedge by adjusting only the stock position. 14. If the call is underpriced in period 0 an arbitrage could be created by a. borrowing at 5\% (by buying calls and shorting stock) and lending at geater than 5% b. borrowing at 5% (by writing calls and buying stock) and lending at geater than 5% c. borrowing at less than 5% (by buying calls and shoning stock) and lending at 5% d. borrowing at less than 5% (by writing calls and buying stock) and lending 5% e. none of the above for sure since need more information Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started