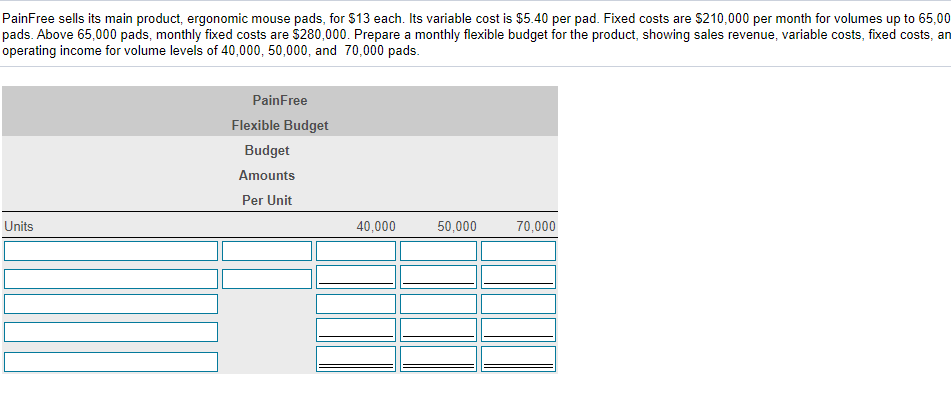

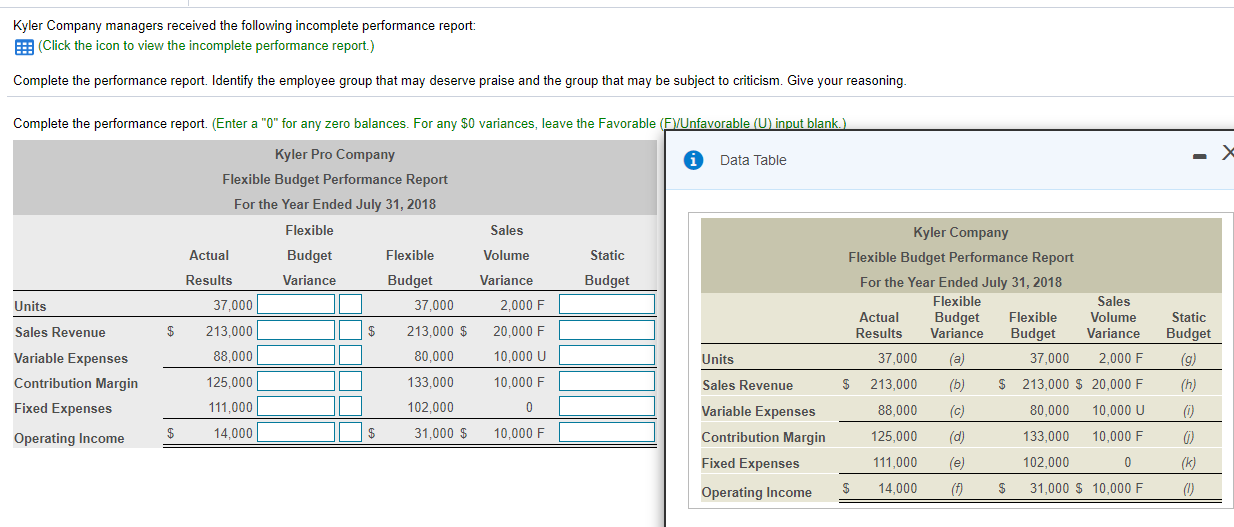

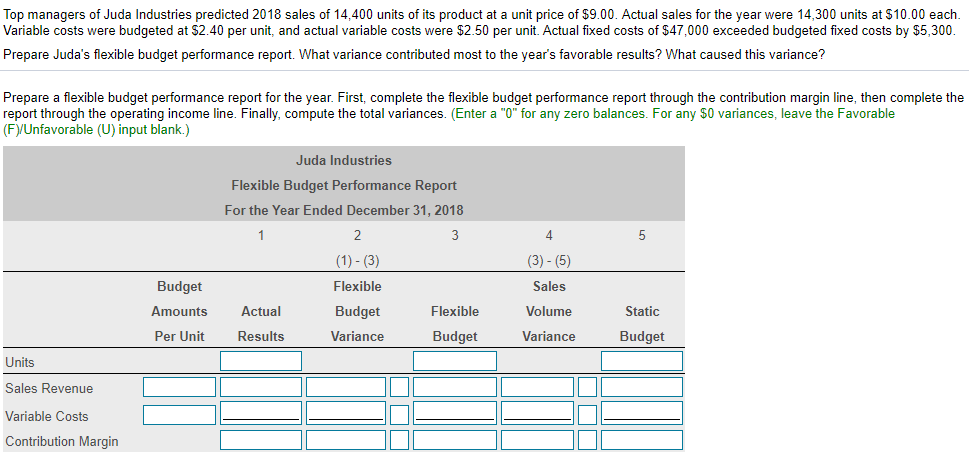

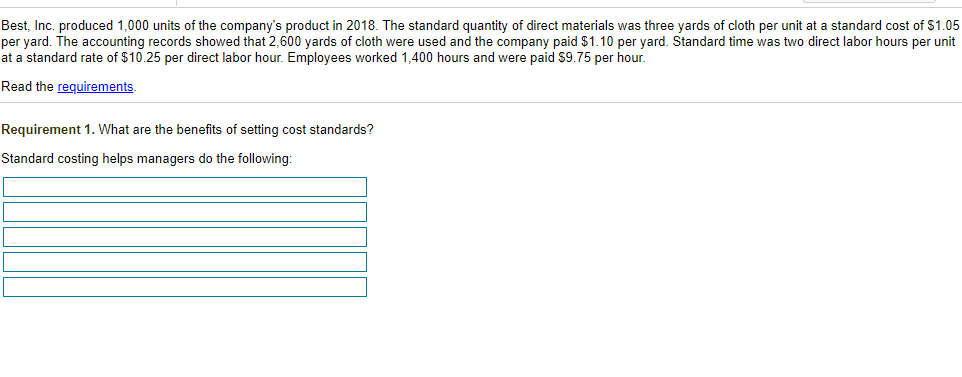

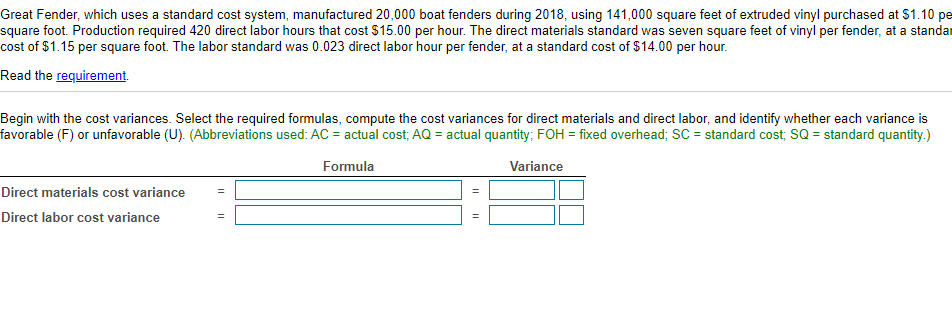

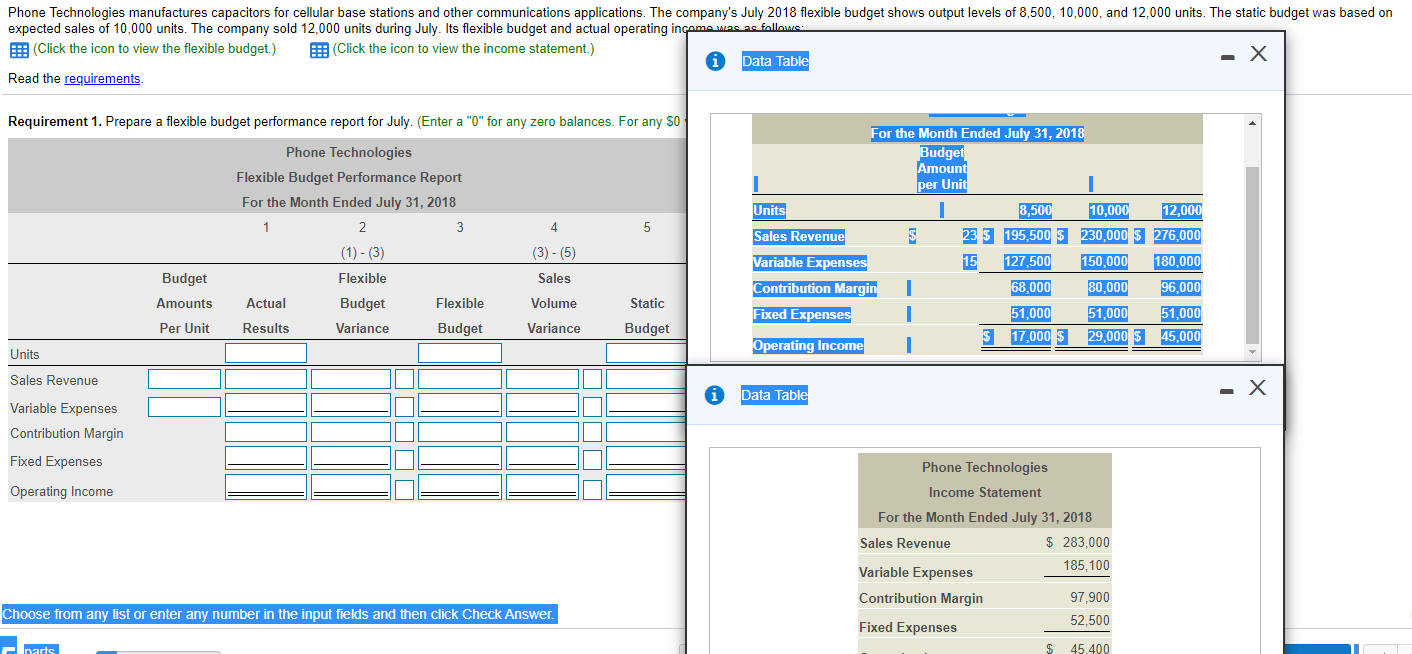

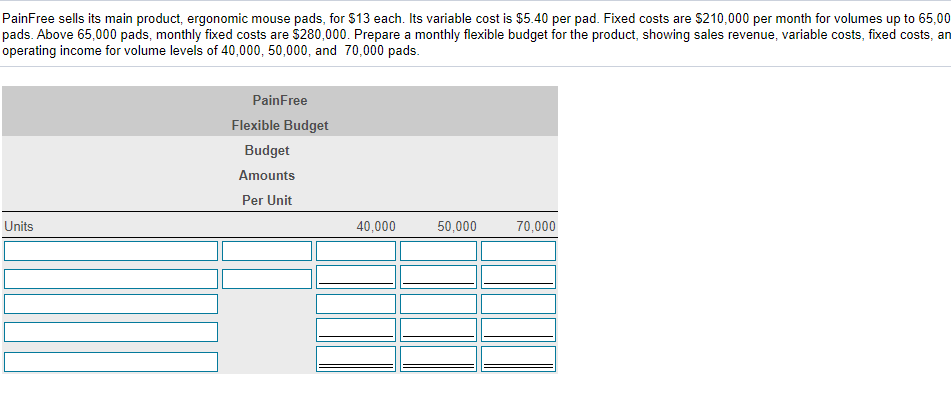

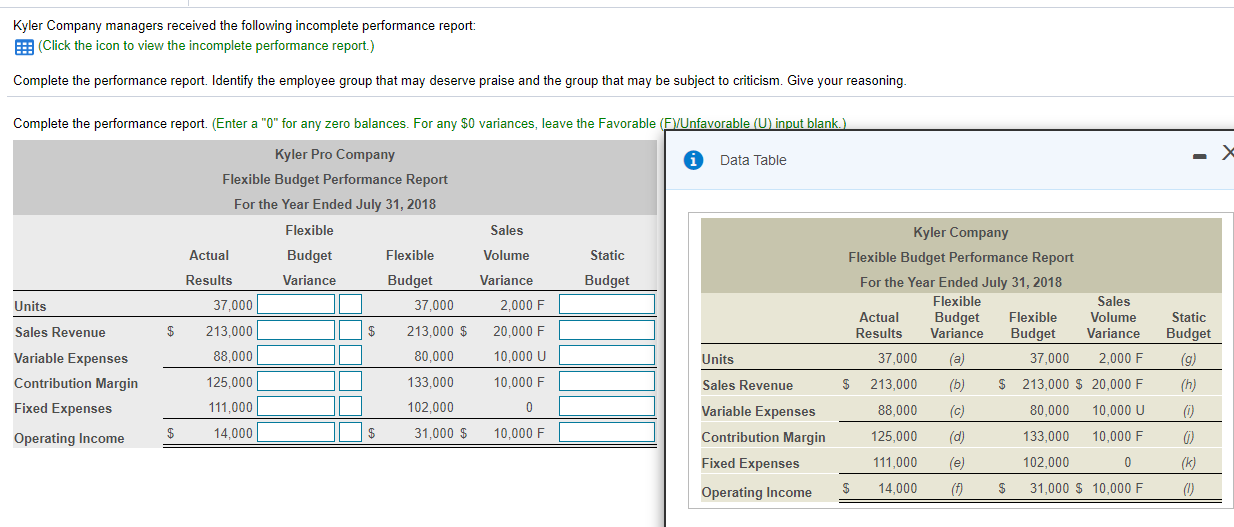

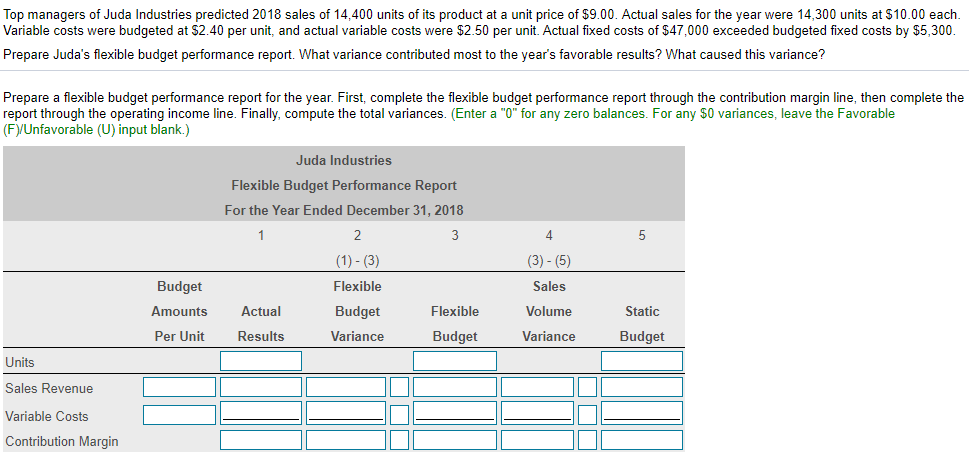

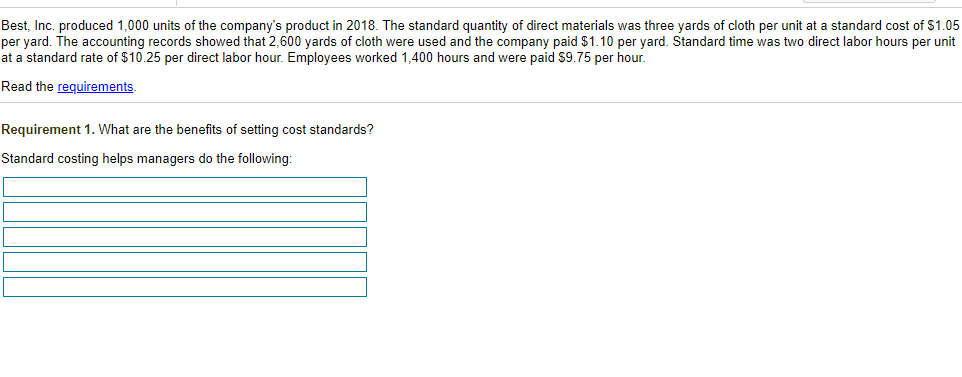

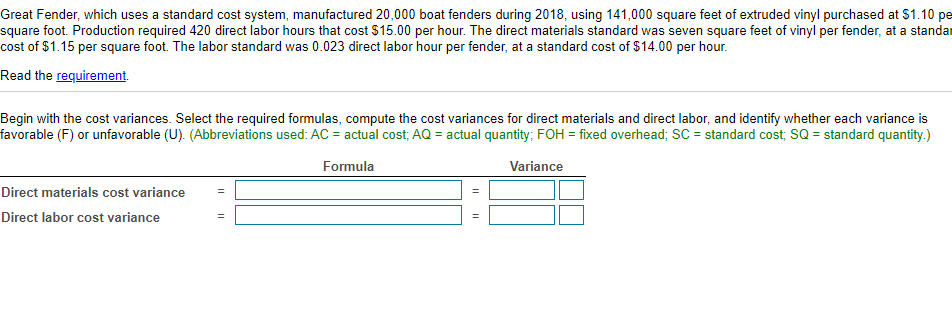

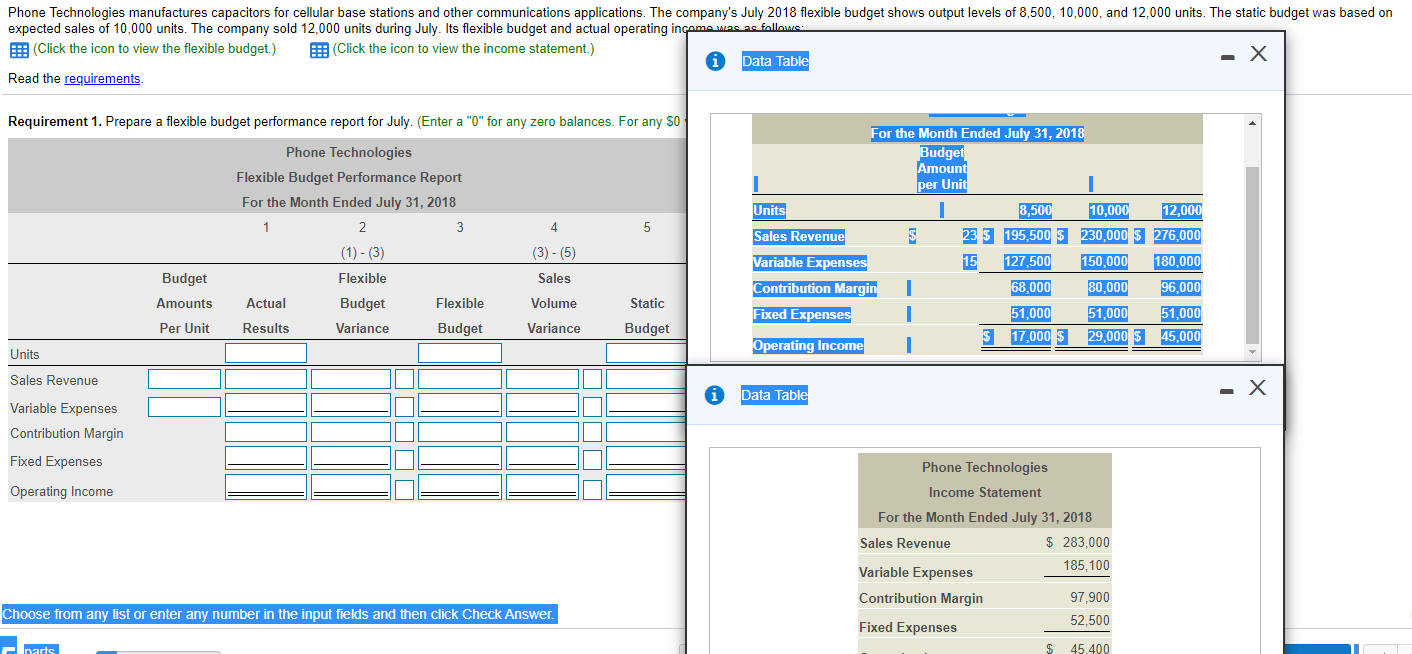

PainFree sells its main product, ergonomic mouse pads, for $13 each. Its variable cost is $5.40 per pad. Fixed costs are $210,000 per month for volumes up to 65,00 pads. Above 65,000 pads, monthly fixed costs are $280,000. Prepare a monthly flexible budget for the product, showing sales revenue, variable costs, fixed costs, an operating income for volume levels of 40,000, 50,000, and 70.000 pads. PainFree Flexible Budget Budget Amounts Per Unit Units 40,000 50,000 70,000 Kyler Company managers received the following incomplete performance report: E: (Click the icon to view the incomplete performance report.) Complete the performance report. Identify the employee group that may deserve praise and the group that may be subject to criticism. Give your reasoning. Complete the performance report. (Enter a "0" for any zero balances. For any $0 variances, leave the Favorable (FYUnfavorable (U) input blank.) Data Table Sales Kyler Pro Company Flexible Budget Performance Report For the Year Ended July 31, 2018 Flexible Actual Budget Flexible Results Variance Budget 37,000 37,000 213,000 $ 213,000 $ 88,000 80,000 Volume Static Budget Units Variance 2,000 F 20,000 F 10,000 U Sales Revenue $ Kyler Company Flexible Budget Performance Report For the Year Ended July 31, 2018 Flexible Sales Actual Budget Flexible Volume Results Variance Budget Variance 37,000 (a) 37,000 2,000 F $ 213,000 (b) S 213,000 $ 20,000 F 88,000 (c) 80.000 10,000 U 125,000 (d) 133,000 10,000 F Static Budget Units (9) Variable Expenses Contribution Margin Fixed Expenses 125,000 133,000 10,000 F (h) 111,000 102,000 0 0 Sales Revenue Variable Expenses Contribution Margin Fixed Expenses $ 14.000 $ 31,000 $ 10,000 F Operating Income 0 111,000 (e) (k) 102,000 31,000 $10,000 F $ Operating Income 14,000 (1) $ (0) Top managers of Juda Industries predicted 2018 sales of 14,400 units of its product at a unit price of $9.00. Actual sales for the year were 14,300 units at $10.00 each. Variable costs were budgeted at $2.40 per unit, and actual variable costs were $2.50 per unit. Actual fixed costs of $47,000 exceeded budgeted fixed costs by $5,300. Prepare Juda's flexible budget performance report. What variance contributed most to the year's favorable results? What caused this variance? Prepare a flexible budget performance report for the year. First, complete the flexible budget performance report through the contribution margin line, then complete the report through the operating income line. Finally, compute the total variances. (Enter a "0" for any zero balances. For any $0 variances, leave the Favorable (FYUnfavorable (U) input blank.) Juda Industries Flexible Budget Performance Report For the Year Ended December 31, 2018 2 3 5 (3) - (5) (1)-(3) Flexible Budget Sales Amounts Actual Flexible Volume Static Budget Variance Per Unit Results Budget Variance Budget Units Sales Revenue Variable Costs Contribution Margin Best, Inc. produced 1,000 units of the company's product in 2018. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.05 per yard. The accounting records showed that 2,600 yards of cloth were used and the company paid $1.10 per yard. Standard time was two direct labor hours per unit at a standard rate of $10.25 per direct labor hour. Employees worked 1,400 hours and were paid $9.75 per hour. Read the requirements Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: Great Fender, which uses a standard cost system, manufactured 20,000 boat fenders during 2018, using 141,000 square feet of extruded vinyl purchased at $1.10 pe square foot. Production required 420 direct labor hours that cost $15.00 per hour. The direct materials standard was seven square feet of vinyl per fender, at a standa cost of $1.15 per square foot. The labor standard was 0.023 direct labor hour per fender, at a standard cost of $14.00 per hour. Read the requirement Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost, AQ = actual quantity; FOH = fixed overhead; SC = standard cost, SQ = standard quantity.) Formula Variance Direct materials cost variance Direct labor cost variance 11 Phone Technologies manufactures capacitors for cellular base stations and other communications applications. The company's July 2018 flexible budget shows output levels of 8,500, 10,000, and 12,000 units. The static budget was based on expected sales of 10,000 units. The company sold 12,000 units during July. Its flexible budget and actual operating income was as follows: Click the icon to view the flexible budget.) F: (Click the icon to view the income statement.) Data Table Read the requirements Requirement 1. Prepare a flexible budget performance report for July (Enter a "0" for any zero balances. For any 50 For the Month Ended July 31, 2018 Budget Amount Phone Technologies Flexible Budget Performance Report For the Month Ended July 31, 2018 1 2 3 per Unit 4 5 (1)-(3) (3) -(5) Units Sales Revenue Variable Expenses Contribution Margin Fixed Expenses Flexible Sales Budget Amounts 8,500 10,000 12,000 23 $ 195,500 $ 230,000 $ 276,000 15 127,500 150,000 180,000 68,000 80,000 96,000 51,000 51,000 51,000 $ 17,000 $ 29,000 $ 45,000 1 Actual Flexible Volume Static Budget Variance Per Unit Results Budget Variance Budget Units Operating Income Sales Revenue Data Table - X Variable Expenses Contribution Margin Fixed Expen Operating Income Phone Technologies Income Statement For the Month Ended July 31, 2018 Sales Revenue $ 283,000 185,100 Variable Expenses Contribution Margin 97,900 52,500 Fixed Expenses $ 45,400 Choose from any list or enter any number in the input fields and then click Check Answer. narts